India is the largest producer of cotton among its peers—China, US and Brazil and produces about 6,188,000 tonnes of it per year. Due to the versatility of this lightweight fibre and its pliability, it fits into many diasporas, especially in the arena of textile and apparel making.

Considering this, India also enjoys its position as one of the top cotton exporters in the world.

Over the years, particularly during the pandemic, the demand for cotton textiles has shot up, as have the sales of cotton textiles and cotton apparel. As that was what the consumers wanted during the WFH mode.

Moreover, the growing demand from the domestic apparel industry continues to spur investments as well. According to Industry watcher India Ratings, the demand for cotton remained at an all-time high in the second half of FY21 and it improved from the second quarter of FY22 after a slight dip in the first quarter. Also, on the back of improved consumer spending, the demand momentum has sustained for home textiles in the domestic market.

So far, the picture was rosy. And everything appeared to be in order. Until the prices of raw cotton began to rise, which has led to all the visible cracks in the cotton community.

But why is this happening. Let us explain!

Demand-supply economics

One reason is obvious, there is too much demand.

But the supply didn’t keep up, due to which the prices shot up.

A simple explanation for any commodity price increase is demand pull inflation, which occurs when the demand exceeds the available supply. When there are fewer items available, consumers are willing to pay a higher price to obtain the item. As a result, prices rise. The same logic can be applied to the rise in raw cotton prices.

According to a World Bank report, the average price of raw cotton in the first quarter of 2021 was $1.64 per kg, which was 3 per cent higher than the average price in 2020. In the fourth quarter of 2021, prices were projected to rise to $1.72 per kg.

Like in most other industries, the pandemic has had a role to play here as well. Due to the stagnating production and plateaued demand for cotton textiles during the lockdowns, the entire supply chain was affected. Even the cotton plantations in India were affected, resulting in lower crop growth.

However, the reopening of the industries skyrocketed the demand for cotton. Consumption in 2021 grew faster than anticipated, which only added to the demand-supply gap. This led to a reduction in global cotton stocks and higher prices.

It’s a basic and simple explanation. But there’s more to it than that.

Cotton economics

Cotton farming, on the other hand, is a high-risk activity. To begin with, the cotton crop requires attention because it is susceptible to attack by bollworms and pests. As a result, pesticide costs are relatively high. Cotton harvesting also necessitates manual labour, which increases spending.

This entire process has become more expensive over time.

For instance, in Maharashtra which is known for one-third of India’s cotton production, there has been a massive increase in cultivation prices. According to the Commission for Agricultural Costs and Prices (CACP), the per hectare cultivation cost increased from Rs 14,234 in 2000-01 to Rs 84,743 in 2018-19.

Meanwhile, other cotton producing states like Gujarat saw an increase of Rs 75,186 from Rs 10,691 and Tamil Nadu saw an increase from Rs 28,149 to Rs 1,13,334. According to media reports, this is a 4 to 7 times increase.

Due to the pandemic, the prices have further escalated as inflation is at its peak. That’s another reason for why the farmers have increased their prices.

In addition to this, the cotton agrarian sector was already in the doldrums to begin with. Inclement weather played spoilsport for the farmers of this country in 2021, as rains in early October delayed the harvest. This resulted in lesser cotton crop, leading to a reduced opening stock for the new cotton season. Hence, there was a rise in prices.

“Cotton cultivation in India is dependent on various factors viz, inputs quality at farmlands, per hectare production capabilities and the weather. However, the pricing is determined based on the fluctuations in the commodity markets while at the backend it is the overall production in India which is hampered by diseases and unfavourable weather conditions,”

adds Mayank Tiwari, CEO & Founder at ReshaMandi, a B2B natural fibre supply chain company.

Reportedly, the rise in the prices of cotton has compelled the spinners to hoard their stocks. Which has further increased the prices. According to some media reports, last year, the government wrote letters to cotton producing states, just to check on the incidents of hoarding and to stop them to control the rising prices.

But clearly that didn’t pan out.

Cotton prices woes

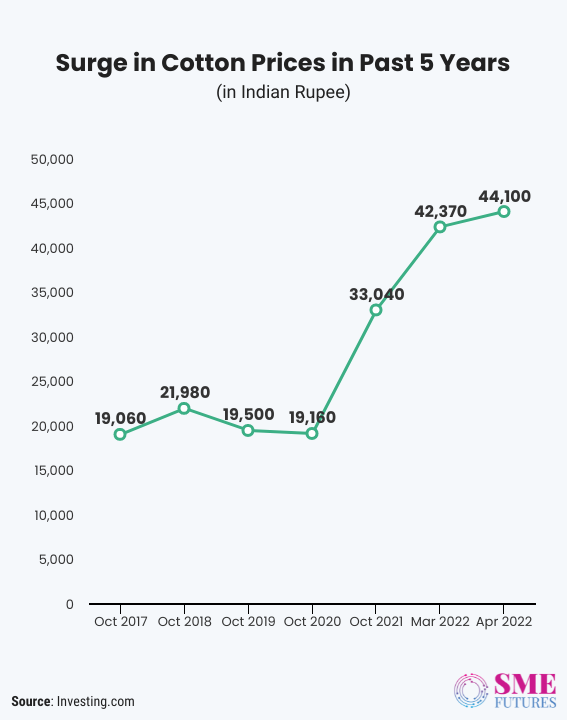

Cotton prices have been out of control since October 2021.

During the cotton season 2021-22, though the season started with a comfortable opening stock of 75 lakh bales (1 Indian bale = 170 kg) and an estimated crop of 360 lakhs bales, the cotton prices started skyrocketing from the beginning of the season owing to the unprecedented volatility in the international cotton prices.

“Cotton is a commodity which has a global supply chain. So, the supply from key cotton producing countries impacts cotton prices,”

says Anuj Khumbat, Founder and CEO of Weather Risk Management Services.

Talking about how the prices get affected, he tells us that cotton prices are mostly governed by the global cotton prices, which determines the prices in India as well. And to some extent it also depends on the Minimum Support Price (MSP) of the cotton.

“The government is not procuring a large amount of cotton from the farmers. But the Cotton Corporation of India (CCI) is driving cotton prices by setting the MSPs for cotton. What happened is that in 2020, for cotton, global prices subdued. But the MSPs were higher. On the other hand, farmers were expecting better prices, but they didn’t get that as per the expectations from the industry, because the global prices were low,” he explains.

But don’t the MSPs cushion these losses? Khumbat agreed that they do but only to a certain extent.

“MSPs don’t work for long. Because unlike wheat and rice, the procurement quantity of cotton is low compared to both these crops. It’s only a fraction of the total cotton production that happens in India,” he says.

Analysts’ views on the prices

Considering the circumstances, at the start of 2022, earlier in January, market analyst India Ratings, had already projected continued high prices in the sector.

“The continued surge in domestic cotton prices during November 2021 was led by a rise in international and domestic demand along with minimal opening stock, despite new cotton arrivals and nil procurement by the Cotton Corporation of India,” it said in a report.

Besides that, the agency estimated a decline in inventory levels by the end of the current cotton season with a lower opening stock and slightly higher consumption. Similarly, the domestic stock-to-use ratio is expected to decline in the new cotton season.

And down the line, the agency’s projections remain the same about the prices.

In fact, the surge in oil prices have already impacted the already high prices in the cotton industry. “Cotton yarn prices increased 3 per cent MoM in February 2022 due to the rise in cotton prices as well as due to a reduction in the production amid the high export and domestic demand. The spreads increased up to Rs 60.14 per kg in February 2022,” the agency reported.

According to the ratings agency, MMF products witnessed a drastic rise in prices in February 2022 due to the increase in crude oil prices.

“Ind-Ra expects the prices to increase further owing to the US ban on Russian oil and the US tie-ups in Europe, along with a rise in raw material prices, led by the ongoing geopolitical issues and increased cotton prices,” the report concluded.

The domino effect

Whenever commodity prices gain, there is a domino effect on the entire value chain. The same is happening to the cotton commodity prices.

Now, as the industry has been reporting an increase in demand, the mood of the cotton yarn manufacturers has soured due to the high raw cotton prices.

For instance, those manufacturers who were using Gujarat Shankar-6 cotton, had to buy it at Rs 8,930 per quintal as compared to the Rs 6,788 per quintal that prevailed in October of last year. Similarly, good quality kapas price has increased from Rs 7,575 to Rs 10,760. Moreover, according to the stakeholders, quality cotton is not available in the market and the premium for the same is 5 to 7 per cent higher. The mills are also finding it difficult to procure cotton.

Since last year, the cotton stakeholders including the cotton yarn manufacturers, the spinners and the textile and apparel makers and the industry associations have reached out to the government, urging it to do something about this situation.

Majorly, they have been asking for the waiver of the 11 per cent import duty for a long time. Which can be broken down to – 5 per cent basic custom duty + 5 per cent Agriculture Infrastructure Development Cess (AIDC) + 1 per cent cess.

The major reason for this ask was the bringing down of the prices.

Apparently, stakeholders such as the Southern India Mills’ Association (SIMA) or the Apparel Export Promotion Council (AEPC), reasoned that due to the import duty on raw materials, Indian apparel is more expensive, due to which India is losing out to the competition in the international market. The removal of these duties will ensure a level playing field for the textile and clothing sector.

The current state of the market

In response to the continuous demand, the government waived off import duties for a limited period till September 30.

There were a plenty of positive reactions to this move by the government.

“This move will promote the exports of the apparel and made-ups sectors significantly by softening the prices of yarn and fabrics as well. Cotton textile exports will get a further boost as the high prices of cotton were blunting our competitive edge,”

says A Sakthivel, President, Federation of Indian Export Organisations (FIEO) in a media statement.

“This would help the mills affected by the frequent rise in the cotton prices to buy cotton at cheaper prices and also help more arrivals,” says South India Small Spinners Association (SISPA) president J Selvan.

As a supply chain participant, Tiwari also feels that the decision has come at the right time to support the overall textile and apparel industry in India. “Being an ecosystem enabler in the natural fibre space, we not only welcome the move, but we are sure that the stakeholders, from farmers to the textile units are all happy. This move will help strengthen India’s position further in the global textile and apparel space and make us a reliable hub of cotton globally,” he further added.

The decision went down well with most of the cotton community but the same cannot be said for the farmers and the weavers.

A conflict of thoughts

“The removal of import duty is no doubt supportive of the industry because it provides ease in importing the raw material. But it creates lots of confusion as well,” asserts Khumbat.

This is because, it was only in the summer of last year that the government had imposed import duties of 10 per cent in the form of BCD and AIDC. Earlier until 2021, there was no duty on cotton imports.

That’s why, the nearly 10 million cotton farmers from all over India are shocked by the announcement of the waiver of the import duty on cotton.

Moreover, for the past five months, cotton farmers have been enjoying a good remuneration of up to Rs 10,000 per quintal for their crops due to the scarcity of cotton. According to the farmers from the south, it’s the best price that they have ever received. Earlier they used to get Rs 4,000 to 5,000 for a quintal.

With this there’s more fear in the agrarian community then peace.

A cotton farmer, VKV Ravichandran from Thiruvarur district of Tamil Nadu, questions the government’s intent. Sharing his thoughts on an open forum, he writes, “It is a big blow to all the cotton farmers. Why should the government drain our scarce FOREX reserves? The government is more inclined to appease the textile industry through such duty waivers at the cost of the Indian farmers. With this kind of hasty policy decision our farmers’ incomes will be reduced substantially (by more than 50 per cent). What is the workable roadmap for the Indian farmers?”

It’s a unilateral decision

Calling it a ‘unilateral decision’, the All-India Kisan Sabha says that it’s a step that has been taken at the behest of the corporate textile companies. The apex body claims that this announcement would lead to an inflow of cheap foreign cotton. “This move comes without ensuring assured remunerative prices and procurement of cotton grown by the farmers in India,” it says.

The body argues that in the absence of an effective procurement policy and a Price Stabilisation Fund (PSF) to ward off the adverse impact of such an inflow on prices, this could lead to a further burden on the crisis-ridden cotton farmers of our country. “It should not be forgotten that the cotton-belt in India has the highest number of suicides by farmers in distress,” the AIKS says.

Similarly, farmers’ leadership bodies, such as the Bhartiya Kisan Union, have also expressed dissatisfaction with the decision and have called for an agitation.

The hoarding menace

The weaving community in Sankarankoil, Tamil Nadu went on strike post the announcement, which adversely impacted the sari production in the area. The reason was the same—the increase in the prices of cotton yarn but the intent was different.

“Even if the government was to reduce the tax, the yarn prices will keep increasing. The hoarders are keeping a huge stock of yarn leading to the increase in its prices,”

the Secretary of the Master Weavers Association, T.S.A Subramanian told the media.

In the last few days, there has been a 64 per cent hike in the prices according to weavers. The price of a yarn bundle weighing 4.75 kg has increased from Rs 1,455 in the April of 2020 to Rs 2,385 in the April of 2022.

“It means that there is something wrong in the market. Market forces are playing with the lives of the poor power loom weavers, and we cannot allow them to be fooled. The government must take stringent action against the hoarders and take steps to bring down the cotton yarn prices on a war footing,” they said while implying that the high prices will force the power looms to shut down.

The weaving community is worried that the decline in the production of saris will lead to the market shifting base and are urging the government to intervene.

Until then

The cotton prices which were rallying at a high of Rs 45,000, are somewhat declining, majorly due to the imports pouring into the country. Officials say that this effect will be more visible in the coming days.

Meanwhile, the think tanks and the analysts feel that the stakeholders should give it some time, instead of rushing to conclusions, even as the cultivators are reeling under a barrage of problems, geographical or political.

Tiwari says, “We feel that as there are more conversations around it and better understanding, the farmers will find the move supportive. This will enhance their chances of reaping the benefits in the next crop cycle too as the demand stabilises internationally and nationally. In the long run, they will see the positive impact of this step.”

It’s true that imported cotton will lead to a price crash, however, the exemption is till September 30. Considering the cotton cultivation cycle of India, the price crash will not affect 80 per cent of the cotton farmers in any way until the new crop reaches the market in September-October. Till then it’s better to adopt a wait and watch policy.