It is better late than never… this maxim aptly describes India’s scrappage policy. After much delay and brainstorming, the Indian government formulated this policy to scrap out old and unfit vehicles, finally joining the list of those nations that already have a scrapping policy.

While India Inc. is quite content with the announcement, the decision is laudable for many reasons.

First of all, after the successful implementation of BSVI, the scrappage policy is expected to be a win-win situation for all, as various sections of the industry and think tanks are already predicting. The automotive sector which has been in a slump for so long, anticipates that the beneficiaries of this policy will range from entire OEMs to the aftermarket segment. With this policy in place, experts foresee an upswing in new vehicle sales, leading to improved revenue and growth of the automotive market. Given this, the overall turnover of the industry can reach to Rs 10 lakh crore from the existing Rs 4.5 lakh crore as per CARE Ratings.

According to government data, about one crore commercial vehicles (CVs), which include 51 lakh Light Motor Vehicles (LMVs) are above 20 years of age, while another 34 lakh LMVs are above 15 years old. It will also cover 17 lakh medium and heavy motor vehicles, which are over 15 years old, and their replacement will drive demand in the automotive sector.

Further, this move will also help in improving vehicle’s fuel efficiency and ensure passenger safety with better vehicles on the roads. Another intent of this policy is to formalise the informal vehicle scrapping industry. It is also expected that scrapping old vehicles would lead to lower import bills for scrap and crude oil.

Optimistically, the policy will boost investment in the industry by Rs 10,000 crore leading to 35,000 more jobs for MSMEs. While the money coming through GST will enhance the government treasury by around Rs 30,000-Rs 40,000 crores.

Air pollution being a major concern for environmentalists, flushing out old cars is the right step towards curbing vehicular pollution, as old and unfit cars really pollute the environment. Lately, India is continually being counted among the most polluted countries in the world. The World Air Quality Report 2020 by a Swiss organisation, IQAir revealed that twenty two out of the thirty most polluted cities are in India.

Overall, the industry and experts are looking forward to seeing how the various provisions of the policy will work out. But their primary concern will be about how it is going to compel consumers to voluntarily scrap their vehicles. Because many a times, Indians attach sentimental value to their old vehicles.

Why the common man should be interested?

The answer lies in the incentives and disincentives.

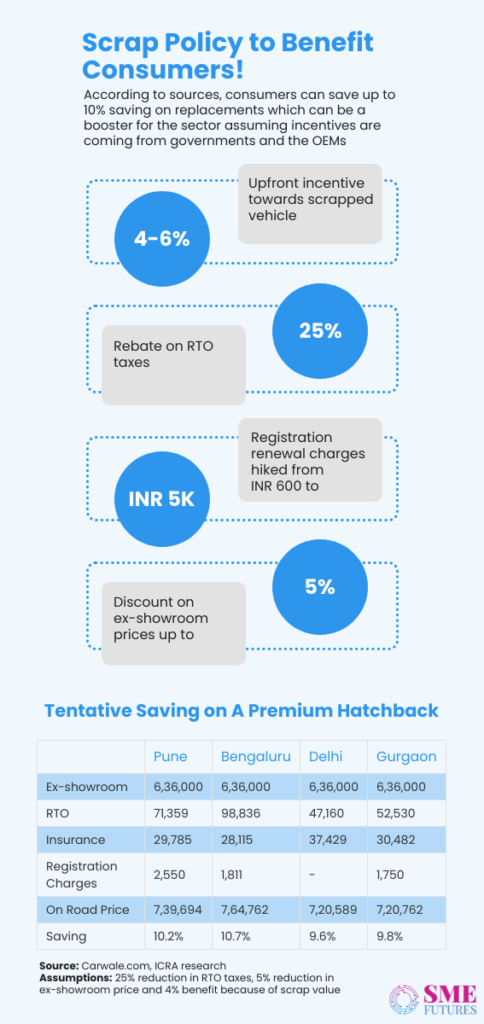

As per the government, the scrappage policy will provide some financial gain to consumers which will encourage them to shift towards newer vehicles and comply with the policy. According to the draft, when older vehicles undergo scrapping, scrap yards are to offer a certain value to the vehicle owners, which can be approximately 4-6 per cent of the ex-showroom price of a new vehicle.

Further, consumer’s new vehicle registration fees are to be waived off if they present a scrapping certificate and this saves them some money as well. Consumers can also get an additional 5 per cent discount on their new vehicles with these certificates. Going forward, the government is in talks with the state governments to offer a road tax rebate of up to 25 per cent for personal vehicles and up to 15 per cent for commercial vehicles, which is going to be good for people’s pockets.

On the other hand, the government has also proposed several disincentives to necessitate compliance with this scrappage policy. There will be an increased fee for a fitness certificate and test, and this will be applicable to those commercial vehicles which are 15 years and older. In case the vehicles fail, they will be de-registered. For private vehicles aged more than 15 years to be re-registered, users must pay the increased fees. Such vehicles will also be de-registered after 20 years if found unfit or in case of failure to renew the registration certificate.

Condition not age should be the criteria

From October 2021, personal vehicles aged 20 years or more have to go for a mandatory fitness test. If they fail, they will be deemed for scrapping as older vehicles pollute 10-12 times more than others. Considering that Indian’s love their vehicles and tend to use them for years, the general public’s reaction to the age criteria has been mixed, where some feel that it is not right to decide a vehicle’s road worthiness by its age.

Experts in the field do not endorse this sentiment.

“If the criterion for scrapping is not defined by age, then the consumer will hesitate in buying newer vehicles and that can demotivate sales,”

says Amrish Malan, Director at Droom Wheels Auto India, a car dealer

“Every technical component has a certain limit for physical usage and in vehicles its best for up to fifteen years. As per my experience in car dealing, even if you renew registration, the old vehicle will not give you the desired output. So, this policy is for the betterment of the market, at least in terms of business,” he opines.

Meanwhile, Preetam Mohan Singh, Senior Vice President, Automotive at Praxis Global Alliance, putting forth his views on the scrappage policy, feels that ideally the scrappage policy is a good option but suggests that the government should add strict provisions as well.

“It’s important to add two things—make it mandatory for all and not optional; in addition to that, implement progressive challans for defaulters. Also, the incentive to dispose of old vehicles and buy new ones needs to be much higher than 5 per cent, else the pull factor fazes out,”

Preetam Mohan Singh, Senior Vice President, Automotive at Praxis Global Alliance

The Inside talk

As we say, the devil is in the details.

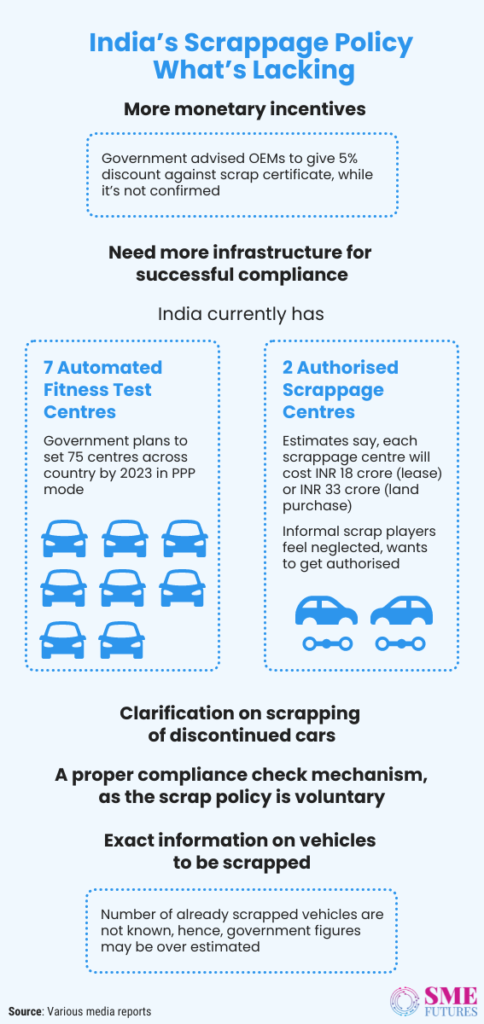

Experts like Singh say that although the first-hand vehicle market will definitely get a boost via this policy, the incentive of 5 per cent is not enough. “It will only become clear once the rules or guidelines are released by the ministry, which is expected by October ‘21,” he said.

Also, it is still an assumption that manufacturers will offer a 5 per cent discount, as the government has gently nudged them to do so. On being asked about whether they will be willing to offer it, Malan comments, “I agree that a 5 per cent extra token discount sounds lucrative to consumers. But it is going to be of no value.”

Stating that it is a harsh truth, Malan says that even if manufacturers are ready to offer this discount, the dealers will not be giving away any profits from their pockets. The automotive industry has been struggling for years now due to liquidity crunch and BSVI, and now Covid has further pushed the economy into the doldrums, severely impacting businesses everywhere. According to him, manufacturers are reeling under immense economic pressure, as the prices of commodities like steel are high. Ultimately the prices of automobiles would be hiked to offset the discounts, leaving the consumers to deal with the negative impact that will accrue from such a scenario.

Giving in to the economic imperatives, automakers such as Maruti, Hero, Toyota, Ford, Renault, Kawasaki and Datsun have already hiked their prices twice in 2021, which if combined, amounts to a hike of about 1 to 6 per cent.

“I agree that the scrappage policy is a laudable step, and it’s going to show results after years, but there are more issues to talk about than just praising this one. One of them is corruption, which is deeply rooted in the system. Anyone can manipulate paperwork at any level including RTO. This should be the next challenge to be tackled,” says Malan while expressing his concern over this grave issue.

It has been noticed that often people while buying or selling old vehicles tend to manipulate documents and tests just to take an easier route to fulfil the process, which is an issue that undermines the health of the government’s ecosystem. Interestingly in 2015, road, transport and highways minister, Nitin Gadkari himself lashed out at RTOs and termed them the most corrupt organisation in the country. Today, it’s been six years since his lashing out, and people in the industry are still talking about corruption. Which shows how deep rooted this issue is even though the government has been coming up with more reforms to overhaul the entire system.

Not a fair game for the scrap businesses!

Another aspect of this policy are the scrap yards, which the government is trying to formalise and promote by the setting up of Registered Vehicle Scrapping Facility (RVSF) across India. According to Singh, this is an opportunity for the setting up of more enterprises. For instance, the setting up of PPP based testing and certification centres and adding more scrap yards will generate more jobs. As per the market estimates by an HDFC bank study, the scrappage policy can help create a vehicle scrappage and recycling market of $6 billion or Rs 43,000 crore.

However, the private players in the scrapping field are not too keen on the announcement of the setting up of new scrap units. According to them, even if this industry is highly disorganized, there are more than enough facilities in each city of each state of India to be used as RVSFs. Questioning its intent, the scrappers are asking that why does the government want to set up newer ones? As this will only discourage and drive out of business those people who are already working in the disorganized scrap yards.

Talking to us, Rupinder Singh, founder of Post Graduate Recycling Services expresses his dismay about this scenario. “Yes, I agree this can be a big opportunity. But in my opinion, the policy might only benefit some giants of the automotive industry. It does not concern businesses like mine in the scrap sector. The scrap yards which the government is planning, will be handed over to those major players. I ask that what will happen to the scrap yards which are currently there and to the lakhs of people working in them? Rather, the government should give them a chance by recognizing them, “he avers.

He further mentions that other countries have well-structured scrappage policies which include the voices of people like him, like in China for instance. He further says, “The government should have heard us and involved us before introducing the policy. They should have given us a chance to convert the business into a legal one. They could have set up a dedicated recycling park like China has done. Or the government should have introduced their own kiosks or a one-window system for dismantling, earned some money by charging them a fee and directed them to scrap players like us. Then it would have been a fair game for us.”

The impact of the scrappage policy on commercial vehicle owners

At the same time, the All India Road Transport Workers’ Federation (AIRTWF) fears that 80 per cent of CV operators might get eliminated from the industry if the policy gets implemented. With demands for negotiations, the apex body has raised various concerns in a letter to the government. According to the association, the main reasons for the crisis in the sector are defective policies, an abnormal increase in the excise duty on fuels, insurance premiums and toll taxes, the burden of which has been jeopardizing the business.

According to the AIRTWF data, petty owners having one or two commercial vehicles and working as drivers cum owners constitute almost 80 per cent of the total CVs in the country.

“Many of them are not in a position to pay the monthly instalments of the loans which they had availed of from private finance companies for the purchase of their vehicles. At this juncture, the introduction of the ‘scrap policy’ will be an unbearable burden on them and will lead to their elimination from the field. This will be disastrous not only for the petty owners but for the nation as a whole. It will pave the way for the big corporates to occupy the road transport sector,” says the letter.

Fate of the luxury, vintage and classic car market

When it comes to the scrapping of old cars, the obvious question that arises is about the fate of vintage and classic cars. The ambiguity on the scrapping of classic and vintage vehicles is one of the main concerns of car fanatics and collectors. However, the scrapping policy is not going to affect vintage cars, as stated by union minister Nitin Gadkari.

But there continues to be a question mark on the fate of classic cars.

According to the industry, vintage cars are those that are aged more than 50 years or were manufactured in between 1919 to 1930. Antique cars are said to be aged 45 years and older. This means that cars such as Padmini, Ambassador or Landmaster are safe. While a classic car is defined as over 20 but between 40 years old. They are the one’s which are expected to adhere as closely as possible to the manufacturer’s design and specifications. Cars such as Maruti Suzuki and its van fall in this bracket (production started in 1980s), and they have made a significant contribution to the writing of India’s automotive history.

Amid the confusion engendered due to this scenario, the fate of classic vehicles continues to be unclear.

At the same time, will the scrapping policy impact the luxury, pre-owned or used car market? Given the fact that car enthusiasts like to add to or change their vehicle collection often, it can increase the influx of used luxury cars in the market.

On this, Singh from Praxis comments, “For the second-hand car market, it was always about vehicles less than 15-20 years old. People would want to buy used vehicles before they aged 6 -7 years and had a driving history of less than a few thousand kilometres only. The scrappage policy is generally linked to the push for new vehicles only.”

Weighing in on this issue, Jatin Ahuja, founder and CEO at Big Boy Toyz says that the scrappage policy has not had much of an impact on the pre-owned luxury car industry. According to him the consumer bracket which falls in this segment belongs to a different section and differs from the general used car industry which majorly deals in utility vehicles. Hence, there are no concerns from them over the scrappage policy coming into action.

“Usually, the consumers who prefer pre-owned luxury cars are car enthusiasts who have a fetish for different sports cars, supercars and luxury or luxury utility vehicles. Usually, we at Big Boy Toyz deal with the cars that are either at a 0 km run or are one or two years old and are in excellent condition, vetted by our own certification process. To have such cars in an excellent condition within a price of your choice – which is providing value for money, does not make the scrappage policy a concern for the brand or the consumers as a whole. Further, in the luxury segment the hands of the owners change in around 3 years, which does not fall under the scrappage policy regulations,” he explains.

However, the scrappage policy has ensured that the supply of cars is in tandem with their demand in the utility vehicle segment mostly, as it does ensure that consumers opt for changing their vehicles sooner rather than later.

The main intent of the policy is to curb pollution, replace older vehicles with newer ones and to spur the growth of the automotive sector and the other ancillaries associated with it. As of now, the policy draft is under observation, as the industry is still having talks on the various provisions. Commercial vehicle operators suggest that the scrapping of the vehicle should be made voluntary but not compulsory. And in case it is made compulsory, then one third of the cost of the new vehicle should be subsidised by the government, another one third should be borne by the manufacturing company as a discount and the rest of the one third cost can be borne by the vehicle owner, which the government should make arrangements for by facilitating bank loans.

However, this might be construed as an inordinate demand because money has to be made.

But if this policy is implemented properly, it can help India to gain a competitive edge globally and be counted among the leading automobile manufacturing hubs in the world. Expectedly, there might be some headwinds in the form of lack of infrastructure. Hopefully, there will be compensations for the consumers in the form of more incentives, GST concessions and lower tax rates.