Festive season 2023 has begun. Among the myriad traditions and celebrations that mark this joyous period, one phenomenon stands out—the surge in demand for auto sales. With this, carmakers anticipate an increase in auto sales.

According to Acuité Ratings & Research, sales of passenger automobiles, two-wheelers, and commercial vehicles are already up and will continue to rise.

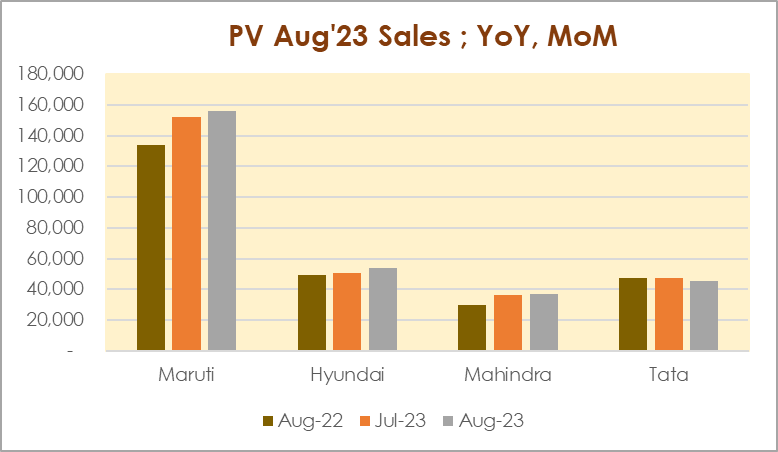

Passenger vehicles

- The total domestic PV sales volumes of the top 13 players continued to show a healthy annualised growth at 9.8 per cent YoY growth in Aug’23 vs Aug’22, touching almost 3.6 lakh units during the previous month.

- On a sequential basis, the growth was also strong at 2.3 per cent MoM following a 7.2 per cent MoM in the month of July-23.

With regards to retail sales, FADA (Federation of Automobile Dealers Association) also reported a good growth of 6.5 per cent YoY and 10.9 per cent MOM, reflecting some momentum before the festival season.

The aggressive new launches and refresher models particularly in the SUV segment have continued to support the surging demand in PVs across the country.

Commenting on the PV sales scenario, Suman Chowdhury, Chief Economist & Head – Research, Acuité Ratings & Research Ltd. says, “It’s encouraging to see that the PV volumes are responding strongly to the approach of the festive season. Apart from the festive factor, the other factors that are driving growth in the segment are increased consumer preference towards SUV/MPVs segment, improvement in semiconductor availability and also the nearing elections both in multiple states and the central level,”

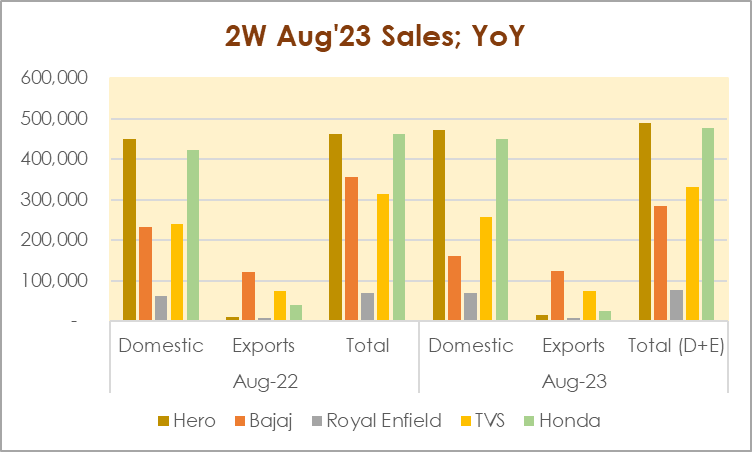

Two-wheeler sales

The total sales of top five 2Ws in the segment reported marginal decline in total sales by 0.3% YoY in Aug’23 compared against Aug’22. However, on a sequential basis, the total sales witnessed a strong recovery by 20.0% MoM as compared against July’23.

The domestic sales almost remained muted with 0.1% YoY growth during Aug’23 vs. Aug’22; but the sequential trend is expectedly, strong at 25.4 per cent MoM during the month, given the onset of the festive season and the higher stocking by the dealers.

Retail sales have seen a better performance with a growth of 6.3 per cent YoY and 2.1 per cent MoM in Aug-23, as per the FADA data.

The export demand from the international market continue to remain impacted reflected by the decline in export volume by 2.5 per cent YoY in Aug’23 vis-à-vis Aug’22. On a sequential basis too, the export demand witnessed decline of 3.3 per cent MoM respectively during the month compared against July’23.

Chowdhury comments, “The improved volumes for Aug’23 raise hopes for a revival in the domestic 2W market. The uptick in dealer level sales is driven by the start of the festive season and partly by the launch of premium end bikes by some of the OEMs. However, the sustainability of any consistent volume growth in the 2W segment will depend on the demand in entry level models which in turn is largely linked to rural demand. On the other hand, the overall demand from the international market remains fragile, given the uncertainty and slowdown in the global economy.”

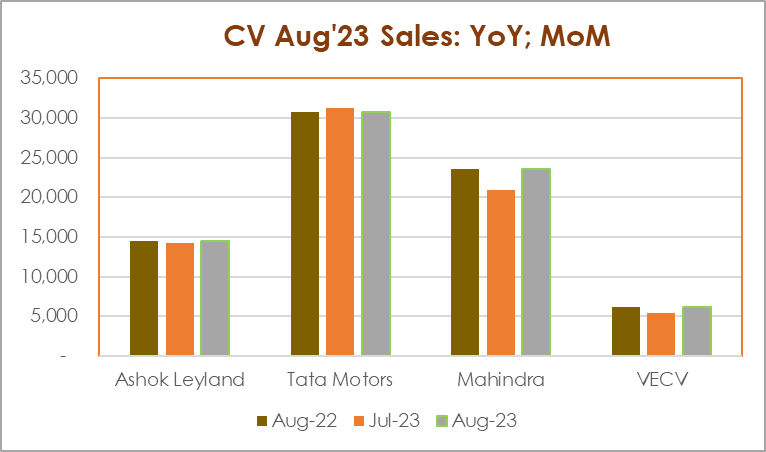

Commercial vehicle sales

• The domestic sales of the top four players in the CV industry continue to remain on positive track with growth of 9.2 per cent YoY in Aug’23 compared against Aug’22.

• On a sequential basis, the domestic sales also witnessed a rise of 4.6 per cent MoM in Aug’23 vis-à-vis Jul’23.

• Further, FADA has reported a 3.2 per cent YoY and 3.0 per cent MoM growth in retail CV volumes during the month of Aug’23.

• However, on a cumulative basis, the volume growth in the Apr-Aug’23 period stood at a modest 0.4 per cent YoY.

• The strong push towards infrastructure development and healthy growth in the e-commerce industry support the domestic demand for all the top CV manufacturers in the country.

“While the CV growth trajectory in the current year is not as strong as in the previous year, the underlying drivers for the sector continue to be at work namely a step up in public sector expenditure in infrastructure, gradual replacement of older bus fleets by government transport corporations and the continuing penetration of e-commerce services that particularly boost LCV demand.” said Chowdhury.