India’s investment landscape is transforming in 2024 with AI, renewable energy, EVs, and fintech leading the charge. While challenges exist, the focus on sustainability and tech innovation presents lucrative opportunities for investors.

India’s economic landscape is undergoing a renaissance, buoyed by technological innovations, evolving consumer preferences, and global economic currents. As India emerges as a global economic powerhouse, astute investors are seeking to capitalise on the burgeoning opportunities and navigate the complexities of this dynamic market.

Technological innovation: Artificial intelligence (AI)

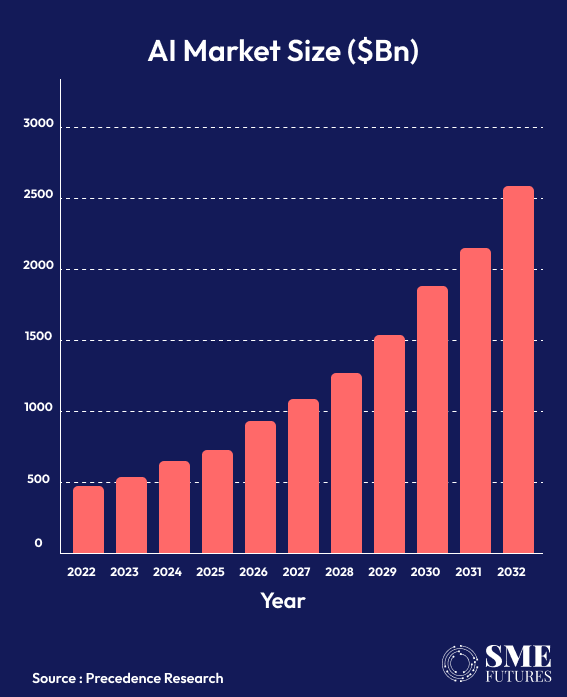

Technology, particularly artificial intelligence (AI), is at the vanguard of India’s economic transformation. Dr. Somdutta Singh, Founder and CEO of Assiduus Global Inc., highlights the significance of AI, stating, “The rise of AI in healthcare is an impressive area for investment.” However, AI’s impact transcends healthcare. Karan Gupta, CEO of Kapso.in, paints a broader picture, stating, “Generative AI is revolutionising multiple industries by enhancing creativity and efficiency, attracting around $25 billion in global investments. It’s making waves in healthcare through faster drug discovery and personalised medicine, transforming finance with advanced predictive analytics, and optimising operations in transportation and retail.”

OpenAI’s Sora.ai technology, for instance is helping the media and entertainment industry by significantly reducing production costs. This is just one example of how AI is not only creating new industries but is also revolutionising existing ones, presenting exciting opportunities for investors who are willing to embrace innovation.

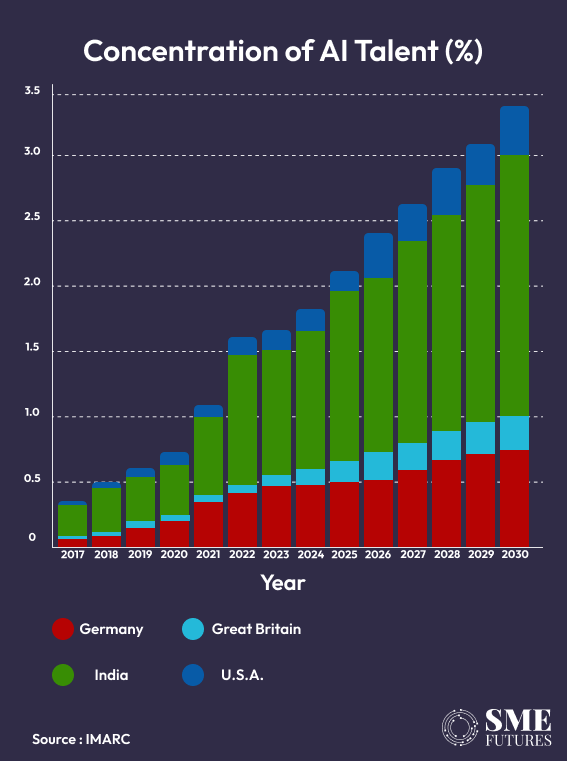

India’s rich talent pool in the tech sector, coupled with supportive government policies, further amplifies the growth potential.

“Sectors focused on technological advancements, infrastructure development, and sustainability are poised for strong growth. However, tax implications and complications of various policies are still an area of concern for professional investors. Regardless, India is at a booming phase with an investment ecosystem marked by immense potential,” says Milan Sharma, Founder and MD of 35North Ventures.

“Given the global macroeconomic trends and the shift in sectoral focus, it will be observed towards healthcare, utilities, and telecommunications. This is already in the picture with marquee investors placing bigger bets on pharmaceutical and biotechnology companies,” he adds.

Renewable energy: A sustainable investment pillar

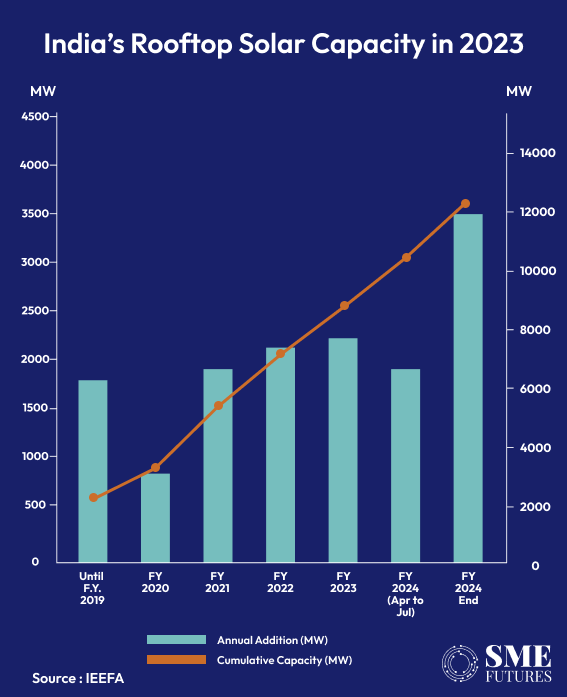

As the world grapples with the urgent need for sustainable solutions, India’s renewable energy sector is experiencing unprecedented growth. The nation’s commitment to clean energy is evident in its ambitious renewable energy targets and the impressive 190 GW of capacity already installed.

Shantanu Srivastava, Research Lead at IEEFA, says, “Due to the favourable cost dynamics of renewable energy technologies, the plummeting of raw material prices lately, the easing of supply chain pressures, and the topping off of interest rates, renewable energy development in India has seen an upswing.”

This surge in renewable energy development presents a lucrative and sustainable investment avenue. Notably, recent capacity auctions have surged 3.5 times year-to-date in the first three quarters of FY2024, compared to FY2023, indicating a growing appetite for clean energy investments.

Boost to fintech sector

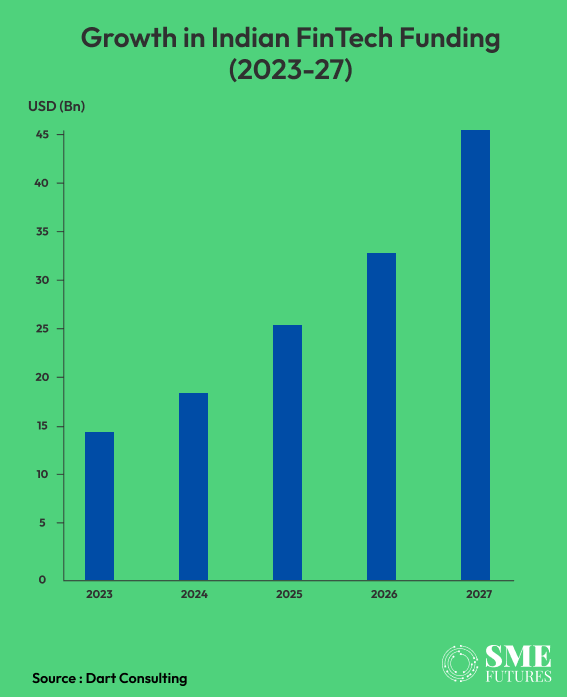

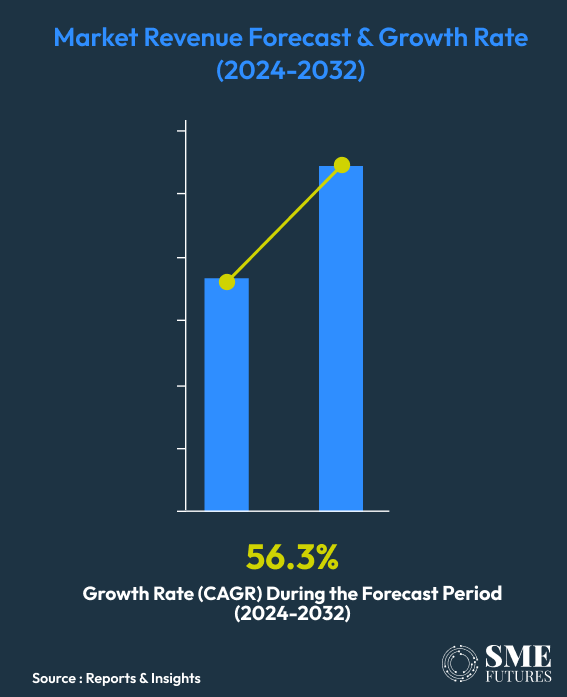

“The fintech sector is poised for transformative growth in 2024 and beyond, propelled by technological advancements, digital adoption, and evolving consumer preferences,” says Nehal Gupta, Founder and MD of AMU.

As McKinsey highlights, the sector has seen robust expansion, with fintech revenues expected to grow at an annual rate of 15% from 2024 to 2028, nearly three times faster than the traditional banking sector’s 6% growth rate.

The convergence of emerging technologies, changing consumer preferences, and government initiatives is creating a fertile ground for growth and investment in India.

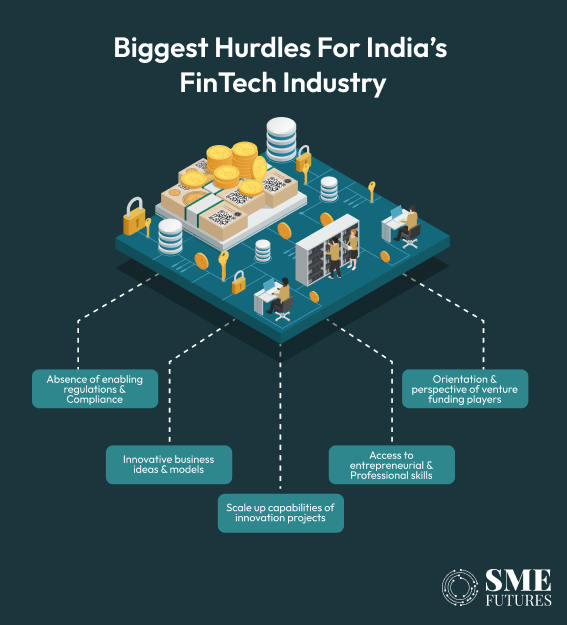

Neha Juneja, Co-founder and CEO, IndiaP2P, contends, “The fintech sector is poised for significant developments in 2024 following an eventful 2023. Due to regulatory and credit tightening in the previous fiscal year, we are likely to see accelerated growth among more established fintech models rather than newer ones. A heightened focus on compliance, including KYC/AML implementation and other regulatory norms, is expected, which may increase costs for many players, particularly smaller ones.”

“This environment may drive consolidation, with regulated models and single feature fintech businesses merging into multi-feature apps and models. Exciting areas to watch include cross-border payments, wealth management apps, climate finance, and targeted credit underwriting,” she adds.

Electronic Vehicle (EV) accelerating sustainability

India’s electric vehicle (EV) market is poised for significant growth in 2024, driven by increasing demand for sustainable transportation, favourable government policies, and a growing ecosystem of innovative start-ups.

Dinesh Arjun, CEO and Co-founder of Raptee, highlights the impressive ROI in the EV industry, which has been outperforming many other sectors over the past few years.

“We see an unprecedented opportunity in the upstream EV supply chains, where competition is intensifying. Financial investors, including banks and VC firms, are increasingly recognising the potential for substantial returns from EV start-ups,” he asserts.

“We anticipate that EV market penetration will rise to 11-13% by FY25, reflecting the accelerating adoption of electric vehicles worldwide. This growth is driven by increased investment, technological innovation, and supportive policy environments globally,” he adds.

There’s also a sustainability imperative towards the rise of EV. The overarching goal of transitioning to EVs is to reduce pollution and combat climate change.

“By 2030, we expect EVs to penetrate more than 40% of the automotive market, generating over $100 billion in revenue. This rapid growth underscores the importance of developing robust recycling and e-waste management systems. Increasing recycling rates, conserving natural resources, decreasing greenhouse gas emissions, and promoting sustainable consumption are the things we should focus on,” says Harry Bajaj, CEO, Mobec innovation.

While the outlook is optimistic, challenges remain. There is a growing concern surrounding the charging of EVs. A lot of work needs to be done on installing charging stations and making sure that these stations do not use fossil fuels or thermal power sources.

“To maximise the pollution-reducing benefits of EVs, investments in renewable energy sources for charging are crucial. Additionally, standardising components like batteries and charging connectors is vital for the industry’s growth, as learned from the mobile industry’s past fragmentation. Government intervention is also necessary to address charging infrastructure challenges and charging speeds, which currently hinder EV adoption,” says Parveen Arora, Partner, BTG Advaya.

Investments in climate tech and ESG

The investment landscape of 2024 is witnessing a profound shift, with climate tech and ESG (Environmental, Social, and Governance) considerations playing a pivotal role. This transformation is being driven by groundbreaking innovations and sustainable solutions that are reshaping market dynamics.

Climate tech is emerging as a key focus area for investors, driven by the urgent need to address climate change and mitigate its adverse effects.

“The funding environment for start-ups remains challenging but climate tech start-ups are getting a lot of attention from investors. A lot of the funding in the climate tech sector became possible on account of increased funding support of over 10 billion USD in concessional capital due to the Inflation Reduction Act in the US,” says Ankit Mathur, Co-founder, Greenway Grameen. India-specific initiatives like the PLI scheme for electric mobility and electronics supply chains are also fuelling this transformation.

Investors are particularly eyeing opportunities in areas like electric mobility, carbon removal, and climate-smart supply chains, recognising the potential for both financial returns and positive environmental impact.

Alongside climate tech, ESG investing is gaining significant traction among investors globally. “Consideration of ESG factors in investment decision making processes is fast gaining traction among investors globally. There has been a significant shift in investor preferences post the pandemic, who are now assessing investment risks and opportunities from the perspective of ESG factors. The biggest driver behind the wider adoption of ESG investing is rising climate action globally,” says Shantanu Srivastava, Research Lead at IEEFA.

The agritech sector is also playing a crucial role in promoting sustainability and climate resilience. “Agritech companies are set to drive rural economic transformation through innovative technologies, enhancing crop yields and resource efficiency while aiding farmers in climate adaptation,” says Dr. Sat Kumar Tomer, Founder and CEO, Satyukt Analytics.

Navigating challenges: Volatility and funding

The Indian investment landscape is not without its challenges. Global economic trends, geopolitical events, and market volatility can create headwinds for investors.

“When it comes to navigating volatility, diversification is always key. Spread your investments across various asset classes and sectors to avoid being overly exposed to any one area. This helps mitigate risk. Additionally, stay informed about market trends and adjust allocations accordingly,” says Teja.

Regulatory complexities and evolving policy frameworks can also pose hurdles. Alternative financing plays a major role in options like revenue-based financing in addressing these challenges.

“Alternative financing solutions offer start-ups the chance to secure capital without collateral, providing fairness and flexibility, unlike traditional bank funding. This avenue also allows for bias-free capital raising, unlike VC firms where personal connections often dictate access to funding. The cumbersome process of traditional fundraising often leaves many young entrepreneurs underserved, particularly those in India’s digital-first businesses,” says Gupta.

India’s investment landscape in 2024 is a dynamic and multifaceted terrain, offering a plethora of opportunities for those willing to embrace innovation and navigate the complexities of the global economy. By staying informed about emerging trends, diversifying portfolios, prioritising sustainable practices, and remaining vigilant against new threats like deepfakes, investors can position themselves for success in this rapidly evolving market.

The road ahead may be fraught with challenges, but the opportunities for growth and transformation are immense. As Milan Sharma puts it, “India is at a booming phase with an investment ecosystem marked by immense potential. By leveraging the opportunities presented by technological advancements, sustainable initiatives, and diverse market needs, investors can contribute to India’s growth story and reap the rewards of their investments.”