Union Budget 2022: Will there be a booster dose for India Inc in it?

The India Inc wish list for the Union Budget 2022-23: With a lot of expectations from many fronts, sectors and industries are suggesting a host of measures for swifter growth.

Anushruti Singh January 27, 2022

MORE IN Focus

It’s rush hour for gold in 2024, and India inc is riding new trends

IPL’s impact on hospitality: Boosting tourism, hotel bookings, and revenue surge

Will 45-day payment rule revolutionise MSME support?

The future of digital banking: Lessons from Paytm Payments Bank’s regulatory hurdles

Empowering women imperative for inclusive development in India

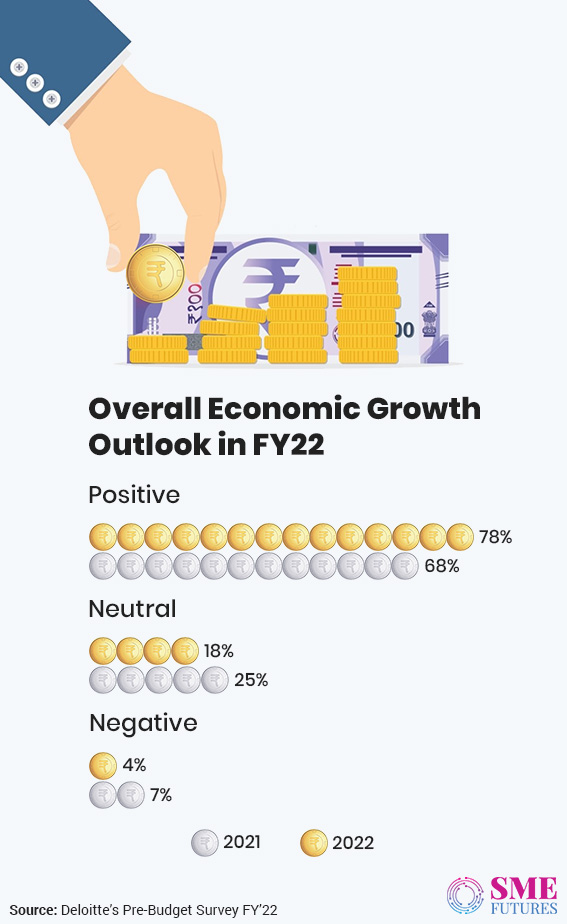

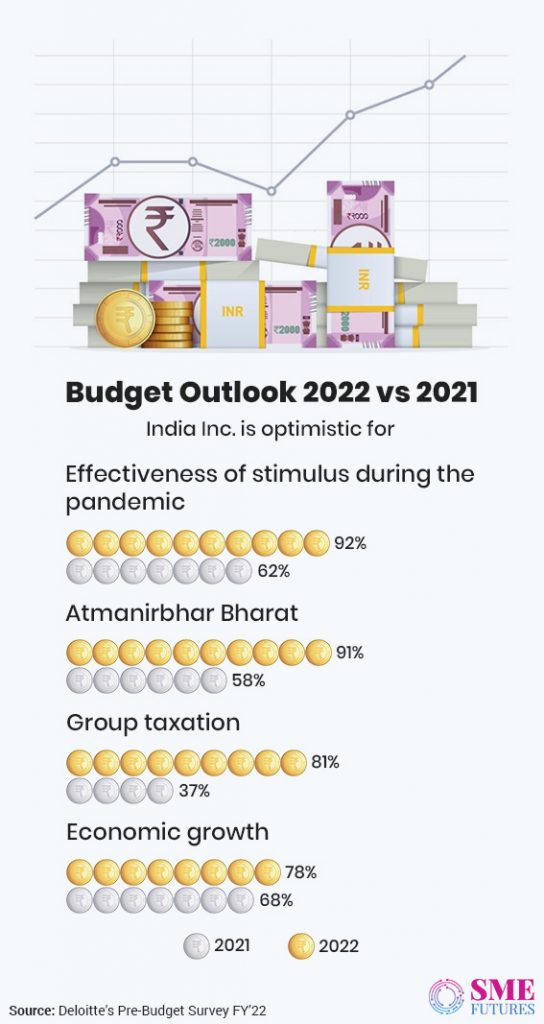

The government was expecting a GDP growth of 9.2 per cent for FY21-22 and a V-shaped recovery curve. But, continued disruptions hampered economic activities, resulting in India’s GDP going down to 7.3 per cent in the FY2020-21. With Omicron raging across the country, India is witnessing below-average fourth quarter performance, which has further dampened economic sentiments.

At the same time, third wave uncertainty might force the government to push the fiscal pedal more to support this fragile recovery and print in a 6.5 per cent fiscal deficit. According to a report by brokerage firm Barclays India, the government is likely to budget for around Rs 42 lakh crores of capex next fiscal.

Professor Vidya Mahambare, Chairperson, UB-GL Centre for Banking Excellence at Great Lakes Institute of Management touted the economic recovery of India as weak and uncertain.

According to the professor, among the four drivers of demand – private consumption, private investment, government demand and exports, the first two cannot be expected to drive overall recovery in the near future.

“This is because job creation and income generation have been uneven across the sectors with concentrated gains in exports led sectors such as Information technology and hopefully this will continue,” she says.

With India witnessing a continuous rise in the Omicron wave, analysts like Ratish Pandey, Business & Executive Coach, Ethique Advisory for the MSME and Start-up sector also think that it can hamper the economy.

“Had I been commenting about 20 days back, probably my comments would be more towards how the federal government should rebuild and focus on reducing the budget deficits. However, we know exactly how uncertain things are with the new wave hitting India like a tsunami. The Modi government should do well, and I hope that they will be able to make adjustments to their planning, as the budget document is almost ready,” he says.

Given the current scenario, analysts and industry stakeholders get vocal on what the government should focus on in the upcoming budget 2022.

“Focus should be on government schemes to support infra and job creation should continue. Schemes led by lending banks for MSMEs/SMEs should be extended at least to the end of the calendar year 2022. And continued support should be provided to the lower strata of the earning populace to ensure their wellbeing,” says Pandey who has been watching India’s progress closely and points out a few areas where government measures are needed the most.

For the start-ups, it has been a phenomenal year – thanks to all the brilliant ideas, India saw a huge spurt in the number of unicorns. The support provided under the start-up India initiative should continue and be extended by another year. For the manufacturing / industrial sector, specific PLI schemes have been successful. New sectors should be added, he further recommends.

Create more informal jobs

If India needs to recover from the economic slump, the Union Budget should focus on capital spending in physical infrastructure and in social sectors such as health and education, which are also labour intensive, and should be front-loaded, suggests Prof. Mahambare.

“This would create low-skilled jobs that were lost in sector construction and would lead to an increase in demand for sectors such as cement, steel, and eventually attract private investment as capacity utilisation levels rise. While a high allocation to schemes such as NREGA may help, it can only be a temporary solution,” she adds while urging the government to find alternative jobs.

Though tracking the informal workforce in India is difficult due to a lack of up-to-date indicators, the informal sector was the first to lose jobs during the pandemic. According to a recent SBI analysis, the informal sector contracted to 15-20 per cent of the GDP in 2020-21 from 52 per cent in 2017-18.

Besides that, Professor Mahambare also recommends continued fiscal support, since monetary policy tightening is also expected to start globally and in India, in the face of rising inflation. This, however, need not result in a higher fiscal deficit to GDP ratio given tax buoyancy from the formal sector, she says.

Demand-supply generation

Today, the government has quite a lot of proactive policies for the manufacturing sector, like PLI and other initiatives. But India Inc feels that a lot of work still needs to be done in order to generate demand. Hence, the budget should focus on a few important things for demand generation.

Talking about it from a budget perspective, Sandeep Lodha, Co-founder at Netweb Technologies, says, “We need to see how the local buying of made in India products is encouraged. The government should fund a scheme for tech adoption, and government purchases of high-end IT products should be encouraged/prioritised to help create more demand.”

For instance, data centre operators should be incentivised to use more “Made in India” products, he says. “This will help the country to achieve the PMO’s objective of achieving Atamnirbhar Bharat. Local server technology development will help to bring cutting-edge technology to the country while also addressing the nation’s security concerns,” he adds.

On a similar note, Rahul Goel, VP Finance at Moglix, a B2B platform, says, “Demand side measures that can cool inflation rates would be to rationalize GST rates on raw materials like iron and steel, cement, fabrics, and petrochemicals. Overall, the nominal incidence of GST on manufacturing should be rationalised from 18 to 12 per cent. It will go a long way in giving inflation relief to MSME units and in strengthening their balance sheets.”

While talking about supply generation, Goel recommends that the Union Budget 2022 should continue to focus on the execution of fiscal outlay initiatives that have already been announced. “The CAPEX spending on the National Infrastructure Pipeline is one major area where government spending will generate a positive long-term effect. The Union Budget 2022 should look to scale up the PLI umbrella for the manufacturing of other categories of white label goods under the Make in India initiative,” he suggests.

Boost Aatmanirbhar Bharat

As we are going through another wave, the importance of Atma Nirbhar Bharat cannot be emphasised enough. To boost Indian manufacturing and MSMEs, the industry needs a stable GST tax slab, says Avneet Singh Marwah, CEO at SPPL, the Exclusive Brand Licensee of Blaupunkt in India.

“No product should be above the 18 per cent slab, and they must now encourage consumerism to improve market sentiment,” he says.

According to Marwah, this step could make India the world’s third-largest market for television. The market size could grow by 15 per cent each year, reaching 16 million units. “We urge the government to not change any customs duties for the time being, as the industry is moving towards stable conditions. We also request the FM to have timelines for PLI scheme initiatives for display panels and semiconductor chips,” he asserts.

According to Marwah, the other important sector where the government needs to intervene is the cargo sector. “We’ve seen a 10x increase in sea freight in the last few years, and along with that timeline, it has increased by 2x. There is a big syndicate in this sector, which is causing this delay and causing a huge loss to the economy as these delays are being managed at Indian sea ports as well,” he elaborates.

He also talks about a lower tax rate on consumer electronics, which will encourage consumers to buy higher ASP products. “This will also help in digital India, as consumers will opt for more tech products,” says Marwah.

Focus on IT infra

In the past, industries experienced a few hiccups in their supply chains, which pushed India Inc to diversify towards the digital supply chain solution. Which is one step towards enabling India to build resilient supply chains, which are imperative if it aims to become the premier manufacturing destination of the world.

Industry sources and users of digital supply chain infra such as Goel of Moglix want to see announcements introducing incentives for digital supply chain transformations for small and large manufacturers.

Entrepreneurs such as Lodha feel that the government should work on making India’s R&D side stronger.

“There have to be special incentives for companies investing in R&D, there must be government incentivised and facilitated collaborations between the companies and premium education and R&D facilities,” he asserts.

This will be a major game changer as the R&D and education systems will become more aligned with the real world of commercially valid products, and the industry will benefit from innovation and local enhancement of technology to create global competence, adds Lodha.

Quality education means private participation

IMD’s World Competitiveness ranking places India’s education sector at a dismal 59th place out of 64 countries, with only 45 per cent of all graduates being considered employable.

Obviously, we cannot expect India’s government to bridge this education-employability gap by itself. Also, since there is an impetus on digital education, the sector needs greater support from the private sector along with a wider deployment of technology to ensure that its goal of quality education for all is met.

Dr. Akhil Shahani, Managing Director at Thadomal Shahani Centre for Management and CEO at Shahani Group, hopes that the Union Budget can facilitate this by reducing the GST rate for providing educational technology and ancillary services from 18 to at least 5 per cent.

“The government should allow private investors to set up schools and colleges with the ability to generate profits and equity returns. It should also allow foreign educational institutions to easily set up campuses in India, to promote healthy competition among local players. Collateral requirements for school/college educational loans should be reduced, along with interest rates by public sector banks, to allow more families to afford the fees of quality institutions,” he suggests.

Then, skill training is also imperative. Dr. Shahani says that special sops need to be given to teacher training colleges, to enable them to expand and provide higher quality talent to institutions. “None of these suggestions require additional funds from the government, we just need a practical and holistic approach to opening up education regulations,” he opines.

The real estate sector expects a host of measures

As the unveiling of the Union Budget 2022 approaches, the real sector market is rife with speculations over the announcements that will come in the favour of this industry.

Dr. Amish Bhutani, Director at Bhutani Grandthum in his pre-budget speculations, worries that the third wave may create some setback for the real estate sector, thus it is critical that the government should announce a host of measures for the swift recovery of this sector.

“The real estate sector is expecting the government to increase capital outlay so that an impetus to the economy can be provided,” he avers.

According to him, the stakeholders are hoping for a dynamic and favourable policy because the sector is focused on contributing nearly 13 to 14 per cent to India’s GDP by 2025 and reach a market size of US$ 1 trillion. Among other wishes, relaxations in taxes to boost the sector and rise in FDI inflow are the key expectations from this budget.

“Waivers or reductions should be offered on GST’s on raw materials such as steel, cement etc. Raw materials prices are increasing and a reduction in GST rates can give a lot of relief to the real estate fraternity. Tax relaxations under Section 24, such as a hike in the Rs. 2 lakh rebate is another relaxation expected from this budget,” says Bhutani.

“The real estate sector has also been demanding a single window clearance mechanism for many years now. In addition to this, it is a favourable moment to award industry status to the real estate sector, enabling it to avail of cheaper credit facilities from financial institutions and a dedicated fund should be there to focus on real estate innovations and digitization. Easing of liquidity and short-term tax holidays are expected to go a long way in boosting the overall recovery of the real estate sector,” he elaborates.

According to Dr. Bhutani, the government should also focus on nurturing employment and increasing consumption. The government’s focus on infrastructure and investment will help create jobs, increase demand and help drive competitiveness.

Drone players are demanding support

Lately, drone technology has gained momentum in India, especially since the changes in the rules and regulations for drone operations. And due to the announcement of an allotment of Rs 120 crores via the PLI scheme over the past three years. This makes the stakeholders believe that the budget will also provide some tax relief and promote the ‘Make in India’ campaign for drones more aggressively.

Vishal Saurav, CEO & Founder of VFLYX India, a drone technology company, wishes for a significant amount of subsidy for Agri drones. “This will help Indian farmers to adopt the latest technology, thus giving a boost to India’s biggest industry- agriculture. Opening the defence sector more to private players will be a shot in the arm. If the import duties are reduced, it will encourage drone manufacturing in India so that the overall cost of the system is way lesser,” he avers.

While Vipul Singh, Founder & CEO of Aarav Unmanned Systems (AUS) expects the promotion of more start-ups and initiatives around the ease of raising funds.

“Many drone companies in India have signed new deals to start large-scale, commercial B2B drone operations in 2022. With this budget, we will expect the government to simplify policies, create a strong credit system for MSMEs and provide better working capital support that would help drone companies to scale up manufacturing and leverage the PLI scheme. We will also witness employment opportunities which we believe are important for the revival of demand in the post COVID era,” he says.

The insurance sector needs more focus

Lately there has been a spur in the growth of the insurance sector on the back of the pandemic and the rise in health complications and is it is being driven by technology. IBEF data estimates say that there are over 110 insurtech start-ups operating in India. Meanwhile, funding to this segment has increased from $11 million in 2016 to $287 million in 2020, according to the InsurTech Association (IIA) and IRDAI has been consistent in developing this space in the country.

Given this scenario, the players in this sector have high hopes from this budget.

Sanchit Malik, Co-founder and CEO of Pazcare says that to accelerate growth, a lot needs to be done.

“18 per cent GST on insurance premiums could be decreased. Tax relaxation is expected as start-ups have suffered huge losses due to the pandemic. It has highlighted the need for having health insurance and tax benefits should be encouraged for the same,” he says.

He further feels that awareness needs to be created in terms of taking insurance, as it is available for everyone, but not availed of by many. “FDI was increased in FY2021 while keeping in mind that at least 50 per cent of the board members should be Indian residents. This would in turn introduce Indian citizens to newer technologies and expand the insurtech horizon. The budget for 2022 is expected to help the start-ups and the insurtech sector in the same manner,” he adds.

GST rationalisation for the gaming sector

The online gaming industry is currently valued at $1.8 billion and is expected to reach US$ 4-5 billion by 2025 according to the EY – AIGF report. This Implies that since the sector is growing fast, online gamers too are estimated to grow from 360 million in 2020 to 510 million in 2022. Currently, there are over 400 gaming start-ups that are accelerating the growth of this sector.

Therefore, the All-India Gaming Federation is demanding GST rationalisation.

The body explains that a game of chance attracts a higher GST tax rate vis-à-vis a game of skill. Online games operate either on the ‘rake fee’ model wherein the gaming platform charges a rake fee for facilitating games or ‘freemium’ models wherein the gameplay is free but additional features may require users to purchase specific items for a monetary price. A rational imposition of GST is therefore vital for the sustainability of this industry.

The industry is growing at an impressive CAGR of 25-30 per cent and holds significant potential for overall economic growth, job creation and contributing to the government’s vision of a trillion-dollar digital economy by 2025. To enable the industry to realise its peak growth potential, it is imperative that the GST regime for the online gaming industry is kept rational and at par with the other technology platforms and services.

“It is important to highlight that regressive taxation of these emerging sectors will only make the business unsustainable in India. Our recommendation is that the tax authorities should align their policies with internationally accepted principles of taxing the online gaming sector and provide certainty to the industry.” says Roland Landers, CEO, All India Gaming Federation.

Talking about crystallising the GST levy mechanism, Landers further adds, “The valuation mechanism in levying GST should be clearly outlined to avoid any ambiguities and potential litigations leading to tax demands as the same will adversely impact the business plans, the operations, and the entry of the new players in the industry.”

Martech Industry’s wish list

Martech or marketing technology is among the few segments that witnessed a surge through 2021 as the shift towards the virtual picked up pace and is likely to stay at that level for some time now. Even government and global multi-lateral firms embraced this change fairly early and quickly.

The push towards digitisation and virtualisation has reached to the tier 2/3 cities and beyond. With this, Digital India, which is one of this government’s pet themes has gotten a huge push. To keep logging in the success, martech companies are aiming at globalizing digitalization, rationalizing taxes, upgrading infrastructure & internet footing with set goals & measurement criteria.

Piyush Gupta, President, Kestone says that bringing down direct taxes, making the regulatory environment simpler and more rationalised, enabling ease of doing business in foreign countries, changing the current moribund corporate lending sentiment, increasing digital infrastructure investments and finally adding more teeth and muscle to the “Digital India” initiative will really help the overall economy.

“We are not seeking direct help beyond this larger macro support and in easing the road ahead for players like us who want to grow globally. Of course, as a citizen, we would like to have inflation reined in, fuel and gas prices to be stable, consumer confidence to grow and central investment in infrastructure to continue” he says.

Silver economy slated to grow

The senior population in India accounts for 18 per cent of the total population. However, it is expected to more than triple from 104 million in 2011 to 300 million by 2050. It’s time to talk about the massively underserved senior market.

The silver economy refers to products and services aimed at the purchasing potential of the elderly and has by far been the most neglected sector in the past budgets. In the past few years, post retirement senior lifestyle demands are changing the market trends, especially in the real estate segment.

With demand going up for senior care services and products, it will be interesting to see if the current budget has something in store for senior citizens and the silver economy.

Mohit Nirula, CEO, Columbia Pacific Communities feels that 2022 will be a breakout year for the senior living sector with a many fold increase in demand and new supply coming into the market.

“2022 will be the tipping point for the sector as senior citizens and their children appreciate communities designed for seniors as being the preferred option for seniors living independently and as a complete solution for all their needs – today and tomorrow,” he says.

According to a 2018 CII report, there was a 10X gap between supply and demand for homes in senior living communities in urban India. Given that India adds 4 – 5 million senior citizens each year, this gap has only grown in the last three years.

Stakeholders hope that there will be some measures for the growth of this sector. Due to the sour experiences of seniors while dealing with the pandemic, who faced a lack of support in these adverse conditions, the interest in homes in senior living communities has reached unprecedented levels.

G. Srinivasan, CEO, Athulya, a senior living community, opines that the elderly segment needs a series of initiatives particularly related to their health to facilitate better services.

“We need initiatives to motivate youngsters to take up a career in the healthcare industry and continuous development programs for skill enhancement. This will address the current demand for healthcare professionals. Also, we request to increase the health insurance age limit for senior citizens and to include provisions to increase the coverage, irrespective of existing medical illnesses,” he suggests.

In addition, support to healthcare tech start-ups, more R&D and incentives to develop healthtech will reduce dependence on international companies, feels Srinivasan. “We also expect the government to considerately reduce the taxes imposed on medical equipment that are very essential, which will result in bringing down the overall medical expenses for an individual with ailments and comorbidities. Eventually, helping our senior citizen community to fight the potential escalations in their medical bills. And finally, we request the government to increase the tax benefits against their medical expenses and to revise the existing deduction for senior citizens as the cost of living has increased,” he elaborates.

In addition to this, irrespective of the sectors and industries, the stakeholders have a host of recommendations mainly related to increased expenditure, relief in taxation and the introduction of growth inducing initiatives. Given this, we will keep bringing more budget related articles for you. Until then, please share your comments and tell us about your expectations from the fourth Union Budget of FM Sitharaman.