India has recorded the highest ever annual Foreign Direct Investment (FDI) inflow of US$ 83.57 billion in the fiscal year 2021-22. In 2014-2015, FDI inflow in India stood at a mere US$ 45.15 billion as compared to the highest ever annual FDI inflow of US$ 83.57 billion reported during the financial year 2021-22 overtaking last year’s FDI by US$ 1.60 billion despite military operation in Ukraine and COVID-19 pandemic.

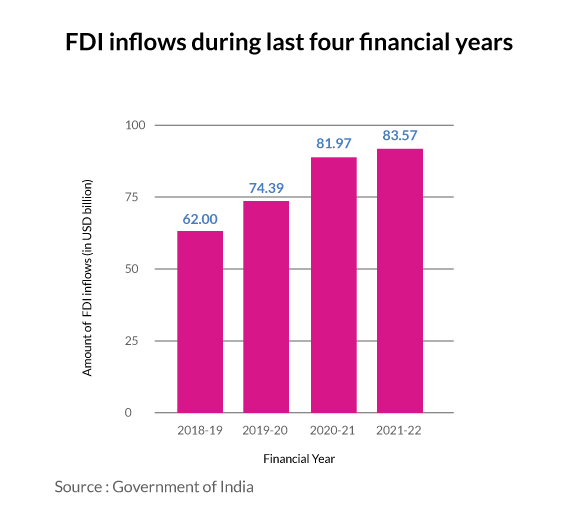

Here’s how the FDI inflow in India has increased over the last four financial years:

The following trends in India’s FDI inflow are an endorsement of its status as a preferred investment destination amongst global investors.

It may be noted that FDI inflow has increased by 23 per cent post-Covid to US$ 171.84 billion (March 2020 to March 2022) in comparison to FDI inflow reported pre-Covid from US$ 141.10 billion (February 2018 to February 2020) in India.

Also Read: India gets stricter on FDI norms; mandate nod from govt for neighbouring countries

In terms of top investor countries of FDI Equity inflow, Singapore is at the apex with 27 per cent, followed by the U.S.A with 18 per cent and Mauritius with 16 per cent for the FY 2021-22. While Computer Software & Hardware has emerged as the top recipient sector of FDI Equity inflow during FY 2021-22 with around 25 per cent share followed by Services Sector with 12 per cent and Automobile Industry with 12 per cent respectively.

Under the sector of Computer Software & Hardware, the major recipient states of FDI Equity inflow are Karnataka with 53 per cent, Delhi with 17 per cent and Maharashtra with 17 per cent during FY 2021-22. Karnataka is the top recipient state with a 38 per cent share of the total FDI Equity inflow reported during the FY 2021-22 followed by Maharashtra with 26 per cent and Delhi with 14 per cent.

The majority of the equity inflow of Karnataka has been reported in the sectors of Computer Software & Hardware at 35 per cent, Automobile Industry at 20 per cent and Education at 12 per cent during the FY 2021-22.

Also Read: FDI trends: Companies choosing to invest in new markets seek stability

The steps taken by the Government during the last eight years have borne fruit as is evident from the ever-increasing volumes of FDI inflow being received into the country, setting new records. The Government reviews the FDI policy on an ongoing basis and makes significant changes from time to time, to ensure that India remains an attractive and investor-friendly destination. The government has put in place a liberal and transparent policy for FDI, wherein most of the sectors are open to FDI under the automatic route. To further liberalise and simplify FDI policy for providing Ease of doing business and attract investments, reforms have been undertaken recently across sectors such as Coal Mining, Contract Manufacturing, Digital Media, Single Brand Retail Trading, Civil Aviation, Defence, and Insurance and Telecom.