With the changes introduced to income tax, Union Budget 2025 is surprisingly a people’s budget. Also, with various measures, it has set the foundation for a consumption-led growth model, one that will drive private investment and boost spending. Simultaneously, with measures like the manufacturing mission and the term loans scheme, the MSME sector has been given a shot in the arm. In yet another reform, the Indian Government has revised the definition of MSMEs by increasing their investment and turnover threshold.

This change aims to support MSMEs in achieving greater scalability, technological advancement, and improved access to capital.

Commenting on the initiative, Sudarshan Chari, Managing Director & Head – SME Banking, DBS Bank India, states, “The new definition is poised to drive a broader impact by extending benefits to a wider range of businesses and unlocking new opportunities for enterprises.”

However, will this expansion truly help all MSMEs, or will it tilt the scale in favour of the larger enterprises within the sector? Let’s look at the revised MSME classification and understand its dynamics.

Breaking down revised MSME classification

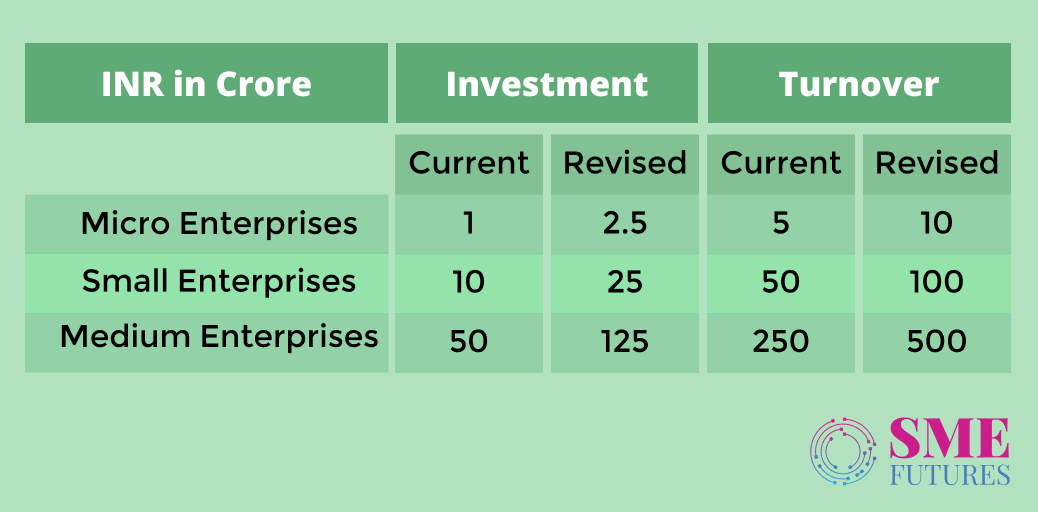

The revised classification raises the investment and turnover limits by 2.5 times and 2 times, respectively. The table below outlines the changes:

This increase means that businesses now have more room to expand while still benefitting from MSME schemes.

Arjun Ranga, Managing Director, Cycle Pure Agarbathi, asserts, “The revision in the classification criteria for MSMEs, with enhanced investment and turnover limits, makes the definition more inclusive. This will empower small businesses to thrive and scale their operations, contributing to the overall growth of the manufacturing sector.”

Also Watch: MSME Reclassification Explained

Rationale behind new classification

Nitesh Mehta, Partner, M&A Tax and Regulatory Services, BDO India, elaborates, “This reclassification will facilitate a lot of companies to get classified as MSMEs and thereby become eligible for MSME benefits, including access to credit. This measure, coupled with the setting up of a new Fund of Funds, with additional funding to start-ups is likely to fuel further growth for early-stage companies.”

Step towards achieving $5 trillion economy

Due to the various initiatives for MSMEs, the sector is witnessing a sea change in its growth and competitiveness and has moved on from basic consumer goods production to manufacturing advanced products.

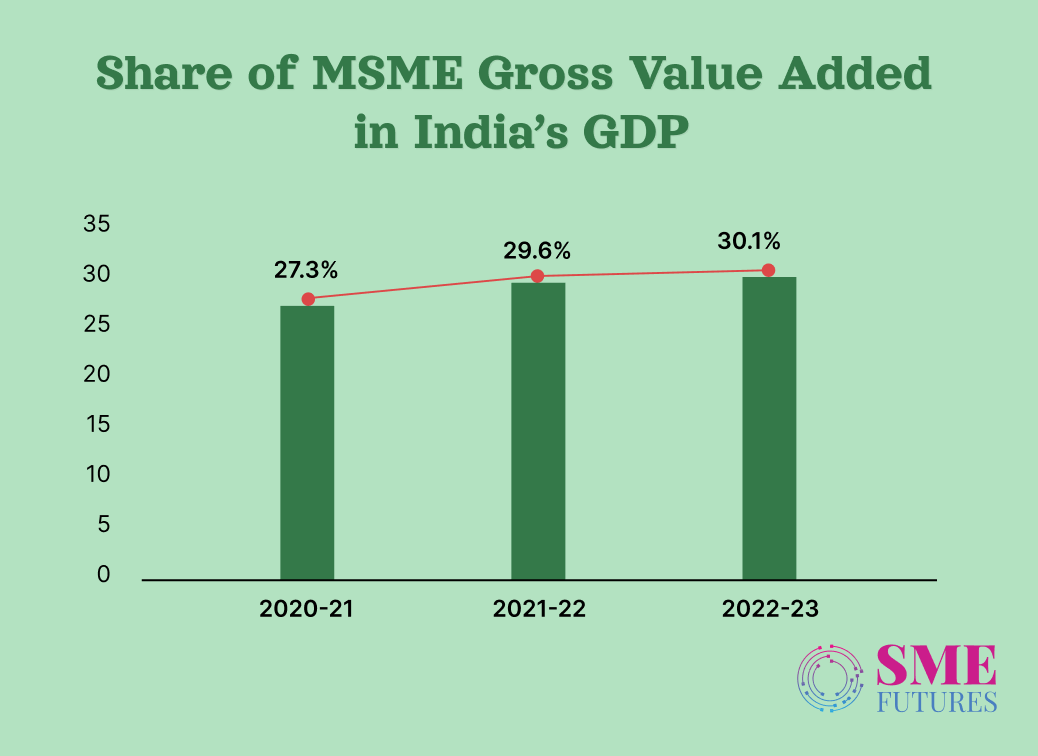

If we go by the latest numbers for Gross Value Added (GVA), it has increased from 27.3 per cent in 2020-21 to 29.6 per cent in 2021-22 and 30.1 per cent in 2022-23, highlighting its growing role in national economic output. However, despite the impressive numbers, Indian MSMEs are still behind global MSMEs.

According to India inc, this reclassification will enhance competitiveness.

Hemant Jain, President, PHDCCI, says that the revised definition will have a long-term positive impact on India achieving a $5 trillion economy and strengthen its manufacturing sector, boosting its global competitiveness.

MSMEs will be able to expand their operations without the immediate concern of losing the benefits associated with their classification. This flexibility encourages businesses to grow and remain competitive in both domestic and international markets.

However, Jain is concerned that the micro units should not suffer at the cost of the larger units. “The micro units constitute more than 90 per cent of the MSMEs. Thus, it’s of utmost importance that the funds reach the micro units to a larger extent as they are more in numbers. This will not only encourage the micro units but will also help them scale up their business operations and maintain their working capital cycle,” he asserts.

More benefits

The second benefit would be technological upgradation.

According to the MSME Digital Index 2024 by PayNearby, over 65 per cent of MSMEs utilise some form of digital technology for their daily operations. This includes smartphones. However, 36 per cent showed resistance towards adopting new technology. While 18 per cent of MSMEs blame the high cost of its implementation for not adopting technology.

A study by Vi Business reveals that nearly 60 per cent of MSMEs intend to digitise their business processes, with 43 per cent planning to increase their digitalisation budget by 2025.

Given the emphasis on digital solutions, the new higher investment limits will facilitate the adoption of advanced technologies, leading to improved productivity and innovation within the MSME sector.

The reclassification will also improve access to capital, say experts.

The current challenge is to bridge the MSME credit gap of $530 billion. MSMEs in India are largely unorganised and uninformed about schemes, with inadequate collaterals. Consequently, bank assessments usually go awry when it comes to lending to these businesses.

Experts opine that the reclassification along with other initiatives like the new digital credit assessment model will be a game changer. With the elevated turnover limits, MSMEs can demonstrate higher revenue potential, making them more attractive to financial institutions and investors, thereby easing access to necessary capital.

Prakash Sankaran, MD & CEO, Invoicemart, says, “The combination of the revised MSME definition along with the November 2024 government notification on the mandatory onboarding of entities with turnovers over Rs 250 crores will unlock efficient cash flow management for MSMEs, empowering them to scale new heights. This move will encourage broader participation from the 7000+ entities with a turnover range between Rs 250 – 500 crores.”

Jain opines, “Additionally, the preferential benefits available to micro and small enterprises under priority sector norms for credit and other schemes would be available to a larger number of units by increasing their limits.”

Also, revising the classification criteria for MSMEs will inspire businesses to scale their operations without the fear of losing the benefits tied to their status, resulting in more job creation.

Since the government is already working on a new digital credit assessment model, the risk assessments are going to be more transparent, perhaps stricter than ever. This could lead to small businesses shying away from formal processes. However, experts feel that the reclassification works because it brings in more ease.

A few questions

Now the question arises, how will the reclassification change the finance dynamics?

Neha Juneja, CEO & Co Founder of IndiaP2P, elaborates, “They (MSMEs) have to worry less about crossing threshold limits and losing out on available government benefits and initiatives. Currently, these businesses face a huge credit gap with less than a fifth of their credit needs served via formal credit channels. The new, increased credit guarantee thresholds should encourage banks and institutions like us to lend more to MSMEs.”

However, most MSMEs are served via NBFCs and some impetus towards additional liquidity for MSMEs will be necessary for greater credit coverage.

There is another side to the story too.

When we ask about the potential challenges that MSMEs might face in adapting to the new classification criteria, Jain explains, “An important challenge which the MSME sector might face in adopting to the new classification criteria can be the diversion of some of the benefits including the priority sector credit towards the larger sized MSMEs. This could impact the growth of micro and small enterprises at the bottom.”

These apprehensions can be mitigated by allocating a minimum percentage of priority sector credit and other schemes for the micro and small units as per the existing definitions.

Are financial institutions prepared to accommodate the increased funding needs? We ask.

Juneja answers, “Both financial institutions and MSMEs must adapt. Lenders need better risk models and liquidity support, while MSMEs require stronger financial literacy. Expanding credit availability requires more proactive initiatives on both sides to bridge the credit gap and ensure smoother access to funding.”

Transformative shift for India’s MSMEs?

The reclassification of MSMEs under Union Budget 2025 marks a major shift towards strengthening India’s small business ecosystem. It will enable greater credit access, encourage technological advancement, and allow businesses to scale without fear. This move has the potential to make Indian MSMEs more competitive globally. However, only time will tell how it all eventually pans out.