It is now simple to manage your money and spend it anywhere in seconds thanks to recent technological advancements. Scanners and QR codes are ubiquitous. You don’t even have to carry a wallet. UPI and real-time payments (RTP) have made transactions seamless and instant and our lives easier.

Unfortunately, for some people, QR codes and online transactions can turn into a nightmare. It happened to Mumbai-based IT professional Roshan Mishra (name changed). In January 2024, he lost ₹1.2 lakhs after receiving a fake message claiming that his bank account would be suspended unless he updated his KYC details. Clicking the link led him to a page that mimicked his bank’s website, where he unknowingly entered his credentials. Within minutes, scammers siphoned off his savings using RTP.

This is just one of many examples, but with the digital payment revolution, criminal fraud is only increasing. A survey by FICO, titled 2024 Scams Impact Survey: India, states that 60 per cent of consumers in India have received a text, email, or phone call that they thought was part of a scam.

At the same time, 54 per cent of consumers said that their friends or family had been scammed. This implies that Indians are aware of scams and the damage that they can do. Let’s take a look at how online payment systems are becoming a way for scammers to commit frauds and leading to massive financial losses for unsuspecting consumers.

Real-time payments: Double-edged sword?

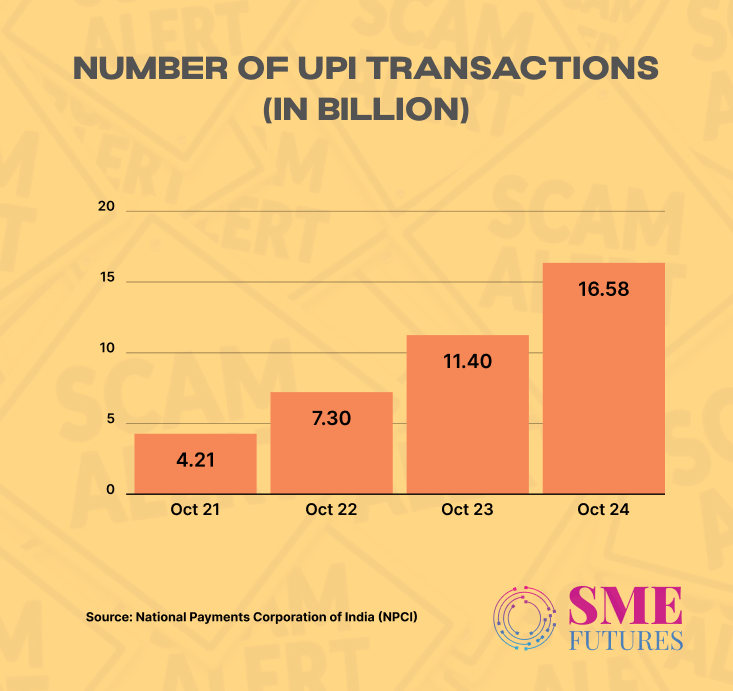

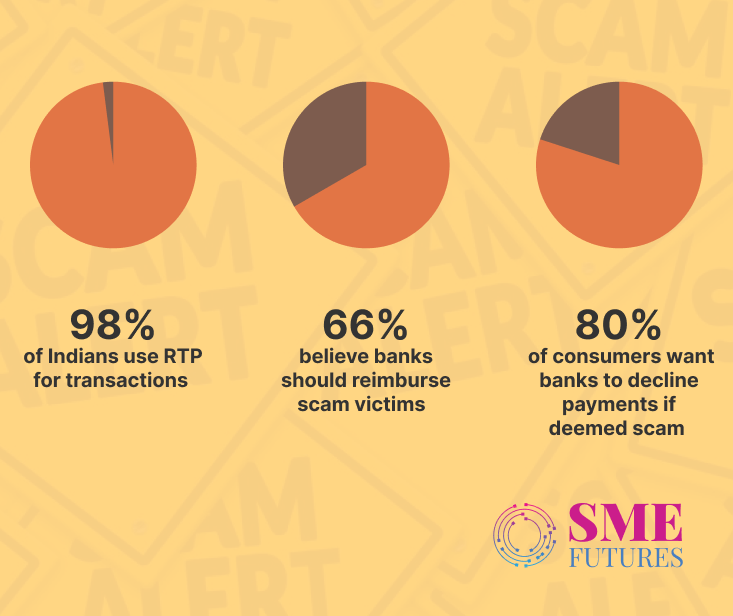

As new consumers become smarter, real-time payments keep increasing. It’s not going to stop. The FICO survey reveals that 98 per cent of their respondents have used RTP for transactions, and 79 per cent plan to increase their usage in the next 12 months. This highlights the growing reliance on digital payments.

Consequently, scams are on the rise too.

Fewer Indians have information on how to deal with these scams or situations. Conversely, scammers are also coming up with new ways to defraud people, for example— by digital arrest, which makes no sense. And yet people are falling for these tricks.

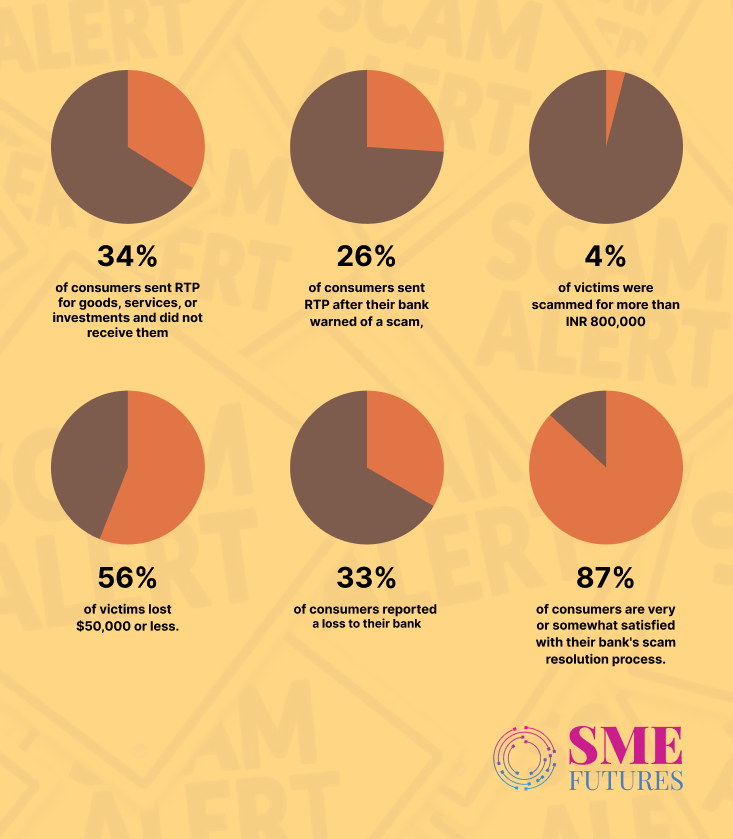

According to the survey, fewer Indians admitted they had reported losses in 2024 than in 2023, yet the percentage of high-value losses (exceeding ₹800,000) doubled from 2 to 4 per cent of reported losses.

Though 56 per cent of reported losses were relatively small — less than ₹50,000 — such a loss can still be devastating. And Indians’ above-average willingness to send RTP after receiving a warning from a bank is a concern for both consumers and banks.

“RTP usage will continue to grow and diversify as more transactions happen among consumers, businesses and public sector entities. Yet, there is a pressing need for education on scams and the risks tied to irrevocable payments. Banks must leverage automation, clearly communicate risks and provide robust scam defences to protect Indian consumers,” says Dattu Kompella, Managing Director, Asia, FICO.

Anatomy of RTP scams

This is just to give you a gist of how scammers trick victims into making payments.

- Fake investment scams – Fraudsters promise high returns through bogus investment platforms.

- Fake payment links – Suspicious links in the form of lucrative offers, job links, etc.

- E-commerce fraud – Customers pay for products on fake websites but never receive them.

- Loan fraud – Scammers impersonate banks, offering fake loan approvals in exchange for upfront payments.

- Phishing attacks – Victims receive an SMS or emails urging them to transfer money to avoid fake penalties or account suspensions.

- How officials can respond

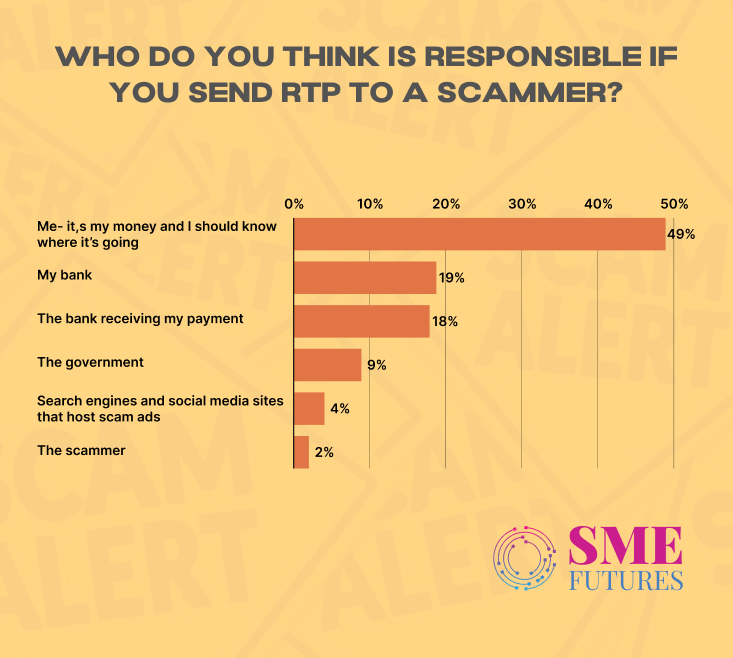

The FICO report suggests that 88 per cent of Indian consumers believe that RTP includes sufficient security checks, which is untrue.

56 per cent of victims complained to their bank, while 30 per cent escalated their grievances to regulators.

66 per cent of Indians believe banks should reimburse scam victims at least partially.

Also, Indians expect their banks to be their partners in the fight against fraudsters. In fact, 80 per cent stated they would view their bank more positively if it intervened in real time to prevent a suspected scam payment.

“A bank’s ability to combat scams hinges on advanced technologies like AI-powered analytics, contextual decisioning and real-time customer engagement. These tools enable targeted warnings and automated actions, such as step-up authentication and transaction suspensions, to enhance scam prevention and protect customers effectively,” Kompella asserts.

Scams are hard to stop

Unlike credit card transactions, RTP transactions are instant and irreversible. Fraudsters exploit this feature to their advantage, often moving stolen funds through multiple accounts within seconds.

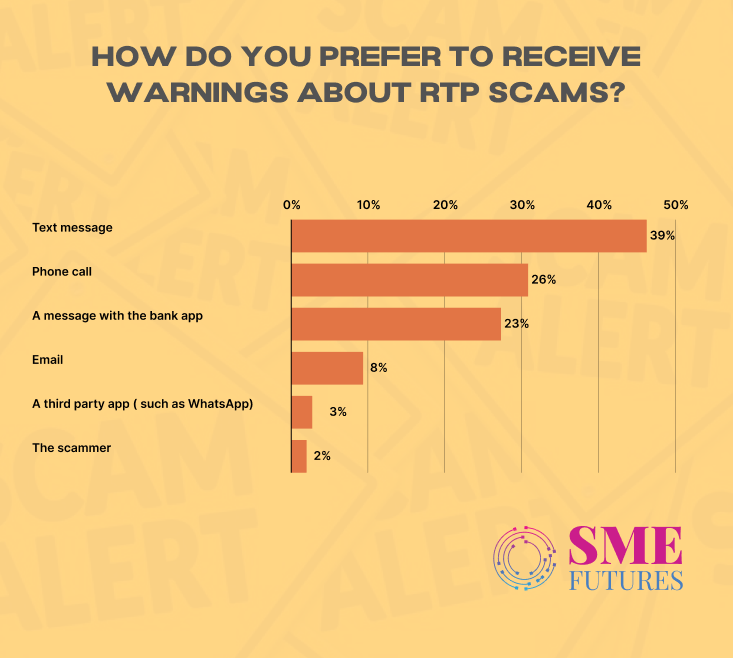

Indian consumers have a variety of channel preferences for scam notifications. Here is snapshot of how they want to get information.

Despite banks shifting to more secure channels such as bank apps, no single method suits all. Banks must be prepared to reach out through any communication channel, in real-time, and with two-way capabilities.

To combat scams effectively, banks must enable real-time, two-way communication across multiple channels. Automated alerts and proactive engagement can significantly reduce the risk of fraudulent payments.

Simultaneously, consumers want their banks to deploy better fraud detection systems. Another set of consumers suggested providing more warnings about known or emerging scams by banks. The FICO survey states that 80 per cent of consumers would feel positive about their bank if it proactively declined a payment that had been identified as part of a scam.

The bottom line is that consumers expect to be educated, informed, and protected by their banks.

What needs to change?

Industry experts and banking officials suggest stronger fraud detection and intervention measures:

- Enhanced AI-based Fraud Detection – Banks should integrate real-time AI analytics to detect suspicious activity before a transaction is completed.

- Mandatory Cooling-Off Periods – Implementing a delay for high-value RTP transactions can allow customers time to review and cancel transactions flagged as potential fraud.

- Stronger Consumer Awareness Programmes – The survey found that 27 per cent of Indian consumers want banks to provide more scam alerts and warnings.

- Improved Collaboration Between Banks and Regulators – Enhanced coordination can help track and freeze fraudulent transactions more effectively.

Balancing speed and security

India’s push towards a cashless economy is irreversible, but unless stronger safeguards are implemented, consumers will continue to lose hard-earned money to scammers. Banks, fintech firms, and regulatory bodies must take urgent steps to strengthen real-time fraud detection, educate users, and introduce safeguards to make digital payments truly safe.

Therefore, the next time that you receive an offer that sounds too good to be true or a message demanding urgent action, take a moment to verify it. In the world of real-time payments, one wrong click can cost you everything.

Shape

Infographic insights from the report

📊 98% of Indians use RTP for transactions

📊 66% believe banks should reimburse scam victims

📊 80% of consumers want banks to decline payments if deemed fraudulent