With Donald Trump’s unexpected victory for a second presidential term, global markets, political analysts, and industry stakeholders are evaluating its implications. For India, Trump’s return to the White House brings both opportunities and challenges. To understand what lies ahead, it’s essential to revisit Trump’s first presidency and analyse its impact on India, particularly in trade, technology, and geopolitical dynamics.

A look back: Trump’s first presidency and India

During Trump’s first term (2017–2021), India-US relations witnessed significant developments. Lisa Curtis, who served as Deputy Assistant to Trump and Senior Director for South and Central Asia, observed an “elevation of the US-India relationship.” Trade, defence, and technology collaborations flourished, with India gaining access to advanced military technology, including armed drones.

Curtis highlighted Trump’s rapport with Prime Minister Modi, which played a crucial role in fostering mutual respect. Events such as Modi’s address to 50,000 Americans in Houston and Trump’s Ahmedabad rally with over 100,000 attendees symbolised the strengthening bond. “That relationship really helped cement a lot of the progress that was made,” Curtis notes in an interview with PTI.

However, it wasn’t all smooth sailing. Tariff disputes, India’s reliance on Russian defense equipment, and oil imports from Iran often tested the bilateral ties. Trump’s “America First” policy led to a focus on US domestic interests, creating friction in areas like trade and immigration.

The trade landscape: How Trump’s policies affected India

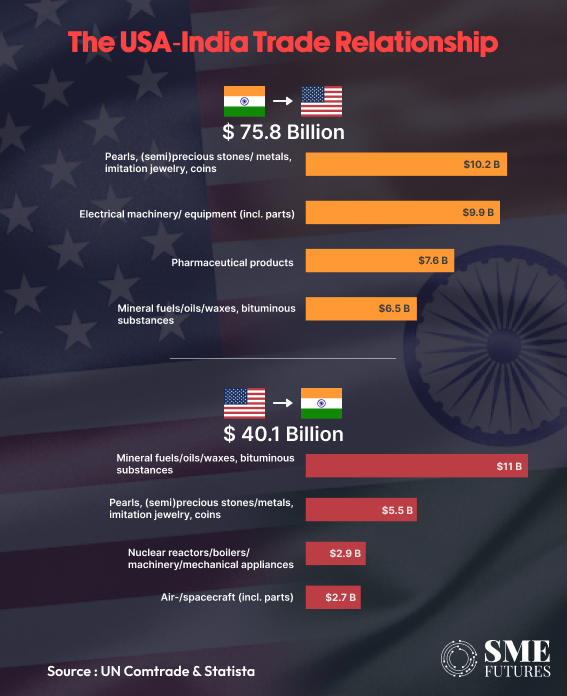

Trade was a critical aspect of Trump’s first term. By 2019, bilateral trade between India and the US had grown to $146.1 billion, up from $118 billion in 2016. This 23.8 per cent increase reflected stronger economic ties, but it wasn’t without its challenges. The US imposed tariffs on Indian steel (25 per cent) and aluminum (10 per cent), prompting retaliatory duties from India on 28 US products, including almonds and apples.

Despite the growth, India faced challenges such as the withdrawal of its Generalized System of Preferences (GSP) status in 2019, which impacted $6.3 billion worth of Indian exports. Trump justified this move by citing India’s “unfair trade practices.”

Now let’s look at what Trump 2.0 means for India. Unanimously, India Inc believes that Trump’s reelection provides a mixed bag for India. Let us split it down into key sectors:

Opportunities amid friction

One of the most significant aspects of Trump’s presidency was his tough stance on China. This indirectly benefitted India by reducing tensions along the Line of Actual Control (LAC) and encouraging economic collaboration between India and the US.

His tariffs on Chinese goods encouraged US companies to diversify their supply chains, providing Indian exporters an opportunity to fill the gap. This trend, known as the “China+1” strategy, aligned with India’s goals of boosting manufacturing and exports under the Atmanirbhar Bharat initiative.

Suman Chowdhury, Executive Director and Chief Economist at Acuité Ratings & Research, remarks, “Higher tariffs on Chinese goods should translate into better opportunities for exports of manufactured goods from India. China plus one strategy may receive an impetus under the new government. Higher end services exports to India may also see a sustained growth. However, Indian companies will need to invest in local US operations to fully capitalise on this trend.”

On the other hand, Mukesh Aghi, President of the US-India Strategic and Partnership Forum, states, “China is trying to improve ties with India to ease pressure from the Trump administration. Agreements on border patrolling and direct flights between India and China are early signs of this impact.”

India also played a pivotal role in Trump’s “America First” policy. Aghi adds, “India can complement the US by offering secure sourcing solutions while also becoming a key player in the global supply chain.”

Defence and technology angle: Strengthening strategic ties

Trump’s first term also saw significant advancements in defence and technology partnerships. Under his administration:

– Armed Drone Technology: India gained access to armed drones like the Sea Guardian Predators.

– Defence Deals: Major deals included the purchase of Apache and Chinook helicopters and P-8I maritime surveillance aircraft.

– Quad Alliance: The US, India, Japan, and Australia formalised the Quad alliance to counter China’s growing influence in the Indo-Pacific.

These developments were critical in building trust and confidence between the two nations. Curtis talking about Trump first term mentioned that the technology controls on India were lifted, allowing the country to gain access to armed drone technology. India is now in the process of purchasing 31 Sea Guardian predators. “This period saw the strengthening of not only the defence and security relationship but also the building of confidence and trust. Additionally, the Quad was initiated during this time.” she says.

However, the IT sector may face hurdles. Trump’s past restrictive immigration policies, including changes to the H-1B visa program, disrupted Indian IT professionals and firms.

Given that Jathin Kaithavalappil, Assistant Vice President at Choice Broking, warned that similar policies under Trump 2.0 could disrupt operations for Indian IT giants like Infosys, TCS, and Wipro. “The Indian IT sector is heavily reliant on H-1B visas, and restrictions could create operational bottlenecks,” he notes.

Energy and currency volatility

So far, Trump’s energy policies, particularly his focus on reducing oil prices, had mixed implications for India. Lower global oil prices benefitted India, one of the largest oil importers, by reducing its import bill. However, currency volatility posed challenges.

Chowdhury highlighted the depreciation of the Indian rupee during Trump’s tenure. “There are indeed some headwinds visible on the external front. The INR saw significant volatility amidst market turbulence, and this trend could continue under the new administration,” he says.

The INR has seen a material depreciation over the current week and breached the level of 84.4/USD, amidst a regain in the strength of the dollar. FPI outflows from the equity markets have been consistently high throughout Oct-24 and at USD 10.4 bn, the monthly outflow is clearly one of the highest in recent times.

In addition, the total reserves of RBI have seen a dip to USD 684.8 bn on Oct 25, 2024 from USD 701.2 bn as on Oct 4, 2024. Given the increased trade deficit in the first half of the fiscal, the CAD is already expected to increase to 1.2 per cent in FY25 from 0.9 per cent in FY24.

“Further, the likelihood of a slowdown in the pace of rate cuts by the US Fed is now higher if the proposed tariff hikes on imported goods particularly from China are implemented,” adds Chowdhury.

Stock market and corporate sentiment

Trump’s victory has already influenced market dynamics. Indian stock markets reacted positively, with experts like Narinder Wadhwa, Managing Director of SKI Capital, noting, “The Indian stock market has seen a good recovery. Historically, US elections bring volatility, but Trump’s victory seems favorable for India.”

Corporate America also welcomed Trump’s reelection, claims Aghi. According to him, “They (Americans) feel Trump understands how challenging it is to run and grow businesses. He will hopefully bring the taxes down for corporations, which will help them to become much more profitable and grow the business itself. The corporate community welcomes the new administration, which is the Trump administration,” he remarks.

“The market has gone up. What’s interesting is also that the dollar has become stronger. That shows the confidence in the incoming administration by corporate America,” Aghi says.

Road ahead: Opportunities and challenges

Trump’s return to the White House presents a mix of opportunities and challenges for India. On the positive side:

– Trade: The “China+1” strategy could boost Indian exports.

– Defence: Strategic partnerships and technology transfers are likely to deepen.

– Energy: Lower oil prices could reduce India’s import bill.

However, challenges remain:

– Tariffs: Trade negotiations could intensify, with the US demanding lower tariffs on its exports.

– Immigration: Restrictive visa policies could impact Indian IT firms.

– Geopolitics: India’s ties with Russia and Iran could clash with US policies.

Dr. SP Sharma, Chief Economist at PHDCCI, sums it up well: “Relations between America and India have been very cordial, and the Indian economy will continue its march towards becoming a Viksit Bharat by 2047.”

A new era of pragmatism

Trump’s second term signals a continuation of pragmatic, interest-driven India-US relations. While challenges persist, the opportunities for collaboration in trade, defense, and technology are immense.

As Aghi aptly notes, “India’s role in the global supply chain and its alignment with US policies will become more pivotal. Both nations can achieve mutual success through strategic cooperation.”

The road ahead may not be without obstacles, but the potential for India-US relations under Trump 2.0 is undeniable. With careful diplomacy and economic strategy, both nations stand to gain significantly from this renewed partnership.