Casual, colourful, chic or comfortable.

One can define footwear using many adjectives. And everyone has their own preferences. India especially, is known for the wide variety of footwear that can be found in its markets.

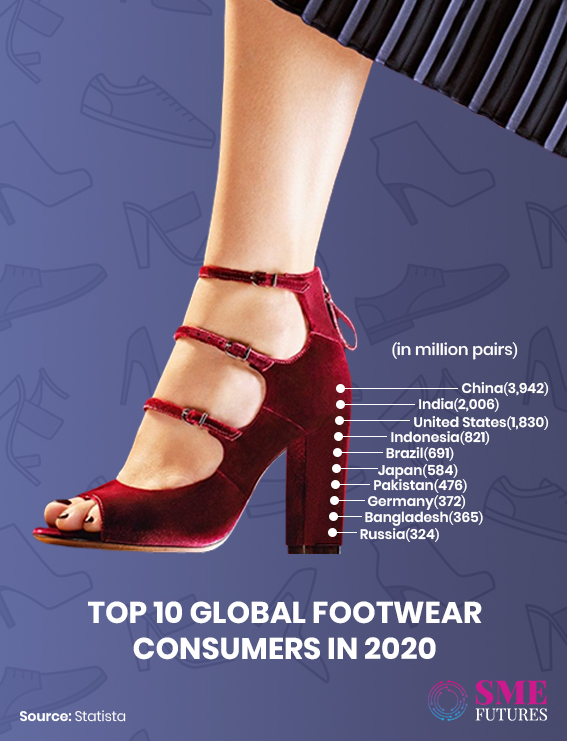

Over the years, India’s panache for footwear has evolved in many senses and is known worldwide. To begin with, being one of the largest markets for footwear, India comes second only to China in terms of footwear consumption.

Estimates curated by ICICI Securities say that in 2020, India consumed around 2.56 billion pairs. This was a surge of 4.5 per cent from 2015. Total footwear consumption is estimated to be at 2.9 billion pairs by 2025.

Whereas Statista says that by 2022, 95 per cent of sales will be attributable to non-luxury goods, as the rise of e-commerce contributes significantly to the purchase of footwear online.

Considering this context, the footwear sector is critical for India’s economy. Contributing 2 per cent to India’s economy, this sector employees over 2.5 million people and can further create two million jobs down the line. Meanwhile, a majority of the footwear manufactured in India is domestically consumed. The remaining are exported, as they are specifically meant for the American and European brands.

If we go by market forecast estimates, then market is growing significantly.

Its value is expected to grow at a CAGR of 15 to 17 per cent from Rs 920- 950 billion in 2022 to ~Rs 1,380- 1,450 billion in 2025.

Growth drivers

In brief, this growth has occurred on the back of rapid urbanisation and industrialisation. Nevertheless, we can’t ignore the exponential increase in the demand for footwear either, as consumerism is at its peak in both the online and offline worlds. Plus, consumer expenditure capacities are also driving this market’s growth.

“The pandemic has caused a change in the mindset of a lot of people,” opines Dr. Simran Mann Sachdeva, Founder and Director of KazarMax, a homegrown online footwear brand.

The brand has been growing well due to its online sales.

“The online footwear industry has continued to grow in spite of the raging pandemic. We have seen an increase in online sales over the past two years owing to a larger number of people that choose to shop online rather than visit a brick-and-mortar store. The physical stores in malls and shopping complexes, however, have seen huge losses. Overall, we have witnessed a positive growth in the athleisure footwear category for a brand like ours,” she adds.

Notably, this growth is also due to the increase in the Average Selling Price (ASP). The ASP in the fiscal year 2015 was Rs. 308 per pair and grew to Rs. 376 per pair in the fiscal year 2020. In the future, ASP is expected to grow at a CAGR of 5 -7 per cent and is expected to reach Rs. 490-515 in the fiscal year 2025.

What’s the ground reality?

Having said that, just to make sure that the market analysis makes more sense, we spoke to some industry insiders. Some of them didn’t respond, while some of those who did prefer to remain anonymous.

However, the stakeholders unanimously feel that there are more obstacles than growth opportunities for the footwear industry.

“Maybe the positive growth that these industry reports are calculating is possible. But lot of us in the fraternity are witnessing challenges,” a small manufacturer from Madhya Pradesh says.

According to them there are two sides to every story. And the manufacturers are in a grey area right now, the reasons for which are many.

GST is the troublemaker

Since last year, the GST has been the number one troublemaker for the footwear sector.

To give a brief context, last year on December 31st, the GST council decided to hike the tax on footwear priced up to Rs 1,000 to 12 per cent from the prevailing 5 per cent. This step was meant to make the tax slab level, as the GST on footwear valued above a thousand rupees was 12 per cent.

However, the sector reacted very negatively to this decision.

Because, firstly, this increase made footwear more costly for the consumers. Secondly, the ease of doing business went haywire for the manufacturers. Not only that, but the whole value chain has been disrupted because of this decision by the government. They all unanimously say, “It’s a double whammy.”

For instance, for the retailers it means that more tax has to be paid to the government.

A local shop owner, N Bhati from Greater Noida says, “Business was zero during the pandemic. In addition, due to the rise in online sales, the sales have been impacted to some extent, especially for shop owners like us, who do not have big shops in the market. On top of that, we have to sell our remaining stock at the new rates. It means that we are paying up for the 7 per cent gap, according to the new regime. Tell me what to do.”

The increase in GST is taking a huge toll on the manufacturing industry as well.

A Delhi based manufacturer, Pankaj Dhamija, Director at Weldon Shoes says that it has caused a lot of problems for the community. “Especially for the small-scale manufacturers,” he says.

“Survival chances have diminished for those small-scale factories, which have a margin of 5 to 12 per cent. With a 12 per cent GST levied on that, they make zero profit out of it,” he adds.

Old stocks, on the other hand, cannot be repriced and sold. The only alternative is to sell them at a loss. “However, the customer will continue to pay the same price inclusive of GST for the products that are already listed. At KazarMax, we choose to absorb the losses instead of increasing the sale price for the customer,” Sachdeva tells us.

Furthermore, an Agra manufacturer claims that imported Chinese footwear is exempt from the GST increase, causing the made in India shoes to lag behind them in the market.

The fraternity is demanding a reduction in the GST

The CAIT and IAF argue that nearly 85 per cent of the population of the country buys footwear that costs less than Rs 1,000 and therefore any increase in the GST tax rate will directly affect the consumers.

Footwear apex bodies, along with traders’ associations have been trying to persuade the government to reduce the GST rates to provide some relief to this sector’s stakeholders.

But it’s all going in vain.

Dhamija feels that it’s the failure of this sector’s lobbies, that they couldn’t state their case effectively like the textile bodies did when the government announced a rate hike in their GST.

“This is only due to a lack of sectoral collectives. When the government was taking these actions, the textile industry kept urging it to rationalise the GST for the sake of their industry. Ultimately, they managed to effectively convey their concerns to the government departments and the process was put on hold. If we could have taken up this matter aggressively rather than taking it easy, the result would have favoured us,” he asserts.

As the industry at large wants a reduction in the GST rates, Dhamija hopes that its various associations are able to put their case across more effectively this time, for the betterment of the entire sector.

Slowdown blues

The GST rates are only the tip of the iceberg when it comes to the challenges that are being faced by the footwear industry.

The past two years have seen unprecedented challenges being faced by the manufacturing industry. From the decreased raw material imports to the shortages in the labour force, the footwear industry has had to grapple with a multitude of problems.

Even if we they are in recovery mode at the moment, the experts in the field say that due to the pandemic, the sector’s health has been gradually dwindling and most of it is a major chain reaction.

“The Delhi cluster constitutes a significant portion of India’s footwear manufacturing space, accounting for 35-40 per cent of the total production. But this industry has been suffering for quite a long time,” asserts Dhamija.

To begin with, these manufacturers were subjected to the pandemic induced lockdowns. Then there is the GST, which is having a negative impact due to the compliance issues. Though, there was some respite in between, the sluggish demand and overproduction dealt another blow to the manufacturers.

“Most of us are now forced to sell our products at a loss or at the manufacturing price, just to get over with our stock. Furthermore, footwear manufacturing is a credit-based industry. Which implies that we work on the give and take principle. But when demand gets muted, the whole chain gets disrupted as the money gets stuck at various levels. This in turn affects our manufacturing and leads to revenue loss,” Dhamija explains.

The current unstable geo-political scenario has also not helped.

“The export market will definitely be adversely affected by the sanctions on Russia. The political unrest has plunged the manufacturing industry into a lot of uncertainty. Many export houses have had to shut shop due to mounting debt and dead stock,” elaborates Sachdeva.

“Agra exporters deal with European companies 95 per cent of the time. So, we are not exactly under the weather due to this conflict. The percentage is quite miniscule there and we have not been majorly affected due to the Russia-Ukraine conflict,” says the Agra manufacturer.

In fact, a majority of this industry’s stakeholders feel that the direct impact of this conflict on the footwear sector has been minimal. But most of the exporters are still cautious because Russia is a significant trading partner of India.

However, although the direct impact of the Russia-Ukraine conflict on the footwear industry has been minimal, there are a few indirect impacts of this conflict that need to be taken into account.

Inflation has hit hard

The news lately has been all about price inflation, supply chain issues, and rising labour costs. All of this is putting a lot of pressure on the Indian manufacturers and is reducing their profit margins. And the footwear manufacturers are no exception.

This also implies that the product and services prices have skyrocketed.

One of the many reasons for this is the spike in crude oil and global energy prices following the Russia-Ukraine conflict. According to a January 2022 PwC Pulse Survey, 68 per cent of manufacturers agree that inflation is likely to remain elevated at the end of 2022. The footwear manufacturers agree.

“High costs have ruined our manufacturing. From raw materials to input costs to GST. Everything is inflated,” says the anonymous source.

Weighing in, Sachdeva also asserts, “The cost of manufacturing has gone up due to the increased cost of raw materials by 30-40 per cent. Increased fuel costs have led to an increase in supply chain costs as well.”

Raw materials are pricey

Talking about the raw materials, an anonymous source, a manufacturer from Agra laments at the current scenario. “If the government could just make raw materials duty-free, that would be a huge relief for us. We don’t want anything else,” he says.

The Agra industry exports 95 per cent of the footwear made there; for the manufacture of which, they heavily depend on imported raw material i.e., leather. Which mostly comes from Italy, Spain, Turkey or Bangladesh. The high import duties make it more expensive, which in turn adds on to the final manufacturing price. This is forcing brands to shift away to other manufacturing regions such as Vietnam.

“There is a heavy import duty on leather, and most Agra manufacturers deal with crush leather. We have been urging the government to make it duty free, but it is not paying heed. Instead, they are planning to make wet blue leather duty free. Why are they not listening to us, when the Agra industry does 95 per cent exports and contributes majorly to the GDP of the country?” he questions.

Not just him, but the manufacturers from the Delhi cluster too are speaking up about the surge in the prices of raw materials by 25 to 30 per cent. The manufacturers are witnessing high input costs as most raw materials such rubber, plastic and other materials like the solutions used in manufacturing are basically petroleum products.

“Prices are skyrocketing. I haven’t seen such rapid price increases in the last 10 to 15 years. At the same time, raw materials are overpriced, due to the increase in GST and other factors, and we are forced to buy them. For example, pre lockdown, EVA compound was priced at Rs 200 + tax/ kg, but today its around Rs 350 + tax /kg. DVP, was at Rs 80 but now we are buying it at Rs 140. Similarly, packaging material costs have also increased, for example, what cost Rs 5 earlier now costs Rs 10. Furthermore, the raw materials are all petroleum based. With prices escalating day by day, the raw material costs are surging,” Dhamija tells us.

Mostly, footwear priced below Rs 1,000 includes footwear that has been made from rubber, ethylene vinyl acetate (EVA), polyvinyl chloride (PVC) and polyurethane.

The consumers have to bear the cost

However, because this industry is very competitive, the manufacturers can’t just simply raise the prices of their products. And as consumers place a high value on economic products, when the prices rise, they gravitate toward less expensive options.

This can be quite devastating for the small-scale manufacturing units.

Not only this, but the logistics costs have also added on extra woes for the manufacturers. The rise in fuel prices is a cost push factor as well. Dhamija says that it’s another pain point for everyone, as the rising fuel prices have shot up the logistics costs. “All these factors will collectively become pass down costs, implying that the consumers will have to bear the brunt of it all due to the hiked product prices,” he asserts.

And it’s already happening. “A pair of school shoes priced at Rs 85 are now going at Rs 120 to Rs 200 from the manufacturer to the wholesaler. The prices will escalate further from the wholesaler to the retailer level. Ultimately the consumers will have to pay the increased prices,” Dhamija further adds.

There is no PLI scheme for the footwear sector

This is another issue that this industry’s stakeholders have been vocal about.

Since the inception of the PLI scheme, there has been a long-standing demand from the industry for a PLI scheme for the footwear manufacturing sector. According to industry stakeholders, it will increase the productivity of the existing players and make India the most preferred destination for footwear exporters.

Furthermore, the PLI scheme will help with import substitution for input products like ornaments, zippers, soles, buckles, and embellishments. The stakeholders have been constantly questioning and urging the government to play fair and extend the benefits of the PLI scheme to the footwear sector as well.

“During manufacturing we use different types of fabric to make up a pair of footwear. Even then, the government has extended the PLI scheme for textile manufacturing, but not for us. It’s unfair,” says the Agra source.

Recently, the Council for Leather Exports (CLE) also urged the government to extend the production-linked incentive (PLI) scheme to this sector and consider the setting up of a leather park to boost manufacturing, export and job creation.

Leekha sought “the support of the government in achieving the envisaged targets by extending the PLI (scheme) to the leather sector and also considering a leather park scheme similar to the textile sector.” Having said that, as per the Council for Leather Exports (CLE), India’s leather and footwear exports stood at US$ 5.5 billion, which is expected to double by the end of 2025. The extension of the PLI scheme to this sector will increase its value and boost its growth.

The industry source from Agra says, “Also, it’s critical to reduce dependency on China for certain components and raw materials. For this, the component industry in India needs more working capital. Considering this, it’s high time that the government made some draft for the footwear segment to include it under the PLI umbrella.”

Good shoes can take you places

Even though there is no dearth of demand or supply, the current market scenario is quite dull.

Dealing with so many issues, and in survival mode, the stakeholders want to remain positive for the sake of their businesses. However, market researchers expect the footwear market to remain muted for some time. For instance, ICRA calibrated the revenues of domestic footwear entities at 10-15 per cent below the pre-COVID levels in FY2022.

So far, according to the agency, there was limited headroom for the reduction of fixed cost due to varied reasons. The higher raw material prices also impacted margins to an extent. Which is still going on. However, the analysts expect the operating margin to return to pre-COVID levels by Q2 FY2023 with improved scale. At the same time, the large, listed entities will remain strong.

But if we were to take cognizance of all the stakeholder’s concerns, we won’t be able to say the same about the small and medium footwear industries.