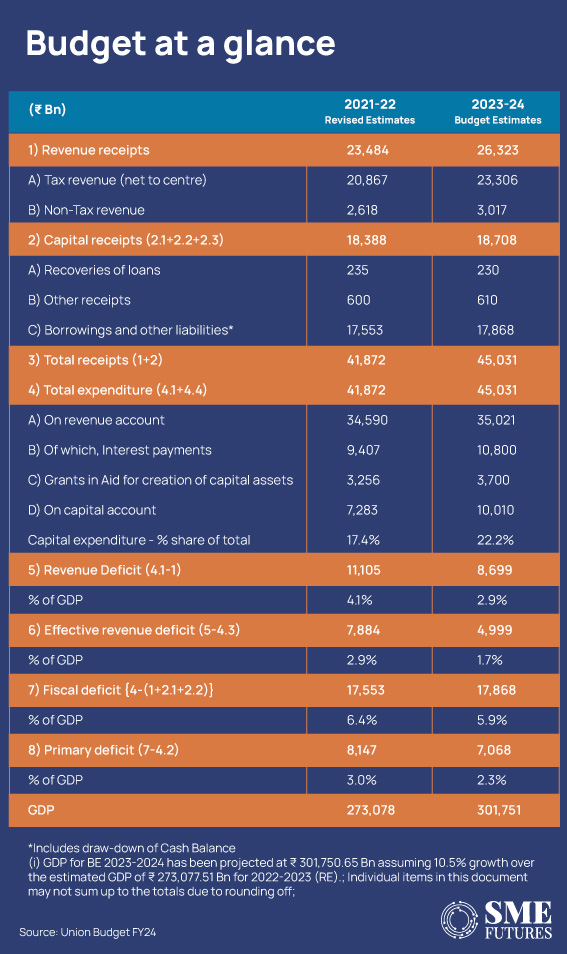

This year, the Union Budget 2023-24 is worth Rs 45,03,097 crores, up from Rs 41,87,232 crores over the revised estimates for 2022-23. This represents a 7.5 per cent increase. Within this, the capital expenditure has been budgeted to show a strong growth of 37.4 per cent while the revenue expenditure growth is estimated at only 1.2 per cent.

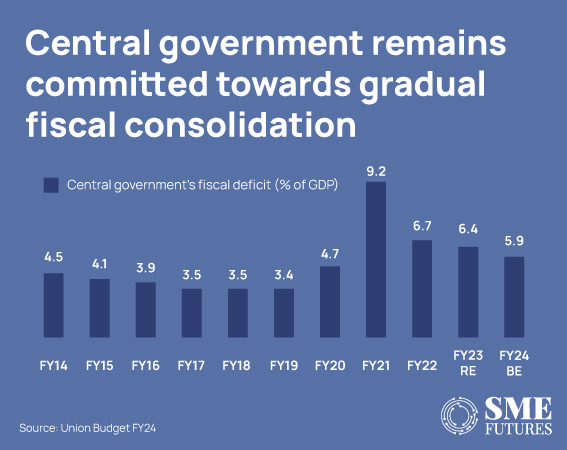

Talking about the government’s financial plan, FM Sitharaman in her budget speech of 2021-22 had announced that the government planned to continue the path of fiscal consolidation and was aiming to reach a fiscal deficit of below 4.5 per cent by 2025-26, with a fairly steady decline over the period. She said that the government has adhered to this path and reiterated its aim to bring the fiscal deficit to below 4.5 per cent of the GDP by 2025-26.

Meanwhile, to finance the fiscal deficit in 2023-24, the net market borrowings from dated securities are estimated at Rs 11.8 lakh crores. The balance of the financing is expected to come from small savings and other sources. The gross market borrowings are estimated at Rs 15.4 lakh crores.

Fiscal arithmetic: Realistic

At an aggregate level, the fiscal arithmetic appears realistic and may be slightly conservative, according to Acuité Ratings & Research.

Gross tax revenues are budgeted to increase by 10.4 per cent in FY24 compared to 12.3 per cent in FY23 RE (revised estimates). The overall tax buoyancy is estimated at 0.99 per cent, implying a stable Gross Tax/GDP ratio of 11.1 per cent. At a granular level, tax growth is expected to be led by GST amidst the ongoing formalisation efforts and the improvement in compliance.

Also Read: RBI to expand application of TReDS to help MSMEs

On a comforting note, the 18.9 per cent contraction in excise collection in FY23 is expected to be partially reversed with a moderate 5.9 per cent increase in budgeted excise collections in FY24. After adjusting for tax devolutions to states, net tax revenues are projected to expand by 11.7 per cent in FY24, lower than the 15.6 per cent growth as per the FY23 RE.

Non-tax revenues have been retained at 1.0 per cent of the GDP for FY24 with a marginal increase in dividend income (from PSEs along with the RBI) from Rs 84,000 crores in FY23 to Rs 91,000 crores in FY24.

The target for disinvestment is broadly flat at Rs 51,000 bn (vs. Rs 500 bn in FY23) with no attempt to project any significant disinvestment success. The moderate size of the budgeted disinvestment target (0.2 per cent of the GDP) can be rationalized amidst an uncertain equity market backdrop and an election heavy season in the next one year.

On the expenditure side, the growth in total expenditure has been budgeted to moderate to 7.5 per cent in FY24 from 10.4 per cent in FY23. This is expected to be led by revenue expenditure, which is likely to see a subdued growth of 1.2 per cent in FY24 vis-à-vis 8.1 per cent in FY23.

Tagging this budget as market-friendly in terms of every asset class, Indian economists feel positive about it as it reflects good fiscal prudence on the back of subsidy rationalisation.

“The budget solidifies the economic agenda of prudential macroeconomic reforms while balancing growth. Capital expenditure at ~Rs 10 trn, which is more than 11 times the amount expended in FY09, will benefit the economy via the time-tested Keynesian principle of spurring infrastructure to create jobs and channelising multiplier cycles. Despite a significant rise in its expenditures, it is noteworthy that the government continues to adhere to its fiscal deficit target of less than 4.5 per cent of the GDP by FY26,” says Arun Singh, Chief Global Economist at D&B.

“In the past three years, the underlying macroeconomic framework and revenue growth assumptions have been conservative and realistic. A strong capex push was the need of the hour. But this objective will be fulfilled only if the state governments as well as the private sector start raising their fixed investment spending. A push to growth without compromising macro-financial stabilisation should improve India’s score in terms of fiscal sustainability,” says Rupa Rege Nitsure, Group Chief Economist, L&T Financial Services.

“Bond yields are likely to fall given that the market borrowing plans are basically unchanged from last year. Besides being advantageous for the nation’s cost of capital, this would also benefit the equities market because it would lower the discounting rate and open the door to higher equity valuation multiples. A prudent approach to spending would help the monetary policy to limit inflation as well,” says Sujan Hajra, Chief Economist at Anand Rathi Research.

Let’s look at the major heads of the Union Budget 2023-24.

GDP growth

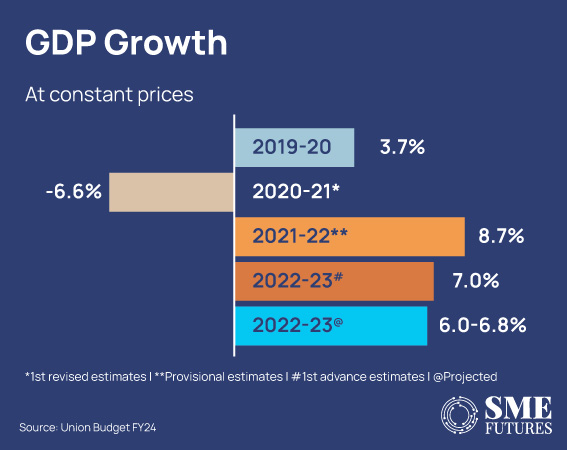

The Economic Survey projected a real GDP growth of 6.5 per cent as per its baseline case. Its overall assessment gives a broader range of 6-6.8 per cent.

While the Union Budget FY24 estimated the nominal GDP growth to be at Rs 3,01,75,065 crores assuming it to be 10.5 per cent in FY24, down from 15.4 per cent in FY23 (NSO’s First Advance Estimates). Consequently, the growth in the GoI’s gross tax revenue has been budgeted to moderate to 10.4 per cent in FY24 (BE) as compared to 12.3 per cent in FY23 (RE).

Note that the GDP in current prices without adjusting inflation is the nominal GDP.

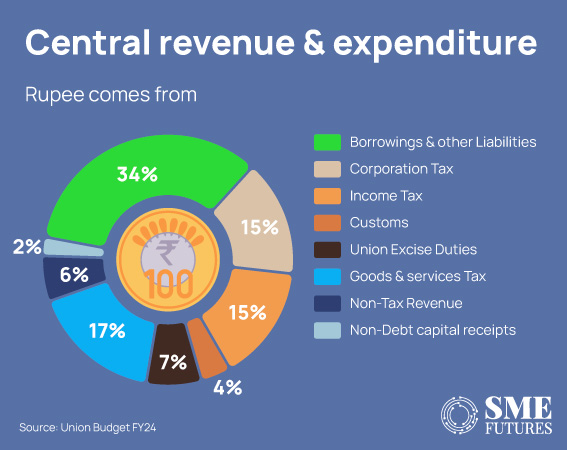

Where the money comes from

Of every rupee in the government’s coffers, 58 paise will come from direct and indirect taxes, 34 paise from borrowings and other liabilities, 6 paise from non-tax revenue like disinvestment and 2 paise from non-debt capital receipts, according to the budget documents for 2023-24.

As per the budget announcement, GST will contribute 17 paise in every rupee of revenue, while corporation tax will account for 15 paise. The government is also looking to earn 7 paise out of every rupee from excise duty and 4 paise from customs duty. Income tax will yield 15 paise.

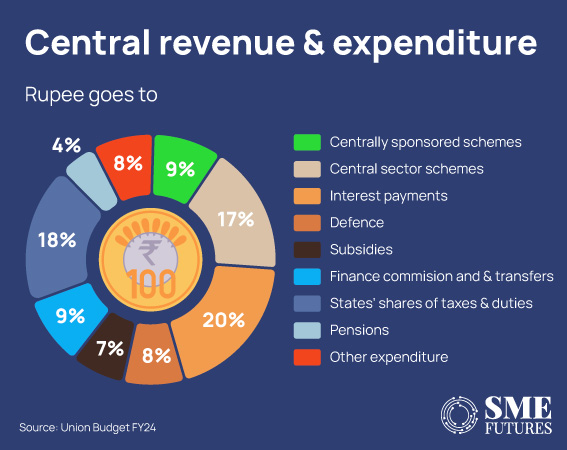

Where the money goes

On the expenditure side, the biggest outlay is on interest payments at 20 paise for every rupee, followed by the states’ share of taxes and duties at 18 paise. Allocation for defence stands at 8 paise.

Expenditure on central sector schemes will be 17 paise out of every rupee, while the allocation for centrally sponsored schemes is 9 paise. The expenditure on the Finance Commission and other transfers’ is pegged at 9 paise. Subsidies and pensions will account for 7 paise and 4 paise, respectively. The government will spend 8 paise out of every rupee on ‘other expenditures’

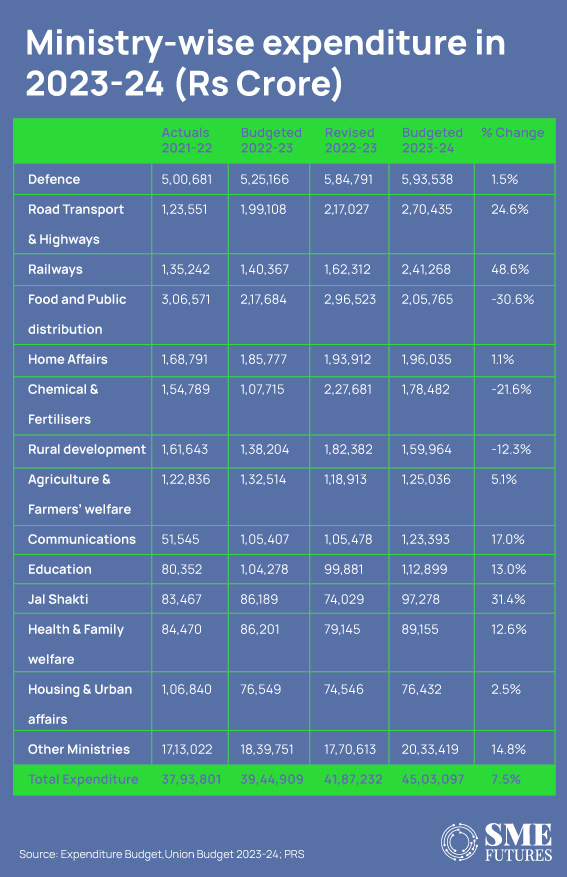

Defence bags the most moolah

In 2023-24, the ministries with the highest allocations account for 55 per cent of the estimated total expenditure. Of this, the Ministry of Defence has been allocated a total budget of Rs 5,93,537.64 crores, which is 13.18 per cent of the total budget. The total defence budget represents an enhancement of Rs 68,371.49 crores over the budget of 2022-23. This includes an amount of Rs 1,38,205 crores for defence pensions.

However, stakeholders feel that the allocation to this sector could have been better.

Commenting on the budget outlay, Gaurav Mehndiratta, Partner and Head, Aerospace and Defence, KPMG India says, “The capex for defence gets a nominal increase of 7 per cent VS a 33 per cent increase in the nation’s overall capital expenditure commitment. We believe this capex allocation misses a commensurate reflection of the government’s impetus on defence manufacturing.”

On the other hand, this year the FM has granted high allocations to several other ministries as well.

Also Read: ENGN: Ushering in new era for female athletes in India

These include Road Transport and Highways (6 per cent of the total expenditure); Railways (5.4 per cent), and Consumer Affairs, Food, and Public Distribution (4.6 per cent). Let’s have a look at the expenditure on the ministries with the 13 highest allocations for 2023-24 and the changes in the allocations as compared to the revised estimate of 2022-23.

Meanwhile, among the top 13 ministries with the highest allocations, the highest percentage increase in allocation has been observed in the Ministry of Railways (49 per cent), followed by the Ministry of Jal Shakti (31 per cent), and the Ministry of Road Transport and Highways (25 per cent).

The government has given a capital outlay of Rs 2.40 lakh crores for the railways. This is the highest ever outlay which is about 9 times the outlay that was made in 2013-14. According to experts, this is mainly on account of the increased capital outlay on commercial lines.

“We will describe this budget as a work in progress keeping in mind the various medium and long-term goals which have been articulated by the current government over the last almost one decade. What has received a thumbs up from all the stakeholders is the consistent push for public capital expenditure. The railway sector in particular has received significant attention given its role in long distance and urban connectivity apart from freight and logistics where higher efficiencies can improve India’s export competitiveness significantly,” elaborates Sankar Chakraborti, Group CEO, Acuité Ratings & Research.

Market implications

The FY24 Union Budget offers relief to the bond market as the announced gross borrowing target of Rs 15.4 trillion is lower than the consensus estimates of the close to Rs 16 trillion. Since the headline fiscal arithmetic appears credible, there is no prima facie reason to expect the need for additional borrowing at this stage.

According to Acuité Ratings & Research, the 10Y g-sec yields continue to remain soft and the budget has given a rationale for that softness. This is in line with their view of bond yields remaining range bound (7.10-7.50% on the 10Y) until March 2023. However, with global monetary tightening having almost run its course (while the US Fed is expected to pause in March 2023, we anticipate the RBI to deliver its final rate hike of 25 bps in Feb 2023 and opt for a pause thereafter), bond yields could drift lower in FY24.

Having said that, the moderation is unlikely to be swift as (i) the overall supply pressure on account of gross borrowing remains elevated, and (ii) the ballooning interest burden (at 3.6% of the GDP in FY24) on account of mounting debt levels would make achieving the fiscal deficit target of “under 4.5% of the GDP by FY26” a challenging task. This would require a doubling down on the policy front to shed fiscal flab, an aggressive implementation of the monetisation strategy and an enhancement in tax coverage and compliance.