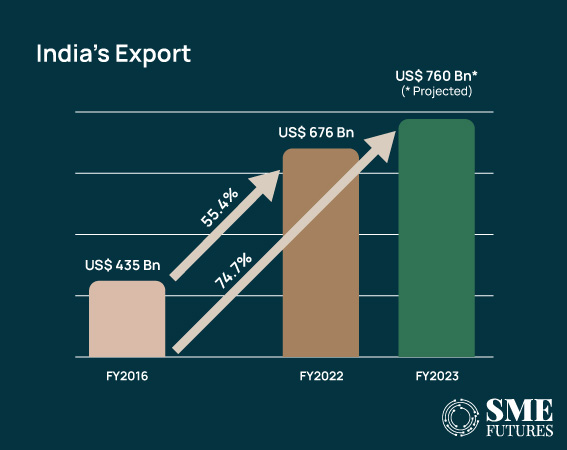

Indian exports are on a gradual increase. Despite the fact that trade has been going through a fluid geopolitical situation and disrupted supply chains.

In 2021-22, the country’s goods and services exports reached an all-time high of $422 billion and $254 billion respectively, bringing total shipments to $676 billion.

Recently, India’s overall exports crossed this figure.

The country’s exports have risen from $500 billion in 2020-21 to $750 billion today. An all-time high.

Now its aiming for a much bigger target. $2 trillion by 2030.

To do so, and to keep pace with the increasing exports, the government has unveiled a new Foreign Trade Policy.

“I am confident that India’s trade will touch $2 trillion in exports by 2030,” Piyush Goyal said as he introduced the new policy. The new Foreign Trade Policy will encourage trade in the Indian rupee, he added.

What’s new this time around

Releasing a foreign trade policy is not a new thing for any government. Through it, the government hopes to grow the industrial and production industries by putting its policies into practice.

The FTP 2023 aims for process re-engineering and automation to make doing business easier for exporters. It also focuses on emerging areas such as dual-use high-end technology items under SCOMET, e-commerce export facilitation, and export promotion collaborations with states and districts.

The new trade policy has four goals: To transition from an incentive-based regime to a tax-remission-based regime, to improve the ease of doing business, to promote exports through collaborations, and to focus on the emerging areas.

However, there are a few things that have changed.

Breaking with its old tradition, the government has not given any expiry date to the FTP, implying that there is no end date to the policy. However, experts will be updating the document as and when it is deemed necessary.

According to Santosh Sarangi, Director General of Foreign Trade (DGFT), this makes the policy very dynamic. “As there is no end date, we will keep changing this document and update it,” he says.

The new FTP also seeks to make the Indian rupee a global currency and allow international trade settlement in the domestic currency. The DGFT said that the overall exports, inclusive of merchandise and services, are likely to touch $770 billion in FY23, against $676 billion in FY22.

Commenting on the new FTP, Gunjan Prabhakaran, Partner & Leader – Indirect Tax, BDO India, feels that the new Foreign Trade Policy 2023 appears to be forward-looking and dynamic. “The flexibility that can be amended to address industry requirements is a testament to the fact that the government realises the need to keep evolving with the changing global requirements,” he points out.

FICCI President, Shubrakant Panda also feels that by doing away with the sunset clause and the end-period, the FTP will allay the apprehensions of the exporters and importers, ensuring stability, continuity and certainty amidst the changing geo-political environment.

Focus is on MSMEs

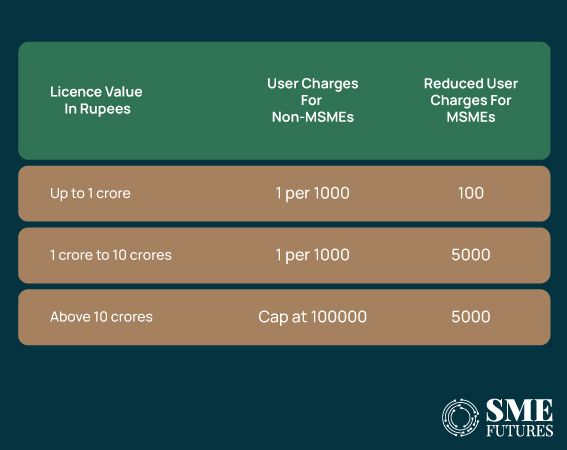

The past few years have been a time of ups and downs for most businesses, especially the MSMEs. The new FTP focuses on reducing friction across the ecosystem and on giving an impetus to the country’s exports. For instance, fee and transaction cost reduction measures have been announced. According to the DGFT, almost 50-60 per cent MSMEs will benefit from this. From paying about Rs 1 lakh for their licenses earlier, now they have to pay only Rs 5000.

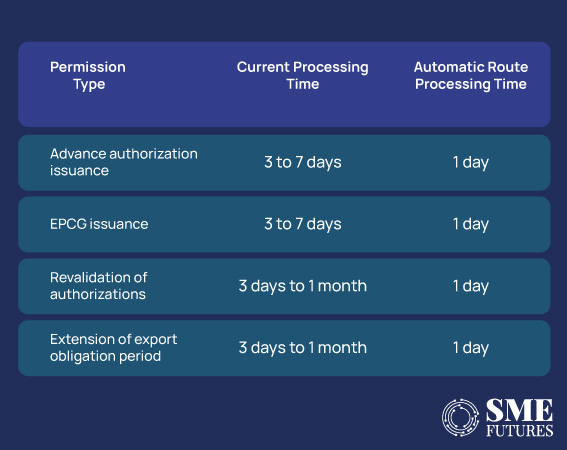

These provisions are expected to reduce the processing time for the revalidation of various authorisations, which currently ranges from three days to one month to one day.

Moreover, the FTP 2023 codifies the implementation mechanisms in a paperless, online environment, building on the earlier ‘ease of doing business’ initiatives.

Export promotion initiatives

While the new policy comes at a time of economic uncertainty, it offers a new approach for businesses looking to expand their trade. For those, the new FTP includes a slew of new measures.

To encourage exports, the government has added four new towns to the previously existing list of 39 Towns of Export Excellence (TEE). They are Faridabad, Mirzapur, Moradabad, and Varanasi. TEEs are the towns that produce goods worth Rs 750 crores or more.

Also Read: Global PC market in the doldrums, notebooks suffer 34% decline

According to the experts, this addition is expected to boost the exports of handlooms, handicrafts, and carpets. Besides, this scheme will also give a thrust to the cluster-based economy.

The TEEs will have priority access to export promotion funds under the MAI scheme and will be able to avail themselves of the Common Service Provider (CSP) benefits for export fulfilment under the EPCG Scheme.

The FTP also provides capacity building at the district level. Under this, there will be a slew of initiatives to create new exporters and training and outreach programmes by the DGFT officers.

Apart from this, the new FTP allows rupee payment to be accepted under the FTP schemes. As per analysts, this step will be an effective one towards the internationalisation of the rupee.

Commenting on these initiatives, Nisschal Jaain, Founder and CEO, Shypmax, says, “By minimising the export license fees from around 100,000 to 5,000, MSMEs have been given their due share of relief. This will also expand the horizons of the export market in India and make India’s a far more competitive ecosystem. Another factor which strengthens India’s footing in the global market is the internationalisation of the rupee which comes off as very beneficial for exporters. Their dependency on dollar pricing will start to decline. Additionally, 4 new towns of excellence along with the 39 existing towns will focus on the exports of handicrafts and handlooms, supporting the small-scale artisans.”

Recognition to exporters

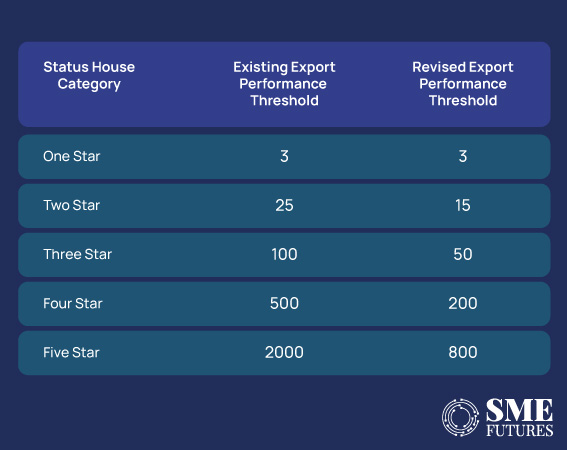

To further promote exports, the new FTP will now recognise exporters based on their export performance. For this, there will be a star rating system.

Exporter firms with a ‘status’ will be a part of the capacity-building initiatives. Similar to the ‘each one teach one’ initiative, 2-star and higher status holders would be encouraged to provide trade-related training to interested individuals based on a model curriculum.

This will assist India in developing a skilled labour pool capable of servicing a $5 trillion economy by 2030. The status recognition norms have been re-calibrated, allowing more exporting firms to achieve 4 and 5-star ratings, resulting in improved branding opportunities in the export markets.

Exporter firms that have been recognised with a ‘status’ based on their export performance will now be partners in capacity-building initiatives on a best-endeavour basis.

Promoting exports from the districts

The FTP aims to form partnerships with state governments and advance the Districts as Export Hubs (DEH) initiative, which aims to promote exports at the district level and accelerate the development of a grassroots trade ecosystem.

Efforts will be made at the district level to identify export worthy products and services and to address concerns through an institutional mechanism – the State Export Promotion Committee and the District Export Promotion Committee, respectively. District-specific export action plans will be developed for each district, outlining the district’s strategy for promoting the export of its identified products and services.

Vinod Kumar, President, India SME Forum, asserts that the new FTP is a watershed moment, giving states the power to formulate their own export policies.

“The FTP takes the best practices of the 30-40 leading jurisdictions. For most MSMEs that once dreamt of exports, the new FTP will make it a reality. Giving more authority to states to create institutional mechanisms at the state and district levels to strategise will allow for a more nuanced approach and will make it easy to recognise and mitigate the hurdles faced by the exporters, thus decentralising the promotion of exports,” he elaborates.

Facilitating e-commerce exports

Understanding the potential that e-commerce exports bring to the table, the government has decided to gain from it. Being a promising category, it requires policy interventions that are distinct from the policies for traditional offline trade.

Various estimates place the e-commerce export potential between $200 to $300 billion by 2030.

The FTP 2023 outlines the intent and roadmap for establishing e-commerce hubs, as well as for the related elements like payment reconciliations, bookkeeping, returns policies, and export entitlements.

As a starting point, the FTP 2023 has increased the consignment-wise cap on e-commerce exports via courier from 5 lakhs to 10 lakhs. This cap may be revised further or removed entirely based on exporter feedback.

The integration of courier and postal exports with ICEGATE will allow exporters to claim FTP benefits. Based on the recommendations of the working committee on e-commerce exports and inter-ministerial deliberations, a comprehensive e-commerce policy addressing the exim ecosystem will be developed soon.

Extensive outreach and training activities will be undertaken to strengthen the capacity of artisans, weavers, garment manufacturers, and gems and jewellery designers to onboard them on e-commerce platforms and facilitate increased exports from them.

“E-commerce exports require paradigms tailored to leverage the huge opportunity that lies ahead for India,” Dr. Aruna Sharma, IAS, Director General, FIRST & Former Secretary GOI says about the initiative.

“The development of a conducive regulatory ecosystem that is supportive of the digital economy and technology-driven exports is a positive move in the right direction. The incorporation of a dedicated e-commerce chapter in the new FTP will provide MSMEs with the ability to compete globally and work towards the goal of a $5 trillion economy,” she adds.

Kumar of the India SME Forum also adds that this will help MSMEs with easy stocking customs clearances and returns processing. “This will help in reducing the hurdles of logistics and compliances for them, empowering MSMEs to become part of the global supply chains,” he avers.

Amnesty scheme

Finally, the government is committed to reducing litigation and fostering trust-based relationships to help exporters to overcome the various challenges that they have to routinely face.

The FTP has introduced a special one-time amnesty scheme to address the defaults on Export Obligations (EO), in line with the “Vivaad se Vishwaas” initiative, which sought to settle tax disputes amicably.

Also Read: Real estate sighs a breath of relief as RBI keeps repo rates unchanged

This scheme will help the exporters who have been unable to meet their obligations under the EPCG and Advance Authorisations and are burdened by the high duty and interest costs that are associated with pending cases.

All pending cases of the failure to meet the Export Obligation of the mentioned authorisations can be regularised by paying all the customs duties that were exempted in proportion to the unfulfilled Export Obligation. Under this scheme, the interest payable is limited to 100 per cent of the exempted duties.

However, no interest is payable on the portions of the Additional Customs Duty and the Special Additional Customs Duty, which is likely to provide relief to exporters by lowering their interest burden significantly.

Experts hope that this amnesty will provide these exporters with a fresh start and an opportunity to comply.

“Exporters engaged in the manufacture and export of proprietary products and who are not an AEO status holder, would be much relieved with the extension of the “Self-ratification scheme for the fixation of input-output norms” to the 2-star and above status holders. Currently, the ratification of self-declared norms by authorities takes a long time which exposes the exporters to the risk of differential duty and interest or additional Export Obligation after importing inputs duty-free against Advance Authorisation as per the self-declared norms,” says Prabhakaran.

Initiatives to make India an export hub

Right now, India Inc is appreciating the new approach of the FTP as it reflects and integrates the dynamic nature of foreign trade in the present day.

A slew of affirmative measures have been undertaken under the new FTP, which include- No sunset of five years, the continuation of Advance Authorisations/ EPCG/ DFIA, a reduction in the licence fee for MSMEs, a reduction in the threshold for star houses, merchandise trade for restricted goods, the internationalisation of trade in the rupee, battery electrical vehicles being declared eligible for reduced obligation under the EPCG, the special Advance Authorisation scheme for the apparel and clothing sector, benefits and facilitation for the e-commerce sector, an amnesty scheme for the one-time settlement of default in Export Obligation by Advance Authorisation and EPCG authorisation holders, the digitisation of applications under the FTP, the reduction in the application fees for MSMEs, and the standardisation/ reduction of composition fees for the extension of the Advance Authorization.

Most experts are of the opinion that the measures that have been undertaken by the government for giving a boost to Indian manufacturing and exports through its robust policy initiatives, the integration of technology for improving the business environment and the introduction of measures for promoting exports, will go a long way in achieving India’s export target for 2030 and in enhancing India’s market share in global exports.

However, the stakeholders also feel that a thorough evaluation of the new FTP is required to objectively assess the various benefits that have been outlined in it.