“Right now, the major issue that we are dealing with is of delayed payments. This pinches us financially,” says Rajan Behal, Vice President, Banarasi Vastra Udyog Association, a prominent member of the Banaras silk industry.

“You will not believe me if I say that many of us (stakeholders) till today, haven’t received many outstanding payments since the pandemic. This is one of the impediments that the MSMEs are facing here,” he further points out.

Not only businessmen like Behal, but there are lakhs of similar MSMEs which are facing delayed payment issues.

Delayed payments are one of the most severe problems that are hindering the growth of MSMEs which contribute almost 30 per cent to the economy of the country. A lack of timely payments results in MSMEs going into debt, which interrupts their growth and expansion.

A big conundrum

Earlier this year, the Global Alliance for Mass Entrepreneurship (GAME) estimated that the problem of delayed payments to MSMEs is in the magnitude of Rs. 10.7 lakh crores, with 80 per cent of this being attributable to payment delays to micro and small enterprises (MSEs), totalling up to Rs 8.55 lakh crores.

Also Read: Is the future of trade secure with new Foreign Trade Policy?

The problem of delayed payments is exacerbated by the lack of credit, specifically the working capital facilities that are available to these businesses.

Reports such as the IFC’s 2018 Financing India’s MSMEs estimate that the total addressable debt requirement of micro and small enterprises was Rs 24 lakh crores in 2018, with an estimated 70 per cent being attributable to the elevated working capital needs of these businesses.

“This is an issue that can only be tackled over time by maintaining a constant pressure. It is also an issue that remains to be resolved not only in India, but in several countries across the globe,” comments Dr V Anantha Nageswaran, Chief Economic Advisor to the government in a statement.

He hopes that over time, through some of the legislative and budgetary announcements, we can slowly bring about a mindset shift, not just in the private sector, but also in the public sector. And then, mechanisms and artificial interventions will no longer be necessary when the prompt payment culture becomes entrenched within the MSME ecosystem as an integral part of normal large enterprise behaviour.

Why does it never end?

Legally, delayed payments occur when buyers delay payables to their micro & small enterprise partners.

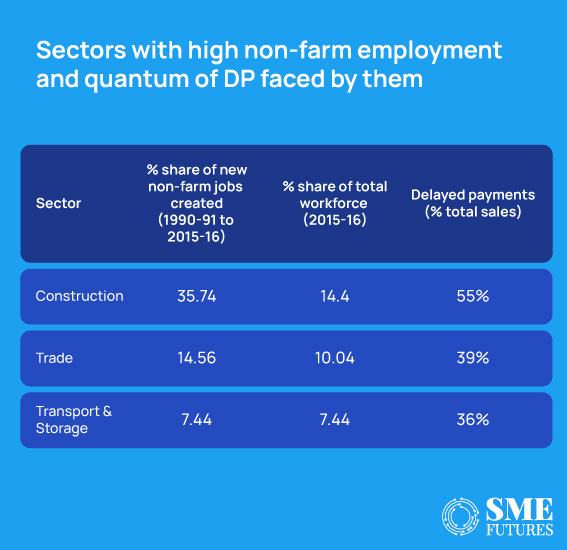

One independent study suggests that sectors such as construction, trade, and transportation had the largest share in the total number of new jobs created between 1990-91 and 2015-16. However, they also faced the most payment delays.

Also Read: SME loan delinquencies to increase for Indian finance companies: Moody’s

According to a report by LEAD (Leveraging Evidence for Access and Development) at Krea University, 53 per cent of the firms in their sample laid off their employees, and more than 50 per cent of the firms in the sample experienced payment delays or received no payments between June 2020 and July 2021. While this could be a one-time occurrence caused by the COVID-19 pandemic, the delayed payment is a problem which is way more ancient.

The magnitude of the gap created by delayed payments begs the question – Why this is a challenge?

The answer is always the same-Money or the lack of it.

The challenges are particularly at two levels. The first one is related to accessing working capital or the working capital gap. And the second one is the lack of awareness around dispute mechanisms for the redressal of delayed payments.

Alexander Kemper, Founder and CEO, C2FO, a global platform for working capital points out, “Delayed payments and the lack of formal financing can adversely impact a nation’s potential to create jobs. While struggling to cope with payment delays, business owners are also under pressure due to long winded credit evaluation criteria and processes that limit their access to loans.”

If you look at the problem closely, it’s a vicious circle—where delayed payments cause lack of capital and vice versa.

On the other hand, despite a slew of financial measures from the government, private banks and fintechs; it seems like the challenges for working capital never end. According to the Global Alliance of Mass Entrepreneurship and C2FO report on delayed payments, the major reasons behind the working capital demand are long payment cycles and significantly delayed payments.

Also Read: Crypto Assets require immediate attention from G20, says FM

“The banking sector is yet to view MSMEs as a major client. This is clearly visible by the extent of the overall credit facilitated to them. RBI has mandated under the Priority Sector Lending norms that scheduled commercial banks (SCB) extend a minimum of 7.50 per cent of the bank’s credit (Adjusted Net Bank Credit) to micro-enterprises alone. The data on credit extended by the SCB to the non-food segment reveals that their credit to the massive 6.30 crore MSME segment is only Rs. 17.2 lakh crores which is 14.5 per cent of the total non-food segment,” the report mentions.

“Uninterrupted cash flow is a pre-requisite,” says Ravi Venkatesan, Founder, Global Alliance for Mass Entrepreneurship (GAME).

“Most MSMEs grapple with a dearth of financial assistance, a lack of mentoring support to scale their businesses, and technological obsolescence. Enterprises can become efficient and create more jobs if they have access to markets, finance & technology, and a strategy to become more competitive,” he adds.

Barriers in raising disputes against delayed payments

To address the issue, the MSMED Act, 2006 establishes a legal guardrail of 45 days within which payments should be made to MSMEs.

The FM has said that the expense deduction claims would be allowed only when they are actually paid. It will be allowed on an accrual basis only if the payment is within the allotted time period. This has been introduced within the ambit of Section 43B of the Act.

And platforms such as the MSME Samadhaan extend the mandate of the MSMED Act’s 45-day limit by providing a mechanism for MSMEs to raise disputes on delayed payments.

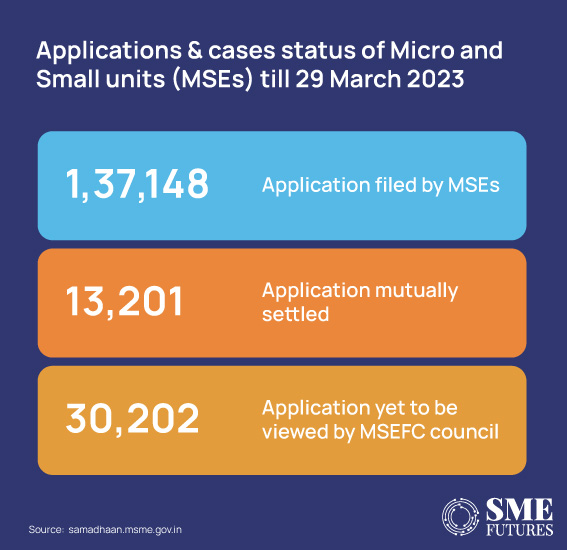

However, the uptake of such solutions is abysmal since less than 1 per cent of India’s registered MSMEs have raised a complaint through Samadhaan.

The major barrier behind this is the lack of awareness around recourse mechanisms. The GAME report reveals that 30 per cent of the entrepreneurs who participated in the survey didn’t even know about MSME Samadhaan.

Also Read: North East to have Entrepreneurship Development Centres in higher education institutions

Those who know about the portal feel that it is slow and cumbersome. This is the second barrier which stops MSME businesses from raising complaints.

The GAME report observes that 1.28 lakh applications were submitted (at the time of research). Of these, 26.2 per cent were either mutually settled or disposed of by the MSEFC, while a staggering 25.7 per cent have yet to be viewed by the council, and 24.9 per cent are still under consideration, highlighting the fact that case resolution has been slow and insufficient.

Thirdly, MSME owners avoid legal action because it is costly and time consuming and most businesses already operate on razor-thin margins. The opportunity cost of taking legal action against late payments or non-payment of dues is frequently greater than the cost of not acting.

This is especially true when large buyers with legal teams delay payments, burdening MSMEs with mountains of paperwork. Also, a lack of documentation causes issues when MSMEs want to file a case against an errant buyer.

Also Read: India’s mobile phone exports surpass 90,000 Crores in FY 2022-23: ICEA

Furthermore, recourse mechanisms are frequently not used due to the buyer’s fear of losing future orders. MSMEs rely on repeat orders from their existing customers, and finding new customers is daunting. Entrepreneurs feel that filing a case will almost certainly result in the buyer not placing another order with them. The fear of losing future orders also prevents MSMEs from utilising institutional mechanisms.

“We know about it, but I feel it’s a waste of time. We are in the textile business and supply readymade kid’s garments to wholesalers. It would be a daunting prospect for us if we had to file a complaint every time there is a payment delay,” says a manufacturer on condition of anonymity.

So, what can be the solutions

Increasing financial inclusion by providing multiple options to MSMEs to meet their working capital needs is at the heart of all the proposed solutions to the delayed payments problem.

These options require multifaceted support, ranging from government policy to improved financial product delivery by the public and private sectors, with a strong emphasis on data.

The GAME report on delayed payments proposes a few viable solutions to this problem.

- Strengthen cash flow- It could be achieved by providing credit guarantee. The government recently extended the CGTMSE scheme. Another program that can provide support in this direction is the RAMP scheme.

- Create real time credit scores for new to credit customers- One of the biggest challenges for an MSME while accessing credit is their lack of a credit or CIBIL score. Here, MSMEs can use the FIT Score, which will enable banks to review them while making their lending decisions. Moreover, creating a Public Credit Registry (PCR) for which the draft guidelines have been recently circulated, may be an even more powerful tool to address this gap.

- Incentivising corporate buyers to support their MSME partners- India can benefit from programs such as the Prompt Payment Code on the lines of the one which is in effect in the UK. Furthermore, sellers can include bank account/beneficiary info on their e-invoices so that the buyers have a unique virtual account into which the payments will be received, and the buyer can commit to making these payments at the invoice level.

This would address the concerns about repayment. The commercial benefits offered by the supplier or the bank to the buyer may be needed to bring about this change management at scale.

- Integrate the TReDS- The TReDS platform can be a gamechanger for the MSMEs. Its integration with GST e-invoicing can bring about an ease in the settling of bills.

A C2FO study of 15 large Indian corporations found an 80-90 per cent match between the data available in the GST e-invoicing portal and the data in the corporate buyers’ ERP systems. Furthermore, once the invoice information is available on the TReDS, the Buyer’s Input Tax Credit reports can be used to verify the authenticity of an invoice and use it as a “deemed” acceptance of the bill. Factoring transactions could then be taken up with greater ease.

Also Read: UP govt exempts 100% stamp duty for women entrepreneurs

While the TReDS holds much promise, the volumes have been slow to pick up.

- Simplifying dispute resolution- One way to simplify the mechanism is to leverage GST data to identify defaulters.

The availability of the invoice level info in the GSTN, combined with the reporting of invoices against which buyers have claimed the ITC, is a powerful tool. It can be used to identify where the buyers are benefiting from the ITC while not making payments to suppliers or acknowledging supplier invoices on the TReDS.

Furthermore, the case disposal process to increase the Micro and Small Enterprise Facilitation Council’s (MSEFCs) capacity and the slow rate of case resolutions has hampered the successful adoption of MSME Samadhaan as an ideal solution for delayed payments. It can be resolved by allowing the Online Dispute Resolution (ODR) providers to join the MSEFC.

Allowing the ODRs in would increase the MSEFC’s capacity by providing technological solutions such as video conferencing, e-signature, and mediation support, allowing for faster case resolutions.

- Redesign existing processes- ODRs can strengthen the MSEFC’s capacity by involving professionals such as arbitrators and mediators in the case disposal process, who can assist the MSEFC members in ensuring timely case resolutions.

According to GAME’s 2022 report on delayed payments, the issue of delayed payments for MSMEs is multifaceted, much like the sector itself. Because of the problem’s multifaceted nature and severity, all the stakeholders in the ecosystem, including but not limited to the union and state governments, the account aggregators, the banks, and the NBFCs, must work together to solve it.