Gone are the days when being an artist meant being broke. The Indian art market has altered dramatically in the last 20 years. We now live in a world of DIYs and art NFTs. While hitherto, art was considered as a collectible or a luxury item, it has now been moved into a new category—capital asset.

This indicates that Indian art is now an investment, and the art market is not just a fad but is worth billions. And auctions are making it possible for these works of art to be profitable.

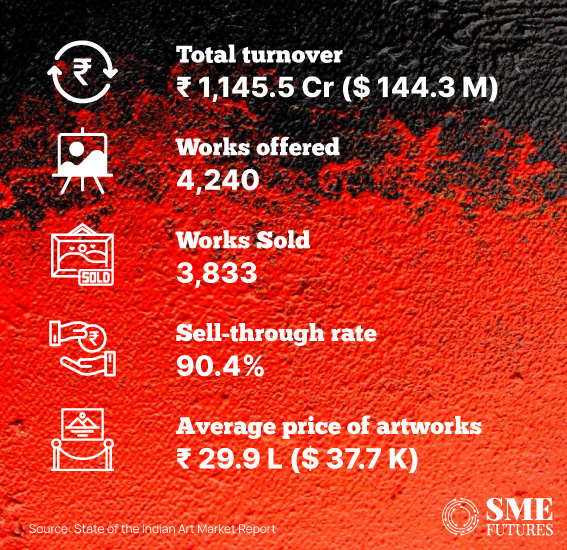

In fact, the Indian art market has clocked in a mammoth turnover of $144.3 million through the sale of 3,833 works in FY23, according to the ‘State of the Indian Art Market Report FY23’ by Grant Thornton Bharat and Indian Art Investor.

Backed by over 40 years of auction data, this report reveals the overall performance of the Indian art market at auction over FY23 and states that all the major growth parameters are in the green and shows a strong growth trajectory for the art market. Here are some of the key statistics that will help us to understand the pulse of this market.

FY23 recorded impressive sales

After outperforming FY22 at auction, the Indian art market is still going strong. In FY23, 3833 art works were sold through auction. While the art market recorded a 9 per cent rise in turnover with Rs 1,145 crores ($144.3 m). There was also a 6 per cent rise in the number of works sold from the previous year, making FY23 the most successful year for Indian art at auction.

According to the report, the market recorded an impressive sell-through rate of 90.4 per cent. For the uninitiated, the sell-through rate is the number of works sold against the number of works offered and hence is the indicator of demand and liquidity in the market.

Also, the average price of artworks sold in FY23 stood at Rs 29.9 lakhs ($37.7k), which is a modest jump from the previous year.

“This growth is due to the democratisation of art,” comments Pallavi Bhakru, Partner, Private Client Services, Grant Thornton Bharat.

“There were few preservers of art who could really afford it or were enlightened enough to want to put money into it. Today, there is a broader segment of people who understand and appreciate art,” she says.

According to her, art has always been a lucrative investment among high-net-worth individuals (HNIs) for diversifying wealth and creating value. Today, the pool of investors looking to include fine art in their investment strategies is widening.

“These days if someone wants to buy an expensive piece of art, the galleries are willing to give you an instalment plan for it. It’s like buying a car on an EMI,” she adds.

A sudden growth spurt in the art market

The report shows that the Indian art market at auction witnessed noteworthy traction this year, with a total of 132 auctions offering 4,240 works; an increase of 11 per cent from the previous year in terms of the works that came up for sale.

The market observed high liquidity, with an impressive sell-through rate of 90.4 per cent.

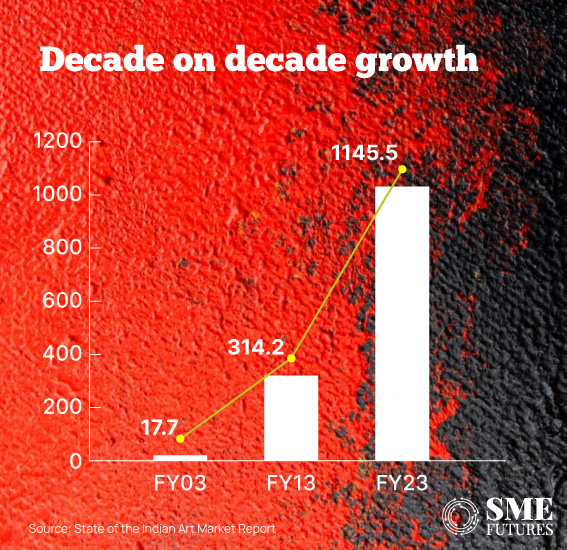

“The Indian art market is at an all-time high. Data from the report reveals that the auction market has grown by 265 per cent since FY13. The mean auction estimate for FY23 stood at $93.1 million. At a turnover of $144.3 million, the market recorded a positive deviation of 55 per cent from its mean estimate,” says Arvind Vijay Mohan, the Founder of Indian Art Investor, in a statement.

“There were a total of 164 artists who set new records this year and every year is witnessing new records, rising volumes and increasing sales turnovers. All these are indicators of the buoyancy and the positive sentiment in the Indian art market,” he adds.

Modernists and pre-modernists both witnessed a 7 per cent increase in terms of the number of artists featuring at auction in FY23.

Mohan feels that following the pandemic, the Indian art market is witnessing a sudden but good boom. “It has completely skyrocketed. The past three years have been a very clear indicator of the potential of this industry. According to the data, over the past two decades the market has grown from FY03 to FY13 and so on. The growth numbers are clearly indicative of a market which is very firm and only moving upwards,” he points out.

According to Mohan, in the past three financial years, from FY21 to FY23 there has been a growth of 28 per cent y-o-y, which depicts stability.

Online auctions have added to the growth

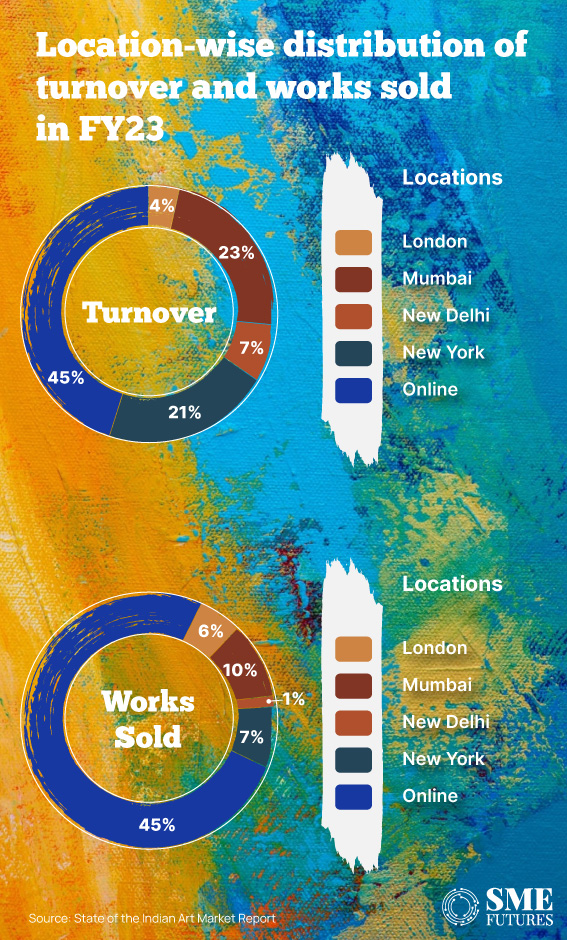

According to the report, there were a total of 103 online auctions held in FY23. These online auctions accounted for 45 per cent of the total turnover generated in FY23.

The market churned out Rs 521 crores ($67.6 million) in FY23.

Whereas the overall data reveals that the online auction market was in itself responsible for 75 per cent of the works sold in the auction market as a whole, with sales of 2,869 works.

Approximately 63 per cent of these works fell in the Rs 5 lakh bracket.

Interestingly, nearly 30 per cent of the turnover that was generated from online auctions came from the works that were valued between Rs 1-5 crores and 22 per cent of it came from the works that were valued above Rs 10 crores.

The online ecosystem has changed the art auction landscape in multiple ways.

It has made art accessible.

It has opened up the art market to new entrants.

It has helped to educate art patrons and art investors about the benefits and the process of bidding at auctions.

Online auctions have also been a significant force in pushing the market forward. Over the next few years, experts predict that online auctions will be the drivers of the majority of the movement in the market.

Does size matter

Maybe not in everything, but it definitely matters in terms of artworks. How big should an artwork be and what should be the scale of the artwork that your space needs, are the basic questions that pop up when you start thinking about buying an artwork. However, there are many myths in the market related to the size of artworks.

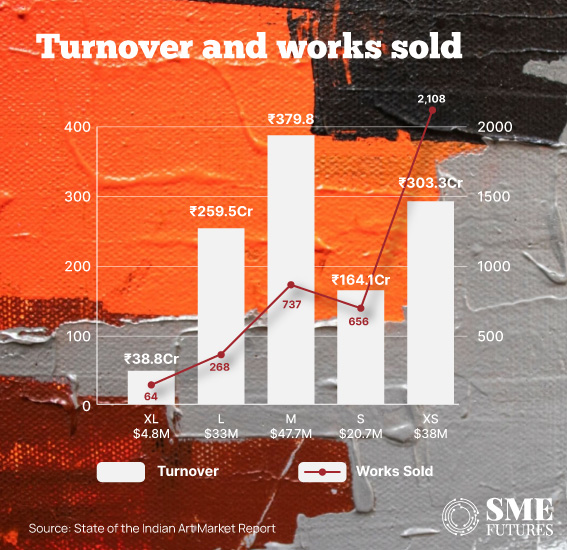

It is normally believed that larger format artworks are more expensive by virtue of their size.

Since the larger format artworks are fewer in number and are not as readily available compared to the smaller sized ones, there are limited options available in the market. Also generally, they are commissioned works of art.

However, the sales data from the art market this year goes contrary to this popular belief.

This data clearly indicates that with the help of online solutions, the art market is growing by leaps and bounds. Also, there is no longer a debate about whether art is an asset class.

“By setting clear requirements, doing extensive research and seeking help and advice from professionals who can guide and manage this investment avenue, investors can acquire desirable works of art, thereby adding value to their portfolio for generations to come,” Bakhru asserts.

But now, the dilemma is about how to identify the works of art that truly have the potential to appreciate in value and about how to include art as a component in a comprehensive wealth-building strategy. While not yet formally a part of the financial product suites of most banking institutions, there are a large number of private wealth management firms that are steadily integrating art in their wealth management portfolios.

Considering everything, it is clear that there is great excitement in the art market, coupled with an influx of capital from both generational and novice investors. It is quite apparent that art as a lucrative investment is now being actively pursued by some while being curiously considered and explored by many others.