The United Kingdom became the first country on December 2 to authorize the usage of a Covid-19 vaccine for use. Hence, Pfizer-BioNTech vaccine will be available for mass usage in the country. India too is considering now a tie-up with Pfizer. While procuring a vaccine candidate doesn’t seem much of a challenge now, devising an effective distribution plan for the entire country may prove to be a herculean task.

Meanwhile, Indian vaccine candidates have also increased the pace of their clinical trials. Currently, 30 vaccine candidates are working for vaccine within the country. Five vaccine candidates are under different phases of clinical trials among these. COVAXIN by Bharat Biotech-ICMR and COVISHIELD by Serum Institute of India (SII) are in phase 3 clinical stage of development.

India is also hosting clinical trials for all major vaccine contenders. SII is conducting phase-3 trial of the Oxford-Astrazeneca vaccine and is expected to submit its final set of data in next couple of weeks. Dr Reddy’s Laboratories and the Russian Direct Investment Fund (RDIF) started adaptive phase 2 and 3 clinical trials for Sputnik V in India.

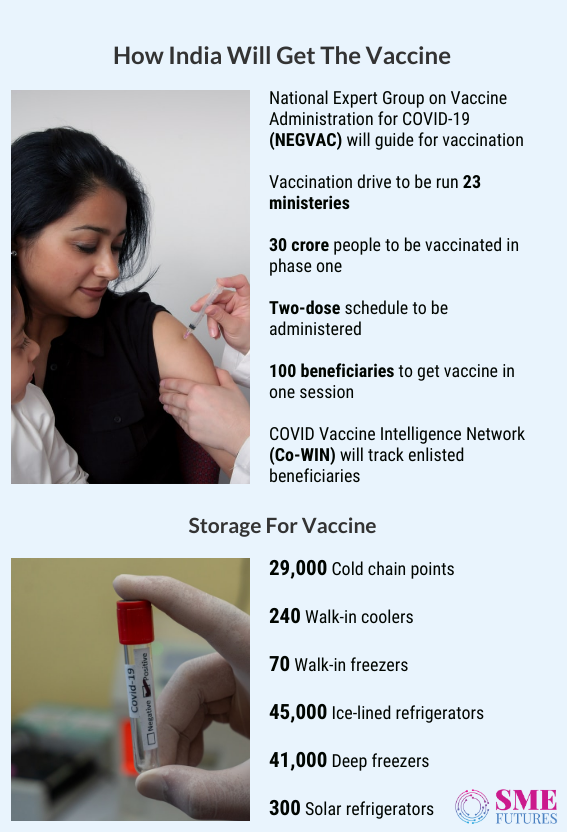

Along with this, Biological E. Ltd has also started early phase 1 and 2 human trials of its COVID-19 vaccine candidate. As of now, government has issued guidelines for mass vaccination drive that may begin in first week of January. Furthermore, Pfizer, SII’s Covishield, Bharat Biotech’s Covaxin have sought emergency approval from the Drug Controller of India which are being reviewed by the subject expert committee.

Significance of Pharmaceutical Manufacturers

As the last leg of fight for development of vaccines nears and pharmaceutical sector focuses on finding the treatment, India Inc is gearing up for the massive opportunity that comes with an efficacious vaccine in India. Stakeholders such as third-party manufacturers, ancillary players, logistics, packaging firms, supply chain players all are planning to become an active part of this drive.

Elaborating about the opportunities for stakeholders, Rajesh Khosla, President and CEO of AGI Glaspac says, “We believe that it is a huge opportunity for Indian manufacturers and start-ups of various industries to increase exports and reduce imports. It is a golden opportunity to raise the bar for made-in-India products in international markets.”

The momentum is also pushing pharmaceutical stakeholders to capitalise this wave of opportunity. “In India, only giants like Bharat Biotech have the approval currently. But in future, it will be very beneficial if companies match standards of exacting the vaccine as per the WHO and MHRA standards,” says Priyanka Sharma, Director—Sales and Marketing, a third party or contract manufacturer in the pharmaceutical sector.

The immunization will not end with the current population as it is an ongoing process. Every newborn will be given this vaccine. Third party manufacturers in India are hence cautiously observing the scenario. They are mostly planning their steps according to upcoming vaccines.

Infact, third party manufacturers from Baddi industrial belt which is known for pharmaceutical manufacturing have formed joint ventures with big pharma companies to manufacture vaccine. For instance, Russia’s Sputnik V will be manufactured by a company Panacea, according to media reports. Madhav Chopra, business development officer at Lifecare Neuro Products Ltd tells us that though his company is not involved in such contracts but, many companies will be involved, but they are not allowed to say anything or disclose any information. He further says that as of now there will be no major challenges which can be viewed as hurdle.

According to Sharma, “Post clinical trials, we will know how long the protection will last and will we be able to eradicate the impact of last leg of the pandemic completely. Third party manufacturing will depend on companies that are manufacturing the vaccine, and how many of them will get government’s approvals. India is yet not clear about how they will go about it.”

Investments of packaging sector

Packaging is an integral part of drug manufacturing. Experts suggest that for Covid-19 vaccines, only Borosilicate glass packaging is utilized. The glass packaging market is already witnessing a stark rise in demand for vaccine glass bottles. This demand is likely to generate unprecedented sales not only in India but across the world. Khosla claims that with this increase in demand, pharmaceutical sector will grow. It can be because of demand for immunity building medicines or due to demands for an upcoming vaccination drive.

Seeing the current market sentiments, Khosla’s company AGI is ready to cater to demands. The company has already invested Rs 220 crores in a new plant which will focus on the ‘AGI specialty glass division.’ Khosla tells us that AGI Glaspac’s entry in the new segment of manufacturing specialty glass is a strategic decision. “It will allow us to cater to the much-expected rise in global demand after the pandemic subsides,” he adds.

At the beginning of the lockdown, AGI had predicted the market forecast. Therefore, they made sure to be future ready with required manufacturing glass vials at large. “For COVID Vaccine packaging, we have dedicated two assembly lines in our existing infrastructure. We have also communicated to various vaccine candidates such as Bharat Biotech that we are ready to supply glass packaging,” he tells us.

According to an estimate of various institutions, even initial global vaccination campaign requires one billion units. That is roughly equivalent to two per cent of the current annual demand for borosilicate glass containers for injectable drugs. Yet, further vials will be required for COVID-19 treatments along with other unrelated therapies that have been postponed because of the crisis.

Considering this, other giants in glass bottle manufacturing such as Schott AG and Piramal Glass have also come ahead to provide specialised pharma glass globally. Stepping up to ensure the adequate supply, Schott India has added a manufacturing facility in Gujarat within the span of a year. It will enable 25 per cent increase in the production capacity.

In addition to that, the company is increasing manufacturing of borosilicate glass tubing globally by 40,000 tons. It will provide enough raw material to produce an extra 6.8 billion standard vials. Piramal Glass has also ramped up manufacturing of moulded and type 1 vial in different sizes anticipating huge demand. They have also added a furnace of capacity of 45 TPD for manufacturing of type 1 glass as a backup.

HVAC players to ensure quality storage

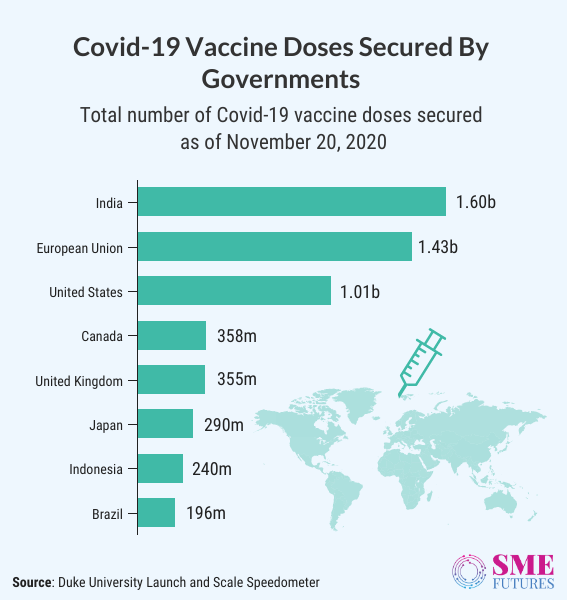

India is the largest buyer of COVID-19 vaccines in the world with 1.6 billion doses. According to the global analysis, this number could cover 800 million people. It is almost 60 per cent of world’s population which will be enough to develop herd immunity. To ensure an effective distribution in such an enormous population, vaccines need to be stored efficiently at the suggested temperature. This varies from vaccine to vaccine (8 to -90 degree celsius).

The cold chain players therefore come to the forefront in this. A player in HVAC&R sector, Bry-Air currently serves major pharmaceutical companies and hospitals globally. Dinesh Gupta, Director, Bry-Air (Asia) spoke to us about how cold chain industry is gearing up for the vaccination drive. According to him, players of this industry have an unsung contribution in ensuring the quality and standards of the vaccine which are preserved at every stage.

Recently, sanctity of numerous tests taking place worldwide was under the scanner. Even best labs around the world were facing trouble in churning out the correct data for rapid tests taking place. Moisture or humidity control has a significant role to play in ascertaining the correct test results. At all times, the humidity of the quick test production room must be controlled because it causes the absorption of moisture in the sample surface which means a sample can be compromised.

Gupta tells us that experimenting facilities, hospitals, and delivery partners will necessarily require environment control solutions to assure vaccine’s quality. Therefore, upcoming vaccination brings a mountain of opportunities for us. He says, “These companies largely rely over Bry-Air solutions for all their environment control needs and the arrival of COVID-19 vaccine will further increase the demand for our world-renowned products and solutions.”

Elaborating requirements of pharmaceutical industry at this moment, Gupta says that his company is uniquely positioned to provide customised solutions. “Indian pharma is growing, from vaccines to API manufacturing and from diagnostic kits to producing a variety of nutraceuticals. Hence, the country now has world’s attention. All these growth areas require support of smart dehumidification solutions which are practical and cost-effective.”

Another player in this field, Thermo King by Trane Technologies has expanded its Indian portfolio storage solutions to meet requirements for the storage of Covid-19 vaccines. This new cold storage solution can maintain temperatures of -70 degrees Celsius for an extended period. It can also be leveraged to reduce degradation of vaccine vials, and most importantly could prevent lack of accessibility of vaccine.

In an official statement company says, “It’s an ‘unbroken’ link to cold chain solutions for Covid-19 vaccine distribution. As one of the leading products in intermodal transportation, we also have the SuperFreezer refrigeration unit with ultra-low temperatures down to -70°C that delivers unmatched low-temperature performance. This is to maintain and deliver products of highest quality while extending their shelf life for increased profitability.”

The company is also engaging with pharmaceutical and transport companies, policymakers, regulators, and other industry partners to discuss ways to strengthen the cold chain. The official statement adds, “We know that we can help to mitigate risk – we have a long history in cold chain expertise and are actively working to innovate and address complexities and potential challenges of the mass distribution of a temperature-sensitive vaccine.”

Challenges and opportunities in vaccine distribution

Another major challenge in distribution of vaccine under the controlled environment and temperature is how to transport it. According to the WHO, nearly 20 per cent of temperature-sensitive health care products are damaged during transportation and 25 per cent of vaccines reach their destination in a degraded state due to breaks in the supply-chain.

Immunization with over 1.6 billion dosage in a short period of time is hence an enormous opportunity for the supply chain players. The pharmaceutical companies, state governments, and non-governmental organisations are already scrutinizing the market and evaluating their alternatives for partnerships. Government, on the other hand is prioritising various population groups for vaccination.

The first 30 crore Indians to get inoculated will be healthcare and frontline workers and individuals with co-morbidities. Given that the overall process is complex and requires ultimate quality compliance, air freight is going to be a preferred supply channel. Hence, major Indian airports will provide flexible slots and separate temperature-controlled zones while air cargo operators would run multiple flights in a short time span to transport Covid-19 vaccines.

According to Chhatrapati Shivaji Maharaj International Airport spokesperson, Mumbai airport will become the ‘largest pharma gateway in the country’ and it will provide flexible slot allocation for ad hoc freighter operations for transportation of Covid-19 vaccines. The CSMIA will provide “round the clock green channel with dedicated truck docks, X-Ray machine, ULD (unit load device) buildup workstation” and key account managers will be deployed for “round the clock monitoring of vaccine operations’, the spokesperson told in a statement.

In a media statement, air cargo operator Blue Dart spokesperson claims that the company’s air capability “has various scalability options including charters as well as variable timing options.” Blue Dart has six Boeing 757 freighter aircraft in its fleet. He has further added, “We have eight pharma grade conditioning rooms at eight strategic locations like Mumbai, Chennai, Hyderabad, Ahmedabad, Pune, Kolkata, Delhi, Bangalore, and Pune.”

If we talk about supply chain challenges, cold-chain infrastructures that adhere to Good Manufacturing Practices (GMP) exists only in the top six cities of India. Further, most of the vaccine delivery practices are still without quality monitoring. Hence, authorities would not be sure about efficacy of the vaccine while it is administered. So, reach and quality at the time of administering are two key challenges for most of the supply chain players.

Saurabh Pandey, Co-founder and CEO of Aknamed, a new age hospital supply chain company says that the company is focused on helping hospitals in the delivery of better healthcare and a critical piece of that effort is delivery of the right pharmaceutical and surgical products.

He tells, “For the last several quarters, we have been at the forefront of helping our hospital partners in procuring, stocking and administering temperature sensitive pharma products and vaccines across the country. We have now geared up with validated cold-chain capability in 15 cities.”

To adhere to standards, the supply chain startup is scaling its physical presence by increasing its investment in cold-chain capability. It is also strengthening its tech capabilities to monitor the movement of each vial or dose. This is done by providing a cloud-based data monitoring system that provides full transparency of the temperature maintained throughout the transportation. This will give confidence to authorities about the efficacy of vaccine while administering it.

Development of an alternative medicine

India has been a hub for alternative medicines. Indigenous alternative medicine systems such as Ayurveda, Unani, TCM and some others have proved to be pivotal in boosting immunity against COVID-19. Hence, during this global health crisis, pharma experts and medical practitioners are also exploring prophylaxis through natural and herbal products. Manufacturers of this segment are also researching on various products related to the cure and immunization of Covid-19.

Out of 122 trials of medicines for Covid-19, 67 were Ayurvedic medicines developed by Ministry of Ayush. For instance, Dalmia Group has developed Astha-15. It will be the first Ayurvedic drug and an indigenous formulation from India in the global market that addresses respiratory disorders in this widespread disease. In other news, clinical trials for an ayurvedic remedy called Immunofree by Corival Life Sciences and nutraceutical called reginmune by Biogetica showed exceptional results in treating covid related symptoms.

Akshi Khandelwal, Founder and CEO of Butterfly Ayurveda spoke to us about development of an indigenous medicine. According to her, Ayurveda has proven to be very effective. Herbs like Giloy and Ashwagandha are very effective to boost immunity of human body and also treat symptoms of this disease in their primitive stage. One of its classical treatment is Amritaarishta, a decoction syrup made of giloy.

It is very effective in all kinds of fever and flushing out toxins from the body and building immunity. “Due to such a strong foundation of Ayurveda, many modern Ayurvedic formulations have been and are being developed. Butterfly Ayurveda’s Coronafly which will be renamed Covifly and Patanjali Ayurved’s Coronil are some examples of it. These are also useful in treating the symptoms of COVID and boosting immunity against it,” she adds.

Future of equitable distribution

India ranks third in the pharmaceutical market in terms of volume and thirteenth by value and is known as major provider for generic drugs world-wide. As per the IBEF estimate, the sector accounts for nearly 3.1 to 3.6 per cent of the global pharma industry in terms of value. It is expected to reach $100 billion by 2025. With opportunities generated due to distribution of vaccine, it could go beyond this estimation.

“With the advent of pandemic, contract manufacturing of salts, hand sanitizer industry, mask industry, packaging, and PPE kit manufacturing industry has also boosted. Overall, many health oriented, and hygiene-oriented businesses have opened, and Make in India products and policies are getting a boost. Even government is trying to make India more and more self-reliant,” expresses Khandelwal.

Although it’s a major thrust to contract or third-party manufacturing in the country, it will bring many challenges along. Players in the sector are considering waiting for some substantial vaccines. Sharma of PharmaKing says, “As manufacturing, logistic and supply chain is directly related, we plan to wait and see the market and the production first.”

She further points out that adhering to WHO regulations will be a big challenge for stakeholders. According to her, in past many of the manufacturing facilities have taken regulations lightly. If stakeholders want to grab opportunity, they need to mend their facilities to be able to be a part of it.

The newly developed vaccine falls under general drug licensing. Any pharmaceutical facility with this license can manufacture the vaccine. In addition to it, it is not necessary for a manufacturing unit to be WHO certified but a unit can be used to extract the vaccine if has met WHO’s rules and regulations.

Other challenge that stakeholders talk about is procurement of APIs. The sudden turn of events gave us all a clarion call to become self-reliant in producing generic drugs. Gupta of Bry-Air talks more about this challenge. He says, “The only challenge that we see is our country’s dependency on China for sourcing APIs. In this direction, government also sped up opening plants within the country for quality API production.”

Sharma of PharmaKing believes that if the government caps vaccine for Covid-19, manufacturers will encounter challenges to procure APIs and other related requirements. “This will result in the surge of demand and supply will be limited or short. All the pharma giants will then store huge quantities of APIs and this will further result in increase of prices,” she expresses.

On packaging front, Khosla sheds some light on challenges that the sector can face. According to him, this vaccine requires specialised packaging material made up of glass. It is not going to be a small quantity as huge volumes of vials are required. For such a scale of manufacturing, players in this field must invest and organise their assembly lines with best solutions. This needs capital and a long-term contract to gain from this opportunity.

Secondly, the demand is going to be concentrated as the vaccination drive begins. According to Khosla, the demand for covid vaccination will be short-term which will be a focus of 2021. “Afterwards the demand will decrease drastically and will be concentrated to infants. So packaging players are not sure of what they will do after creating specialised facilities and capacity for such products,” she tells.

Khosla further elaborates, “If any manufacturer wants to raise its capacity, it will take good time of at least six months to rebuild an infrastructure. This includes implementation of machinery, manpower, technology and other things. The sudden demand surge is going to create a lot of problems and challenges for us as well as for the entire supply chain.”

Anmol Arora, CEO, Docvita foresees an air of apprehensions on the covid medicine in public. He says, “After the launch of Covid-19 vaccine in India, the vaccine will carry a lot of confusion and apprehensions among people for few days. The safety of supply chain will be crucial, as organised criminal networks could also try to advertise and sell fake vaccines.”

He suggests that pharma companies should partner with telemedicine players such as Practo, DocVita, mFine, DocsApp and others to raise awareness. “In this way, we can help people develop confidence in the vaccine and address any concerns of people about the vaccination. Telemedicine platforms could also help pharmaceutical companies in getting data and extending help to patients who may experience side-effects of the vaccine,” says Arora.

There is are enormous efforts and investments going into the development of Covid-19 vaccine on various levels. The planning includes many aspects of implementation across the country and world with various stakeholders involved. Hence, there is tremendous pressure on all. But once the vaccination drive starts, we might witness how challenges could prove to be more daunting on the ground and opportunities could prove to be more lucrative.