On the four-year anniversary of the implementation of the goods and services tax, Prime Minister Modi tweeted, “GST has been a milestone in the economic landscape of India. It has decreased the number of taxes, the compliance burden & the overall tax burden on the common man while significantly increasing transparency, compliance and overall collection. #4YearsofGST.”

For the government it’s one of their success stories.

The GST, one of the most significant tax reforms in independent India’s history, is based on the notion of ‘one nation, one market, one tax’. It has subsumed almost all domestic indirect taxes, barring a few major exceptions like petroleum products, alcohol, and stamp duty on real estate.

With the goal of simplifying India’s indirect tax regime, GST was launched in 2017 amidst a challenged consensus and troubles around technical readiness. Since then, the GST landscape, policies and law have evolved constantly.

The authoritative rationale is that despite the current blow to GST collections due to the pandemic, GST has greatly aided trade and industry in the last four years along with bringing many changes in the tax regime. During the four years since its implementation, GST has transformed the way businesses are conducted.

The finance ministry states that GST, which is both consumer and taxpayer friendly, has aided in increasing tax compliance through lower rates. As high tax rates in the pre-GST era were a deterrent to paying taxes.

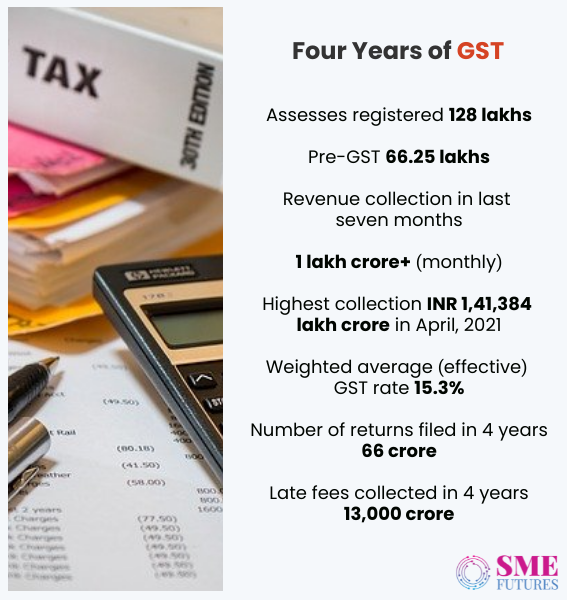

So far, over 66 crore GST returns have been filed.

With this, it has mitigated the challenges caused by different tax rates in each state, inefficiencies, and compliance costs across India. According to the ministry, compliance with GST has been steadily improving, with approximately 1.3 crore taxpayers registered.

However, the way GST is perceived by government officials, experts, businesses, and industry insiders varies.

SK Rahman, Joint Secretary, GST Council says that the government is focusing on resolving industry issues despite fighting COVID and negative GST tax revenues. He emphasises that the GST Council has held 44 meetings so far, which shows the integrity and seriousness with which industry issues are being taken up for the smoothening up of operations.

“So far, rate rationalization has been done on a number of goods. Other important decisions relating to online registration, refund claims, QRMP, GSTR 9 & 9C, e-invoicing, extension of due dates for various compliances, e-way bills and the waiver of late fees among other measures have been taken for helping trade and Industry,” he says.

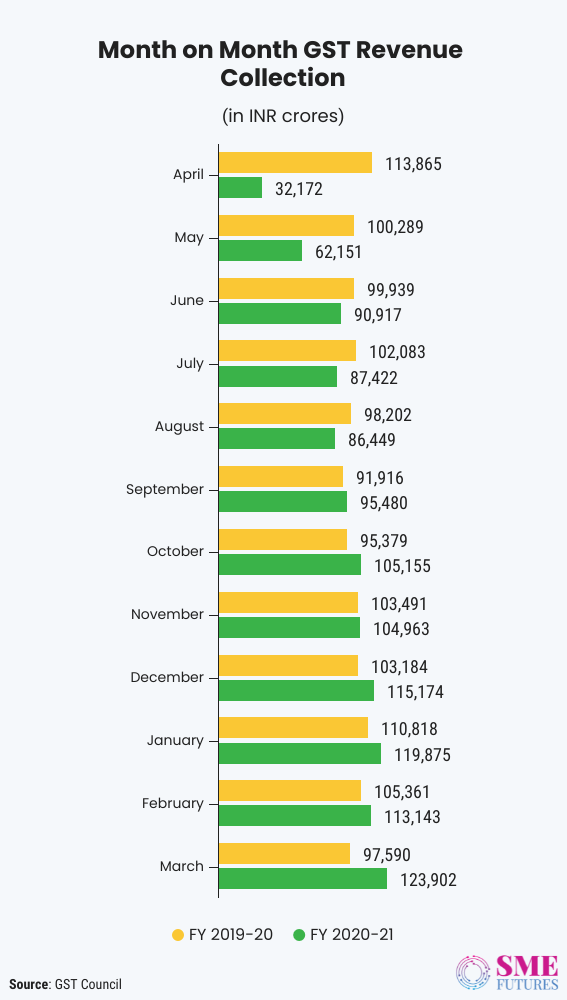

In the last four years, the tax base has almost doubled from 66.25 lakhs to 1.28 crores. For eight months in a row, GST revenues have crossed the 1 lakh crore mark. There was a record GST revenue collection of Rs. 1.41 lakh crores in April 2021. The capacity of the GST Network has been suitably upgraded to mitigate technical glitches and system failures to provide a smooth filing experience to taxpayers.

President of PHD Chamber of Commerce and Industry (PHDCCI), Sanjay Aggarwal says that GST has made it easier to do business in India, “Overall, it’s now much easier for businesses to set up operations here due to the one tax regime. There is an improvement in our world ranking for setting up operations and getting registered in India,” he tells us.

In the last four years, India’s rank in the ease of doing business index has ascended to 63 from 130 earlier, among 190 countries.

“All you have to do is complete and submit an online form to obtain a GSTIN. Launching a new business and subsequently expanding it, will be comparatively easier under the GST regime,” says Jay Jhaveri, Partner at Bhuta Shah & Co LLP and a GST subject matter expert who concurs with the view that GST has indeed made doing business easier.

Ease of doing business and transparency are some of the positive aspects of GST, Jhaveri points out.

He says that under GST, due to the registrations being centralised, the rules are uniform for all the states across the country.

“Previously, businesses providing both goods and services had to calculate the VAT and service taxes individually. GST eases the process by removing the distinction between goods and services; tax will be calculated for the final total, not individual products, or services,” he avers.

Adding to that, he points out that GST has reduced the tax disadvantage which was created during the pricing of products due to the multiplicity of taxes. “Tax disadvantage is significantly reduced, making Indian products price competitive domestically and internationally,” he opines.

“Moreover, the transparency introduced by GST in terms of vendor reconciliations, tariffs, nationalized law framework etc is unmatched compared to the erstwhile laws,” he further adds.

But it’s a much pampered and hyped tax, say a few

P Thiaga Rajan, the finance minister of Tamil Nadu, has long been a vocal critic of GST. Recently in a virtual meet he said, “When we went into it, we went with apprehension.”

“We went in with a lot of trepidation and fear and some hope of outcomes that would give long term and widespread benefits. However, nearly five years down the line, the fears have grown immensely while the benefits have not even been realised by even 20-30 per cent,” he further said in a meeting organised by IIM-B’s alumni association.

“Sensible people may agree or disagree on a design or system or platform, but logic says that you keep re-evaluating based on the outcomes. Have you achieved the goals you wanted? Have you avoided the failures you feared? If the answer to both those is ‘no,’ logical people would say ‘re-tool, re-structure’,” he added.

His concerns also align with those of many businesses and apex bodies.

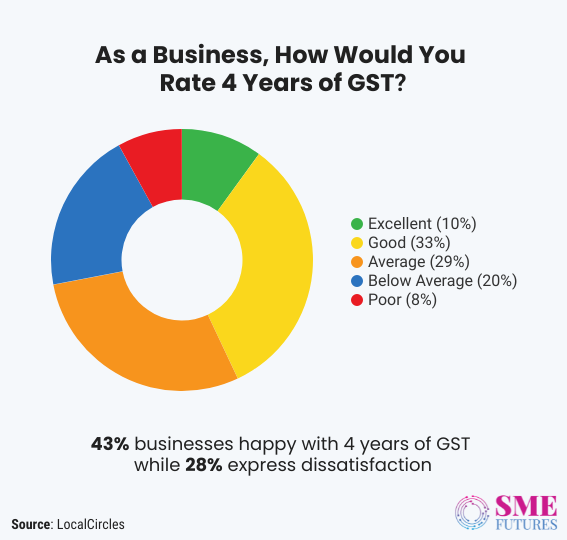

Out of 5,831 respondents, only 43 per cent of businesses are happy after 4 years of GST while 28 per cent have expressed dissatisfaction, revealed a recent survey by LocalCircles on four years of GST.

In another poll by the agency, 66 per cent of Indians feel that GST should be changed to a 2 or 3 rate structure. While 55 per cent are in favour of the merger of GST rates of 12 per cent and 18 per cent into a single 15 per cent GST rate.

Meanwhile, the Confederation of All India Traders (CAIT) touted GST as a ‘colonial taxation system’.

It is not compatible with the ground realities of business conducted in India and the resources available with the traders, said CAIT. “It is not the central government alone but largely the state governments, that are more responsible for distorting the GST taxation system and bringing disparities and anomalies in the GST, making it a more complex system and a big headache for the traders,” it further stated.

Incomprehensible to taxpayers

Despite various good intentions, GST has still not come up to the expectations of the people. There might be many reasons for GST’s negative externalities.

The complexity of the process is one of them, says Jhaveri, from his vantage point as an expert.

According to him, under the new regime, some processes are too complex to understand for the layman, he says, “A business has to register online for GST in every state involved in its sales process. Since the entire registration process takes place online, small business owners who are not used to working online might not find the transition easy. Thus, most of them will need intermediaries to obtain registrations for them. This will add to their cost.” This is another aspect which people find problematic.

The processes are lengthy, and it has become more complex for a taxpayer to reckon with the rules, as different states have a unique set of their own.

“There is a plethora of issues where different state’s GST authorities are taking different views and consistency has not been attained. It will take a significant amount of time before jurisprudence evolves under GST and until then, businesses will have to operate under a cloud of uncertainty,” Jhaveri further adds.

Next, he points out that a taxpayer must file 37 returns per year which is daunting, “There will be around 37 returns in a fiscal year. GST returns will also require you to close your books monthly, which, realistically, will take a lot of time,” he says.

Adding to that, he states that smaller businesses can be penalised for mistakes that they might have committed unknowingly.

“Uncircumscribed powers that are necessary to administer the law effectively are being misused to instil fear in the minds of smaller businesses which are grappling with difficulties in understanding the law and being penalised for mistakes and errors committed in ignorance,” he asserts.

In the recent past, the GST Council has empowered the authorities to cancel the GST registration of any trader without giving them any notice or an opportunity for a hearing. According to the traders’ association, unfettered and arbitrary powers are given to officers without realising that the misuse of such powers may lead to corruption.

“The GST law has been greatly distorted by the authorities which is evident from the fact that since the date of GST implementation till the 31st of May, more than a thousand notifications have been issued and interestingly the traders have not been allowed to rectify their returns even once. In such a situation, how can we expect a timely compliance of the taxation system from these traders?” asks CAIT.

Not so good and simple tax!

Even after four years of GST implementation in India, the GST portal is still struggling with many challenges.

“There are too many and too frequent changes, which has added to the chaos,” says Dr. Sanjiv Agarwal, CA and Partner at Agarwal Sanjiv & Company in Jaipur.

According to the Export Promotion Council for EOUs & SEZs (EPCES) data, in the first ten months of GST inception, the government tinkered with it 376 times. After this, the GST rules have been amended multiple times and how many times it was done can only be attested to by the government. Some recent changes have been done relating to the e-way bill, refund provisions, registration procedures and in the Finance Act.

“GST has been badly hit by multiple returns and multiple dates to remember. While it may have eased the life of revenue collectors but that of the taxpayers and professionals has become more challenging owing to the technical glitches and operational inefficiencies at the GSTN level,” says CA Dr. Agarwal in his commentary.

At the same time, one of the challenges that the assessors and stakeholders such as CAs are witnessing is the unavailability of proper information. The rules are amended but the official portal fails to update itself with the said amendments in a timely manner.

So far, no National Appellate Tribunal has been constituted. No Central advance ruling authority has been constituted either, giving a free hand to states to interpret the law in their own way, further distorting the fundamentals of ‘one nation-one tax’.

Bimal Jain, Chairman, Indirect Taxes Committee, PHD Chamber says “GST was envisaged as a good and simple tax but it’s not up to the mark for a number of reasons like- lots of teething troubles and hurdles on the seamless flow of credit across the supply chain, buyers are denied credit even if they have paid taxes to the suppliers, blocked credit, glitches on the GST common portal, the rules formulated in GST are contradictory to the provisions of the GST law, lots of frequent changes do not give any certainty to the taxpayers and problems also arise due to the parallel proceedings by both the CGST & the SGST Authorities.”

PHDCCIs Aggarwal too feels that there are still many unresolved areas where there is scope for modifications. They include Input Tax Credit, GSTR 2A/2B, classification of goods & services under the HSN/Service accounting code, e-invoicing, quarterly return filing, the monthly payment of taxes scheme (QRMP) and valuation among others.

He then suggests, “Small service providers should be allowed to make the payment of GST on a receipt basis, as against an accrual basis, to provide ease in working capital needs for the small taxpayers and it should be made quarterly for them.”

Adding more to the list of challenges, Jhaveri pointed out that an imperative key issue is to rationalise tariffs that can be consistently applied rather than subjecting them to frequent changes. “Understanding the operational issues of key sectors such as real estate, infrastructure, education etc where there is a significant divergence in the interpretation of key issues and issuing the necessary guidance to avoid unnecessary litigation is another key area,” he says.

Inclusion of petroleum products

The demand to include petroleum products in the GST ambit has been long overdue.

With the rising fuel prices, discussions and demands on the issue have only increased.

Udayan Choksi, Partner-Indirect Tax at Khaitan & Co suggests in a video message, “It’s one of the changes that can help businesses, especially in COVID times. Talks have been going on for some time to include petroleum products in GST and allow input tax credit on these goods. It will be great if this inclusion can be made at the earliest as it will substantially reduce the tax cost for Indian businesses.”

Jhaveri also feels that if the government were to consider this step, it could rationalise the prices of petroleum products. But the future course for bringing about changes of this nature in the GST law is not easy.

Statistics suggest that the centre and states earn more than Rs 5 lakh crore per year due to 60 per cent of tax collection on petroleum products. However, if petroleum products are brought under the GST regime, a 28 per cent tax and cess will be levied because that is the highest tax slab in the tax regime. Which means that with a 28 per cent tax on petroleum products, only Rs 14 would be collected per litre, as opposed to Rs 60 now. This would result in a deficit of Rs 2 lakh crore to Rs 2.5 lakh crore for both the central and state governments.

That is why the states have been resisting this demand whereas, the finance ministry has already clarified that at the moment, there are no such plans. Bringing petroleum products under the GST regime can distort the revenues of both the state and central governments.

Impact on SMEs

SMEs, which contribute close to 50 per cent of the intermediate industrial output, and around 42 per cent of exports, had waited anxiously for the new tax regime.

Over the years, the tax reforms have provided lots of ease for the MSME sector, opines Aggarwal of PHDCCI. “The tax regime includes systems such as monthly payment & quarterly filing of GST returns, relaxation in mentioning compulsory HSN/SAC code for B2C supplies, etc., which allows GST implementation with ease of business overall,” he tells us.

However, we cannot deny that the MSME perception is that this law has created more obstacles for them rather than making taxation easier.

“Such a perception is largely driven by the fact that the manpower required for compliance as well as professional fees for such compliances have shot up significantly adding to their working capital woes,” explains Jhaveri.

LocalCircles survey findings gauge this perspective. The survey found that 1 in 2 businesses is spending more time on GST compliance versus pre-GST business taxation, and that the majority are facing issues in understanding, logging-in, and submitting information on the GSTN website.

In comparison to pre-GST, 64 per cent of businesses say that their monthly accounting costs have increased post-GST. 57 per cent of businesses also said that invoice matching between inputs and outputs is their top issue with GST.

However, small businesses are yet to realise the key positive impact in terms of the significant hurdles and excessive tax payments that were required to be made under the erstwhile laws at the time of assessments. Under the new law, these have become controllable factors today rather than them having to wait for years to get clarity on the same.

Having said that, Jhaveri opines that although GST has been extremely challenging for this sector, stability is slowly but surely being achieved. “This law will immensely benefit this sector as it is evolving. Moreover, it’s because of GST that the MSME sector is becoming more compliant with the other laws. Accounting books are being prepared in real time and they are able to realise the side benefits in terms of better rates of banking finance, timely compliance under other laws, reduced late fees and penalties etc,” he asserts.

GST going ahead

GST has unquestionably improved compliance culture, expanded the tax base, reduced tax evasion, made indirect tax collections more stable even in difficult times and brought in transparency. But one question remains: can GST achieve its stated goal of being a “good and simple tax”?

On this PHDCCI’s Aggarwal strongly suggests the simplifying of GST Laws, saying, “Confidence can be built by further simplifying GST Laws, which is not truly turning out to be a good and simple tax for lots of reasons viz. frequent changes in the GST law, contradictory advance rulings, refunds not being allowed automatically within a specified time period and a large number of circulars and rules, etc.”

On the same note, Jain of PHDCCI says that GST will be successful if we instil confidence in the minds of taxpayers and encourage new registrants by letting them know that no penalty is going to be levied on them in the first 3 years of their registration for mistakes or non-compliance to procedural laws so that the small taxpayers can come forward and join the GST journey to increase the tax base and revenue for the government.

He further added that presently businesses are not in a position to discharge GST liabilities from their pockets and therefore, they should be allowed to pay GST on a receipt basis as against an accrual basis, as was prevalent under the service tax regime for taxpayers having an aggregate turnover of Rs. 50 Lakh annually.

This move will not only help the business fraternity in their survival but will also help in their growth, benefit their employees and ultimately prove to be good for the health of the economy.

Finally, it is a law that has subsumed various indirect tax laws and it is important to impart the necessary training to field officers at a central level so that the inconsistencies amongst the state administrations can be ironed out, adds Jhaveri as he talks about making GST more compatible with the taxpayers.

Lastly, it is impossible to assess the myriads challenges that might be faced by this law in the future but swift action and touching base with the business realities on the ground can make this law a success in a complex democratic country like India.

It looks like there is a lot to watch out and prepare for in the near future!