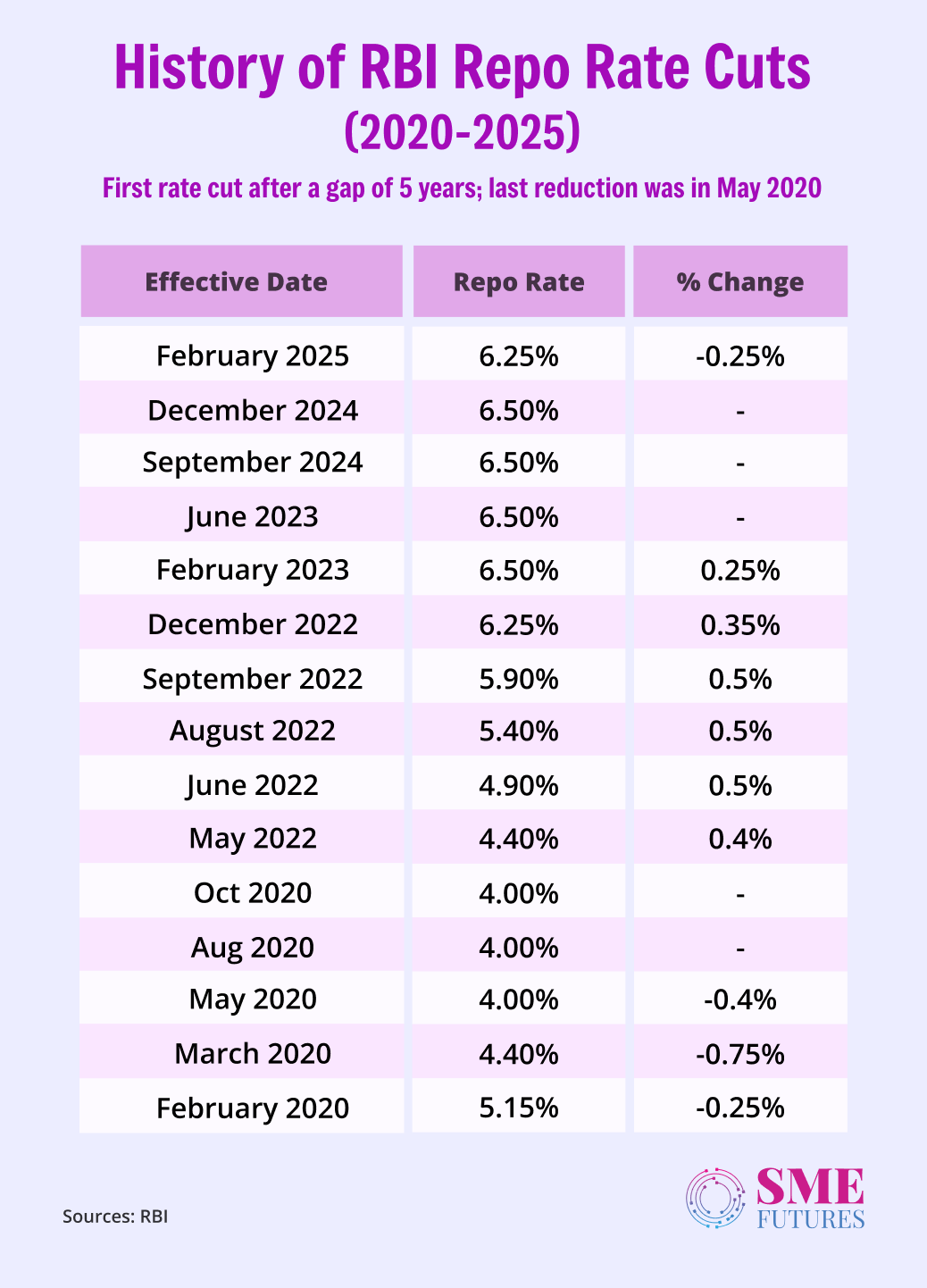

In a long-awaited move, the Reserve Bank of India (RBI) has cut the repo rate by 25 basis points, bringing it down to 6.25 per cent. This is the first rate cut in five years and signals a shift in the central bank’s approach to stimulating economic growth amid global uncertainties.

Let’s understand why this rate cut matters.

The decision comes as India’s GDP growth is projected at 6.7 per cent for FY26, slightly higher than the estimated 6.4 per cent for FY25. Inflation forecasts have also been revised downward, with the RBI expecting 4.2 per cent inflation in FY26, compared to 4.8 per cent in FY25.

By making borrowing cheaper, the rate cut is expected to boost investment, increase consumer spending, and drive growth across sectors.

Suman Chowdhury, Executive Director & Chief Economist, Acuité Ratings & Research, “RBI has maintained the existing neutral stance amidst the volatile external environment. The cut has been driven by increasing concerns on the growth momentum in the economy particularly “subdued urban consumption”.

He adds, the tone of the governor’s speech seems to suggest that the approach to inflation targeting will be a little more flexible.

Expert insights: Mixed bag of reactions

Welcoming the move, George Alexander Muthoot, MD of Muthoot Finance, said, “The 25-basis point reduction in the repo rate signals a decisive step toward supporting economic growth and consumption. This move aligns with the government’s post-Budget 2025 efforts to stimulate demand, providing much-needed liquidity while easing borrowing costs for businesses and individuals.”

He further added that reduced borrowing costs would lead to increased demand for gold loans and support rural consumption.

Chowdhury highlights that RBI has also provided comfort on the liquidity scenario albeit no new steps have been announced. It has also clarified that the intervention in the forex market will be measured based on excessive and disruptive moves in the currency.

Chowdhury emphasised that this move is part of a “shallow rate cycle,” suggesting that future rate cuts will be data dependent.

“We believe that RBI MPC has initiated a shallow rate cycle with low visibility and limited clarity on the future rate cuts. The retention of the neutral stance highlights that the policy direction may be revised depending on the incoming data points and the external environment,” he says.

Market reactions: Cautious optimism

The Indian stock markets responded positively to the announcement. The Nifty 50 gained 0.35 per cent, while the BSE Sensex rose by 0.28 per cent. Rate-sensitive sectors such as financials, auto, and real estate saw notable gains.

However, Jigar Trivedi, Senior Analyst at Reliance Securities, warned about currency volatility, stating, “The rupee may stay volatile, and the undertone remains bullish in the USD-INR pair. The RBI may not intervene aggressively in the currency market, which could mean short-term fluctuations.”

On the other hand, food inflation is expected to soften on the back of new crops’ arrival.

Sectoral impact: Who stands to benefit?

Sarvjit Singh Samra, MD & CEO of Capital Small Finance Bank emphasis that by aligning monetary policy with the Union Budget’s investment and growth focus, the RBI has reaffirmed confidence in India’s financial system and long-term economic resilience.

According to him, with borrowing costs set to ease, MSMEs, rural businesses, and semi-urban borrowers stand to benefit the most.

“The macroeconomic outlook, coupled with favourable growth-inflation dynamics and a well-balanced mix of fiscal and monetary policies are aligning for pro-growth stance, creating an ideal environment for accelerated credit growth and vibrant business momentum in the economy and banking space, especially for banks like ours, with a clear focus on serving the Middle Income Group (MIG) segment with emphasis on rural and semi-urban areas (SURU),” he says.

Home buyers to make move

Then the real estate industry is one of the first sectors to witness the impact, as it’s the most rate-sensitive one.

Venkatesh Gopalakrishnan, Director at Shapoorji Pallonji Real Estate, notes, “This step highlights the central bank’s commitment to bolstering economic growth while fostering a favorable environment for investors and homebuyers. Lower borrowing costs will enhance home loan affordability, bringing homeownership within reach for many.”

Anuj Puri, Chairman – ANAROCK Group says that with rate cut many first-time homebuyers who had been hesitating to take the plunge are likely to make their move now as home loan rates will reduce – as long as banks pass on the key benefits to buyers.

“Given that housing prices have risen across the top 7 cities in the last one year, this breather is welcome and timely,” he says.

As per ANAROCK Research, 2024 saw average housing prices rise by anywhere between 13-30 per cent in the top 7 cities, with NCR recording the highest 30 per cent jump. The average prices in the top 7 cities collectively stood at approx. INR 7,080 per sq. ft. in 2023-end, while in 2024-end it increased to approx. INR 8,590 per sq. ft. – a collective increase of 21 per cent annually.

Commercial real estate, especially office spaces, can also benefit from lower borrowing costs for businesses, and lower rates also make REITs more appealing since investors look for stable returns in a falling interest rate environment.

That said, the rate cut may be less effective by rising property prices if inflation remains as high as it is now. Also, it remains to be seen if banks pass on the full benefit to borrowers in a timely and seamless manner.

Banking more accessible

The rate cut will lower lending rates, making credit more accessible for businesses and consumers. “The decision brings borrowing costs to their lowest level since January 2023,” says Jindal.

However, Narinder Wadhwa, MD & CEO, SKI Capital Services, pointed out, “The unchanged CRR suggests that RBI is focusing on controlled liquidity infusion rather than aggressive easing. Given the current growth-inflation dynamics, another 25-bps cut could be on the table later this year, especially if inflation remains under control.”

Additionally, Micro, small, and medium enterprises (MSMEs), which often struggle with high borrowing costs, could see a significant impact. Lower interest rates mean cheaper credit, which could lead to business expansion and job creation.

What’s next? Will there be more rate cuts?

While this cut is a significant move, experts remain divided on whether the RBI will continue on an easing cycle.

Abhishek Pandya, Research Analyst at StoxBox, noted, “While this 25 bps cut was expected, a change in stance from ‘Neutral’ to ‘Accommodative’ would have been an icing on the cake. We anticipate another 25 bps rate cut in April, provided inflation remains under control and liquidity conditions improve.”

Similarly, Praveen Khandelwal, MP and Secretary General of CAIT, highlighted the need for further stimulus, stating, “Lower EMIs on home and business loans will provide financial relief, boost disposable incomes, and enhance consumer spending. If the income tax exemption limit is increased in the upcoming budget, it would significantly enhance household savings and market liquidity.”

The RBI’s first rate cut in five years signals a shift towards a more growth-friendly monetary policy. While this move is expected to support economic activity, the central bank remains cautious, keeping future rate cuts dependent on inflation trends and global economic conditions.

With sectors like real estate, MSMEs, and consumer lending set to benefit, the next few months will be crucial in determining whether this marks the beginning of a sustained easing cycle or just a one-off adjustment.