The recent boom in Small and Medium Enterprise (SME) Initial Public Offerings (IPOs) in India has stirred up excitement and created new opportunities. Investors are rushing to these IPOs, drawn by the chance of big profits and the appeal of supporting smaller companies with high growth potential. But this enthusiasm hides a more complex situation. The growing interest brings more risk, worries about market manipulation, and the need for tighter regulations.

The current rush: What’s behind it and why investors are interested

SME IPOs are booming thanks to a mix of government support, investor interest, and strong results across industries. Rajesh Singla, CEO and Founder, Planify, elaborates on this trend, saying, “We’ve seen that the current rise in SME IPOs is due to helpful government rules, more investor knowledge, new tech use, and the good performance of SMEs in many different fields.”

India’s SME sector drives the country’s economy, fuelling jobs, exports, and new ideas. Many small companies show the kind of financial success that investors find appealing. Singla says, “Government programmes like the Mudra Scheme, tax breaks, and the PLI (Production Linked Incentive) plans have set up a good climate for SMEs.”

Another thing to consider is the increasing interest from both everyday and big-money investors. Rich folks and smaller investors alike are seizing the opportunity to make big profits. The BSE SME IPO Index, for instance, has shown a whopping 195% yearly gain over the last 10 years. No wonder SME IPOs have turned into a must-have investment.

However, the potential rewards come with significant risks. SME IPOs are more volatile and have shorter track records. This makes them riskier investments compared to the IPOs of larger, more established companies. Krishna Patwari, who started Wealth Wisdom of India Pvt. Ltd, cautions, “SEBI has warned that these trends can create a false sense of high returns, pushing investors to buy at inflated prices, which raises red flags about market bubbles and risks to investors.”

Risks investors should watch out for

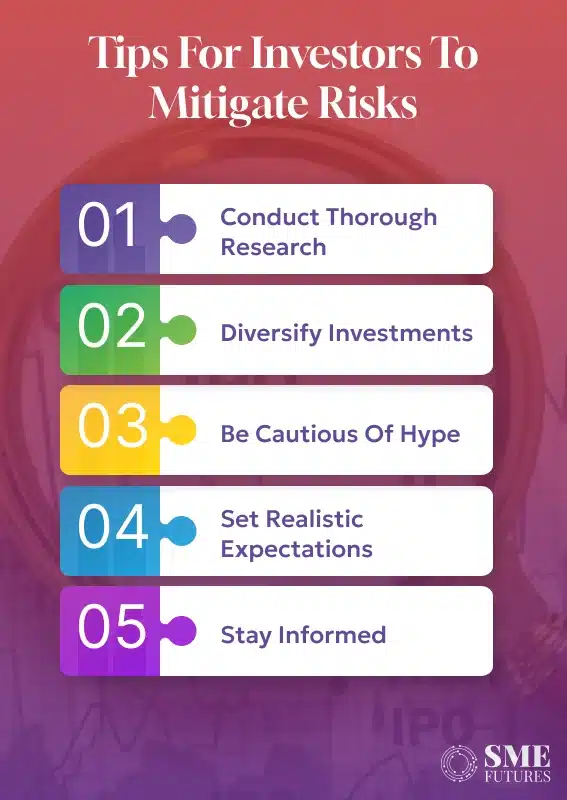

Even though SME IPOs promise huge profits, they come with special risks that investors should consider beforehand. Gaurav Goel, a business owner and a SEBI Registered Investment Adviser, has watched retail investors get caught up in the hype, sometimes to their disadvantage. “In recent years, we’ve seen people go crazy over SME IPOs, with investors often making choices based on grey market premiums instead of looking at the companies’ basic strengths. Some IPOs have had their values messed with, and there have been times when merchant bankers have teamed up with promoters to give shares to family members,” he says.

Besides the risk of shady practices, the stocks of small and medium-sized companies often have less trading activity, bigger purchase amounts, and a shorter history of results. These stocks can be dangerous for people who don’t know much about finance. “People who invest need to look at important numbers like how the price compares to earnings, how much return the company gets on its money, how much cash it brings in, and how trustworthy the owners are. If they can’t figure this out on their own, they should ask someone who knows about these things,” Goel emphasises.

Krishna Patwari seconds him, saying, “Retail investors should do their homework on the company’s business model and financial results as well as on the broader market trends. It’s crucial to not only spot growth chances but also the risks such as changes in regulations or economic slumps before investing one’s money.”

Strict regulations are essential in a scenario where unequal access to information still creates hurdles for retail investors. Unlike bigger IPOs where facts are easier to find, SME IPOs often lack full analyses, making it tough for the average investor to make smart choices.

SEBI’s role in protecting investors

As the dangers become clearer, the Securities and Exchange Board of India (SEBI) has started to tighten its rules. SEBI has set a 90 per cent price limit for the pre-opening session of SME IPOs to control the “craziness” in the market. But will this be enough?

Goel thinks SEBI’s actions are good, but they’re not enough. “The regulator needs to make the minimum IPO size Rs 50 crores and lower the smallest amount that retail investors can put in. This will help boost liquidity and make the market easier to get into. SEBI should also crack down harder on merchant bankers and make sure companies going public are more open about their business,” he asserts.

Narinder Wadhwa, Managing Director, SKI Capital, underlines that stronger rules on disclosures and closer checks of post-listing price changes could stop some of the market tricks now in use. “SEBI could think about changing the lock-in times for some types of investors after listing. This will help cut down on betting and protect the market,” he contends.

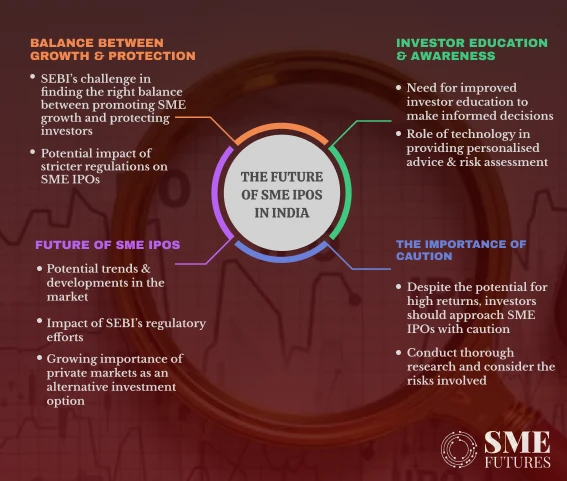

One of the main problems that SEBI faces is striking the right balance between shielding investors and helping the market grow. While tougher rules could make the market safer, they might also put off smaller companies from going public, which could slow down the growth of SMEs—a key part of India’s economy.

The evolution of investor behaviour

As rules get stricter, investor habits might change. Krishna Patwari thinks SEBI’s actions will make investors more careful, but this could also push them to check out other ways to invest. “As the rules for SME IPOs become tougher, we might see more investors moving towards private market investments like private equity and venture capital. These give chances for high growth but without as much public oversight,” he says.

Still, SMEs that decide to go public find that the IPO market gives them a special chance to make money and grow. Rajesh Singla stays hopeful about what’s next for SME IPOs in India. “If the basics stay strong, and businesses keep showing that they can grow, the SME IPO market looks good. It’s all about picking the right companies—those with honest leaders, good business plans, and big dreams for the future,” he avers.

Investor education: What’s missing

The experts in the industry agree that we need to educate investors better. As more people start investing, often without much knowledge about money, there’s a growing demand for easy-to-understand learning materials. Patwari stresses, “Industry pros need to work together to improve investor education. Rules should require simple educational resources, and schools should teach about money.”

Technology could also help close this knowledge gap. “Smart computer programmes that give personal advice and check risks could assist investors in making smarter choices,” he adds.

The road ahead

As the SME IPO market keeps changing, it will usher in new challenges and opportunities. The way in which the SME IPO market and the private unlisted space work together will be interesting to watch. Both offer room to grow, but the tough rules in the public market might push more companies and investors to choose private options.

SEBI’s ongoing work on adjusting the regulations will have a big impact on the future of SME IPOs in India. By keeping an eye on openness, protecting investors, and helping small and medium businesses grow, the market can keep doing well—giving chances to both companies and investors.

In all this excitement, being careful is still important. As Goel rightly avers, “People who invest need to check things out and not get carried away by all the market noise. There’s always a reason behind the craziness.”