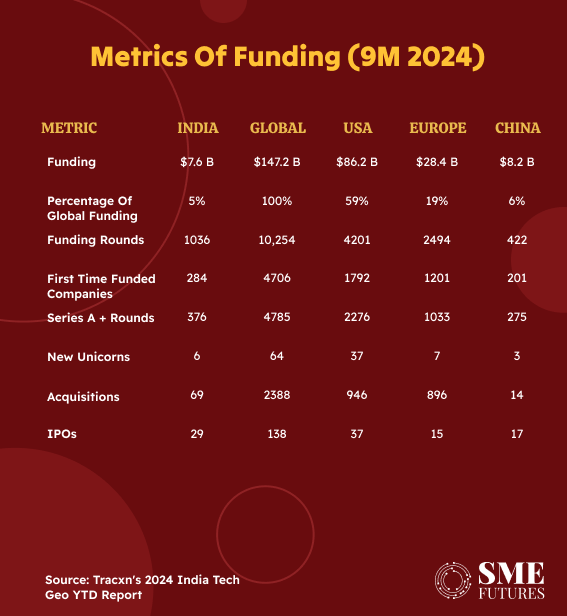

India’s startup scene has shown that it can handle tough times even when the world economy slows down. In 2024, India became the 4th biggest tech hub in the world. While global markets have grappled with tighter financial conditions, India has weathered the storm, drawing on its innovative spirit and rapidly growing digital economy. Even though venture capital and private equity money dropped a bit—$7.6 billion in 2024 compared to $8.2 billion in 2023—India still proves that it’s a top spot for new ideas.

This article looks at how India’s tech industry is going strong even when times are tough. It’s getting a boost from growing areas like fintech, retail tech, and cleantech. Cities such as Bengaluru, Mumbai, and Gurugram still lead the way as crucibles of new ideas. We’ll take a close look at Tracxn’s 2024 India Tech Geo YTD Report and hear from industry experts, and learn about the trends, hurdles, and new chances that will shape the future of India’s tech world.

India’s tech world stays strong in 2024: Growing economy sparks new ideas

At the core of India’s start-up success lies its strong economy, which will grow by 8.2 per cent in 2024, surpassing global growth rates. This economic strength has built a firm base for the country’s growing tech scene, helping its start-ups to handle the financial troubles that have struck other big markets. India’s dynamic business world, backed by its young and tech-smart people, has enabled it to deal with the global funding slowdown better than many other nations.

According to Ravi Jain, Co-founder of Blostem,“The fintech sector works where new ideas meet rules, and finding the right mix is key. We’ve adjusted fast, making sure that following the rules doesn’t hold back our fresh thinking.”

Investment trends and how decreased funding affects things

Even though India’s startup scene is still going strong, it took a hit with a 7 per cent drop in total funding—going from $8.2B in 2023 to $7.6B in 2024. This dip has led to a big change in where investors are putting their money. They’re playing it safe now, giving $4.7 billion to more established companies. Meanwhile newer start-ups are feeling the pinch, with their funding taking a nosedive to $2.2 billion.

The global funding slowdown, which has an impact on geopolitical tensions and a tightening capital market, has pushed investors to focus on mature startups which have shown that they can scale. Pankaj Sharma CEO of Religare Finvest Ltd, contends, “Investors are drawn to companies that show openness, can adapt, and bounce back. This matters a lot in a shaky market where handling risks is key to growing in the long run.”

Although funding issues continue, India’s push for financial inclusion and tech innovation have enabled fintech companies to keep growing. “The growth of digital financial services and solutions like Unified Payments Interface (UPI) have created new paths for fintech firms, opening up fresh market opportunities in cities and villages across India,” Sharma adds. This has played a key role in keeping the sector moving forward despite global challenges.

Sectoral performance: Top performers and strugglers in 2024

Retail tech: Causing a revolution in customer experiences

Retail tech stands out as one of India’s top performers in 2024, pulling in $1.95 billion in funding—a 23 per cent jump from 2023. Flipkart and Meesho still lead the e-commerce scene, pushing growth through shopping experiences that use tech and cater to each person. Also, the boom in quick commerce has boosted companies like Zepto, which grabbed $665 million in funding this year. Zepto’s super-fast grocery delivery shows how shoppers’ wants to have changed, with speed and ease now being the key factors.

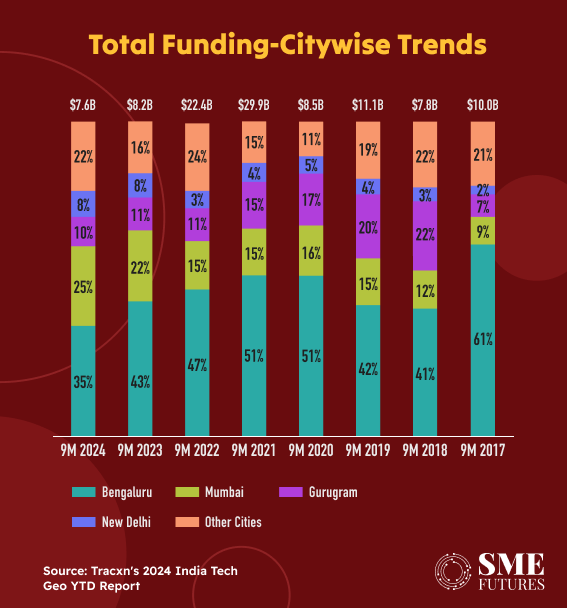

Raja Singh Bhurji, CEO of The StepUp Ventures observes, “Bengaluru’s mix of cultures, along with its global mindset, have helped start-ups to grow. The city’s focus on learning and its pool of top talent allows start-ups to come up with new ideas and get more funding.” Bengaluru’s leading position in grabbing 35 per cent of the total funding in 2024, shows how much the city drives India’s retail tech growth.

Fintech: Balancing new ideas and rules

Fintech has emerged as a key part of India’s tech scene, attracting $1.49 billion in investments. The industry has seen quick digital uptake, pushed by offerings like digital fixed deposits (FDs), giving people new options to handle their money. Ravi Jain from Blostem thinks that the field’s wins come from striking a balance between following rules and pushing tech forward. “We talk to regulators which lets us lead in new ideas while making sure that our products meet the criteria of the changing rules,” he says.

Cleantech: The future of sustainability and electric mobility

India’s goal to reach Net-Zero emissions by 2070 has made cleantech a fast-growing industry, but it still faces big challenges. Pritesh Talwar, President of Lectrix EV, asserts, “The cleantech industry is still new in India, and scaling solutions like electric vehicles comes with issues such as high initial costs and worries about running out of power. However, these problems also create chances to come up with new ideas.” Lectrix EV’s Battery-as-a-Service (BaaS) model is one such new idea, which has cut the cost of owning an electric two-wheeler (E2W) a lot by offering flexible leasing and swapping options.

Lectrix EV aims to create a lasting ecosystem, not just electric vehicles. They’ve set up 250 battery swap stations in Delhi and want to add 400 more throughout India. This network has strategic placements to lessen range anxiety, which stops many people from buying EVs.

Aerospace and defence: Public-private partnerships and emerging technologies

India’s aerospace & defence sector is changing. Public-private partnerships and a focus on self-reliance are driving this change. The Make in India programme has pushed for more domestic production. Simultaneously, AI and robotics advances are reshaping our defence capabilities. Kiran Rudrappa, CEO of Posspole, says: “The government’s Strategic Partnership model and public-private collaborations are critical for driving innovation in the aerospace sector. AI and robotics are key to enhancing India’s defence efficiency.” Yet, the sector still faces money problems. Companies are now looking to use government plans like iDEX to back new ideas.

Emerging unicorns and IPO surge: New growth engines

India has welcomed six new unicorns in 2024, including Money View and Perfios. This shows strong growth potential even though overall funding has slowed down. These companies are leading the next wave of innovation in areas like fintech and enterprise tech, which are the key players in India’s changing tech scene.

The IPO market is bouncing back, with 29 tech IPOs in 2024 compared to 15 in 2023. This trend shows that investors have more faith in public markets and companies want to take advantage of the opportunities to get cash and grow their presence worldwide.

City-wise trends: Bengaluru leads as new hubs emerge

Bengaluru stays at the heart of India’s start-up scene, grabbing the biggest chunk of investments in 2024. Still, places like Mumbai and Gurugram keep attracting lots of investor interest, while Hyderabad and Pune are turning into new spots for fresh ideas. These cities have a mix of available talent, helpful rules, and good set-ups, which are key to pushing the next big wave of tech growth.

Raja Singh Bhurji says that Bengaluru’s teamwork-focused start-up culture, backed by incubators and co-working spaces has a big impact on sparking new ideas. “The city’s go-getter attitude and set-up have made it a welcoming place where start-ups can grow,” he asserts. As things get more competitive, Bhurji thinks that start-ups will need to stand out by offering unique solutions in up-and-coming fields like AI and healthcare.

Looking forward, India’s tech scene is set to gain from helpful government rules and worldwide changes. Getting rid of the Angel Tax, along with plans like venture capital funds for spacetech, will keep driving new ideas across fields. Also, global shifts—like less reliance on China for semiconductors—might open up new opportunities to invest in India’s manufacturing and tech areas.

As India’s tech world keeps changing, its special mix of a strong economy, government backing, and a skilled workforce will make sure that it stays a world leader in new ideas.