For the last several months, the automotive industry has crept along at a snail’s pace, which has also influenced auto dealerships at large, creating a huge slump in their business. Currently, auto retail is one of the highest employment providers to the urban as well as the rural economy, providing 2.5 million direct jobs and an equal number of indirect jobs. Although, due to the slowdown in the sector, the dealer community is facing one of the toughest times in terms of dealer liquidity and adequate working capital availability for the past six months and, in a few cases, even threatening the survival of their business.

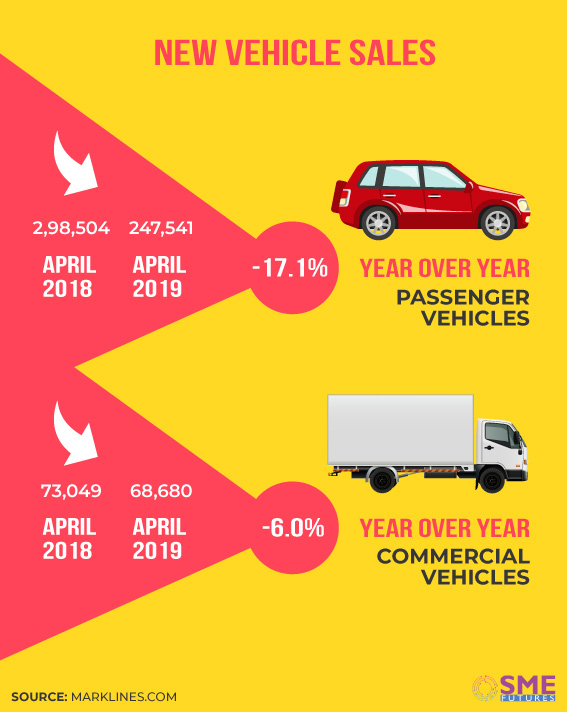

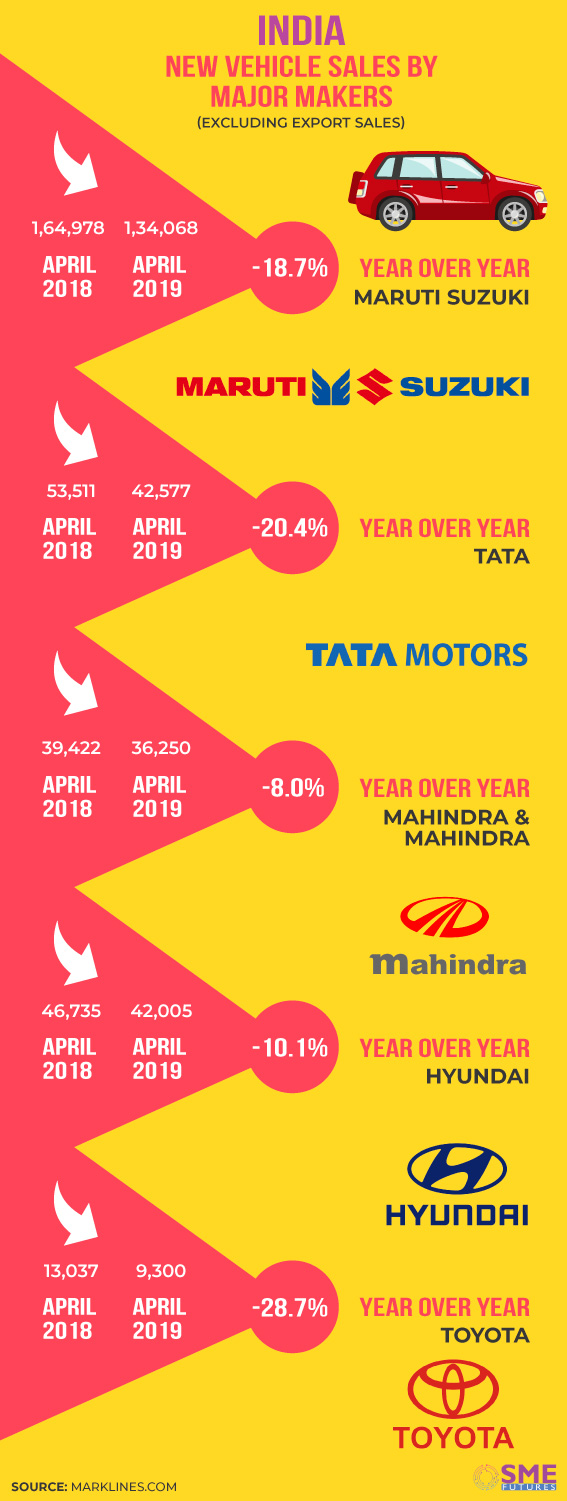

Last year, over 2.55 million units of passenger cars have been sold, of which sales can be attributed to a series of new launches from auto-makers. But since July 2018, vehicles are down in sales due to a series of events such as Kerala floods, regulatory changes, high fuel prices, cash crunch and so on, which has also increased the cost of ownership. Likewise in the months of November and December, passenger vehicle sales declined by 3.43 per cent and 0.43 per cent, respectively, says Society of Automobile Manufacturers Association (SIAM). During the slump period, homegrown utility vehicle major Mahindra & Mahindra reported a 2.83 per cent decline in its passenger vehicle sales at 15,091 units in December. Tata Motors saw sales dip by 4.31 per cent to 15,395 units during the month. According to SIAM, the total two-wheeler sales in December declined by 2.23 per cent to 12,59,026 units, compared with 12,87,766 units in the year-ago month. Though market leader Maruti Suzuki India posted a 1.5 per cent increase in its passenger vehicle sales at 1,19,804 units in December, its rival Hyundai Motor India also reported an increase of 4.82 per cent at 42,093 units. But the overall domestic automobile industry’s sales volume plummeted 14 per cent year-on-year (yoy) in March 2019, according to a report from India Ratings and Research. Federation of Automobile Dealers Association (FADA), too, states that the sales drop was worst in the 42-day festive season due to liquidity crunch.

This year too, dealers are worried. After a month of spike in sales of passenger vehicles in January, which was largely due to year-end stock clearance getting extended and a few new launches, the auto-dealers witnessed downward growth in February, which turned out to be one of the slowest months for auto retails with a fall in total auto sales of 3.65 per cent yoy. March also ended on the same note. Weak consumer sentiment along with a rise in borrowing costs and increased fuel prices dented the domestic automobile sales last month. Saharsh Damani, Chief Executive Officer of FADA, speaks on the present sentiments in the auto dealership sector, “Auto dealership is directly related to the auto industry; if the sector is doing well, dealers will also strike it rich. But post September and the beginning of the festive season, we witnessed one of the worst seasons in the last five to seven years. Indian auto sales are experiencing a prolonged slowdown as its already seen six months of slowing sales and growth reversal, and positive triggers in the near term appear few”.

‘Oil’y Situation

According to automobile dealers, one of the major reasons for the drop in sales was fluctuation in fuel prices, which disturbed the sales pattern. A recent study by the Reserve Bank of India (RBI) confirms that only domestic fuel prices have seen a lagged (two months) negative impact on auto sales growth. According to the study, the recent slowdown can be explained by relatively high fuel prices. Using firm-level stock prices data, the valuation of auto-firms reacts inversely to fuel price movements. “The biggest impact of crude prices is seen on the sales of commercial and passenger vehicles, suggesting that the fuel price is more important for these segments as compared to two-wheelers. The information on the recent crude price increase helps explain the recent decline in auto-sales”, the RBI states in its Mint Street Memo.

The study also states, “A 100 basis points (bps)growth in fuel prices today will decrease the automobile sales growth (excluding two-wheelers) by 72 bps two months down the line. This evidence corroborates the importance of fuel price movements for the automobile sector”.

In the current Indian scenario, as global oil prices are surging, it will most likely be a challenge hindering auto-sales. As of now, domestic prices have been allowed to lag till the end of elections. Economists, too, have warned that for oil-import-dependent India, higher global prices could lead to a weaker Rupee, higher inflation, the ruling out of interest rate cuts, and further weigh on twin current account and budget deficits. Retailers compounding the future pain have held off passing on to consumers the higher prices during staggered general elections, which began on April 11 and ended on May 23, according to sources familiar with the situation.

And as expected, oil marketing companies (OMCs) are now covering up for their previous losses and increase petrol and diesel prices in phases irrespective of market conditions. For instance, in New Delhi, just after the poll ended retail price of petrol gained by 9 paise per litre to ₹ 71.12 and diesel by a higher 15 paisa per litre to ₹ 66.11. Retail petrol and diesel prices have consistently moved downwards in May even though global oil prices have remained firm. Nitin Goyal, Treasurer at the All India Petroleum Dealers Association, representing fuel stations in 25 states, said that prices were similarly held down for 19 days in the southern state of Karnataka last year, when it held state assembly elections, only for them to surge after the vote. Goyal says, “Consumers should be ready for a rude shock of a massive jump in retail prices, similar to the level we have seen in the Karnataka state election”. Thus, fuel prices are expected to have an effect on consumer sentiments, which, in turn, may have a negative effect on the purchasing decisions of consumers. Predicting the situation, Damani says, “It seems that the first half of this FY will pass on the same trajectory as we are seeing since the last few months”.

As per one market assessment, oil companies lose just over ₹150 crore per day if retail petrol and diesel prices are under-priced by ₹ 1 per litre on any given day. Going by this yardstick, OMCs may have lost several thousand crores in the run-up Lok Sabha elections 2019.

New rules impact sales

Auto-dealers still have no respite as the insurance sector has made it costlier for consumers to buy their dream vehicles for which they need to shell out more on premiums. In line with the Supreme Court directive, the Insurance Regulatory Development Authority of India (IRDAI) has mandated insurance cover for new cars and two-wheelers for three and five years, respectively. This has caused consumers to back out on their next auto purchase, resulting in a steep downfall in the sales graph.

Auto-dealers inform that the new rules have halted the consumers to buy new vehicles for now, as their budget does not allow for such northbound jump of premiums at the starting of the purchase and, hence, the market is looking a little cold. “New insurance rules have slowed down the sales, especially for two-wheelers. The cost of increase in insurance for consumers is heavy, as it is mandatory to pay five-years insurance. All this has created a snowball effect, which has brought a dip in the market”, expresses Damani.

The insurance sector takes it as a benefit for consumers in the long term, as it will address the problem of under-insurance of vehicles, while buyers will be free from paying yearly. On the flip side, Devendra Rane, Founder and Chief Technology Officer of online insurance selling portal Coverfox.com, also sees it as a whip in the hands of vehicle dealers to force buyers into accepting insurance plans at a much higher cost from them only rather than what would be available in the open market. The new guidelines might be used by dealers and showroom owners to misguide the customers or enticing fear in their minds. He says. “They might try to convince vehicles buyers into believing that if they buy a new vehicle without insurance from them, they would be falling on the wrong side of the law and face legal fines and penalties”.

This will impact the planned budget of consumers as they are forced to buy insurance from dealers at the time of vehicle purchase at a cost higher than the price through some other channel, says Animesh Das, Head of Product Strategy at Acko General Insurance. “Consumers who were in a dilemma over purchasing a new vehicle may take a call to avoid buying the vehicle or may end up purchasing a lower variant. So for an average car, the increase in on-road price will be 10 per cent or more”, he adds.

GST still hurts

It has been some time since the inception of the GST; industries are still feeling its pinch. The automobile retail industry constitutes around 15,000 dealers and the market value of around ₹ 5 lakh crore. Earlier it was the insertion of section 49A that was creating distress, but recently, the government has taken action and introduced a new rule, 88A, which nullifies the impact from the changes brought in by the former.

However, auto retailers seek a cut in the GST rates in the passenger vehicle and two-wheeler categories, from 28 per cent to 18 per cent. According to industrial sources, a price hike of 10 to 15 per cent is bound to happen with the compliance of new emission BS-VI and other safety regulations. With this the dealers worry about the impact on the demand of vehicles.

Auto-dealers are especially emphasising on slashing the GST rate for two-wheelers, which practically constitutes more than 70 per cent of the total sales. Vice President of FADA and auto-dealer from Allahabad, Vinkesh Gulati has sought a demand for a rate cut, “It is not an apples-to-apple comparison when it comes to two-wheelers and luxury car sales, as they have a huge price difference. Thus, we are requesting regularly to bring down the GST rate at least in the two-wheeler segment so it can boost the sales”.

Rajan Wadhera, President of the Society of Indian Automobile Manufacturers, advocates the demand, “A price hike of even 10 per cent would impact the sales in the two-wheeler segment, which currently witnesses a off-take of over 22 million units annually”. He adds that the passenger vehicle segment prices also will go up in the range of 10 to 15 per cent due to technology and safety enhancements. “There also we need serious consideration by the government so that it is a win-win situation for all”, he says.

Inventory dilemma

Starting with the huge hike in insurance costs in September, auto-dealers are seeing a lot of negative factors come together in the past few months, leading to major postponement in purchase decisions and overall weakening of consumer sentiment, hence creating a huge vehicle inventory. Across the country there is a high stock situation in passenger vehicles and commercial vehicles; the situation that had seen partial correction in the last two months is now back to unsustainable levels, as seen in November 2018. Auto-dealer association FADA has highlighted the issue especially among two-wheeler dealers. Commenting on the issue, Ashish Harsharaj Kale, FADA President, says, “Full inventory is a serious concern. It has now reached alarming proportions in some geographies, and has breached the unheard level of 100 days of stock. Navigating smoothly out of the current slowdown is what we need and we are already in a cost regulation mode to curb the situation”.

High inventory demands maintenance, thus creating a tight operational and liquidity environment for the dealers to work in. In such conditions, the retailers are looking to reduce their inventory fast. Thus, they are offering huge discounts and sales. Subrata Ray, Senior Group Vice President, ICRA, says, “Subdued consumer sentiments as well as increased insurance costs, interest rates and fuel prices besides overall price increases (on account of commodity inflation, safety norm tightening) have caused demand postponement. Also, absorption of insurance cost, model-specific financing schemes by some OEMs in some regions and in addition to some dealers offering discounts”, he says.

But it seems heavy discounts and offers such as free insurance are failing to nudge the public into buying. Monthly estimates, too, are showing gloomy inventory levels, which are said to be more than 30 to 35 days for passenger vehicles and over 60 days for two-wheelers. “Discounts during December 2018 were the highest in recent memory, somewhere as high as 60 to 70 per cent yoy. But they also failed to propel sales”, says an official from FADA.

On the inventory, Grant Thornton India Partner, Sridhar V. says, “To increase market share or maintain it, OEMs were pushing inventory, which led to a pile up at the dealers’ end. OEM’s will now resort to discounts to retire the inventory”. Given the current situation, dealers urge OEMs to recalibrate their production to regulate dealer invoicing to facilitate return to stock normalcy for dealerships to maintain a sustainable business environment till the industry again hits a high growth trajectory.

Besides these challenges, dealers have also sought attention to the everlasting problem of skill gap in every sector. Today, auto dealerships need people to sell products with collaboration of newer technologies for enhancing customer experience in a showroom, while competing with tech startups born out of information technology challenging the traditional dealers. According to the study on auto dealers by Tata Strategic Management Group, talent management and talent retention are major concern areas. Attrition rates at auto dealerships are high and lie in the range of 20 to 30 per cent, even going up to 40 per cent for certain levels, mostly due to low compensation and lack of professional development. With the changes happening, auto dealerships need appropriate manpower recruitment and training to fill the gap and sustain.