India’s festive season is more than just a time for celebrations—it’s a business phenomenon, a wave of heightened consumer spending that brands ride to meet annual targets and foster growth. This year, the enthusiasm for Diwali and related festivals has taken the economy by storm, with sales already crossing ₹54,500 crore in the first week. The landscape, however, is changing, as businesses harness evolving trends, shifting consumer behaviours, and the rise of quick commerce to capitalise on this seasonal boom.

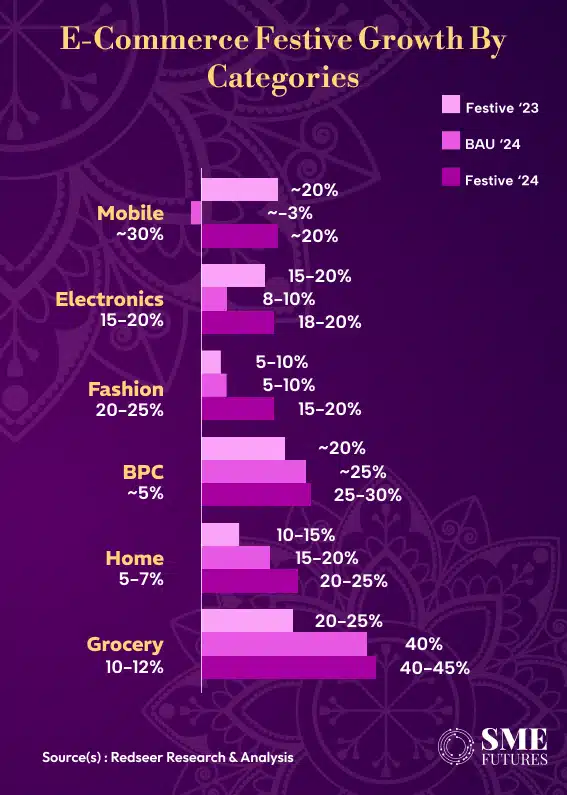

Reports from Redseer Strategy Consultants and Datum Intelligence indicate that consumer spending is at an all-time high, driven by the demand for both affordable fashion and premium electronics. The buzz isn’t limited to urban centres; Tier 2 and Tier 3 cities are making their presence felt with significant growth across multiple categories.

Rise of affordable fashion and tier 2 markets

The first leg of the festive season, from September 26 to October 6, saw an unexpected surge in sales from the unbranded and value segments, particularly in women’s apparel, jewellery, and kids’ fashion. Ethnic wear has emerged as the star of the show, with a bulk of orders coming from Tier 2 and beyond.

“The dynamics are shifting,” notes Kushal Bhatnagar from Redseer. “While high average selling price (ASP) products like smartphones and large appliances dominated the early festive days, affordable items in fashion are now driving growth in the second wave. Ethnic wear and kids’ fashion are surging, thanks to strong demand from smaller cities.”

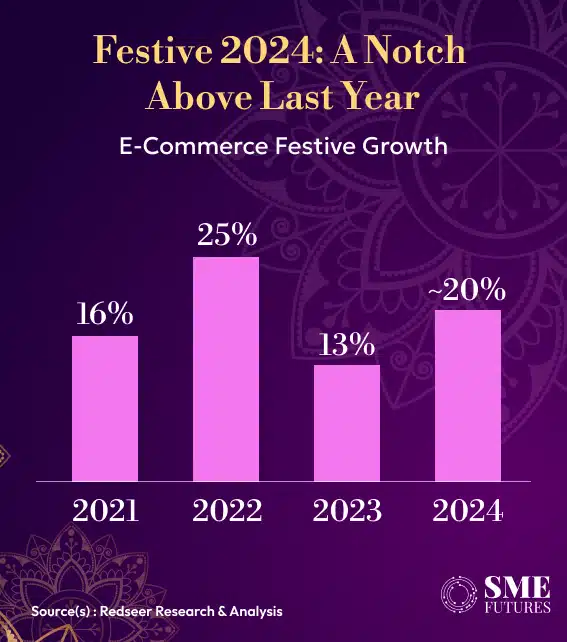

Earlier, in 2023, the nine-day festive event saw approximately 19 per cent YoY growth over 2022.

Premium electronics surge amid comfort-driven spending

Rising temperatures and humidity levels across under-served regions have spurred the demand for air conditioners and refrigerators, contributing heavily to sales of consumer durables. Meanwhile, metro and Tier 1 cities are leading the charge in premium electronics with consumers upgrading to robotic vacuum cleaners, water purifiers, and high-end TVs.

Interestingly, the mobile phone market, although showing muted overall growth, has witnessed a significant shift from Android to iOS, with Apple thriving in the premium segment. This trend points to a growing preference for ultra-premium products, a sector that recorded 12 per cent YoY growth during the early festive wave.

Automotive and trading sectors gear up for peak season

The festive period has traditionally been a critical time for the automotive sector, as Original Equipment Manufacturers (OEMs) work to close any sales gaps. Jayapradeep Vasudevan, Chief Business Officer at Raptee, explains the significance of this period for electric vehicles (EVs).

“Festivals are the time when auto brands chase volume targets with product availability and promotional offers. This year, with multiple EV brands well-stocked, the industry is poised for record sales. While Raptee is yet to start deliveries, we see great potential for the upcoming seasons.”

Similarly, trading MSMEs are seizing the festive opportunity by securing business loans to stock inventory. Hardika Shah, Founder and CEO of Kinara Capital, highlights the surge in demand from trading enterprises:

“We’ve seen a 63 per cent jump in loan inquiries from trading MSMEs this season. Electronics, personal care, and jewellery are leading in demand. With consumer spending projected to increase, business owners are not only stocking up but also investing in property improvements and business growth.”

E-commerce platforms ride the quick commerce wave

The rise of quick commerce platforms is reshaping the festive shopping landscape. With consumers now seeking instant gratification, platforms offering fast delivery for essentials like groceries, beauty products, and personal care items are seeing exponential growth. Quick commerce has also made inroads into categories like mobile phones, further diversifying its portfolio. As per the Redseer, quick commerce is likely to continue its rapid growth spree and could see ~100 per cent YoY during the festive period, enabling ~8 per cent of the festive GMV.

This shift towards lower ASP categories reflects changing consumer preferences, with groceries and beauty products driving multiple orders. According to Datum Intelligence, e-commerce platforms recorded 26 per cent growth in the first week alone compared to 2023, with mobiles, electronics, and home merchandise accounting for 75 per cent of total sales.

Giant in the delivery sector is also seeing an unexpected rise in the deliveries. That being said, Nitin Navneet Tatiwala, Vice President, Marketing & Airline Network (MEISA) at FedEx is anticipating a significant surge in demand, with the e-commerce segment driving more than 10 per cent growth in logistics demand for FedEx in the region.

“The convenience of online shopping, coupled with rising consumer expectations, places a premium on efficient and reliable deliveries,” he says. “FedEx is harnessing advanced digital tools, including AI-powered logistics and real-time tracking systems, ensuring end-to-end visibility, delivery flexibility, and an enhanced customer experience—empowering businesses to handle heightened demand with confidence,” he asserts.

On the other hand, here is the projection that Redseer Report has from the e-commerce sector.

Role of workforce expansion and personalisation in retail success

Festive demand has also brought an increased need for seasonal hiring across B2C sectors. Amit Jain, CEO of TeamLease HCM, explains the significance of quick hiring during this period:

“Most B2C brands scale up their workforce during the festive season to meet rising demand. Our focus is on providing seamless recruitment and onboarding so businesses can enhance customer experience without delays.”

On the retail front, SMOOR Chocolates is focusing on personalisation and convenience to attract last-minute shoppers. Kanchan Achpal, CMO of SMOOR Chocolates, shares their strategy:

“We launched our festive collection early, with personalised hampers and delivery-friendly products available through quick commerce. Our offerings blend traditional sweets with modern elements, like choco mithai, catering to evolving tastes. We’re also investing heavily in performance marketing and influencer partnerships to increase reach.”

Technology meets tradition: UBON’s expansion into smaller markets

UBON, a leading mobile accessory brand, has targeted Tier 2 and Tier 3 cities for the festive season, aiming to bridge the gap in tech accessibility. The company’s strategy goes beyond metro markets, focusing on expanding its distribution network to remote regions.

“We believe quality technology should be accessible to everyone,” UBON’s leadership emphasises. “The festive season is an opportunity to ensure that consumers in smaller cities enjoy the same level of innovation available in metro areas.”

UBON’s strong retail partnerships and logistics capabilities enable it to stock thousands of shops across smaller towns, providing everything from Bluetooth speakers to car accessories. This strategic focus not only builds brand recognition but also caters to rising tech demand in under-served areas.

Season of opportunities

As India gears up for Diwali and the extended festive season, businesses across sectors are capitalising on the surge in consumer demand. With the first week of sales already crossing ₹54,500 crore, expectations are high for the remainder of the season, with total sales projected to touch ₹1 lakh crore by November 3. Meanwhile, Redseer projects that during the festive season 2024 (typically defined from Onam to Bhaidooj), e-commerce is expected to generate over ₹100-120 thousand crore in gross merchandise value (GMV).

The shift towards AI, quick commerce, and personalised experiences reflects the changing dynamics of festive shopping. Companies are focusing on innovation and agility—whether by leveraging micro-influencers, expanding into smaller markets, or launching early collections.

As premium electronics and affordable fashion continue to lead the charge, and businesses ramp up operations to meet demand, one thing is clear: the festive season of 2024 is shaping up to be a pivotal moment for India’s economy. And for brands willing to adapt to the evolving landscape, the rewards are immense.