Shopping for groceries online is not a new phenomenon as it has been there for the past many years. Ordering online for daily FMCG products, vegetables etc. have catapulted the e-commerce market in India towards rapid growth. However, the e-grocery sector got a major boost last year, when out of necessity, a majority of Indian households which were not buying online earlier, also started to shop online for groceries.

Kanika Bansal, a mother of two shared her experience with us, “Earlier, we used to go with the kids to malls which usually have stores such as Big Bazaar or More Fresh for grocery and other shopping. It was a kind of outing for us. But since last year things have changed. I have completely switched to online grocery shopping now, “she says.

Another consumer Jatin says, “I can see how India has changed in a couple of years. Digital transactions have changed the way we shop. 2020 has only accelerated that change. Today our next door kirana shops take online payment and even vegetable vendors do digital transactions. And it just makes life easier.”

Indeed, these comments indicate that Indian households have been very receptive to this change, and hence, the essential e-grocery market, which was once considered nascent, is now in ascendence.

With the number of online retailers on the rise, the Indian e-grocery market has grown at a lightning 70 per cent+ pace last year and is expected to keep up with this healthy pace and grow 8 times in size in the next 5 years, according to new age advisory and research platform RedSeer. Let us look at some interesting figures and statistics about this sector which indicate how the $600 billion grocery industry has been disrupted by e-grocery platforms and how consumer behaviour has changed.

Indian grocery—A giant among all markets

The Hindi phrase—Roti, Kapda aur makaan is apt to describe the basic foundations of every Indian household. However, the most imperative of them all is roti or food, which is the outstanding item among all the things that account for the total retail spending in India.

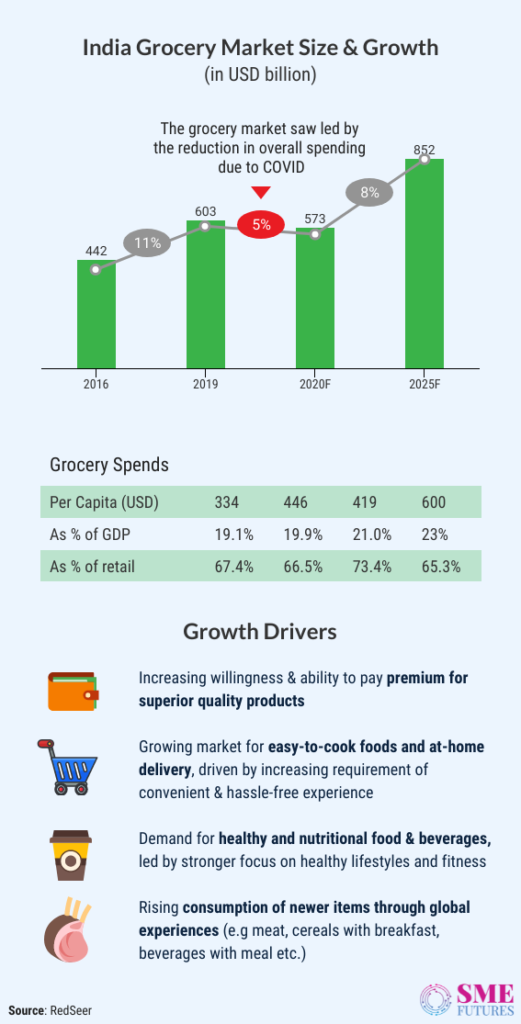

Just digest this—groceries account for 66.5 per cent of the total retail spend in India, which translated into a huge $600 billion+ market in 2019.

Did you know that India’s grocery retail is considerably higher than the US, the UK or even China. Basic products such as non-meat, fresh produce and staples account for almost 80 per cent of the grocery spend in India.

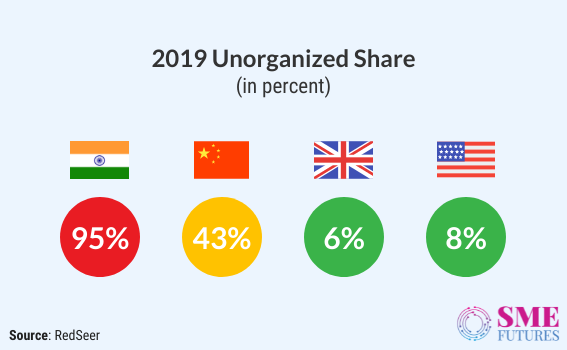

Although the grocery market has evolved so much, kirana or mom-&-pop stores are still the lifeline of this sector. As per the evaluation, it accounts for more than 95 per cent of the total retail spend.

The RedSeer report states that kirana stores thrive on their solid ability to provide convenient and localised service to consumers, primarily in tier 2+ cities that accounts for almost 80 per cent of the grocery spend in India. Of the 11 million total kiranas in India, 8 million+ are present in tier 2+ cities.

Whereas the organised buying and merchandising (B&M) segment is limited to metros and tier1 cities, with an extremely limited penetration in the grocery segment. In 2019, organised B&M accounted for only 5 per cent of the total grocery spend.

In 2020, this sector witnessed a little bump due to consumption blues and supply chain disruptions.

The overall grocery market saw a 5 per cent dip. But being an essential category, grocery was the least affected retail category due to the COVID induced lockdowns. It is now projected to grow at a healthy 8 per cent CAGR and become a humungous $850 billion+ market by 2025.

E-grocery market—Taking huge strides with digital solutions

So far, digital grocery platforms have disrupted the grocery space in India.

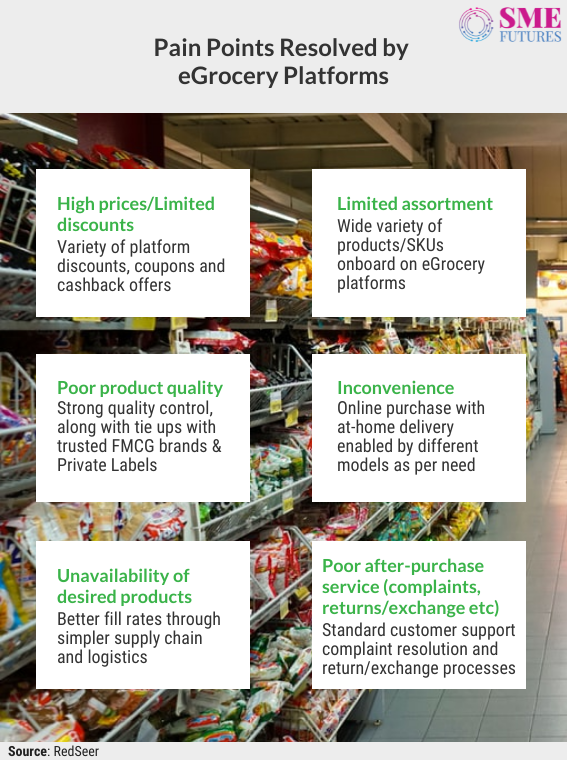

Operating on a simplified supply chain and a tech-enabled retail layer, these platforms have been able to positively transform the consumer’s grocery shopping experience. At the same time, they have played an instrumental role in expanding the supplier/brand reach across consumers.

In addition to this, they are selling products at much cheaper prices, giving more choices and providing doorstep deliveries, which most consumers want in today’s scenario.

Let us have a look at what e-grocery platforms are exactly doing for us.

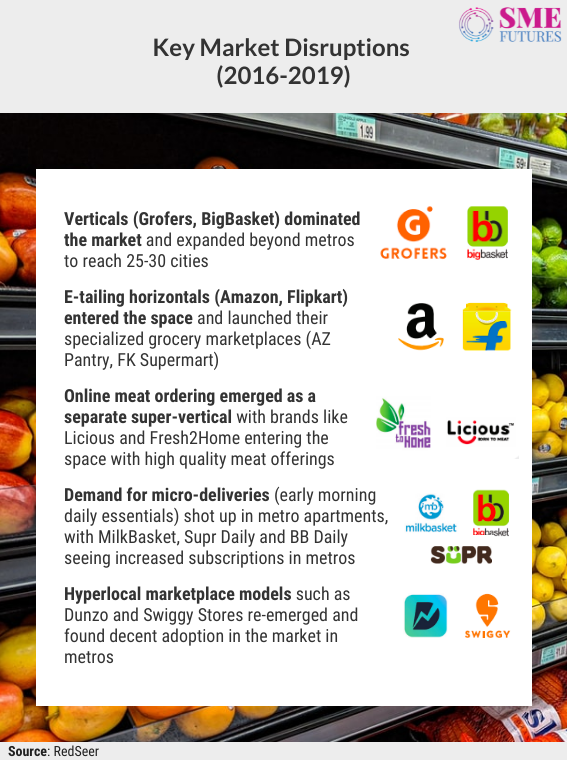

In the last few years, the e-grocery market has shown promising growth with innovative business models in place. In 2019, the sector clocked $1.9 billion GMV with a 60 per cent CAGR. This rapid growth can simply be attributed to some of the key disruptors in the market.

COVID-19—A blessing in disguise for the e-grocery sector

Due to COVID-19, Indian consumers resorted to e-grocery platforms, encouraged by the safe and hygienic purchase experience that they provided.

I am sure that the e-commerce industry cannot deny that the pandemic led to great growth for it last year, which benefitted e-grocery players a lot and soon many others rushed in to seize the opportunity as well. For instance, retail giant Reliance launched its own grocery platform JioMart in May’20, Amazon Pantry expanded to 300+ cities, Swiggy started delivering groceries etc. Besides these big names, multiple new players started their own online grocery stores, while most retailers partnered with these e-grocery platforms.

One such grocery platform is Vedik Green, based out of Greater Noida which started operations amidst the pandemic last year in October. It’s founder Utkarsh Sharma spoke to us,

“It’s a one stop grocery platform which includes organic products, cold-pressed oil and flour and delivers products to your doorstep. We have been getting a good response since our inception as people are now more health conscious. Footfalls have increased in the last 5 to 6 months in the offline space while the online traction is faring well.”

Utkrash Sharma, Founder, Vedik Green

According to Sharma, the consumers are quite receptive and there is an incremental increase of 8 to 10 per cent in their revenue every month, which is a steady growth. Given this growth trajectory, he has plans to expand the brand in terms of product penetration via partnering with other retailers in the societies of Greater Noida.

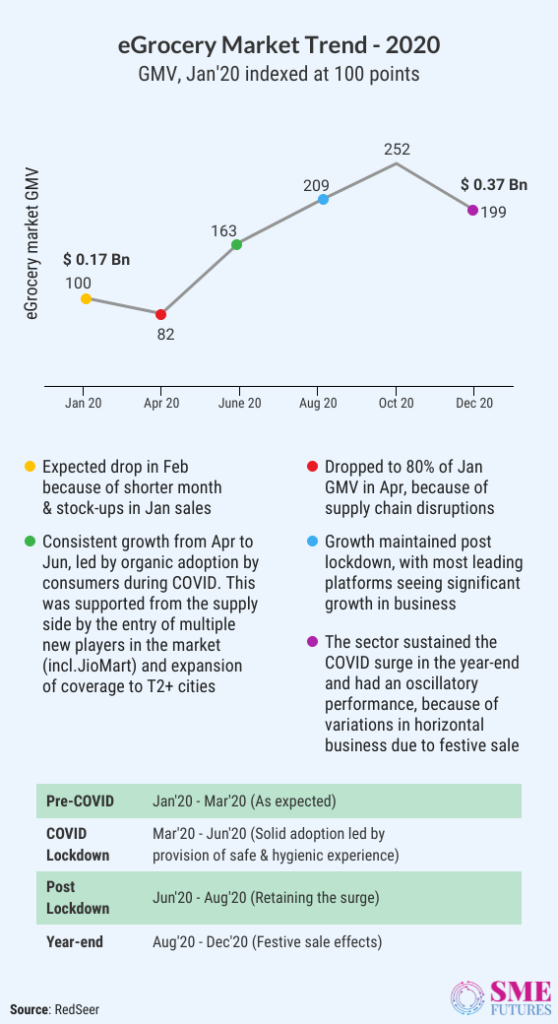

To summarise, the rising number of internet users, online transactions and consumers’ willingness and awareness towards online shopping has supported the growth of the e-grocery segment. According to the market data, the market reached 1.6x of the Jan’20 GMV in June. While, post lockdown, the segment was able to sustain the surge for the remaining year and exited 2020 at almost 2x of the Jan’20 GMV.

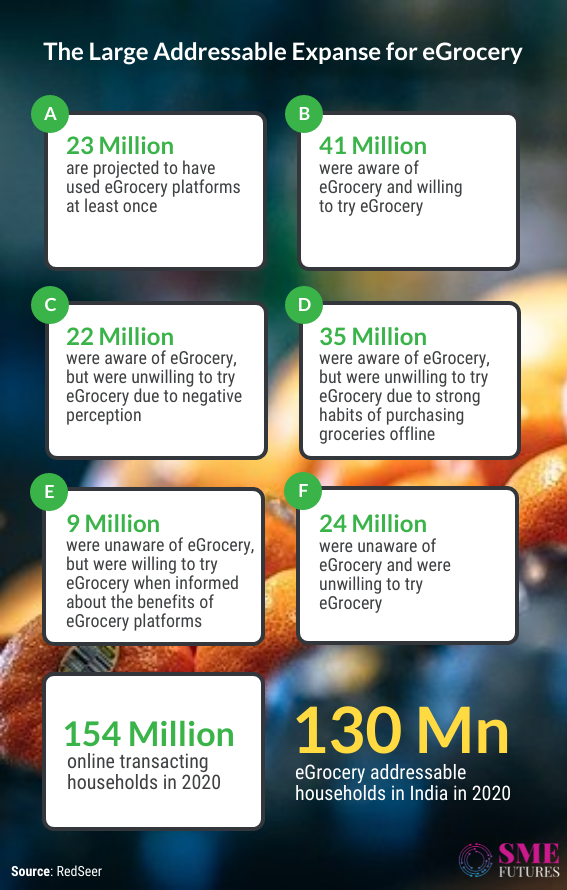

An enormous headroom to grow

In 2020, internet penetration increased rapidly. There were around 670 million users with internet access, of which, more than 400 million people used internet platforms actively. Meanwhile, RedSeer estimates that 75 per cent of the active internet users (i.e., 300 million) are estimated to have transacted online for services as well as products last year. “This translates into 154 million online transacting households in India in 2020. Driven by the growing internet penetration, this base of online transacting households is likely to reach 233 million by 2025,” states the report.

Further analysis of the number’s shows that around 130 million users who were transacting online, either used e-grocery apps or knew about them and were willing to use them. Here is a breakup for further understanding.

Since you and I are still ordering groceries online as the second wave of the pandemic hits us, the Indian e-grocery market has a long way to go. Despite the significant boost that the e-grocery sector experienced recently, the online platforms in the field still have a penetration of less than 1 per cent of the total grocery space in India.

However, driven by the multiplication effect of COVID on the pro-sector factors, the e-grocery market is projected to reach to at least 3 per cent of the total grocery outlook for 2025. Estimates predict a solid growth of a 53 per cent CAGR in the next 6 years. This will enable the e-grocery market to reach a $24 billion GMV in 2025.

Meanwhile, the market has been observing other key trends as well. Consumers who were earlier reluctant to order fresh produce online are now more likely to buy fresh produce along with the other FMCG products online. Other categories like packaged F&B and fresh meat, are also expected to see a decent increase in their online share post the COVID pandemic.

Also, besides affordability, which is the most important purchase criteria, hygiene and quality are now the next important criteria for online purchases. At the same time, leading e-grocery platforms have launched their own private labels at affordable prices to woo consumers considering that consumers usually stick to an affordable brand or to one of their liking. D-mart is a notable example, having a good retention rate, it has grown much faster than its competitors (CY19 revenue—$2.1 bn compared to Future Retail $3.5 bn).

The tendency for stocking up or bulk buying and demand for faster deliveries are further providing an impetus to e-grocery platforms who are gearing up for a long stay.

Overall, there are immense untapped addressable opportunities for the e-grocery players, considering that the major portion of their target audience resides in tier2+ markets. While the e-grocery platforms are still scattered in top metros and tier 1 cities of India, the scenario is changing fast, and these players should adopt new and innovative ideas and strategies to expand their reach. Focusing on innovative business models, reducing the margin prices and forwarding that to the consumers will definitely go a long way in accomplishing these goals for them.