Finance Minister Nirmala Sitharaman unveiled the first paperless union budget 2021-22 today. The budget vows to boost income of Indians and their purchasing power in a bid to revive domestic economic growth. Prime Minister Narendra Modi lauded this budget and said that the budget shows India’s self-reliance in unprecedented circumstances.

This budget gave major emphasis to healthcare which includes vaccination drive this year. FM also announced host of measures on disinvestments, extension in tax holiday for startups, and scrapping of IT for senior citizens. Although taxation slabs remained same but the taxation procedure has been altered. The changes in it include hikes in customs duty to benefit Make in India campaign.

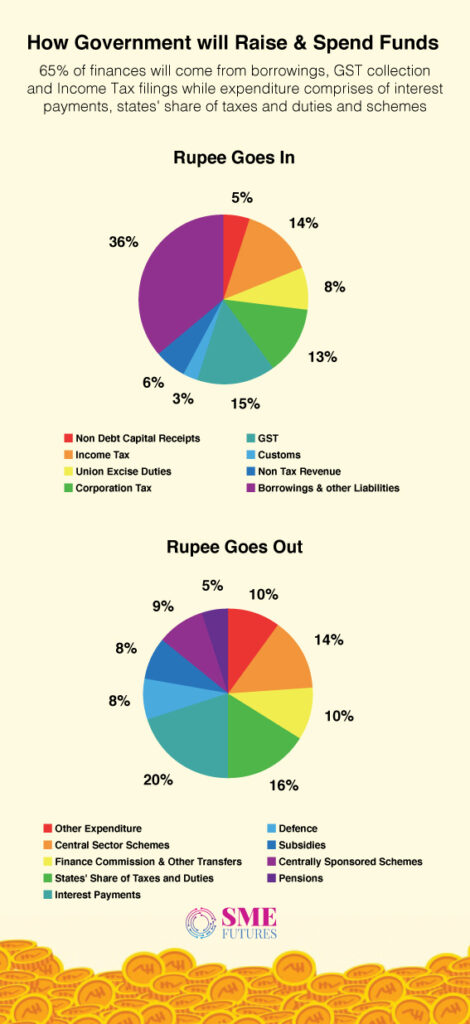

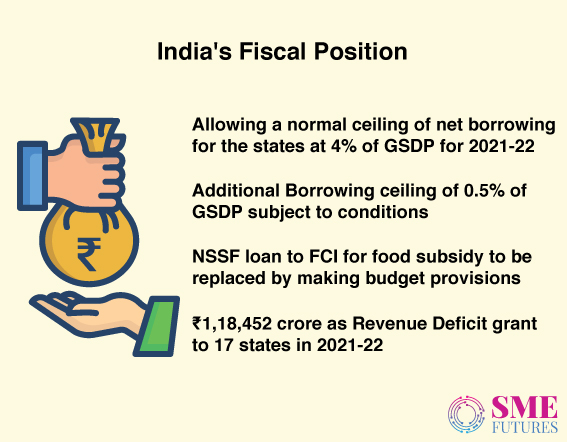

Some measures to relax NPAs and numerous infrastructure pledges were also announced for poll-bound states. According to the FM, fiscal deficit for this year stands at 9.5 per cent of the GDP, and is estimated to be 6.8 per cent in 2021-22. Meanwhile, experts are of opinion that the third budget of the current Finance Minister acknowledged spending challenges while addressing the demands of India Inc.

Kaushal Agarwal, Chairman, The Guardians Real Estate Advisory adjudges this budget as a pragmatic and visionary. According to him, “The estimated, gradual reduction in the fiscal deficit from 9.5 per cent to less than 4.5 per cent by 2024-25 will help in boosting consumption in the economy.”

Commenting about the boost to infrastructure sector, he says that the government’s big bet on infrastructure is bound to pay off in the long-term and will also catapult desired growth for real-estate and the economy.

“The NPAs of PSU banks has seen an encouraging reduction from 8.96 to 6.8 trillion by the end of fiscal 2020. The setting up of ARC and AMC for banks troubled with bad loans and NPAs alongside the further re-capitalisation of Rs.20,000 crores will help in improving the lending capacity of the banking and financial sector,” he adds.

The government’s decision to extend tax holiday for affordable housing projects by another year is a step in the right direction to realise the PM’s dream of Housing for All by 2022, he says. On the same note, Dr Samantak Das, Chief Economist and Head of Research, JLL India calls this budget as a pro-infrastructure and pro-investment.

He opines, “Given that the economy is well on its path to recovery, Union Budget 2021 has focused on enhancing expenditure while keeping the fiscal targets away for the short term. This budget focuses on augmenting infrastructure with a special focus on expediting urban infrastructure projects which will act as a strong catalyst in driving real estate in urban areas. There is also a consistent thrust on the agriculture sector and is likely to result in higher incomes and drive consumption.”

The proposed easing of restrictions on leverage by InvITs/REITs will attract more REITs listings and thus higher investments into real estate. The announced monetization of surplus land of government and government bodies is also a welcome move. However, its implementation still needs to be monitored.

While there are no significant new policy announcements and programmes pertaining to real estate, its commitment towards boosting affordable housing remains intact. He says, “The budget has extended the benefit of additional interest deduction on home loans for first-time homebuyers in the affordable segment. Further, there is a time extension to claim the tax holiday on profits from affordable housing projects until March 2022.

The government has also continued to promote affordable rental housing schemes by providing tax exemption for notified rental housing projects. This will further accelerate the pace of investments in this scheme and is likely to fall in line with achieving the overall objective of Housing for All. Samir Sathe, Executive Vice President, Wadhwani Advantage at Wadhwani Foundation, says the current budget has a thrust on globalising supply chains in manufacturing.

“Altogether budget is a welcome step for SMEs, albeit indirectly and with a lag. But the SMEs will need to experience on benefits of such investments only in the latter part of 2021 or 2022. I am hopeful and happy about the changes on the healthcare. The most remarkable is the Foundation and Advantage program. The key is in its implementation,” tells Sathe.

To enhance the enterprise culture, FM has proposed to revise the definition for small companies Under the Companies Act 2013. This will allow companies with paid up capital not exceeding Rs 2 crores to come under the definition of small companies from the earlier limit of Rs 50 lakhs. Under the revision, turnover limit criteria will then extend from Rs 2 crores to Rs 20 crores. This revision is expected to benefit more than 2 lakh companies.

“The act of increasing thresholds of the small company definitions is symbolic not fundamentally disruptive. This will make more companies beneficiaries of the SoPs and concessions that the government has in mind with a view to protect them. This does not change fundamental competitiveness of the small companies unless they build management capabilities to make the best use of concessions,” .

add, Samir Sathe, Executive Vice President, Wadhwani Advantage

Meanwhile start-ups can take a sigh of relief because of relaxed taxation norms. This is with extended one year tax holiday. Roma Priya, Founder of Burgeon Law, boutique law firm opines that the startup sector has been grappling with the compliance burden challenges since some time now and we are happy to see that the government has addressed some of the challenges.

She says, “The Union Budget 2021 was awaited with many expectations and it seems to be relief oriented. The reduction of compliance burden on small businesses will further strengthen their threshold. The one-year tax-holiday policy could be helpful for startups that have been badly hit by the pandemic and need reduced interest rates to recover. Also, the move to incentivize the incorporation of OPCs is another step towards innovation and can increase the number of Aatmanirbhar Ventures across India.”

Kaveri Sachdev, Co-founder and CEO of My Pooja Box confesses that budget has given what was required as the start-up sector was badly affected as a result of pandemic. “The COVID-19 pandemic had ravaged all sectors, but it is the micro small and medium enterprises (MSME) sector that is said to have borne the maximum brunt of pandemic.”

She added, “Happy to see the tax holiday for start-ups being extended by a year. This will give major relief to start-ups across the country. This move is expected to improve the liquidity issues faced by such businesses. Similarly, more such incentives are required to be introduced by the government to boost employers as well as employees which can be done by providing more tax exemptions or deductions etc.”

Healthcare industry welcomes budget

Sitharaman has also proposed Rs 35,000 crore outlays for COVID-19 vaccines for the next fiscal. In addition to it, she has announced the rollout of pneumococcal vaccines across the country to help in saving over 50,000 deaths annually. Commenting on the budget, Dr. Shravan Subramanyam, Managing Director, Wipro GE Healthcare told that with 137 per cent increased budget allocation healthcare has taken center stage for the benefit of citizens of India.

“It is heartening to see government’s focus on health and wellness for an Atma Nirbhar Bharat. We applaud the new budget which takes a holistic view of healthcare to move towards Aatmanirbhar Bharat with an emphasis on preventive and curative healthcare, reducing the rural urban divide and capacity enhancement interventions across the value chain,” he adds.

Commenting on the budget, Nilesh Aggarwal Director & CEO, Medtalks.in says, “This has been one of the most anticipated budgets for the healthcare sector as we were recuperating from the biggest medical catastrophe of our lives until now. He says, “The government has made the right choices as far as the budget allocation for the healthcare sector is concerned. It has also taken right measures related to infrastructure and capacity development.”

Scheme will revitalise the power sector

In the arena of the power sector, FM has announced the launch of a scheme to reform power distribution sector comprising of Rs 3,05,984 crore. A framework will be formed to give consumers alternatives to choose from, the FM told in the budget. It points out that there is a monopoly of distribution companies and sector seeks competitiveness.

Ratul Puri, Chairman, Hindustan Power talking mostly on the announcements on the power sector says that the thrust of budget is on reviving the economy. It is positive and refreshing in its scope and scale. All the announcements are forward looking and will put India back on the growth trajectory.

He further adds, “The announcement of Rs 3.05 trillion packages for discoms is encouraging and will revitalise the ailing power distribution sector. Adding to it, government’s focus on improving financial health of state power utilities will ensure consumers getting more choices as it will promote competition, reliable power supplies, and will make the sector more attractive to foreign investors. Besides, it will give an overall boost to the industry.”

The budget has also given a boost to the non-conventional energy sector by allocating Rs 1,000 crore to solar energy corporations and Rs 1,500 to renewable energy development agencies. According to Puri, it is a great move.

Financial inclusion is the key

One of the key highlights of the budget is setting-up of the development finance institution (DFI) for infrastructure financing and institutional framework to purchase corporate bonds.

“This would solve the issue of liquidity for the infrastructure sector and corporate bond market. Also, with the path-breaking initiative of forming Asset Reconstruction Company (ARC) and asset management company (AMC) for NPA consolidation, banks have been allowed to streamline their focus on the much-needed growth,” comments Shachindra Nath, Executive Chairman & Managing Director, U GRO Capital.

Along with this, government has also reduced the threshold for NBFCs to initiate recovery under the SARFAESI Act, 2002. Opining on this, Nath says, “This is an effective step towards reinstating credit discipline and will increase the penetration of credit to small businesses in the long-term. The government has also doubled its allocation towards MSMEs which would greatly support their revival and the eventual growth,’ comments Nath.

Budget to boost logistics sector

Logistics players are also lauding the announcement of massive investment of Rs. 2000 crore on seven port projects under PPP mode in the union budget.

“This will boost the logistics sector and will enable overall economic growth. Also, under the Recycling Act, 2019, a recycling capacity of around 4.5 million Light Displacement Tonne (LDT) will be doubled by 2024,”.

says Prem Kishan Dass Gupta, Chairman & Managing Director, Gateway Distriparks Ltd

With road and rail connectivity being an indispensable factor of the economic development, an allocation of Rs 1,10,055 crore for railways has been made where the eastern and western dedicated freight corridors will be commissioned by June 2022.

Commenting on the announcement, Gupta says, “This will help in bringing down the logistics cost as well as ensure smooth connectivity between different points of country and ensure easy and faster freight movement. The Union Budget targets 100 percent electrification of broad-gauge railways to be achieved by 2023. This will increase efficiency, and will reduce dependence on conventional fuels.”

Measures to revive food retail

Lauding the multi-faceted announcement Nishanth Chandran, Founder & CEO of TenderCuts, feels that setting-up of fishing harbors will increase fishing trade among the local communities and will create growth of their profession. He tells, “This will help-in bringing in more skilled workers to meet the growing demand in the meat and seafood retail sector.”

“This will also help to boost procurement, facilitate ease of business, and will support meat and retail companies in building a robust logistics and supply chain infrastructure for smooth business operations. Provision of allied loans for agriculture would help in strengthening the poultry, meat and seafood sector”, he adds. Also, relaxations in time period for payment of taxes for the start-ups would help the company to reduce its financial burden. After the turbulent year of 2020, the reforms and measures announced would be a real boost for the start-ups.

Meanwhile, most of industry experts are of opinion that the Union Budget 2021 meets the demands for the revival of economy halfway as it is not very focused on the growth of consumer markets. Rajeev Karwal, Founder Chairman of Milagrow Robots says, “It was absolutely essential for an immediate impact.”

“There could have been more reductions in income tax rates, GST, duties, and excise rates. There are so many sectors which have suffered badly. There are a lot of businesses that are on a road to recovery. Tax cuts would have boosted the market growth. Once the fine print of the budget is read, one can react more. The CAPEX measures and other initiatives must be implemented fully to see a positive impact in the longer and medium term,” he concludes.