Smart home revolution: Examining India’s growing demand for home automation post pandemic

Smart homes or home automation are no longer a far-fetched dream. The growing demand for home automation and the advent of various innovations in this field are establishing a new market dynamic in this sector.

Anushruti Singh June 16, 2023

MORE IN Features

Unravelling the Sustainable Tourism Revolution

Smile trends: Cosmetic dentistry business booms in India

Exploring the education landscape: Anticipated trends in 2024

2024 industry trends: MSME sector to remain crucial growth catalyst

Sectoral trends 2024: Indian agriculture sector is seeing a paradigm shift

People all over the world have become extremely tech smart nowadays. Innovations in AI and IoT have the potential to disrupt practically every aspect of our lives, and now it looks like they can do the same to our homes as well. From sliding your curtains to checking who is at your door to warming up your microwave, everything is just a click or voice command away.

“We can automate any kind of appliance. This is the power of IoT,” says Srikar Bommakanti, an IoT enthusiast and BDM at a white label company, KIOT Innovations, a smart home solution provider, which can automate anything from geysers to TVs to rice cookers, kettles, and wet grinders.

Over the years, smart homes have been gradually taking off in the country.

A 2022 Statista Consumer Insights survey depicts how smart homes are attracting a growing number of consumers. When asked about smart home device ownership, 52 per cent of Indians answered yes for connect devices and building safety/security devices, for example.

In 2020, according to Researchandmarkets, India ranked third in terms of smart homes worldwide. These numbers are only going up, as per Statista’s Digital Market Outlook for 2021. Which also forecasts that the number of smart homes in India is expected to surge to 442 million by 2025.

It is quite obvious that the Indian smart home market has started to feel pretty good. This became especially apparent during the pandemic, when smart homes which were earlier considered a ‘luxury,’ started feeling like a necessity to many.

Indian homes are changing

“I have been in this industry for the last 15 years and I have seen it grow leaner. But within the last 3 years, I feel that the growth has been exponential,” says Hiten Desai, Head-Home Automation, GM Modular.

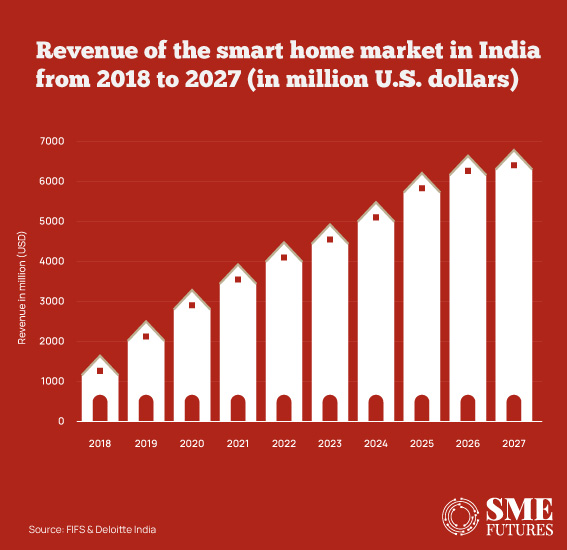

According to various market research platforms, this growth is going to escalate. A recent report by Bonafide Research says that the smart home market in India grew at a CAGR of over 38 per cent, with a Rs 2,800 crore market size in 2021-22. While ResearchandMarkets data states that the market is going to grow at a double-digit CAGR of 15.62 per cent from 2021 to 2027.

Between 2023 to 2027, the revenue of India’s smart home market is predicted to climb by a total of 1,844.1 million US dollars (+36.81 per cent). Following the fourth consecutive year of growth, sales are expected to reach 6.9 billion US dollars, reaching a new high in 2027.

“This is good! The home automation industry the world over and especially in India, is growing at a phenomenal rate,” remarks Vishal Goyal, CTO, Okas, a home automation solution start-up. “That is because a lot of construction is happening. And the aspirational value of the Indian consumer is growing,” he adds.

OKAS has created an AI-powered smart home system that can be controlled via a single user interface. Its USP is that it automatically learns the user’s preferences and provides recommendations and automatic responses.

Convenience is the driving force

Various factors are propelling the remarkable growth of India’s home automation sector. Technological advancements, high speed internet penetration, government driven smart city projects, urbanisation, integration with smartphones and access to technology are the driving forces behind the growth of the smart home industry in India.

Also, empowered by their increased disposable incomes, Indian households are now embracing home automation more than ever.

“Consumers are eager to enrich their lives with technology and the comforts that it brings,” says Sumit Garg, Director at Dooya Motors. Garg is an importer of Chinese blinds and accessories and has been seeing a major surge in demand for these.

“Industry’s growth rate is at 100 per cent. We are seeing a major rise in the demand for the automated curtains and blinds that we provide. The fact is that many Indians still consider a smart home a luxury. We are working to change this mindset. Our idea is to bring down the luxury factor by bringing down the cost without compromising on the quality,” he says.

While according to Desai, it is the technology and the convenience that automated homes provide, which attracts consumers to them.

“Even though the idea that home automation is a luxury persists, there is now the opportunity to invest in and experience the comforts that it brings. The introduction of various technologies, especially the kind that GM Modular have to offer, have brought these consumers to the market.” he tells us implying that once driven by UHNIs, HNIs and architects, the market has now opened its doors to a plethora of consumers.

“We have a dealer driven market where you can go to a counter in the market and get a regular normal switch vs a regular normal smart switch. Consequently, the consumer mindset has changed, and the consumer base has grown dramatically,” he explains.

Bommakanti points out, “I think that it’s the IoT awareness that’s driving growth. However, we are still evolving and are not yet fully aware of the future advantages of this. While there are numerous companies selling home automation products, no company is making IoT affordable.”

He claims that his company can automate a complete 2BHK home within Rs 7,000, which is definitely easy on the pocket.

Scaling the economy is challenging

While the market holds great promise, it also faces several challenges that require careful navigation and innovation to overcome.

To start with, the lack of understanding about home automation amongst the general public poses a challenge. People are still reluctant to adopt new things, resulting in the slow adoption rate in this sector.

Desai comments, “Scaling the economy is the biggest challenge, because it is not even justified today to have those kinds of numbers. When we look at the regular normal switch and accessories market vis-a-vis the retrofit market, it is a very, very small number. The second challenge that we face is explaining the benefits of home automation to the end customer.”

Garg of Dooya feels that it is important to increase the volume in this market, but the middleman driven market is hampering it. “It is another challenge. We are importers and we are unable to factor in our clients’ price points because we are not directly connected to them,” he says.

“The distribution route siphons off tremendous margins. For example, if a motor costs Rs 5,000, they would sell it for Rs 20,000. Therefore, the main reason behind customers being unable to benefit from smart homes is solely due to the distribution channel. If we can reach our clients directly or if the distributors cut their margins, we can significantly boost the volume in this industry,” he adds.

Market is fragmented

According to the stakeholders, this market has just started to flourish but it is still in its early stages and there is a lot that still needs to be done. While there is no dearth of products and solutions from manufacturers in this sector, it is leading to compatibility issues and fragmentation.

Earlier, India used to import the components of this industry but over the last few years, the scenario has changed. “They came from China or Taiwan. But now 80 per cent of the components or devices are manufactured in India. That is good news for us. But we still have a long way to go,” says Bommakanti.

Desai says, “We are at the transition stage now. While it is a fact that the manufacturers are still importing from China (semiconductors), the government and India Inc are working on it. We cannot overcome these problems until India becomes self-sufficient in terms of manufacturing everything, which may happen soon.”

He points out that some industry participants have taken the initiative to define the industry and bring up its standards.

“If you go shopping for a home automation solution, you can wind up buying a curtain or a fan with a remote. Some stakeholders refer to it as automation, but it’s not. To call oneself an automation player, you must have some form of fundamental service. Minimum fundamental production norms. There should be some standards, for example, we have the RERA for real estate, which validates property,” he says.

“I feel that the market lacks guidelines and laws. Also, the market is quite fragmented, though it is evolving. Many people have just jumped on the band wagon because it is a lucrative field. But there is no government agency or an association to govern this sector,” Desai adds.

Integration and interoperability between different devices and platforms can be complex, making it challenging for consumers to create a seamless and unified smart home experience. Standardization efforts are necessary to address this challenge.

“We have a talent shortage problem. This market has started to evolve, and we need a skilled workforce to innovate in this space, which can handle the challenges on ground zero and enhance the user experience,” says Goyal.

However, on the bright side, almost each day, new home automation solutions are debuting in the market, which are solving many problems and making daily routines more convenient for people. Also, with the advent of 5G, the scenario is looking even better for the smart home industry in India.