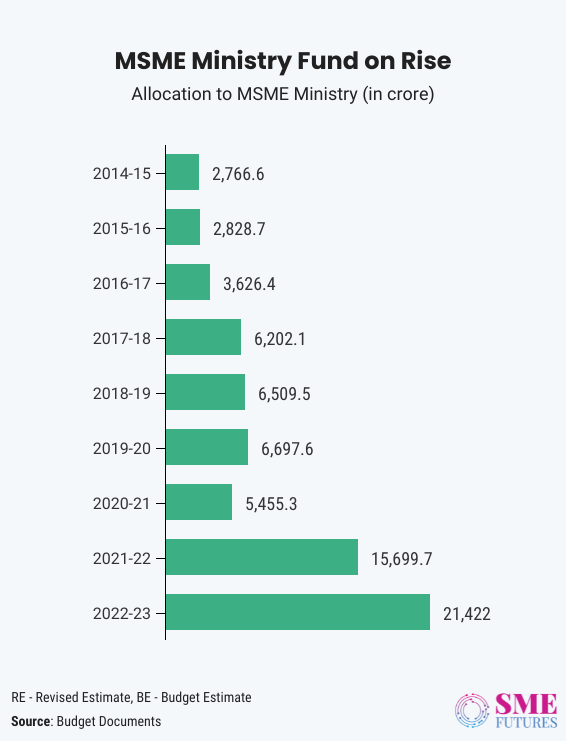

If we talk about budget allocation, the government has allocated to spend Rs 22,138 crore. This is an increase from Rs 15628 crore (revised) in FY23.

CII’s regional vice president Darshan Shah said: “In the budget many schemes, fund allocations and various schemes have been announced for the MSME sector. It will help the sector to bounce back, which will play a major role in generating employment,”

Southern Gujarat Chamber of Commerce and Industries former president Ashish Gujarati feels that this budget is going to boost domestic industry because the government plans to invest Rs 10 lakh crore in capital projects.

Flip side

However, a few MSME stakeholders felt the budget was not what they expected, especially for small business owners.

Vadodara Chambers of Commerce and Industries president Himanshu Patel says, there is mild dissatisfaction too, MSME’s different industries were expecting reduction in GST tariffs, but it remains untouched.

Pharma player, Nikkhil K Masurkar, CEO of Entod Pharmaceuticals agrees, “We are a bit disappointed by no announcement on any sort of GST changes and simplified regulations. Also, we were expecting that the government would allocate separate funds for R&D, formulation and APIs. So, I hope these factors will be taken into consideration in the coming years,”

Bihar Industries Association president Arun Agarwal strongly felt that budget did not included Bihar in any announcement. “We do not see anything for Bihar in the Budget. We are a little disappointed with it. We wanted interest free funds for Bihar so that we could prosper. The per capita income of Bihar is nearly Rs 50,000. The budget could be rated around 8 points except for Bihar,” he tells.

Top 5 announcements

According to previous information from the Ministry of MSMEs, as of November 25, 2022, the number of microenterprises registered stood at 11,735,117 (96.17 per cent), with small businesses coming in second at 426,864 (3.49 per cent) and midsized businesses coming in third at 39,467 (0.32 per cent).

Also Read: Union Budget 2023: Real estate sector hopes for industry status this year

With growing MSMEs in the country, this year, the government announced slew of measures including five big announcements to boost the health of the MSMEs sector.

Credit guarantee scheme

The credit guarantee scheme for MSMEs has been revamped with the addition of Rs 9,000 crores to the corpus, allowing for additional collateral-free guaranteed credit of Rs 2 lakh crore. Revamped credit guarantee scheme to take effect on April 1st, 2023.

This will enable additional collateral-free guaranteed credit of Rs 2 lakh crore. Further, the cost of the credit will be reduced by about 1 per cent.

“It’s been heartening to see that financial inclusion has been clearly laid out as a priority in the 2023 budget, and been backed up by solid policy recommendations.” Says Rajat Deshpande, CEO & Co-Founder of FinBox.

“This is expected to boost creditor’s confidence, leading to higher loan disbursements and reduced cost of funds,” comments Dr Arun Singh, Chief Global Economist, D&B.

Welcoming the step Arroon Gawalli, Founder and CEO of Kreditnotes and MindBrreeze also feels the decision will support the growth of the MSMEs. “The revamped schemes will be infused with Rs. 9000 Cr. to protect them from the burden of rising interest rates,” he said.

So far, the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) scheme has been instrumental in extending microfinance to underserved segments and decreasing the credit gap.

Adding in Saahil Goel, Co-founder, Shiprocket says, “The government’s focus on empowering the MSME sector with the revamped credit guarantee scheme is admirable. The revamped credit guarantee scheme for MSMEs and the Rs 9,000 crore infusion amount in the corpus would further push the entrepreneurial spirit of the country.”

Meanwhile players like Sundeep Mohindru, MD & CEO, M1XCHANGE, a digital invoice discounting platform with TReDS await details to see if TReDS or Factoring gets a share in expected additional collateral free guaranteed credit of Rs 2 lac crore.

Also watch:

DigiLocker services for MSMEs

FM announced to set up DigiLockers for the MSMEs along with large businesses and charitable trusts.

Fintech services in India have already been facilitated by the digital public infrastructure including Aadhaar, PM Jan Dhan Yojana, Video KYC, India Stack and Unified Payments Interface (UPI).

“An Entity DigiLocker will be set up for use by MSMEs, large business and charitable trusts. This will be towards storing and sharing documents online securely, whenever needed, with various authorities, regulators, banks and other business entities,” FM said in her budget speech.

A one stop solution for reconciliation and updating of identity and address of individuals maintained by various government agencies, regulators and regulated entities will be established using DigiLocker service and Aadhaar as foundational identity.

Also Read: Hospitality sector’s expectations from Union Budget 2023

“The introduction of Entity DigiLocker for business enterprises will facilitate online storing of documents which will accelerate the digital transformation of the country,” said V. Srinivasan, Chairman, eMudhra.

Nirav Choksi, CEO & Co-Founder at Credable says that this will enable FinTechs to store and share their documents such as financial statements and IT returns. “The move will further enhance the ease of doing business”

DigiLocker is a flagship initiative of the Ministry of Electronics & IT (MeitY) under Digital India programme. It is a secure cloud based platform for storage, sharing and verification of documents and certificates.

Karan Desai, Founder at Interface Ventures, said that rolling out of a National Data Governance Policy will encourage R&D by using the Aadhaar and DigiLocker platforms to simplify individual address reconciliation and verification across all regulators.

“We appreciate the focus on a digital-first approach and the use of tech to improve financial inclusion in India. The establishment of DigiLocker is a game-changer for the fintech industry. This will simplify the process and save time for customers while also enhancing the security of their personal information,” says Vikas Garg, Co-Founder & CEO, Paytail.

Padmanabhan Balasubramanian, Partner, Protium feels the measure will help companies in the finance sector to further boost their efforts to deliver innovative solutions to customers and drive financial inclusion in India.

Vivad se Vishwas 2.0

The government will bring another dispute resolution scheme under Vivad Se Vishwas-2 to settle commercial disputes, finance minister Nirmala Sitharaman said on Wednesday.

Presenting the Budget 2023-24, she also said a one stop solution for reconciliation and updating of identity of individuals would be established.

The Vivad Se Vishwas scheme provides for settlement of disputed tax, disputed interests, disputed penalty or disputed fees in relation to an assessment or reassessment order on payment of 100 per cent of the disputed tax and 25 per cent of the disputed penalty or interest or fee.

Also Read: Budget 2023: Trade association CTI demands relief for middle-class, small traders

Pankaj Poddar, Group CEO, Cosmo First feels the budget is in line with the vision of making India Aatmanirbhar. “The decision of introducing ‘Vivad se Vishwas’ to return 95 per cent of bid to the MSMEs in case of failures to execute contracts during the Covid period and bring another dispute resolution scheme under Vivad Se Vishwas-2 to settle commercial disputes is indeed a great relief for businesses. Through various initiatives announced in the budget, India will emerge to become a 5-trillion dollar economy,”

Hailing the step, Prabhat Chaturvedi, CEO, Netafim Agricultural Financing Agency says, the Vivad Se Vishwas initiative will boost the confidence of entities dealing with MSMEs as it covers the performance risk. “The announced measure will have a butterfly effect on the credit sector as well as will provide cushion to create an engine of growth,”

Presumptive tax benefit

Government has also announced on several tax related benefits for MSMEs. One of them is rationalization of presumptive taxation regime. As per the budget, the upper limit on turnover for MSMEs to be eligible for presumptive taxation has been raised from Rs 2 crore to Rs 3 crore. While, the upper limit on gross receipts for professionals eligible for presumptive taxation has been raised from Rs 50 lakh to Rs 75 lakh. Given the amount or aggregate of the amount received during the previous year, in cash, should not exceed 5 per cent of the total turnover or gross receipts.

• The receipt by a cheque drawn on a bank or by a bank draft, which is not account payee, to be deemed to be receipt in cash

• Tax audit report exempted for such taxpayers

• No set-off of unabsorbed depreciation and brought forward loss to be allowed in the year when income from business is offered to tax on presumptive basis by specified NR taxpayers

According to Manish Lunia, Co-Founder of Flexiloans.com this step will improve compliance further for MSMEs and reduce the time and cost for it, bringing more MSMEs to the formal sector.

Harshvardhan Lunia, founder & CEO, Lendingkart Technologies says, “The announcements are pro-growth and strongly suggest that the impetus is on setting strong foundations. The budget empowers the MSME sector by providing benefits of presumptive taxation. It is great to see the acknowledgment of the importance of entrepreneurship for India’s economic development,”

Consumer tech player Varun Gupta, Founder & CEO, of Boult Audio opines enhanced limits for micro-enterprises and professionals to take advantage of presumptive taxation have opened many opportunities for the consumer electronics industry.

KV Srinivasan, Executive Director and CEO of Profectus Capital comments, “Increased limit on presumptive tax would provide huge tax relief while enhancing transparency by reducing unreported cash income. The overall message is, ‘Be transparent and gain a tax advantage’,”

PM VIshwakarma Kaushal Samman (PM VIKAS)

For the first time, a package of assistance has been conceptualised for artisans and craftsmen.

“For centuries, traditional artisans and craftspeople, who work with their hands using tools, have brought renown for India. They are generally referred to as Vishwakarma. The art and handicraft created by them represents the true spirit of Atmanirbhar Bharat,” read the budget document.

The new programme PM VIshwakarma KAushal Samman (PM VIKAS) will allow them to improve the quality, scale, and reach of their products. While also integrate them into the MSME value chain. The scheme’s components will include access to advanced skill training, knowledge of modern digital techniques and efficient green technologies, brand promotion, linkage with local and global markets, digital payments, and social security. This will primarily benefit Scheduled Castes, Scheduled Tribes, OBCs, women, and people from underprivileged backgrounds.

Hailing the step, Dinesh Pratap Singh, Co-Founder, WoodenStreet said the scheme will aid in improving artisans’ lives. “This will further include financial support and also access to advanced skill training,”

Tarun Joshi, CEO & Founder, Join Ventures and IGP.com adds in. ” We are thrilled to see the government’s recognition of India’s valued artisans and craftspeople through the PM VIKAS. At Join Ventures, we have always believed in the significance of traditional artisans in keeping our rich cultural heritage alive. And provided them with a global platform to earn from their craft. This is a proud moment for all of us who have been working towards preserving and promoting the timeless beauty of traditional Indian crafts,”

Nisschal Jaain, Cofounder and CEO, Shypmax adds in. “Understanding the ever-increasing global demand for Indian handicrafts and artisanal products, the newly conceptualised PM-VIKAS will create a global stage for Indian small-scale manufacturers. Thus, increasing their contribution to India’s EXIM dynamics,”

Besides these major announcements, the government has also taken initiatives on various front for the overall growth of the MSME sector.

- Plan to enable 8 mn self-help groups (SHGs), formed by rural women, to reach the next stage of economic empowerment through formation of professionally managed large producer enterprises.

- Extension of the date of incorporation for income tax benefits to start-ups from 31 March 23 to 31 March 24.

- Relief to start-ups in carrying forward and setting off losses from existing 7 years of incorporation to 10 years.

- Section 43B of the Act expanded to include payments made to micro and small enterprises, with deductions allowed only when paid and on an accrual basis if within time mandated under MSME Development Act.

- New sub-scheme of PM Matsya Sampada Yojana with Rs 60 bn investment launched to support fishermen, fish vendors, MSMEs, and improve value chain efficiency in the fisheries sector.

- Launch of Skill India Digital platform to expand the digital skilling ecosystem and link with MSME employers.

- Continuation of 2.5 per cent concessional Basic Customs Duty on copper scrap to support secondary copper producers in the MSME sector.

- Amendments being made in sections 10 and 122 of the CGST Act to enable unregistered suppliers to make intra-state supply of goods through E-Commerce Operators (ECOs), subject to certain conditions.