A report by CFA Institute on Investment Professional of the Future said a compelling statement about India an year ago, “India because of the increasing demand for financial services, its strong economic growth, and its number of capable engineers could become the world’s investment hub.”

The statement clearly was meant for times before corona. Can we then infer that India could be world’s investment hub in the current times? The arguments for or against this are plenty. Furthermore, the outbreak arrived at a time when economic scenario was already dwindling and COVID-19 brought numerous challenges and changes along with it.

This economic anxiety also had led to a question mark surrounding the investments landscape of India and whether or not businesses can anticipate funding from investors. As we spoke to experts, we came across the fact that investors are wary of investing after the outbreak of virus. However, some of them see a formidable future for India as an investment hub.

COVID-19 Proving Detrimental for Investment Landscape

According to Anil K Sood, Professor at Institute for Advance Studies in Complex Choices, COVID-19 has already made the bad investment situation worse. He confesses, “A combination of demand and supply uncertainty is a double whammy of an extent that we have not experienced in our living memory.”

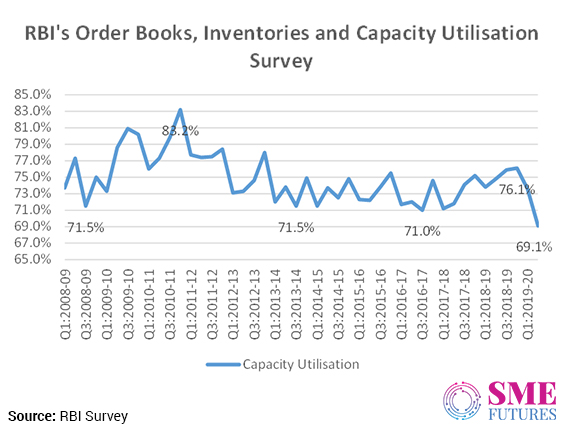

Adding further he says, “India was experiencing a significant slowdown in economic activity for nearly two years. COVID-19 has made the already bad situation worse. Capacity utilization in manufacturing as observed through RBI Survey has fallen to the lowest level in more than a decade.”

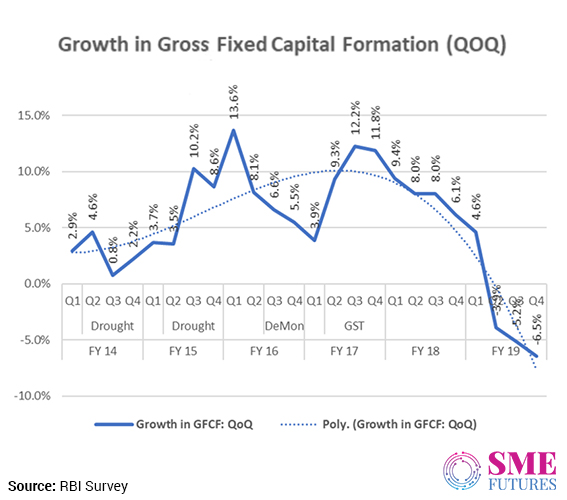

Investment collapse has been in the making since December 2017 as chart 2 below shows. According to the professor, our financial system’s inability and unwillingness to provide risk capital (equity and long-term debt) is a prominent factor that will not allow investment conditions to improve.

He further tells that small businesses mostly have plunged due to the pandemic. The state-of-affairs in micro, small and medium enterprises indicate that challenges pertaining to availability of workers and consumption will make the recovery process slow further. This trend will persist during restart of operations across various sectors.

Though companies have managed to restart and sustain operations at their low capacity during past few weeks, challenges still remain in the areas of working capital, availability of migrant workers, and consumer off-take.

S Ravi, Managing Partner of Ravi Rajan and Co. and the Former Chairman of Bombay Stock Exchange also believe that typical roadblocks have slowed the pace of investments for small ventures. He opines, “Sales are barely improving as consumers are unwilling to come out for making purchases due to COVID-19 related fears. The entire workforce in India is not highly compensated.”

He further adds, “People will conserve whatever little money they have due to rising concerns over COVID-19-related expenses. Small business owners have also indicated that they would like to see return of migrant workers but it doesn’t seem likely in present circumstances.”

Therefore, demand and consequently the investment level is not expected to recover any time soon. Along with this, the aggregate economic activity is still below the pre-COVID normal levels. Reverse migration in large number will further lead to supply chain disruption and it will continue to reduce chances of recovery.

Decrease in Global FDI Flows Hits An All-time Low

UNCTAD’s (United Nation Conference on Trade and Development) World Investment Report 2020 adjudges the pandemic as ‘a supply, demand and policy shock for FDI.’ The report expects global FDI flows to fall by about 40 per cent during the current year tumbling down to one-trillion dollar for the first time since 2005.

The UNCTAD report further says, “The overall directional trend in international production points towards shorter value chains, higher concentration of value added and declining international investment in physical productive assets.”

Ankur Mittal, Co-founder at Inflection Point Ventures says, “The supply and demand chains are experiencing tremendous pressure. Foreign direct investments are an integral part of economic globalisation. Interruptions in the flow of FDI can affect emerging and developing countries. For example, manufacturing sectors which hold a large share of FDI have particularly suffered.”

Apart from direct impact mentioned above, reduction in FDI flows can affect local economic systems as well. It can also adversely affect economy especially when local multinational enterprises (MNEs) are beginning to enter buyer-supplier relations. They are also trying to compete with local firms by hiring and providing training to workers, and exporting their products.

“Impact on FDI flows also depend on the success of public health and economic policy measures initiated by a government. The adverse effects of drop in FDI flows can last longer. It can then prove to be a huge subject of worry for governments of developing or underdeveloped nations,” opines Ankur Mittal.

However, not all seems lost as UNCTAD sees a growing trend towards global restructuring of economic activity. It suggests that global value chain is expected to undergo a transformation, creating opportunities for ‘resilience-seeking investment, building regional value chains, and entering new markets through digital platforms.’

Adding to it, S Ravi, Ex BSE Chairman suggests mergers and acquisitions as a best alternative. “In my opinion, mergers and acquisitions are the best alternative for both Indian and international companies. It is good for those who want to conform to the Indian government’s initiatives and promote local manufacturing. These associations can act as effective tools to harness the advanced technical know-how and larger pool of financial resources from foreign businesses along with deep understanding of Indian manufacturers about complex local market.”

Geopolitical Climate Suitable for India’s Investment Landscape

Despite hurdles that pandemic has posed for businesses of India, experts firmly believe that India’s chance to be an investment hub amid the crisis has boosted. Standing next to China, India has emerged as a lucrative investment destination for strategic partnerships in the Asia Pacific region.

Most of the global companies are dependent heavily on Chinese units for manufacturing. But, it had to face supply-chain disruption due to the outbreak of pandemic. Further, US-China trade war and Indian manufacturing initiatives such as Make in India have only enhanced the confidence of strategic investors to choose India.

According to media reports, Japanese government would pay $536 million to approximately 57 companies for moving factories from China. Opining on this, Vinay Bansal, Founder and CEO at Inflection Point Ventures says, “As many countries around the globe including super-powers have developed hostility towards China, there is definitely a silver lining for India to emerge as a prominent manufacturing and technical hub of the Asian continent.”

This industrial reform can make India an investment hub because of the presence of multifaceted small and medium enterprises. Experts are of opinion that if the country is able to align international standards for manufacturing then it can become a prominent investment hub. “Foreign institutional investors are now looking to not only diversify their supply chains but also to invest in financially sound economies”, says S. Ravi.

Adding further he tells, “India provides this platform through its friendly foreign investment policies and availability of inexpensive skilled workforce. Government of India is in process of identifying 4.6 lakh hectares of land, of which 24 per cent is in industrial areas. This along with other financial incentives like tax breaks, tax holidays etc. are all being looked at in a bid to attract further foreign investment.”

According to US India Strategic and Partnership Forum (USISPF), India needs roughly US$ 100 billion-dollar investment on an annual basis to become a US$ 5 trillion economy. S Ravi further explains, “Unlike economies such as United States and Japan, India can offer foreign investors an opportunity for interest rate arbitrage.” On that note, experts are very much talking about the foreign investments in Jio.

According to them, Jio deal has boosted scenario of strategic investments in India. Rachit Chawla, Founder and CEO at Finway Capital and Director at Risers Accelerator talking about this trend accept that the investment landscape is very bright for India. Google and Facebook investing with Mukesh Ambani is a good example of how India’s caliber to attract foreign investments.

He professes, “I believe we are positively handling the pandemic situation and people are noticing this globally. This is also one of the reasons why we are able to secure foreign investments.” Also during the course of these developments, Indian pharma companies have attracted attention of investors’ lately. Whole world is now looking hopefully at seven Indian pharmaceutical companies which are working development of COVID-19 vaccines.

On the other hand, Arun Natrajan, Founder, Venture Intelligence and Vice President of TiE Chennai reclaims, “Most of money that came through FDI in India especially after March is majorly because of the Jio deal. While they do not represent an SME, overall number of FDI investments from Google and Facebook still looks good. This will further attract more foreign funds. However, the trend is not similar for small businesses and venture capitals.”

Sectors Benefiting from Current Circumstances

While we expect the global investment and FDI levels to fall considerably due to the pandemic, India presents a unique opportunity for investment avenues larger than five years. Professor Anil K. Sood says, “Given the size of market, India presents a unique long-term opportunity for investments in manufacturing, services, and infrastructure.”

According to industry experts, few sectors such as health care, education and information technology have been benefitted. Due to their relevance in the crisis, these sectors are getting a push resulting in more investments. Bansal of Inflection Point Ventures asserts, “Investors are definitely being cautious for now. But, VCs which possess funds are promptly helping potential start-ups in growing and thereby are helping the government in enforcing self-reliance.”

He further exclaims that one can consider investing generously in startups as these are emerging as a lucrative asset after the downfall of real estate and stock markets during last five years. Some manufacturing startups have a huge scope of contributing to a self-reliant India, which is why angel investing platforms like Inflection Point Ventures brings them to investors.

Arun Natrajan is also of the similar opinion. However, he confesses that small firms are still cash deprived but sectors benefitting from the crisis are getting money. He adds, “It is a difficult time for small businesses to attract venture capital investments. But, things are slowly gaining momentum. After unlock in July, VC investors are especially investing in sectors which are indispensable during these times such as ed-tech and healthcare.”

According to Bain & Company’s India Venture Capital report, $10 billion worth of venture capital was invested in 2019. This amount was 55 per cent higher than the money invested in 2018. This year India focused VC investments are comparatively less, and in case of small businesses it is negligible. Though, experts believe that fundraising is going to get better among both limited and general partners in near future.

On the other hand, most MSME owners rely on loans in various forms such as government backed aids or personal loans for funding. One of the major NBFC players, Muthoot Finance mentions that small businesses are coming to them in great strength for gold loans. Bijimon KR, Chief General Manager at Muthoot Finance says that these small businesses wish to restart their operations in a limited capacity after the shutdown.

Muthoot Finance witnessed a 22 per cent growth in its gold loan portfolio in the last financial year that ended in March 2020. Bijimon tells, “Livelihoods of people has been massively hit by constraints that COVID-19 has brought upon us. Though government has initiated moratoriums and relief package to maintain liquidity, but it does not translate into instant interest waiver. It only means taking loans to repay or compensate for losses.”

In such cases, gold loans are really helping the business community like traders, shopkeepers, and small businesses by providing them working capital loans to kick-start their business. On the digital front, CGM Bijimon of Muthoot Finance informs that it has registered massive traffic on its iMuthoot mobile app as well on its online portal in past few months. It has also witnessed a fourfold jump in quantum of loan disbursals through its digital platforms to Rs 224 crore during the month of June.

Way forward for India as Long-term FDI Destination

Indian manufacturing would pave a concrete path to make India a preferred investment destination among investors. However, SMEs first need to optimise their current investment to enhance productivity through process redesign and automation. This will thereby help Indian SMEs to become more cost-competitive. Cost competitiveness is a pre-requisite if Indian firms want to compete with established manufacturing powerhouses like China, Japan and Korea.

Professor Sood explains, “It is definitely possible that India’s share of global FDI will increase during coming few years as it offers a long-term opportunity. However, returns will not be adequate if demand does not recover and we continue to have excess capacity. Revival of demand is hence necessary to make India an attractive destination for financial investors like private equity firms or even for manufacturer’s investors.”

Manufacturing Renaissance Required for Manufacturing

Amidst the COVID-19 crisis, Government of India announced a Rs 20 lakh crore package in order to revive the ailing Indian economy. PM Modi then asked manufacturers to make a self-reliant India. Hence, the final goal is to make companies stronger by investing more in them. Such steps also aim to bring a renaissance in the way manufacturing is operated in India.

Sood believes, “An initiative like Atmanirbhar India will attract large investments only if SMEs are able to build capabilities that help them to compete with global manufacturing power houses.” While it is not easy to compete with them through scale, India can leverage this opportunity through the industry 4.0 strategy which involves ability of Indian firms to build flexible and robust manufacturing systems similar to steps taken by the German government.

The strategy can be a combination of both scale and variety which will help SMEs to lower their costs through economies of scale and scope. He further suggests, “In order to support the renaissance, the Government of India and state governments need to work together to set a national SME renaissance fund that provides long-term risk capital to SMEs. Loan waivers or credit support through banking system is not the solution.”

India lags in global value chains because of its poor transport infrastructure, archaic labour laws, and redundant tax structure. But with the self-reliant India movement gaining the right momentum and larger number of products being manufactured in India, the ultimate goal of making our country an investment hub can surely be achieved.