As the global financial services industry continues its journey of digital transformation, Global Capability Centres (GCCs) in the BFSI (Banking, Financial Services, and Insurance) sector are playing an increasingly critical role. India, already a hub for global outsourcing and innovation, is now home to over 1,500 GCCs, employing more than two million professionals. These centres are not just cost-saving units; they are innovation hubs driving business value. Delving into it further, we understand how talent is evolving in BFSI GCCs in India, exploring skill demands, recruitment strategies, hybrid work models, and the integration of advanced technologies.

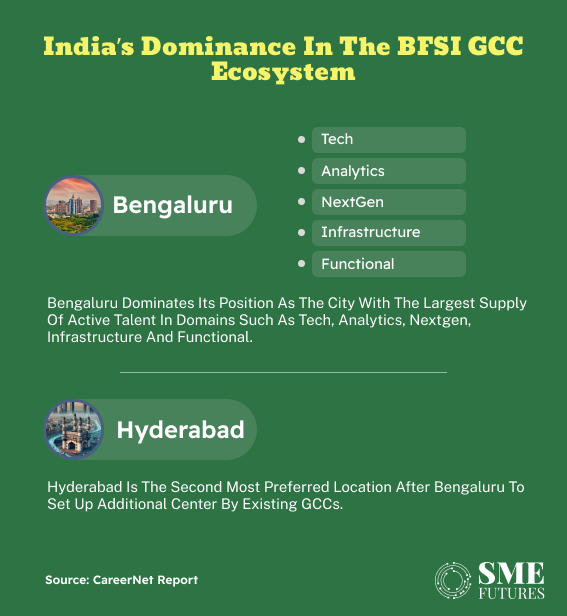

India’s dominance in the BFSI GCC ecosystem

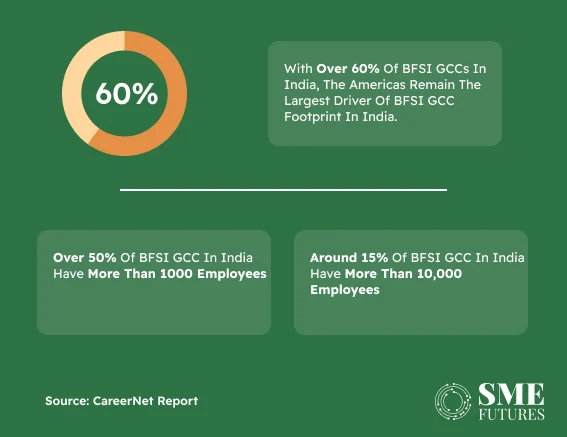

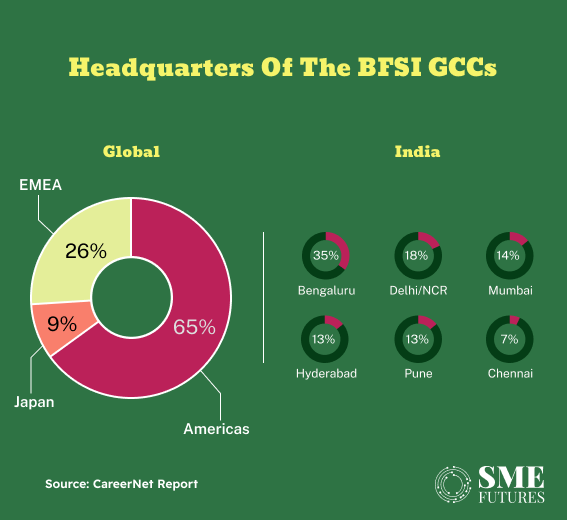

The BFSI GCC footprint in India is significant, with cities like Bengaluru, Hyderabad, and Pune leading the way. According to the Careernet report, Bengaluru hosts 35 per cent of BFSI GCCs, with Hyderabad emerging as a close contender. Hyderabad, in particular, has witnessed a surge in preference as a hub for both new centres and employee relocation. “Hyderabad offers a supportive business environment and a talent pool that is second only to Bengaluru,” the report notes.

Interestingly, these cities are not just centres for employment but innovation hubs where the convergence of technology and financial services is redefining traditional models. With 60 per cent of BFSI GCCs driven by operations from the Americas, the sector’s global interconnectedness further highlights India’s strategic importance.

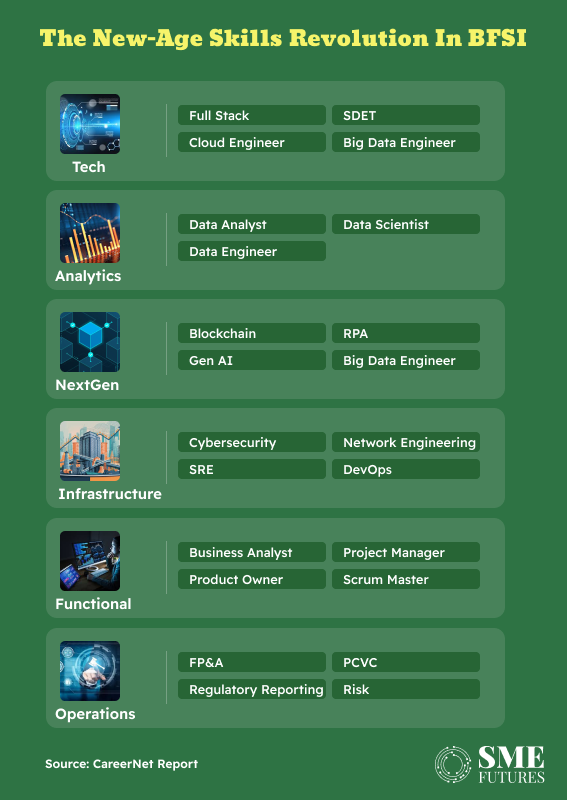

The new-age skills revolution in BFSI

The demand for skills in BFSI GCCs has shifted dramatically, moving beyond traditional roles to embrace technology and innovation.

“Today, the workforce must excel in data analytics, AI/ML, cybersecurity, and cloud computing,” explains Sachin Alug, CEO, NLB Services.

He adds, “Equally important is cross-functional collaboration and adaptability, as digital transformation thrives on interconnected teams.” These skill sets align with findings from the Careernet report, which reveals that 34 per cent of job seekers are focused on tech roles, followed by functional and infrastructure domains at 19 per cent each.

Anand Menezes, Senior Vice President at Maveric Systems, emphasises, “Beyond technical skills, GCCs must evolve into vibrant hubs of innovation, focusing on tailored solutions that drive tangible business outcomes.” This call for innovation highlights the need for a workforce that not only executes tasks but reimagines processes and develops competitive strategies.

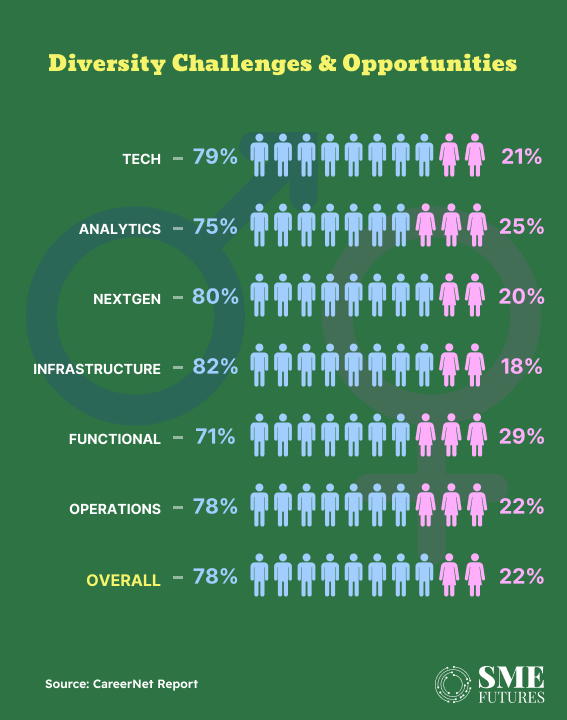

Diversity challenges and opportunities

The BFSI sector faces a pronounced gender disparity, with women constituting just 22 per cent of the active talent pool.

“Diversity is not just about numbers; it’s about creating an inclusive culture where diverse perspectives drive better outcomes,” says Vijayaraj Palaniraj, Senior Manager at EQ India.

Vijay’s insights align with the broader challenge of addressing diversity across geographies and roles, ensuring inclusivity in decision-making and innovation processes.

To bridge this gap, organisations are increasingly adopting diversity hiring initiatives and leadership development programmes aimed at underrepresented groups. While progress is gradual, the focus on inclusivity is becoming an integral part of the talent agenda for GCCs.

Recruitment strategies

Recruitment in the BFSI sector must adapt to rapidly changing technologies and regulatory landscapes. Vijay, emphasising the importance of balancing internal mobility with external hiring, says, “We provide ample opportunities for colleagues within EQ to grow, while also infusing our workforce with fresh talent from the market.” This dual approach ensures not only skill diversification but also employee retention.

Campus hiring and targeted leadership development programmes are gaining traction as organisations look to build a pipeline of future-ready talent. Programmes that emphasise regulatory knowledge, risk management, and compliance are particularly valuable in a sector characterised by stringent oversight.

The hybrid work revolution

Hybrid work models have become the norm rather than the exception, offering flexibility and efficiency. The Careernet report highlights that cities like Bengaluru and Hyderabad remain top choices for relocation, but hybrid models allow organisations to tap into talent across geographies.

“Establishing mutual trust is the foundation of successful hybrid work cultures,” notes Sachin Alug. He emphasises the importance of clear communication and the use of reliable tools like project management software to maintain alignment.

Anand Menezes agrees, saying, “Investing in technology and fostering a culture of continuous learning are key to sustaining productivity in hybrid setups.” These insights underline the shift in workplace dynamics, where collaboration and innovation transcend physical boundaries.

The role of advanced technologies

ERP systems and process automation have become essential tools for BFSI GCCs. “ERP integrates functions like HR, finance, and supply chain, providing a single source of truth,” Alug elaborates. This streamlining not only enhances decision-making but also enables better resource allocation. Process automation reduces manual errors and allows employees to focus on higher-value tasks.

The digital onboarding process is also undergoing a transformation.

Pawan Yadav, Product Head at Jukshio, highlighting the role of AI-driven identity verification in enhancing security and compliance, says, “AI models can detect fraudulent behaviours in real-time, ensuring that onboarding processes are both efficient and secure.” This dual focus on efficiency and security is reshaping how financial institutions interact with their customers.

Upskilling

Upskilling is no longer optional; it is a strategic imperative. Organisations are increasingly investing in mentorship programmes, hackathons, and virtual training platforms to keep their workforce ahead of the curve. “A culture of knowledge sharing and continuous learning benefits organisations through increased productivity and innovation,” Alug contends.

Anand Menezes, underlining a two-pronged strategy for upskilling, says, “Invest in comprehensive programmes for the existing workforce and forge partnerships with universities to cultivate fresh talent pipelines.” This twin approach ensures that GCCs are equipped to handle current demands while preparing for future challenges.

AI and automation

Artificial Intelligence (AI) is emerging as a cornerstone of innovation in BFSI GCCs. “AI-driven automation has significantly reduced manual intervention in onboarding processes, making them faster and more reliable,” notes Pawan Yadav. This technology is not just about efficiency; it’s about creating personalised, secure, and intuitive customer experiences.

With fraud prevention becoming a critical area, AI-powered models are detecting anomalies and preventing threats like deepfakes. The Identity Fraud Report reveals a staggering 3,000% rise in deepfake attempts, highlighting the urgent need for advanced solutions. “Biometric authentication and machine learning are essential for safeguarding businesses and customers against sophisticated attacks,” Yadav asserts.

The future of BFSI GCCs: Strategic focus areas

Looking ahead, BFSI GCCs must navigate a complex landscape of technological advancements, regulatory changes, and evolving customer expectations. Key focus areas include:

Innovation Hubs: Transforming GCCs into centres of innovation that drive business value.

Workforce Diversity: Building inclusive cultures that leverage diverse perspectives for better outcomes.

Sustainability: Integrating sustainable practices into operations and technology development.

“Organisations must blend seasoned expertise with fresh talent to stay ahead of the curve,” says Anand Menezes. By focusing on adaptability, collaboration, and innovation, BFSI GCCs can not only survive but thrive in the ever-changing global landscape.

What lies ahead

The BFSI GCC sector is at a crossroads, where the convergence of technology, talent, and innovation is redefining the rules of the game. From embracing digital transformation to fostering inclusive cultures and leveraging hybrid work models, the path forward is one of resilience and foresight.

As leaders across the industry emphasise, the future of BFSI GCCs lies in their ability to adapt, innovate, and build a workforce that is not just skilled but transformative. With the right strategies, India’s BFSI GCCs are poised to remain at the forefront of global financial services for years to come.