Whether practicing traditions or decorating their surroundings, Indian culture has a profound penchant for hues. It is believed that every colour has its own vibes and impact and this belief is deeply valued in the Indian framework when it comes to painting homes and picking interiors. From hand-painting walls of one’s house with natural colors to decorating with the warli art, over time, the concept of painting in Indian household has evolved as a commercial activity that has grown well, adding substantially to the Indian economy.

117 years ago, Indian paint segment began its journey with Shalimar Paints in 1902, from Kolkata. Today it’s an all-encompassing blend of many organised and unorganised players in the field. Both the markets are additionally fragmented into decorative paints and industrial paints with a wide number of MSMEs in the pool. Market researchers Orbisresearch.com reveal the India paint market is going to fetch a growth rate of around 8 per cent value-wise, over the period of 2022-23.

Abhijit Roy, former President of Indian Paint Association (IPA) also talks about the present scenario of the market. He says, “The Indian Paint Industry, currently valued at around ₹ 50,000 crores, is poised to grow at a healthy rate and is expected to reach around ₹ 70, 000 crores by 2021-22. There is a strong correlation between the Indian paint industry and the GDP growth of the country. It has historically surpassed India’s GDP growth by 1.5 to 2 times.”

In 2018-19, the industry clocked 12 per cent growth in volume terms while in value term, it was 15 per cent. The automotive paint accounts for about 15 per cent of the total paints industry and for 45 per cent industrial segment. With the expansion of organised market in the paint sector, and its increasing penetration in the rural market, the sector is growing at an extremely fast pace.

Sunil Kumar, former president of Indian Small Scale Paint Association (ISSPA) and Director of Glaxci Paints, based out of Sonipat opines, “I believe paint sector is growing fast and promises a splendid future in the country. Per capita consumption of paint is as yet minuscule here, in contrast with different regions, however there is immense scope of growth in the sector particularly for small manufacturers.” According to industry data in India, the per capita consumption of paints is expected to ascend from 4 kg to 6-7 kg by year 2020. When compared to global per capita consumption of 15 kg, India still has plenty of growth potential in store for the paint companies.

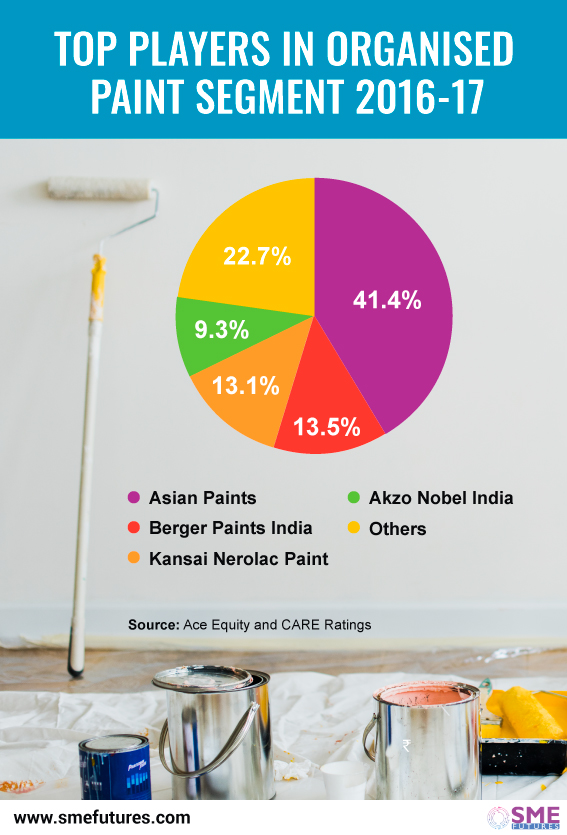

Around 80 per cent of the organised market in the industry constitutes the top players with the largest share held by Asian Paints followed by Berger Paints India, Kansai Nerolac Paint and Akzo Nobel India with a share of 41.4, 13.5, 13.1 and 9.3 per cent, respectively, during 2016-17. Among these players, Asian Paints is the market leader in the decorative paints segment while Kansai Nerolac Paint is the market leader in the industrial paints segment. According to paint makers, majority of the demand comes in from original equipment manufacturers in automobile and the two wheeler segment.

Paints looking brighter

Paint and related products are an important material for various industries such as real estate, infrastructure and automobile. These industries have a huge multiplier effect on economic activities and since they need paints in the process, their growth is directly linked to the how the paint industry is set to grow.

Moreover, Indian preferences are also changing – be it in terms of choosing a product or decorating homes. The change in the pattern of interior decoration and the trend of choosing durable interiors has brought in a new revolution in the field of paint industry. Earlier considered to be an activity taken up only on special occasions, whitewashing or painting has now become an ‘anytime’ activity – people do just to experience the change. Also, Indians are now spending generously on painting, with keen intent to give their homes a new life. Taking cues from this, paint companies are launching highly advanced products now.

While paint was earlier considered one of the costly items in the construction material industry but it is easily available now. A professor at BNM Institute of Technology in Bengaluru, R Maruthi Ram writes about how economic reforms have helped the Indian paint industry. According to him, “In the eighties, excise duty on paints used to be as high as 40 per cent. After reforms, gradually the excise duty started declining from 40 percent to a lower level. Today the excise duty is as low as 12.5 per cent. Earlier, the Modified Value Added Tax (MODVAT) and Central Value Added Tax (CENVAT) facilities have also helped the industry to grow. The dilution of The Monopolistic and Restrictive Trade Practices (MRTP) Act and The Foreign Exchange Regulation Act (FERA), has, to some extent added to the growth of Indian paint industry.” MODVAT came into force in 1986, which was converted into CENVAT in early 2000s into compliance.

Though, the introduction of reforms such as GST, demonetization and Real Estate Regulation and Development Act (RERA) did slow down the sector a bit, but the decorative segment recovered while the industrial paint segment remained subdued. Industry sources are of the opinion that reform led disruptions lasted for a certain period. Additionally, GST rates too came down from 28 per cent to 18 per cent which was another boost as most of the players in the sector fall in the organised category. Roy says, “Although the implementation of GST regime came in as a challenge initially; the reduction of GST rates from 28 per cent to 18 per cent has come in as a breather for the paint industry,”

Infrastructure and Real Estate – The Paint Enhancers

As per the recently revealed budget, government plans to step up infrastructural investments which is further likely to boost sales pace for paint manufacturers. Most players in the sector are optimistic about the impact of up–gradation in infrastructure, roads and metro rail initiatives, on the paint sector. “The objective venture figure of ₹ 100 trillion for infrastructure framework over a 5-year skyline is unquestionably encouraging for the paint sector. Initially, the announcements towards formation of national grids for power, water, gas, internet set the pace for the structure of an energetic, new India and these advances will improve the way of life for the majority, in a huge manner. Besides, it will give the paint segment, colossal open doors even to small ventures as paint business is intensely dependent on infra segments. After all, paint is required everywhere,” says Anupam Kedia, Vice Chairman-Eastern Region, IPA and Director at Anupam Enterprises, based out of Kolkata.

Sops for affordable housing, that were announced in the recent budget, are going to further enhance demands in the paint market. “Budget announcement is majorly focused on infrastructure and real estate sectors, where it will not only create huge number of jobs, for both skilled and unskilled workers, but also create demand for other ancillary industries such as the paint and coating industries downstream,” he adds.

This rapid urbanization, development of housing sector, increment in disposable income and growth of related industries, combined with infrastructure expansion are prime factors responsible for the growth of the paint industry in the nation, especially in the decorative paint segment. Consumption of paints is skewed towards decorative paints that account for 70 per cent of paints sold in India. This is in sharp contrast to the trend in developed countries, where the ratio is skewed towards the industrial segment. Furthermore, increased usage of enamel and emulsion paints over the conventional whitewash, increasing penetration in the rural market and digitization are also driving the paint industry.

Innovations Accelerating Sector Growth

The presence of chemicals in paints has always been subjected to regulations, forcing the sector to keep innovating for attracting customer attention towards other positive aspects. Notably, the way paints are fabricated is still pretty much the same, while most of the innovations have been peripheral, such as paints that are anti–bacterial, anti-corrosion, weather resistant, solar resistant and so on. One of the emerging innovations is the demand for low volatile organic compounds (VOC) products. This pattern has pushed for the next wave of developments in the paint sector and all the crude material makers have presented new scope of items adjusted to the low VOC reasoning.

A report by Future Market Insights titled “Decorative Paints Market: Global Industry Analysis and opportunity Assessment, 2016-2026, talks about changes in the sector, “Introduction of intelligent paints for controlling temperature and heat transfer in varied geographical and climatic conditions around the world is emerging as a major trend in the global decorative paints market. Further, the need to decrease the hazardous impact of solvent based paints on the environment across the globe is pushing manufacturers and consumers to go for water–based paints that emit lower Volatile organic Compounds (VOC) as compared to solvent based paints,” an analyst at market research platform, Future Market Insights—Chemicals and Materials, informs.

Manufacturers are now producing paints that can be used on multiple substrates such as cement walls, wood, glass, tiles, composites and so on. With robust physical and chemical properties, consumers can choose to use paints as per their requirement.

Moreover, the introduction of various innovative manufacturing processes and technologies such as anticorrosive protection, low-VOC content coats and nano coatings, are significantly catering to numerous new and diverse consumer demands. Another factor contributing to industry growth is the increasing application of paints and coatings to protect machines and equipment from rusting and corrosion. As for consumer goods, they serve the purpose of keeping corrosion at bay and make products look better further accelerating the growth of the paints and coatings market.

More That’s Trending

Go Green Revolution– With the advent of internet, consumers are currently keen on the potential ecological and wellbeing effects of the synthetic substances used to make paints and coatings. This is driving a zeal for organic paints produced with recycled packaging and materials. For example, in Canada, Rona Inc’s ECO Recycled Latex Paint is produced using 90 per cent reused materials and ensured by EcoLogo, one of the biggest and best known eco-marking programs in North America.

While Nippon Paint has also launched a car paint, repair service in India for car buyers called Nippon Paint X’press which will use Green Efficiency, a unique paint system that delivers express painting solutions, while complying to EU 2004 emission norms. Its first centre will be setup in Gurgaon following other outlets in major cities.

Nanotechnology– Nanotechnology has assumed a critical job in the paints and coatings industry. Aside from creating zero or low VOC content formulations, industry players are innovating to create nano paints and coatings with different attributes. The recent innovations in nanotechnology have enabled paint manufacturers to develop products that can exhibit UV protective or self-healing properties, or even conduct electricity. Additionally, these products display qualities such as high resistance to scratch, wear and tear, and corrosion.

Joining the App fleet– Brand value is critical in today’s digital scenario. Paint makers are making use of web apps to fabricate the brand value, owing to the growing number of internet users. A popular example is of Dulux app which allows consumers to find stockists and order paint testers for home delivery and also offers video ‘master classes’.

Products depicting stories– Shoppers are now skeptical of conventional marketing methods and branding techniques, rather they find those products more reliable to which they are able to relate to in some sense. Hence, paint manufacturers are attempting creative methods to lure consumers. Furthermore, these products in the paints and coating market function as social signifiers, indicating one’s socio-economic status. Paint manufacturers are increasingly experimenting with ways in which they can capitalize on the budding tastes and preferences of this cluster of customers. For instance, Asian Paints’ series of videos on social media, which showcases homes of celebrities in a web series called ‘Where the heart is’ has been created to attract consumers.

Industry Challenges

The paint industry is heavily dependent on raw materials and there are around 300 odd raw materials required for manufacturing paints. Thus, the prices are largely dependent on the cost of raw material. Nearly 30 per cent of the 300 raw materials are petroleum–based derivatives. Over 65 per cent of input cost is from raw-material. The Indian paint manufacturing industry always faces the pressures of increasing raw-material cost, wherein the primary cost being the spiraling prices of crude oil. The cost of crude oil component is around 40 per cent of the material cost. So, any change in crude oil prices will lead to change in the prices of raw materials. Last two three years have witnessed fluctuations in crude oil prices, significantly impacting the margins in the paint industry.

Another component Titanium dioxide (TiO2) constitutes 15 to 20 per cent of paint composition and its requirement is mostly met through imports. The recent hike in TiO2 prices owing to the growth in titanium dioxide prices in China, from which India imported 41.6 per cent of titanium dioxide during 2016-17 is also one of the factors that affected the paint prices. The prices in China grew on account of stricter regulations imposed by the government on production of titanium dioxide to control air pollution in the country. This too caused slight slowdown.

Of the total titanium dioxide quantity imported by India from various countries, China accounted for the largest share of 41.6 per cent followed by Germany and Korea Republic (South) accounting for 16 per cent and 15.4 per cent, respectively, during the year 2016-17. India imported 13,901 tonnes of titanium dioxide in 2016-17.

With industries such as real estate and particularly the automobile industry witnessing major slowdown over the recent past, the pressure on the paint manufacturers has further increased. This has also resulted in decrease in industrial paint consumption. “The slowdown of the automobile industry and the low growth in construction had impacted the paint industry especially in industrial paint segment. We are seeing demand slowdown,” confirms Kumar.

Despite slowdown in the automotive sector, paint makers are optimistic about the industry’s growth in the current fiscal. Roy says, “We expect economy to do better under the regime of newly elected government and paints industry too is expected to post marginally higher growth rate both in terms of volume and value for the current fiscal, compared to what had been achieved in 2018-19.”

In addition to this, large firms are exempted from competition whereas, small businesses feel pressures as they are unable to compete at price points of raw material locally. Certain raw materials can easily affect their manufacturing and operating funds. On this, Kumar says that India doesn’t lack on raw material availability front but it gets costlier to extract them. “It’s a crude based industry, although there is merely any raw material not present in India beside crude oil, but small businesses often compete with local raw material suppliers due to heavy price point. Whereas, it is cheap to import same raw materials from other countries,” he says. This is another challenge where smaller domestic players are facing stiff competition.

The demand in Indian paint industry is sensitive to price fluctuations of paint products, and varies with the economic and industrial growth. While, the demand in decorative segment is largely dependent on seasonal trends, with increased sales during the festive seasons, the demand in industrial segment is determined by total industrial production. This affects the demand from sectors such as consumer durables, construction, automobiles and others.

A Shift in Sight

The Indian paint industry has begun to look more like the FMCG industry where branding, distribution strength and innovative use of technology have turned out to be unequivocal parts of development against a background of ever changing client inclinations. There have been advancements in the paint market both at the product technology and development level, while the usage side has seen some changes. These have led to better and more secure items, environment friendly paints, cheaper technology and better aesthetics.

The past few years have seen a noteworthy change in the type of products and services available, owing to the scope of developments being acquired by paint makers and the evolving preference towards mid and premium segment items. the entire market landscape of decorative and industrial paint categories has seen huge innovation. The evolving paints market is also witnessing increasing interest for premium products. This has come about as buyers are now more aesthetically aware, and also have the means to opt for better value products, even at higher prices.