Four years of demonetisation have passed but Indians still are debating on whether this policy intervention was a rightful decision. The overnight currency discontinuation of Rs. 500 and Rs. 1,000 created a stir in the Indian economy. The move further proved to be mayhem for MSME businesses while for general populace it meant long queue in front of banks for exchanging notes.

However, the aspirational reform lost its ground on the account of its poor implementation. The other collateral damage was rise in cost of printing new currency including others. RBI had spent Rs 4,912 crore on printing new notes from July 2017 to June 2018. The policy was brought to curb the black money (money circulating with no receipts, non- taxed invoices etc), to fight fake currency, and to encourage the idea of cashless economy but it failed to realise any of these ideas.

India Inc’s perspective after four years

A major chunk of India Inc has responded in a positive way even after four years of this big economic move. Kailashnath Adhikari, Managing Director, Governance Now says, “Yes, I totally feel that demonetisation has achieved all its primary objectives of curbing black money and fake notes and creating an ecosystem for a cashless economy. This has also led to the digital empowerment of a growing economy.”

Bhushan Nemlekar, Director at Sumit Woods Limited, a real estate developer also feels that demonetisation had a positive impact on the economy. He further feels that as one of the prominent players of the economy, the Real Estate industry is still thriving and working hard to deliver promises. The move in his view has certainly helped to enhance the image of industry to a large extent.

Pawan Gadia, CEO, Retail and Ecommerce, Ferns N Petals is of opinion that demonetisation have achieved all its three primary objectives. He tells, “Indeed, it’s a journey that has covered all its three goals. Black money is getting reduced with demonetisation playing a role, coupled with other initiatives like GST and tracking of individual transactions with Big Data. Similarly, fake notes did decrease in number with demonetization.”

He further adds, “Finally cashless economy is on its way, though it is still far off yet. In certain areas, we have achieved stated goals but we are still far away from the digital revolution,” Most of the industry experts we spoke to are of opinion that there were hiccups in the beginning but almost all sectors have recovered from the negative impact of the move. In fact, it had helped them in growing further.

Ambika Sharma, MD and founder of Pulp Strategy, a digital communication and technology agency tells us that overall the adverse impact of demonetisation has waned to a great extent. She adds, “Initially, people were in wealth preservation mode, so the sales of the business dropped. This in turn impacted the agency’s business too. Today demonetisation or becoming cashless is not impacting business negatively at all.

On the other hand, Rhitiman Majumder, Co-Founder, Pickrr, admits that the impact of demonetisation on logistics has subsided over years as businesses have adopted digital alternatives for the exchange of money. He informs, “Initially we thought it would affect our company and all the major industries including real estate. But the move has brought in much needed transparency and has doubled the trust of investors in the logistics sector.”

According to him, cash on delivery orders drastically declined after demonetisation for his firm. He elaborates, “COD orders took a huge hit and never got up to the same percentage. Hence, demonetisation did make a long-term impact because it decreased the overall logistics cost (COD orders bear extra logistics cost). Pickrr’s COD order percentage that was around 78 per cent before demonetization settled to around 70 per cent post demonetisation.”

The cumulative opinion of India Inc suggests that government has been able to achieve the primary objectives behind this drastic economic move. Despite this positive outlook of India Inc, the cash in system has been constantly rising even though the RBI and government of India pushed for a cashless society. Further, the black money and counterfeit currency is permeating in the economy. Hence, questions related to effectiveness of the move still remain unanswered.

Return of black money hoarding

RBI meeting records in media reveal that that board directors of RBI were skeptical about the merit of demonetisation as a move to curb black money. According to report “Most of the black money is held not in cash but in the form of real sector assets such as gold or real estate and this move would not have a material impact on the assets.” However, the government still went ahead with the reform.

In 2016, demonetisation was called surgical strike on black money, but the move barely was able to curb it. The reason behind this was that after the currency ban, almost all (99.3 per cent) of the banned currency returned to the Reserve Bank of India. According to the RBI data, out of the Rs 15.41 lakh crore worth Rs 500 and Rs 1,000 notes in circulation on November 2016, notes worth Rs 15.31 lakh crore returned.

If almost all banned currency in circulation returned does it mean that percentage of black money in our economy was just 0.7 percent. In 2019, the erstwhile finance minister Piyush Goyal while presenting the interim budget, in Lok Sabha said that the anti-black money measures including demonetisation have brought an undisclosed income of about Rs 1.30 lakh crore to tax.

If government’s data is considered, the self-assessment tax of more than Rs 13,000 crore was paid by targeted non-filers. 3.04 lakh people were identified who didn’t file their IT tax. Out of which, 2.09 lakh paid self-assessment tax of Rs 6,531 crore. However, government had expected that around Rs 3 to 4 lakh crore black worth of money can be turned into white. But, figures still are far from expectations. Hence, it’s hard to discern if the reform fulfilled its motive or not.

Is counterfeit currency issue resolved?

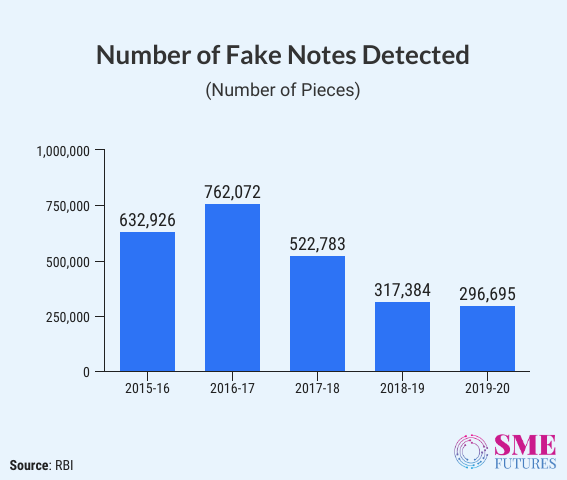

The government states that the total number of counterfeit notes was very high after demonetisation. Introduction of new notes further made the detection of fraud currency easier. In 2016, banks detected 6.32 lakh counterfeit notes because of due to demonetisation exercise. The number went up to 7.62 lakh counterfeit pieces next year. If we calculate for all four years, it is 22.35 lakh of forged pieces of various denominations.

The data for all these years hence tells us there is a decline in counterfeit notes in the system. Even if there is a fall in such currency, it is still being circulated in significant amount. According to latest RBIs annual report, counterfeit notes in Rs 10, Rs 50, Rs 200 and Rs 300 denominations has registered an increase of 144.6 per cent, 28.7 per cent, 151.2 per cent and 37.5 per cent respectively.

Out of the total Fake Indian Currency Notes (FICNs) detected in the banking sector during 2019-20, 4.6 per cent were detected at Reserve Bank of India and 95.4 per cent by other banks. If we go by National Crime Records Bureau (NCRB)’s data, Rs 25.39 crores in FICN were seized in 2019, compared to Rs 17.95 crore in 2018. This shows an increase of 11.7 per cent from previous year.

Interestingly, most fake notes were found to be of Rs 2000 denomination even when the denomination had several detectable high security features. Most of the seizures were from Karnataka (23,599), Gujarat (14,494), and West Bengal (13,637). These figures easily question the government claims about the restriction of fake currency.

RBI report also points that there had been a gradual decline in the circulation of Rs 2,000 notes by 15 per cent in last two years. From 3.36 billion pieces in 2017-18, it went down to 2.73 billion pieces in 2019-20. In terms of value, the share of this denomination in circulation was 37 per cent in 2017-18, 31 per cent in 2018-19, and 23 per cent for 2019-20.

This fall indicates that strategist do not want currency of bigger denominations in the banking system. The prominent reason behind this is high denominations are mostly used for tax evasion, money laundering, and hoarding black money. Hence, last year RBI presses ceased to print Rs 2000 notes altogether.

Cashless economy still in quandary

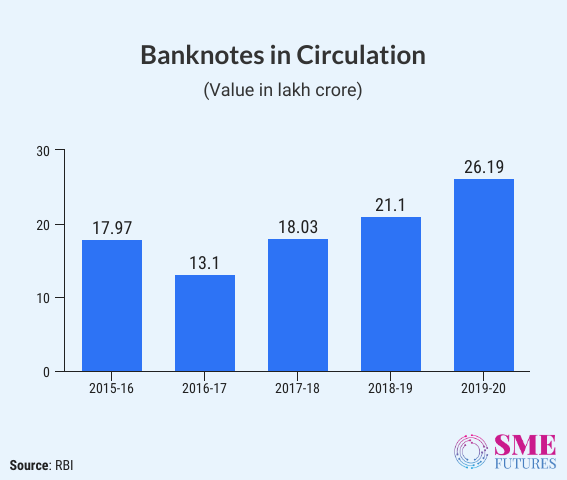

India wishes to be cashless economy. Demonetisation can be considered as a pioneer step towards that direction, but it appears like a farfetched dream still. Till today, our economy is cash driven. RBI data reinforces the fact that cash in the economy is rising steadily despite its relentless pursuit of a cashless society. A comprehensive roadmap on digitisation and online payment also seems ineffective.

The cash currency circulating in Indian economy has reached the record high of Rs 26.19 lakh crore on 23 October 2020 from figure of Rs 17.97 lakh crore in November 2016 which is a hike of 45.7 per cent. Surely, there is heightened awareness of digital transactions and more people are adopting digital payments. But in the last ten months, demand for cash sharply surged in the wake of uncertainty caused by the pandemic.

The cash in circulation rose from Rs 21.79 lakh crore in January to Rs 26.19 lakh crore in October 2020. On this Jayesh Rathod, Executive Director of The Guardians Real Estate Advisory comments, “The cashless economy is still far-fetched and it is important to understand that such changes are always gradual. The circulation of fake notes has however reduced and will reduce further with the help of increased government vigilance.”

Sharma of Pulp Strategy points out that it is a continuous process. The data connectivity, security of online transaction, and current measures by the government which include discouragement in spending large cash amounts without PAN will continue to contribute to the progress towards a cashless economy.

Transformation since inception of the reform

Demonetisation has created awareness for change in the economy. India Inc unanimously feels that it brought digital payment into the mainstream. According to Adhikari of Governance Now, the move has brought digital empowerment and reduced the dependence on cash. He elaborates, “Using digital payment methods such as Google Pay, Paytm, etc has caught everyone’s attention. These have become a preferred mode of payment for even a vegetable vendor or taxi driver.”

Rathore of the Guardians Real Estate Advisory also feels the same, He claims, “The number of people transacting through digital modes of payment has increased drastically if you compare with the number that existed before demonetisation. Since the announcement, the government has incentivized digital payments to envision a country which survives with limited requirements of cash-based dealings.”

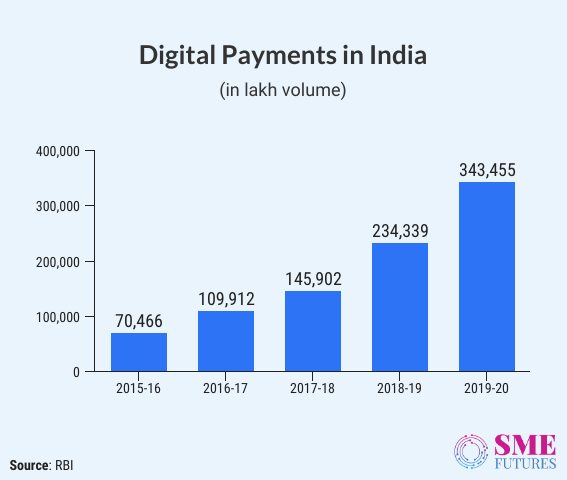

Echoing the similar sentiments, Gadia of Ferns n Petals says, “Cashless transactions have risen and there is a larger adoption of digital payments methods like UPI, Rupay etc especially among millennials. It is amazing to see that from the time of demonetisation even the micro-transactions as small as Rs 10 are happening through digital wallets across different cities. So, there has been a persistent rise in digital payments in the last four years of demonetisation.”

This change has led to an increase in trend of getting a digital receipt to their purchase among consumers. RBI states that India in FY20 witnessed a massive rise in volumes of digital payments to 3,434.56 crore. In five years, digital payments saw an annual growth rate of 55.1 per cent in terms of transaction volumes and 15.2 per cent in terms of value from the period between 2015-16 and 2019-20. In addition to this, the UPI based payment reached a height of 207 crore transactions from the period between 2015-16 and 2019-20.

Majumdar of Pickrr shares his experience on how digital payments have changed his logistics business. He tells, “Currently Pickrr has over 67 per cent of sellers who use online wallets as a preferred billing option which is a huge change since the demonetisation. Further those who are also not on wallets are also transferring money through online banking platforms or cheques.”

Nemlekar of Sumit Woods suggests that going digital and an increase in online transactions has helped the economy to grow faster and has improved India’s ranking in the ease-of-doing business. According to World Bank’s 2020 report, India ranks 63rd (2019) in the ease-of-doing business ranking. Along with a boost in digital economy, nation has witnessed a surge in direct tax collections as a proportion of GDP.

This has been explained by Amartya Lahiri (2020), a royal bank faculty research professor at Vancouver School of Economics in his journal The Great Indian Demonetisation. KV Subramanian, advisor to government has also mentioned it in his article that after demonetisation direct tax to GDP ration has hiked by 0.2 per cent, 0.8 per cent and 1 per cent amounting to Rs 40,000 crore, Rs 1.25 trillion, and Rs 1.89 trillion in direct taxes in 2017, 2018 and 2019 respectively.

Till today, India Inc views that the exercise had a positive impact in long term. However, it did cause a lot of problems for the unorganised MSME sector and for individuals in marginalized section of society. Considering the supporting data, it can be said that India is moving towards a stronger less cash society. However, the objectives for which demonetisation was brought into the system are yet to be realised. Also, the government should aim for long-lasting impact of these motives as the impact of demonetisation has faded in all these four years.