The Emergency Credit Line Guarantee Scheme (ECLGS) began in May 2020.

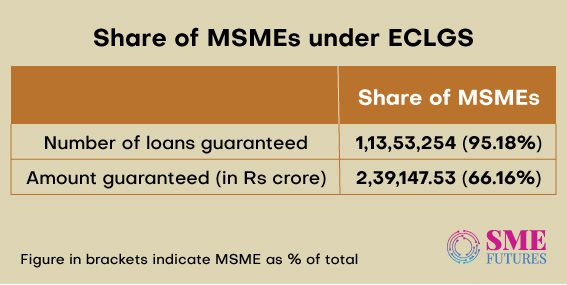

As of 31st January 2023, guarantees amounting to Rs 3.61 lakh crores have been issued under the ECLGS, benefiting 1.19 crore borrowers, according to the National Credit Guarantee Trustee Company Limited (NCGTC), the agency which operates the scheme.

The Economic Survey 2022-23 says that owing to the support of the credit disbursement through this scheme, the credit growth of MSMEs has gone over 30.6 per cent on average during Jan-Nov 2022.

Meanwhile, a CIBIL report states that the scheme has helped MSMEs to deal with the COVID shock, with 83 per cent of the ECLGS borrowers being micro-enterprises. More than half of these micro units had an overall exposure of less than Rs 10 lakhs.

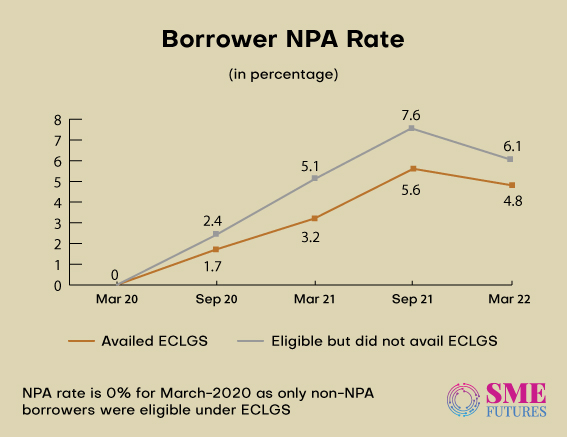

The CIBIL data also shows that the ECLGS borrowers had lower non-performing asset rates than the enterprises that were eligible for the ECLGS but did not use it. As per RBIs figures, MSME loan accounts worth Rs. 2.2 lakh crores have improved since the inception of the ECLGS for the entire banking industry. This means that around 12 per cent of the outstanding MSME credit has been saved from slipping into the non-performing asset (NPA) classification due to the ECLGS.

Not only that, but the scheme has also alleviated their debt servicing concerns while value adding to the GST payments from the MSMEs.

To extend or not to extend!

So far according to the data, the ECLGS has been instrumental in the survival of lakhs of MSMEs in India.

However, the second extension (it was extended in October 2022 for the second time) of this scheme is coming to an end by the 31st of March. According to sources, a third 6-month extension of the programme may be granted by the centre. To chart the progress of the scheme, the finance ministry has called a meeting of the heads of the public sector banks and the heads of the top four private sector lenders. The meeting is scheduled to be held on February the 22nd.

Also Read: RBI may pause repo rate hike next month: SBI Report

On the question of whether the scheme should be extended or not, a section of India Inc argues that the ECLGS scheme is significantly helping MSMEs with their financial needs.

“The extension of the ECLGS will be welcomed, as it is widely anticipated,” says Arun Poojari, CEO and Co-Founder of Cashinvoice, a fintech that helps businesses to resolve working capital shortfalls by unlocking the trapped cash in the MSME ecosystem.

“The scheme has rightfully served its purpose of assisting businesses affected by the pandemic by providing significant financial assistance to the micro, small, and medium enterprises sector. Furthermore, the government should consider broadening the scope of the scheme by effectively incorporating working capital products into it. This will provide stability to the scheme and promote financial inclusion in the economy,” he adds.

Shantanu Bairagi, Co-founder and Director at Artfine, strongly opines that the ECLGS has been extremely effective in keeping the MSMEs afloat. “The additional corpus of Rs 9,000 crores announced in the Union Budget 2023 was a very welcome step, especially given that many industries are still feeling the effects of the pandemic and the high commodity prices. To truly assess the impact of the revamp, we must examine the tenure extensions as well as increase the borrower limits so that the unutilized amount can be used by the MSMEs which are in need of credit,” he tells us.

In a media statement, former SBI Chairman, Rajnish Kumar also spoke in favour of the extension of the ECLGS. According to him, the scheme must continue depending on the government budget.

There’s no need, say a few

There is a section which is not in favour of the extension though.

According to them, the idea of the extension comes at a time when the economy has recovered from the pandemic, and SMEs are seen as needing more help and assistance as many of them are still struggling. While this is one scenario, industry experts believe that extending the scheme without addressing some design issues will not be a good idea either.

If we go by the RBIs December 2022 Financial Stability Report, it points out that “The September 2022 position of the ECLGS lending indicates that distress continues in the MSME sector.”

According to the report, one-sixth of the accounts that availed themselves of the funds under the ECLGS, turned into NPAs.

Also Read: Govt caps maximum GST compensation cess rate for tobacco products

“Even though the micro-enterprises segment availed themselves of a quarter of the loans disbursed under the ECLGS, their share in the overall NPAs stood much higher,” the document reads.

“There is no point in extending the ECLGS again and again, a scheme that doesn’t take care of the needy,” says KE Raghunathan, National Chairman of the Association of Indian Entrepreneurs.

He elaborates why, saying, “The ECGLS scheme was launched to save MSMEs from lockdown restrictions, but it had an inherent flaw in its eligibility criteria. That’s why even after three years, only Rs 3.5 lakh crores out of Rs 5 lakh crores has been committed.”

Many associations have also pointed out that at that time itself, the government should have extended the scheme to SMA1 and SMA2 (Special Mention Accounts) from the date of the lockdown i.e., 22.3.20, instead of announcing the extension to the Normal Accounts from 28.2.20.

According to him, the cut-off date of the outstanding loans should be 22.3.20 instead of 28.2.20 as during the month end, every industry will maintain a maximum drawable amount so that their first-week commitments such as salaries, statutory payments, rentals, etc., can be met, thereby keeping outstanding loans as low as possible as on the 1st of the month.

“Every association argued and pleaded with the government to reconsider these, but that never happened. Instead, the government kept expanding the benefit to larger groups. Also, the fact remains that only 70 per cent of the sanctioned loan is actually dispersed. The reason is, bankers insist on additional collateral security, adjusting the loan towards the moratorium EMI, etc., leaving very little in the hands of the borrower to tide over the COVID-19 crisis,” he says.

On the other hand, even the Revenue Department of the Finance Ministry feels that the extension of the scheme will add no value to the ecosystem.

Speaking at a post-budget analysis session by CII, Sanjay Malhotra, Revenue Secretary, said, “The ECLGS scheme is still open till March the 31st. People can still avail of it, and they are not doing it. I think there is no need for any further extension of it beyond March the 31st.”

Raghunathan strongly asserts that what is required is not an extension of the ECGLS scheme but a new scheme to help those who were not eligible under the ECGLS earlier, offering one-time settlements to those MSMEs who want to close their businesses and restart again and supporting SMA1 and SMA2 accounts, giving them some breathing room to survive.

But the banks are anticipating an extension. If that does not happen, the operations of the mid and small size banks might get impacted. Meanwhile, in the middle of all these speculations, the various data and the general opinions on this scheme suggest that the government might go ahead with the extension. We will just have to wait and see.