India’s economic journey has been remarkable over the past decade, but one of the most unsung heroes of this transformation has been its Micro, Small, and Medium Enterprises (MSME) sector. Accounting for nearly 30 per cent of India’s GDP, the MSME sector is a powerhouse that provides employment to over 150 million people, playing a pivotal role in driving economic growth, innovation, and industrialisation across the country. But how exactly are these small and medium enterprises contributing so significantly to the nation’s economy? Let’s dive deep into the story of MSMEs in India and discover how they’re achieving such impressive feats.

The engine of economic growth

The MSME sector has been a cornerstone of the Indian economy for years. As Shachindra Nath, Founder & Managing Director of U GRO Capital, points out, “The MSME sector contributes significantly to this growth, accounting for nearly 30 per cent of India’s GDP and employing over 150 million people.” This massive contribution is not just limited to GDP but also reflects the sector’s role in fostering inclusive growth, promoting entrepreneurship, and generating employment in both urban and rural areas.

In terms of economic output, MSMEs are responsible for nearly 45 per cent of India’s total industrial production and over 40 per cent of the country’s exports. This means that every time you buy a product made in India, there’s a good chance that an MSME was involved in its production or supply chain. The importance of MSMEs in boosting exports, particularly to untapped global markets, cannot be overstated.

Government support and policy framework

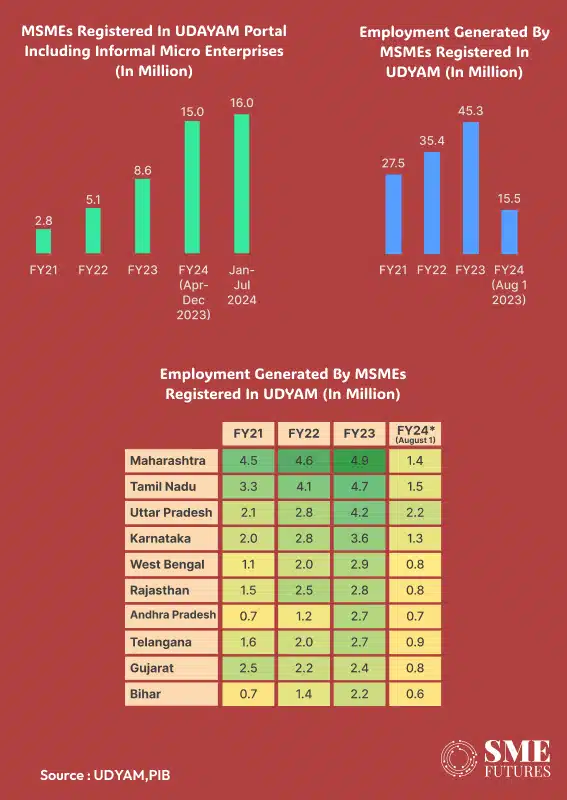

In recent years, the Government of India has stepped up efforts to support MSMEs with a wide array of financial schemes, incentives, and reforms aimed at formalising the sector and improving credit access. One of the key platforms driving this change has been the Udyam Portal, which provides a single window for MSME registration. As of July 2024, over 47.6 million MSMEs have registered on Udyam, receiving formal recognition and access to government schemes that include credit facilities, subsidies, and market linkages.

In the Union Budget 2024-25, the government further reinforced its commitment to MSME growth by allocating ₹22,137.95 crore to support the sector. This includes funds aimed at enhancing credit accessibility, improving digital infrastructure, and bolstering market access. By introducing initiatives like the Credit Guarantee Scheme, the government is making it easier for MSMEs to obtain loans without the need for collateral, an issue that has long hindered small businesses from scaling up.

Additionally, the government has enhanced the Mudra loan limit from ₹10 lakh to ₹20 lakh, aimed specifically at entrepreneurs in the “Tarun” category, which opens doors for more MSMEs to receive financial assistance. The TReDS platform, which facilitates faster invoice payments for MSMEs, has also been expanded to include companies with a turnover of ₹250 crore, thereby bringing 7,000 more companies into the MSME financing ecosystem.

One of the major challenges MSMEs face is access to affordable credit. Many small businesses, especially in rural areas, have traditionally relied on informal lending mechanisms due to the complexity of securing bank loans. However, Non-Banking Financial Companies (NBFCs) are increasingly stepping in to fill this gap. With a 15 per cent compound annual growth rate (CAGR) in assets under management over the past five years, NBFCs have become a key player in the MSME lending ecosystem. As Shachindra Nath explains, “NBFCs have demonstrated remarkable resilience and adaptability… Their ability to reach underserved markets and provide customised financial solutions has made them an indispensable part of the MSME lending ecosystem.”

NBFCs are not just providing credit but are also leveraging technology, such as fintech platforms and artificial intelligence, to improve risk assessment and credit underwriting. This has allowed MSMEs to access loans based on their digital footprint, helping to reduce the reliance on traditional collateral-based lending. This transition from informal lending to formal credit is critical in enabling MSMEs to scale and compete both domestically and internationally.

Also Read: Do you invest in SME IPOs, then this is for you!

Digital revolution in MSMEs

A crucial factor driving the success of MSMEs is the digital transformation that has swept across the sector. The adoption of e-commerce platforms, digital payment systems, and data-driven business solutions has allowed MSMEs to reach new customers, both in India and abroad. According to a report by Dun & Bradstreet, MSMEs that adopted digital tools had a 17 per cent higher turnover than their offline counterparts.

The Indian government has also been pushing the digitalisation agenda, with initiatives aimed at improving public digital infrastructure in critical segments such as agriculture, land records, and MSME credit access. Digital platforms are enabling MSMEs to enhance operational efficiency, reduce transaction costs, and tap into new market opportunities. The formalisation of MSMEs, through digital platforms like Udyam, is helping businesses access credit, streamline operations, and scale faster than ever before.

As Avinash Gupta, Managing Director & CEO of Dun & Bradstreet India, notes, “The initiatives towards technology adoption and digitalisation will further support the current initiatives taken by the government to formalise MSMEs and enhance their access to credit and markets.” These efforts are paying off, with MSMEs now more empowered to take advantage of both domestic and international market opportunities.

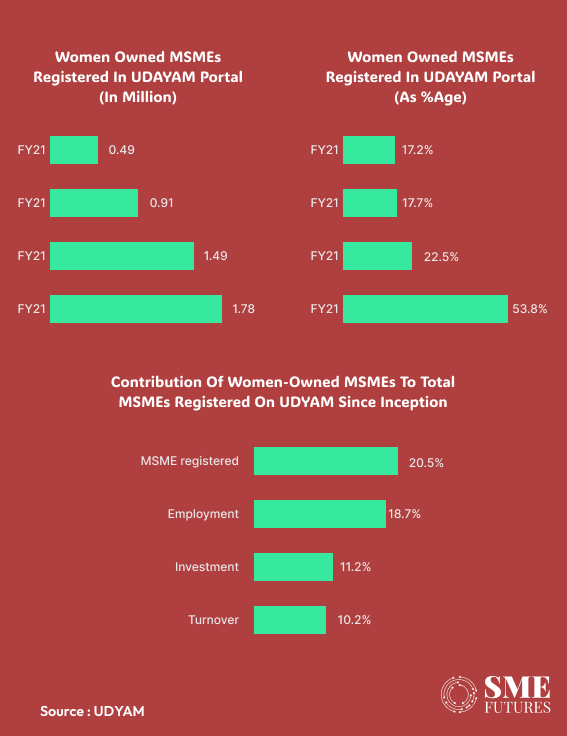

Women-led MSMEs: A rising force

An often-overlooked aspect of the MSME sector is the contribution of women-led enterprises. While women-led MSMEs currently account for 20 per cent of the total businesses registered on the Udyam platform, their influence is growing rapidly. That implies, 1 out of 5 Udyam-registered MSMEs is led by women, contributing to 1 out of 5 jobs but only 1 out of 10 rupees in investment and turnover. These women contribute to 3.09 per cent of industrial output. Importantly, women-owned Informal Micro Enterprises (IMEs) account for 71 per cent of total IMEs, significantly contributing to employment and local economic development.

By formalising and supporting women entrepreneurs through platforms like Udyam, the government is ensuring that women-led businesses have access to the same financial and operational resources as their male counterparts. This is crucial in driving inclusive growth and empowering women to become major contributors to India’s economic success.

Sector-specific growth: Light engineering, food processing, and healthcare

The MSME sector is diverse, with various industries contributing to its growth. One of the standout sectors is Light Engineering, which has become the largest contributor in terms of outstanding credit and turnover share. Other fast-growing sectors include Food Processing, Healthcare, Auto Components, Chemicals, and Electrical Equipment, each playing a critical role in India’s broader industrial landscape.

For instance, the food processing industry is vital to India’s agricultural economy, providing farmers with more value for their produce and creating millions of jobs. Similarly, the healthcare sector, particularly post-pandemic, has seen a surge in demand for MSME-driven innovation in medical devices, pharmaceuticals, and healthcare services.

Challenges ahead: Regulations and compliance

Despite the sector’s impressive growth, MSMEs face challenges, particularly in adapting to new safety regulations for machinery and electrical equipment. These regulations, which will take effect in 2025, align with global standards but may pose financial and technical hurdles for smaller enterprises. Compliance with the Bureau of Indian Standards (BIS) requirements will require significant investments, potentially burdening businesses that already operate on thin margins.

Moreover, while access to credit has improved, the sector still requires better working capital solutions to maintain liquidity, especially during periods of financial stress.

As India aims to become a $5 trillion economy, MSMEs will continue to play a pivotal role in driving growth, creating jobs, and fostering innovation. With continued government support, the adoption of digital technologies, and improved credit access, the MSME sector is well-positioned to contribute upwards of 35-40 per cent to India’s GDP by 2027.

In the words of Avinash Gupta, “The formalisation of MSMEs and enabling their growth in size and scale is crucial to increasing their contribution to GDP.” It’s clear that MSMEs are not just the backbone of India’s economy today—they are the key to its future. As they grow, innovate, and scale, MSMEs will lead India on its journey towards becoming an economic superpower.