Picture this: It’s a scorching summer afternoon in Mumbai. You’re stuck in a nightmarish traffic snarl, with hunger pangs racking your nerves. You feel the urge to gorge on something, anything. With a few taps on your smartphone, a piping hot biryani arrives right at your car window within minutes.

Now, picture this: You’re in a town tucked away in the rural-urban fringe in Rajasthan. You order the latest smartphone online, and it’s delivered to your doorstep in no time.

It may seem like a miracle – bordering on the unreal. But the magic is happening – and happening in India. It’s the magic of India’s delivery market, a sector undergoing a breathtaking transformation, fuelled by technology, changing consumer behaviour, and a burgeoning economy.

India’s delivery boom

India’s love affair with delivery isn’t new. Remember those late-night pizzas and Chinese takeout orders? But today, the market has evolved far beyond those staples. E-commerce giants, direct-to-consumer brands, and even your local kirana store are vying for a slice of this rapidly expanding pie.

As Abhinav Singh, MD & CEO of Devrana, aptly puts it, “India’s delivery market is undergoing a dramatic transformation fuelled by several key trends.” The booming e-commerce sector, powered by rising internet penetration and a growing appetite for online shopping, is the engine driving this transformation.

According to a Renub Research report, India’s eating habits are changing dramatically. Restaurant-quality meal delivery was still primarily limited to foods like pizza and Chinese less than two decades ago, but now it has expanded far beyond it. Indian food delivery has tripled in value since 2018 to more than US$ 5.30 billion.

The numbers speak volumes about this spiralling growth. The online food delivery market alone is projected to reach a staggering US$91.88 billion by 2029, according to Statista. And it’s not just food; everything from groceries and medicines to electronics and fashion is now just a click away.

Quick commerce: The need for speed

In today’s fast-paced world, consumers crave instant gratification. Enter quick commerce, or Q-commerce, the latest disruptor in the delivery market.

“The rapid growth of ultra-fast delivery platforms has intensified the demand for swift and convenient deliveries,” says Singh.

Q-commerce promises deliveries within 10-30 minutes, a proposition that has caught the imagination of urban dwellers. Imagine ordering your morning coffee or a quick snack and having it delivered before you finish your first Zoom meeting. While Q-commerce currently caters to a niche market, its potential for growth is immense.

Praharsh Chandra, Co-founder and CBO of Shadowfax, points out the untapped potential in this space, saying, “While Quick Commerce is gaining popularity, it currently accounts for only 1 per cent of the total SKUs available in e-commerce. This leaves 99 per cent still in need of efficient and high-speed solutions.”

Challenges and opportunities

While the future of India’s delivery market looks bright, it’s not without its challenges. Infrastructure remains a major hurdle. India’s vast and diverse geography, coupled with inadequate road networks and logistics facilities, particularly in smaller cities and towns, poses a significant challenge.

“Logistical challenges in smaller cities and towns include limited infrastructure, diverse geographic conditions, varying local languages, and differing customer expectations. In some areas, we even use boats instead of bikes for deliveries!” says Chandra, highlighting the ingenuity required to navigate these complexities.

Competition is another key challenge. The market is crowded with established players and ambitious start-ups, all vying for a piece of the action. This intense competition is driving innovation and pushing companies to offer better services at competitive prices.

“Competition in the industry is fierce and growing. Both long-standing and new companies are aggressively vying for market dominance. The arrival of large global corporations has significantly elevated service expectations, while local businesses are rapidly expanding their reach,” Singh contends.

Furthermore, the industry must grapple with the balance between rapid growth and environmental sustainability. The carbon footprint associated with delivery operations is also a growing concern.

Delivering a greener future

To ensure sustainable growth, the delivery industry needs to embrace environmentally conscious practices. Electrification of delivery fleets, route optimisation, and the use of sustainable packaging are crucial steps in this direction.

Shadowfax, a leading logistics provider, is leading the charge in this regard. “Shadowfax is committed to balancing fast delivery demands with environmental sustainability. We have set an internal target to transition to 100 per cent electric vehicles (EVs) by 2027, and we are proud to report that over 50 per cent of our bikers are already using electric vehicles, putting us well ahead of our goal,” Chandra affirms.

The industry also needs to address social concerns, particularly the rights and welfare of gig workers. Fair wages, social security benefits, and skill development programmes are essential for building a responsible and equitable delivery ecosystem.

The government’s role

The government has a crucial role to play in fostering a supportive environment for the delivery sector. Investing in infrastructure, promoting electrification, streamlining regulations, and supporting skill development programmes are key policy areas that can buoy growth.

Collaboration between the industry and government is equally important. Regular dialogue, joint pilot projects, and data sharing can help address mutual concerns and ensure that the delivery market grows in a sustainable and inclusive manner.

“Effective collaboration between the industry and government is essential. The industry can provide valuable insights into operational challenges and potential solutions,” Singh emphasises.

Partnering dilemma: To join or not to join

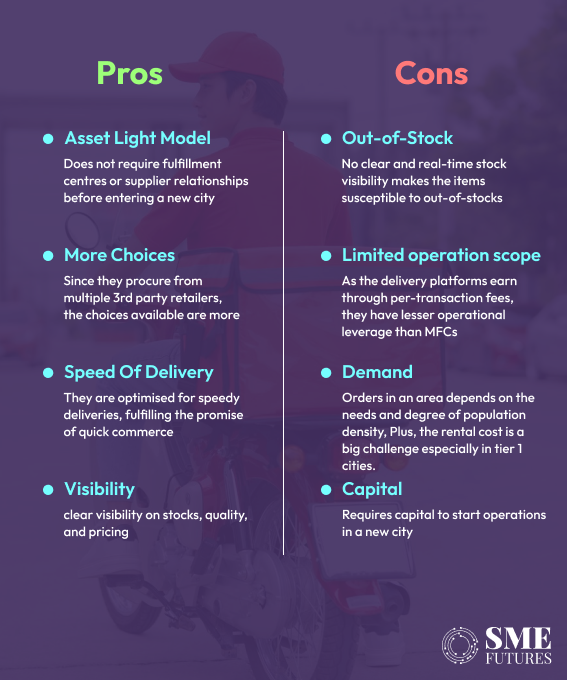

For many businesses, partnering with existing delivery platforms is a strategic decision. It offers benefits such as access to a wider customer base, streamlined logistics, and reduced operational costs. However, it also comes with challenges such as high commission fees and the potential loss of control over the customer experience.

“Deciding whether to partner with a delivery platform in India requires careful consideration of several key elements. A platform’s market reach and customer base are critical. A strong platform can provide businesses with immediate access to a large customer pool. However, aligning the platform’s customer demographics with the business’s target market is essential,” says Singh.

Factors such as market reach, delivery infrastructure, fee structure, and control over the delivery process need to be carefully evaluated.

“Businesses must carefully review the cost structure and fees associated with partnering with the delivery platform,” underlines Vishal Mahajan, Founder & MD, Optimal Retail Pvt. Ltd.

A successful partnership should be built on a clear and transparent revenue-sharing model that benefits both the business and the delivery platform.

India’s delivery market: A bright future beckons

The Indian delivery market is on the cusp of a remarkable transformation. The confluence of factors like e-commerce growth, technological advancements, and changing consumer behaviour is creating a fertile ground for innovation and expansion.

However, the road ahead is not a cakewalk. Infrastructure constraints, competition, and the need for sustainability are key areas that the industry must tackle. Despite all the challenges, the potential for growth is huge. By embracing technology, fostering collaboration, and adopting responsible practices, the Indian delivery industry can deliver a brighter future for businesses and consumers alike.

As George Kuriakose, Founder of Bites n Grill, optimistically predicts, “In the next 5–10 years, we can expect more and more customers to shift to these platforms due to better offers and rates, indicating a promising future for the industry.”