The Reserve Bank of India (RBI) witnessed a notable uptick in consumer complaints during the fiscal year 2022-23, highlighting two important factors. First, there is a surge in public awareness regarding these initiatives, and second, the newly simplified process for lodging complaints is easier. It also highlights the growing importance of robust financial consumer protection mechanisms since the number of complaints is rising. As the banking and financial sector continues to evolve, addressing consumer grievances has become essential for maintaining trust and ensuring equitable access to financial services.

Rise in consumer complaints

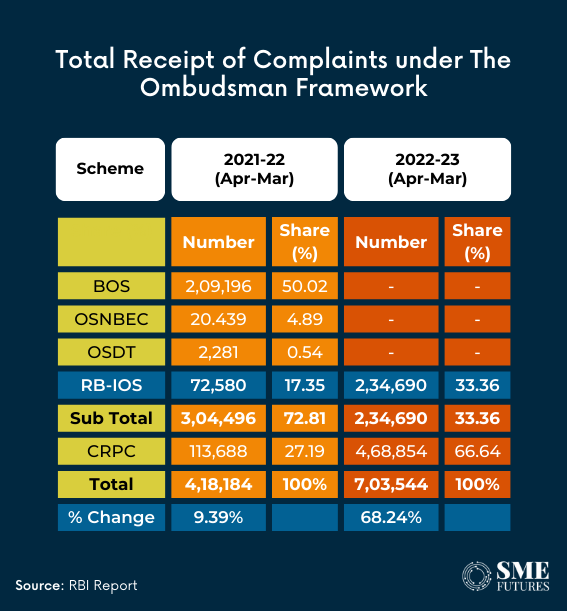

The Revised Banking Ombudsman Scheme (RB-IOS) 2021 saw a staggering increase in complaints received by the Ombudsman offices, totalling 7,03,544 complaints during the fiscal year. This surge, marking a significant rise of 68.24% over the previous year, underscores the need for enhanced consumer protection measures amidst the evolving market dynamics.

Digital channel dominance

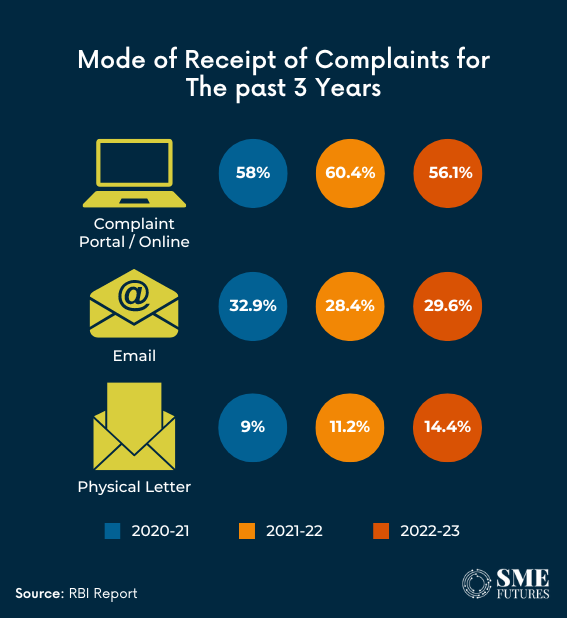

A striking feature of the surge in complaints is that the majority of them were received through digital channels, including the online Complaint Management System (CMS) portal, email, and the Centralised Public Grievance Redress and Monitoring System (CPGRAMS). This trend highlights the growing reliance on digital platforms for lodging consumer grievances, emphasizing the need for robust online grievance redressal mechanisms.

Geographic dispersion of complaints

An analysis of the complaints reveals a diverse geographic dispersion, with certain states emerging as top contributors. States such as Chandigarh, Delhi, Haryana, Rajasthan, and Gujarat registered a significant number of complaints. Despite geographical disparities, consumer grievances underscore a universal need for effective redressal mechanisms nationwide.

Efficient disposal rates

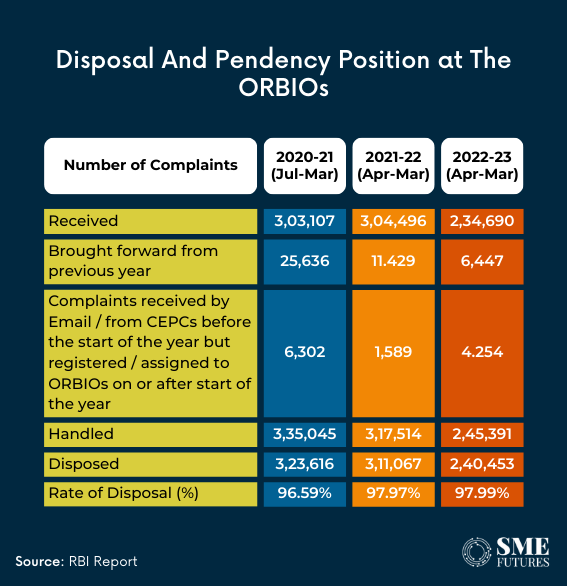

Despite the surge in complaints, the Ombudsman offices maintained commendable disposal rates, with an overall rate of 97.99% during the fiscal year. This efficiency in addressing consumer grievances underscores the effectiveness of the Ombudsman mechanism in providing timely resolution to consumer complaints. However, challenges persist in ensuring equitable access to grievance redressal, particularly in remote and underserved regions.

Cost efficiency and turnaround time

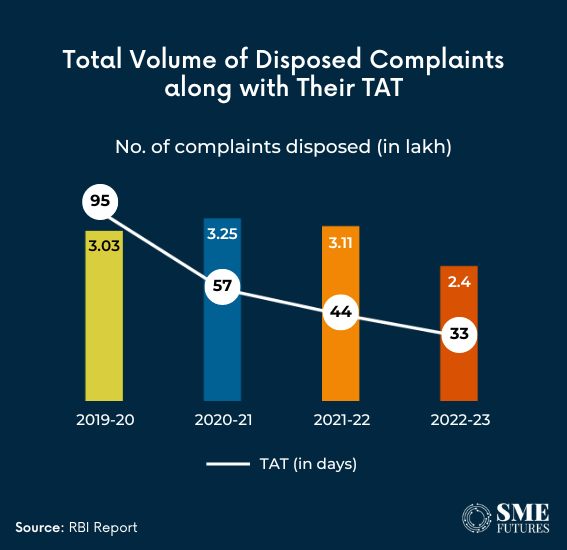

Efforts to streamline complaint handling processes have yielded positive results, evident from the reduction in the average cost per complaint to ₹2,041 and the average Turn Around Time (TAT) for disposal of complaints at the ORBIOs has improved from 95 days in 2019-20 to 33 days in 2022-23. These enhancements reflect RBI’s commitment to enhancing operational efficiencies and expediting the resolution of consumer complaints.

Way forward

Looking ahead, the Consumer Education and Protection Department has outlined key objectives for the period April 1, 2023, to March 31, 2024, under the Reserve Bank’s medium-term strategy framework (Utkarsh 2.0). These include:

- Reviewing, consolidating, and updating existing RBI regulatory guidelines on customer service.

- Integrating internal ombudsman schemes for different types of regulated entities.

- Establishing Reserve Bank Contact Centres at two additional locations to cater to local languages and enhance disaster recovery and business continuity capabilities.

Furthermore, RBI aims to leverage artificial intelligence in the Complaint Management System to enhance complaint categorization, decision-making support, and customer experience. The recommendations of the Committee for Review of Customer Service Standards in RBI Regulated Entities will also be pursued to enrich the customer experience and ensure quality service delivery.

The surge in consumer complaints to the Ombudsman offices signals a pressing need for stronger financial consumer protection measures. As the banking and financial sector undergoes rapid transformation, ensuring effective grievance redressal mechanisms becomes imperative for maintaining consumer trust and confidence. RBI’s proactive measures to address consumer grievances, coupled with its efforts to streamline complaint handling processes, underscore a collective commitment to safeguarding consumer interests and fostering a resilient financial ecosystem.