The Union Budget 2023, presented by Finance Minister Nirmala Sitharaman, has received mixed reactions from the start-up community and the venture capital firms. The budget has announced several measures to support the growth of the start-up ecosystem, but the continuation of the angel tax provisions and the amendments to it have raised some concerns among the start-ups and the investors.

What is angel tax?

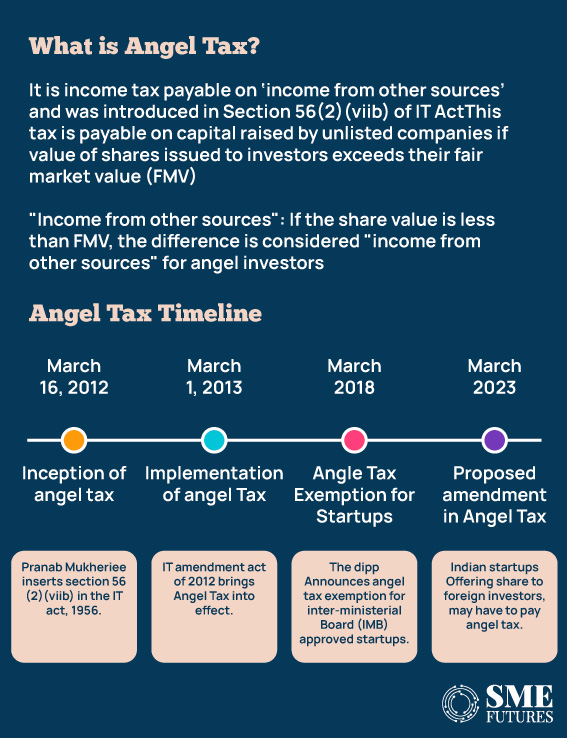

Angel tax is a tax that is imposed on the capital raised by start-ups from angel investors. An angel investor (also known as a private investor, seed investor or angel funder) is a high-net-worth person who provides financial backing to small start-ups or entrepreneurs, typically in exchange for ownership equity in the company. The tax is levied under Section 56(2)(viib) of the Income Tax Act, which states that any sum received by a company in excess of its fair market value is considered as income and is taxable. This tax was introduced to curb tax evasion by shell companies but has since been affecting genuine start-ups who raise capital from angel investors.

What’s changed and its impact on non-resident investment firms?

Earlier, there was tax exemption for two classes of VC funding for start-ups – the alternative investment funds (AIF) in India and the foreign investors.

Now, the exemption for foreign investors has been removed by the government. This has been upsetting for the start-ups as around 90 per cent of their funding comes from foreign investments. Many experts believe that this move could be damaging for the start-ups if exceptions are not made towards start-up funding.

Also Read: Govt focussing on production of high value pharmaceuticals: Mansukh Mandaviya

The Finance Bill 2023 has proposed that the provisions of angel tax will be applicable to non-resident investment firms as well. This means that foreign investment in Indian start-ups will also be subject to this tax. This amendment has left start-ups worried as many of them are now raising funds from global investors.

Vijay Sambamurthi, Founder and Managing Partner of Lexygen, points out that this change could “potentially gravely affect the ability of several Indian start-ups to raise capital”. He further adds that “foreign investors are likely to be cautious in investing in Indian start-ups due to the increased risk of litigation and taxation.”

Impact on start-ups

The Union Budget 2023 has not proposed any exemptions for foreign funds, in the same vein as the current exemption for domestic venture capital funds registered with SEBI. This has been a critical issue for the start-ups who are seeking capital from non-resident investors.

“The budget has extended the period of incorporation for tax exemptions for eligible start-ups by one more year, but this extension is not a meaningful move to boost the start-up ecosystem. Most start-ups are not profitable within the first 5-7 years of their incorporation as they are typically in an aggressive growth mode. Therefore, it would be more meaningful for the tax holiday to commence from the first year in which a start-up turns profitable and then run for 3 years thereafter,” Sambamurthi points out.

Views of industry experts

The continuation of the angel tax provisions has drawn flak from several industry experts. Vishwas Patel, founder of a fintech firm, says, “The budget hasn’t attempted to fix the anomalies in the start-up regulations. Also, the conditions around the angel tax issue that require to be simplified and the tax holidays or the lower tax structure for start-ups has been left unresolved.”

Also Read: India needs Rs 33,750 cr to set up 50 GWh Lithium-Ion cell, battery plants: Study

Ankur Shrivastava, Founder & Managing Partner of Momentum Capital, welcomes the move to increase the benefit of carrying forward the losses of start-ups to 10 years.

“The government should have made other sources of funds available locally for start-ups by incentivising the insurance companies, the EPFOs, the private pension funds, and the other domestic institutions to participate in investing in the burgeoning start-up ecosystem,” he points out.

A lack of clarity in the regulations and the tax incentives for start-ups have been persistent issues for the start-up ecosystem in India. Many industry experts believe that the government needs to simplify the regulations and provide more tax incentives to make India a more investment-friendly destination for start-ups.

Manish Kheterpal, Founder of Water Bridge Ventures, says, “Start-ups need more than just seed funding. They need a supportive ecosystem that helps them to scale their operations, hire talent, and gain market access. The government needs to address these gaps to help start-ups to thrive in India.”

Another issue that has been raised by industry experts is the lack of clarity on the definition of a ‘start-up’. According to Sambamurthi, there is a need for a clear definition of what constitutes a start-up and what criteria must be met in order to receive tax benefits. This will help to ensure that only genuine start-ups are able to receive the benefits, and any misuse of the provisions is prevented.

The lack of a comprehensive policy framework for start-ups in India has also been highlighted as a major worry, even though the government has recently said that it will review the valuation rules on foreign investments. However, experts believe that the exceptions through the valuation rules is not a practical move as they are based on future predictions.

Conclusion

The Union Budget 2023 has announced several measures to support the growth of the start-up ecosystem in India. However, the continuation of the angel tax provisions, combined with the lack of clarity on the definition of a ‘start-up’ and the absence of a comprehensive policy framework, has raised concerns among start-ups and investors, particularly with regards to the impact that this will have on the non-resident investment firms.

The government should consider simplifying the regulations and provide more tax incentives to start-ups, in order to make India a more investment-friendly destination. Additionally, the government should work towards creating a comprehensive policy framework for start-ups, which will provide a clear and stable regulatory environment for foreign investors. By doing so, the government will be able to attract more investment into the Indian start-up ecosystem, which will help to further fuel its growth and development.