Amid the Paytm Payments Bank row, Vijay Shekhar Sharma has stepped down as its part-time non-executive chairman and the board of the bank has been reconstituted.

This dramatic turn of events assumes significance in the backdrop of RBI’s crackdown on Paytm Payments Bank over persistent non-compliance and continued material supervisory concerns.

The impact of this episode is more obvious than ever.

Last month, the RBI unveiled a ‘draft framework for recognising Self-Regulatory Organisations (SROs) for the fintech sector’, outlining the attributes of a fintech SRO, along with the necessary functions and governance standards.

The central bank asserts that, “Self-regulation within the fintech sector is the preferred method for achieving the desired balance.”

On the other hand, on 26th February, top executives of at least 50 fintech companies met the finance minister to discuss regulatory issues. Also, Nirmala Sitharaman has asked RBI to hold monthly meetings with start-ups and fintech firms to address their concerns, officials say.

Also Read: What made Paytm Payments Bank Fumble?

Impact of catastrophe

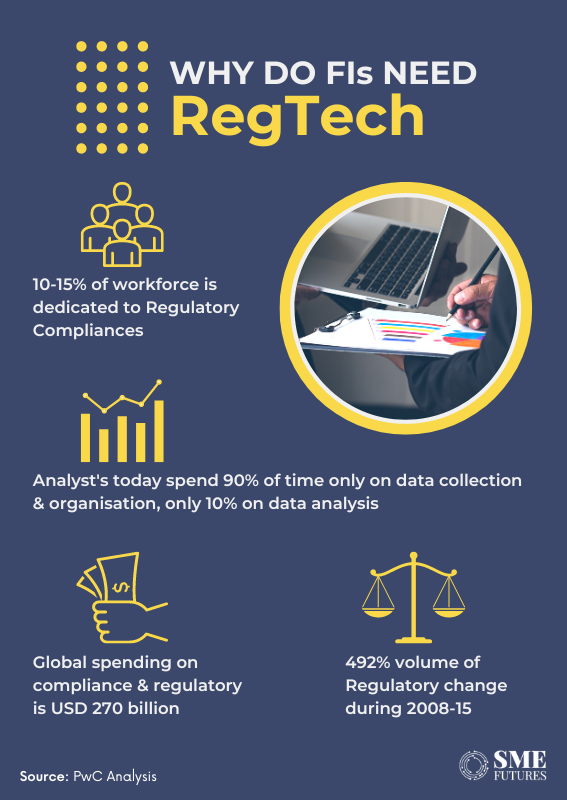

The RBI’s action against PPBL has put the spotlight on regulatory compliance in the fintech industry. This has sparked a new fear among companies, especially fintech companies—how to resolve non-compliance issues.

“What happened to Paytm has shaken up the start-up ecosystem in a good way,” says Ravi Teja Gupta, Founder, Guptaji Invests. “Now the founders and investors will be serious about the basic fundamentals of business, ethics, values and regulatory bodies, rules and regulations,” he adds.

Milan Sharma, Founder and MD, 35North Ventures, a SEBI regulated VC firm feels that the incident has started a debate on data privacy and transaction transparency.

“Since digital payment systems are a new concept, there still needs to be proper regulations around their operations. I feel it’s better from a customer’s financial security standpoint. Fintechs should rather leverage these transformations to build structurally sustainable infrastructures and business models,” he says.

Harshil Mathur, CEO of Razorpay comments, “As the financial ecosystem and digital payments grow, compliance and governance must go hand in hand. Regulators have efficiently balanced innovation with risk management while they allow people to innovate.”

This is where RegTech comes in.

Boost to RegTech

The success of tech-driven compliance ecosystems, such as the one created for GST, underscores the transformative power of technology in regulatory compliance.

Similarly, due to RBI’s regulatory scrutiny and evolving compliance requirements, fintech businesses are increasingly turning to technology to navigate the complex landscape of regulatory compliance. At the forefront of this technological revolution is the burgeoning field of Regulatory Technology, or RegTech, which is now getting a boost.

These tech solutions promise to streamline compliance processes and mitigate risks effectively, asserts Sandeep Agrawal, Co-Founder and Director at TeamLease RegTech.

“The Paytm Payments Bank incident underscores the need for robust compliance frameworks,” he emphasises, adding, “RegTech solutions offer a proactive approach to compliance, enabling companies to stay compliant and mitigate risks effectively.”

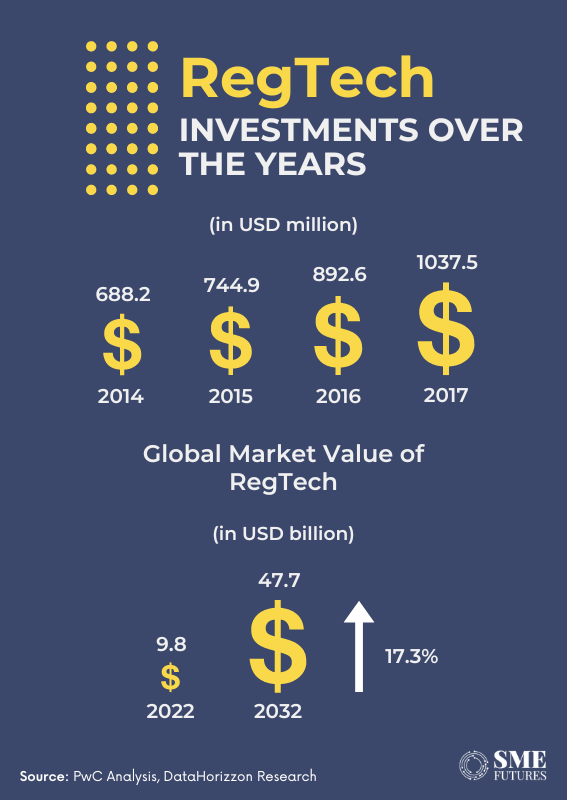

According to international market research platform, DataHorizzon Research, the RegTech market size stood at $9.8 billion in 2022 and is growing at a CAGR of 17.3 per cent and will reach $ 47.7 billion by 2032.

This figure implies greater opportunities in the Indian market.

Agrawal envisions a future where regulators embrace end-to-end digitalisation of compliance processes, driving further growth in the RegTech industry.

“The government’s initiatives in creating tech-driven compliance ecosystems have paved the way for innovation in regulatory compliance. By extending similar initiatives to other regulatory domains, regulators can catalyse the growth of the RegTech industry and unlock its full potential,” he contends.

Thrust to innovation

RegTech is expected to witness further innovations going forward. Additionally, with generative AI avenues, the future appears brighter for the innovators in this domain.

Amidst the ongoing developments, the RBI has bolstered the ‘Enabling Framework for Regulatory Sandbox’ with stricter timelines and compliance provisions. According to the updated framework published on the RBI website, the timelines for various stages of the Regulatory Sandbox process have been extended from seven to nine months.

Furthermore, the revised framework mandates sandbox entities to ensure compliance with the provisions of the Digital Personal Data Protection Act, 2023.

“The objective of the Regulatory Sandbox is to foster responsible innovation in financial services, enhance efficiency, and deliver benefits to consumers,” states the RBI.

The framework has been revised based on the insights gained from running four cohorts over the past four and a half years, as well as from feedback received from fintechs, banking partners, and other stakeholders, the RBI notes.

The ‘Enabling Framework for Regulatory Sandbox’ was initially introduced on the RBI website on August 13, 2019, following extensive consultations with stakeholders.

Impact on partnerships

While recent developments in the fintech world have prompted debate, there are concerns about the possible consequences for future relationships between fintech companies and traditional financial institutions, particularly in terms of consumer trust and perception.

“It broadly comes down to awareness about certain markets and concepts. Sooner or later, once proper compliances are in place, customer trust will build up over time. There’s no denying that these have been breakthrough technologies,” Sharma points out.

Reflecting on the broader significance of PPBL’s experiences, Sharma emphasises the importance of adaptation and compliance in shaping the future of digital banking services. “The market is rapidly evolving and only the most deserving and commercially viable concepts that exhibit expansion will survive. Fintechs have managed to create a large inclusive financial ecosystem by servicing underserved and untapped regions. The future of banking services relies on their ability to adapt to newer regulations and being compliant,” he notes.

Gupta also highlights the importance of curated partnerships in the wake of regulatory challenges, saying, “Partnerships will be much more curated. As the start-up ecosystem and banking industry understand the reactions of wrong partnerships like Paytm, smart people will partner with others (investors) very selectively and carefully. So will consumers while sharing their information with any company, especially the KYC data.”

Regarding concerns about accessibility and affordability of digital banking services amidst regulatory constraints, Sharma remains optimistic. “It is too soon to jump to conclusions. PPBL is under scrutiny for the time being, it’s just facing some restrictions. Their license still stands valid. All innovations are first met with early-stage hurdles, lower market adoptions, and some technical challenges too,” he says.

The regulatory hurdles faced by Paytm Payments Bank serve as a reminder of the importance of compliance, ethics, and curated partnerships in the fintech sector. As India continues its journey towards financial inclusion and digital transformation, navigating regulatory challenges will be essential for sustained progress and innovation.