India’s Micro, Small, and Medium Enterprises (MSMEs) are experiencing a renaissance. These dynamic businesses, forming the backbone of the economy, are not merely surviving; they’re thriving. A combination of factors – supportive government policies, technological advancements, and a thirst for innovation – are propelling MSMEs towards unprecedented growth. This “explosive growth potential,” as described by one industry leader, has captured the attention of both traditional financial institutions and agile fintech start-ups.

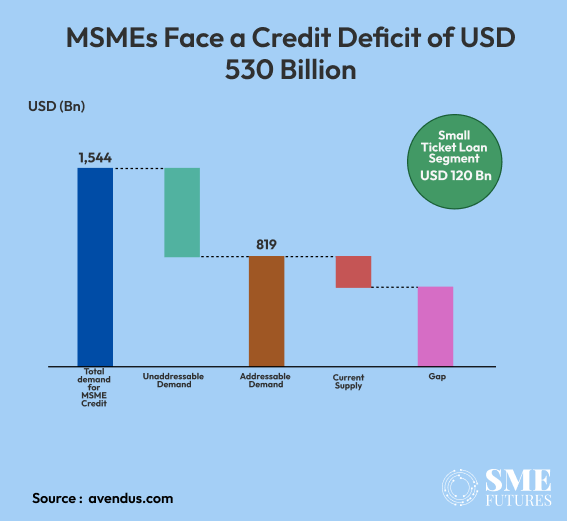

“The MSME sector contributes around 30 per cent to the country’s GDP and generates significant employment. The MSME segment is large, growing, and profitable, yet there seems to be a substantial credit gap. Currently, formal credit supply addresses only ~Rs 25 trillion of MSME financing needs, leaving an addressable credit gap of approximately ~Rs 45 trillion,” says Arun Nayyar, MD and CEO, NeoGrowth.

Unleashing untapped potential

MSMEs are the lifeblood of India’s economy., and provide livelihoods for millions. Their reach extends deep into rural areas, where they deliver essential services and create employment opportunities. Ajeet Kumar Singh, MD and Co-founder of SAVE Solutions Pvt. Ltd., highlights their “profound impact in rural areas,” while Dhanish Goyal, CEO of SD Polymer Pvt. Ltd., emphasises their vital role in driving “innovation and providing a stable base for economic development.”

However, for too long, many MSMEs have been held back by a lack of access to formal credit. “50 per cent of India’s creditworthy SMEs do not receive loans because of outdated underwriting methods,” reveals Hardika Shah, Founder & CEO of Kinara Capital. This credit gap is a staggering $400 billion, representing an immense opportunity for lenders willing to adapt and innovate.

The fintech revolution

Fintech companies are leading the charge in democratising access to finance for MSMEs. They are leveraging technology to address the shortcomings of traditional lending models, creating a more inclusive and efficient ecosystem.

“Fintech NBFCs are perfectly positioned to cater to this otherwise underserved sector as they are adept at blending financial expertise and cutting-edge technology and delivering solutions that MSME entrepreneurs are comfortable with. These factors collectively create a substantial opportunity for NBFCs to bridge the funding gap and support these businesses in their growth trajectories,” Hardika says.

Data-driven decisioning is at the heart of this transformation. Kinara Capital employs AI/ML models to assess creditworthiness accurately, while PaySprint’s, CEO and Founder, S Anand emphasises the use of APIs to streamline banking processes and improve digital collections for MSMEs. These innovations are not just reducing turnaround times for loan approvals but are also providing a more personalised and user-friendly experience for borrowers.

Empowering MSMEs with tailored solutions and digital access

The financial needs of MSMEs are as diverse as the businesses themselves, ranging from working capital to asset purchases and expansion plans. Recognising this diversity, lenders are tailoring financial products to cater to these specific requirements.

“Specialised financial products like flexible working capital solutions and digital lending solutions tailored to MSME needs is the way forward. Second, our focus on technological integration and data analytics enhances operational efficiency and speeds up loan processing, ensuring quick access to finance,” says Subhash Chandra Acharya of SEEDS Fincap.

“In essence, by aligning with demographic trends, minimum time and paperwork and technological advancements, we aim to maximise the potential of India’s vibrant MSME sector while contributing to inclusive economic growth and sustainable development,” he adds.

The move towards personalised solutions not only addresses the specific pain points of MSMEs but also fosters a stronger relationship between lenders and borrowers. By understanding the unique challenges and aspirations of each business, lenders can create products that truly empower MSMEs.

Digital technology is the cornerstone of this empowerment. Gone are the days of tedious paperwork and lengthy approval processes. Today, MSMEs can access credit through seamless digital platforms, making financing quicker, easier, and more transparent.

“MSMEs can apply for loans remotely and seamlessly now, reducing paperwork and turnaround time,” Shah asserts.

“We are also providing multiple incentives which not only promote MSMEs but also ease the process for them to efficiently hop on to the MSME bandwagon. For this, we have even lowered the business vintage. To further encourage women-owned MSME’s, we are providing quick loans which can be availed of within one month of business registration,” she adds.

SEEDS Fincap provides “a robust online system, offering clients convenient access via mobile to track and pay their EMIs.” This shift towards digital not only improves efficiency but also opens doors for MSMEs in remote areas who may have previously struggled to access traditional financial services.

Beyond loans, financial institutions are recognising the importance of providing value-added services to support the holistic growth of MSMEs. Sachin Vashishth, Founder, Loan Expert highlights the need for “cash flow management tools, financial advisory services, insurance, and investment products” to create a comprehensive financial ecosystem.

“This approach goes beyond simply providing funds; it empowers MSMEs with the knowledge and resources they need to manage their finances effectively and make informed business decisions,” he contends.

Government support and collaboration are fuelling the MSME engine

The government’s role in fostering MSME growth cannot be overstated. Supportive policies, such as the Pradhan Mantri Mudra Yojana, have injected trillions of rupees into the sector. “Government support is a huge factor,” affirms Acharya. However, more can be done.

“Enhanced access to technology infrastructure, increased financial literacy programmes, and more targeted subsidies for MSME innovation are required to further accelerate growth,” Anand asserts.

Collaborations between financial institutions, fintechs, government agencies, and industry associations is essential for creating a robust MSME ecosystem.

“This synergy allows for the development of comprehensive solutions, knowledge sharing, and collective advocacy for MSME interests. Partnerships are crucial for connecting MSMEs with suitable lenders and ensuring a transparent and efficient loan application process,” says Vashishth.

Navigating challenges and seizing opportunities

While the future looks bright for MSMEs, challenges remain. The difficulties MSMEs face in obtaining the necessary documentation for loan applications is a problem that technology can solve. Risk mitigation and responsible lending practices are also crucial for long-term sustainability.

“The rise of digital lending platforms, while offering convenience and accessibility, also presents challenges in areas like customer onboarding, fraud prevention, and regulatory compliance. Striking a balance between innovation and security is paramount,” Vashishth emphasises.

Despite these hurdles, the optimism about MSME growth is undeniable. “MSMEs are incredibly resilient and innovative, quickly adapting to challenges. This resilience, coupled with the ongoing digital transformation and supportive government policies, paints a promising picture for the future,” Acharya enthuses.

The government’s proactive role in supporting MSMEs through various schemes and initiatives is creating a favourable environment for growth. However, continued efforts to enhance financial literacy, provide targeted subsidies, and improve access to technology infrastructure will be crucial for sustained success.

The emergence of new players in the lending space, including foreign companies and private financiers, is increasing competition and driving innovation. This is creating a more vibrant and dynamic market, ultimately benefiting MSMEs with more choices and better-tailored financial solutions.

The future of MSME lending is undeniably bright. By addressing challenges, embracing technology, and collaborating across the ecosystem, financial institutions and fintechs can unlock the full potential of this sector, fuelling economic growth and fostering a more inclusive financial landscape.

A data-driven, inclusive future

The future of MSME financing is set to be shaped by data-driven insights, increased financial inclusion, and emerging technologies like AI and blockchain.

“In the near future, increased collaboration between fintechs and traditional banks along with a greater emphasis on financial inclusion is on the page,” says Tushar Bhaskar, Chief Business Officer, Rubix Data Sciences.

Data and analytics are playing a pivotal role in assessing creditworthiness and identifying potential risks, enabling lenders to make more informed decisions and expand their reach to underserved MSMEs.

“By leveraging big data and analytics, banks and financial institutions can significantly enhance the way they assess the creditworthiness of MSMEs. First, they can harness a variety of alternative data sources, including both structured and unstructured data (e.g., social media, customer and employee feedback) to provide a more accurate picture of an MSME’s financial health and creditworthiness,” he adds.

The integration of technology into financial services is also making it easier for MSMEs to access and manage their finances, empowering them to make informed decisions and drive their businesses forward.

Empowering India’s growth engine

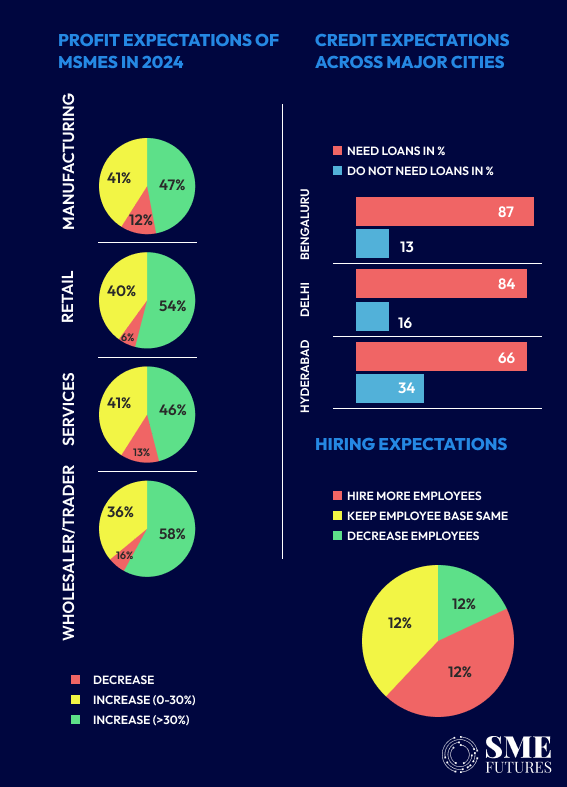

According to the 2024 NeoInsights Survey; 90% of MSMEs are confident about India’s economy in 2024, with the wholesale/trading sector being the most optimistic. 91% of MSMEs said that their profits would increase in 2024. 82% of MSMEs plan to harness the power of online tools in 2024, focusing on digital discovery, digital fulfilment, digital transactions, digital operations, and digital engagement.

As India strives to become a $5 trillion economy, the role of MSMEs cannot be overstated. They are not just businesses; they are the engines of innovation, job creation, and economic growth. With the right support, access to finance, and technological tools, MSMEs can unlock their full potential and propel India towards a brighter future.

The convergence of fintech innovation, supportive government policies, and collaborative efforts is creating a fertile ground for MSME growth. By embracing these opportunities and addressing the challenges head-on, we can ensure that MSMEs continue to flourish, creating a more inclusive and prosperous India.