The initial public offering (IPO) related to small and medium enterprises (SMEs) is doing wonders for the small-scale enterprises which don’t have a lot of funding or investment to start with. These enterprises can be friends and family-based businesses or solo investments with low investments and funds, etc. In a recent report by the Reserve Bank of India (RBI), it has been found that listed SMEs fare better than the non-listed SMEs in India. Although, the exchange has a lot of hurdles that it needs to cross and many gaps that it needs to fill; its future will depend on how well the SMEs are promoted and supported in this country.

SMEs play a pivotal role in the Indian economy. The amount of job opportunities, export and regional development that this sector provides accounts for 29 per cent of the country’s GDP, according to the annual report by the Ministry of MSME, 2018-19 and 2019-20.

Despite being such an essential part of the country’s economy, this sector faces various hurdles in receiving due support and funding from the government. This is also due to the fact that this sector lacks symmetry because of the minimal hard information about it and the higher per unit cost of monitoring it.

Also Read: 90% of Indian female blue collar workers vouch for pay parity: Report

According to research by the World Bank, the demand for debt and equity finance by MSMEs in India is estimated to be Rs 87.7 trillion.

India’s bid for an SME exchange platform

The effort to create an alternative exchange that focuses on SMEs dates to 1989. The Over the Counter (OTCEI) exchange which was specifically set up for SMEs didn’t achieve much success. In 2012, the Bombay Stock Exchange (BSE) SME platform was established along with the NSE SME platform, also known as the NSE Emerge, taking a more profound and comprehensive step towards building a platform which can promote SMEs.

“Since the launch of BSE’s platform focused on small and medium enterprises (SMEs), more than 380 companies have been listed on it. The BSE has so far taken multiple steps towards growing this segment by organising awareness seminars and by signing MOUs with multiple state governments and financial and educational institutions,” says Mitesh Shah, Partner, Physis Capital.

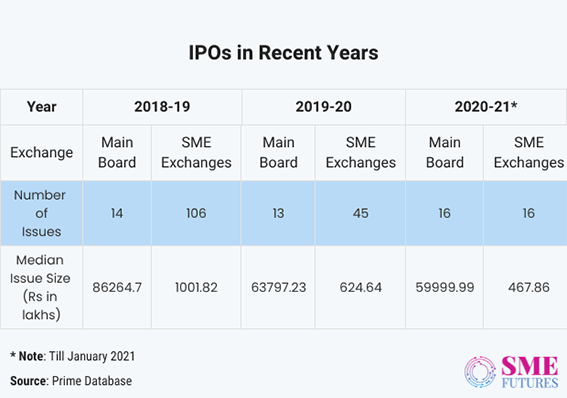

Though the platform witnessed a substantial rise in the number of IPOs, the market capitalisation of SMEs is nowhere near that of the main market.

According to the International Organization of Securities Commissions (IOSCO), 2015, the SME market capitalisation is at around 0.07 per cent in India which is considerably low when compared to other countries like Korea at 10.96 per cent, Turkey at 0.16 per cent, Egypt at 0.33 per cent, South Africa at 0.21 per cent and Malaysia at 0.75 per cent.

The outlook on the SME exchange in India

In the recent years, the government has been focusing on the National Policy Objective of job creation and amplifying productivity. For this, it has been promoting and giving importance to the start-up ecosystem in India.

The SME exchange platform is still at a very nascent stage. There has not been much study into the area but creating a market for capital risk is also essential for developing an entrepreneurial ecosystem.

Also Read: Govt grants Rs 242 crore to IIT-M to encourage lab grown diamond production

To understand the core problems that the SME exchange platform is facing, we have to primarily focus on three important aspects, which are- the extent of under-pricing, aftermarket liquidity and abnormal returns in the long run.

How the SME exchange platform can help start-ups

“The ability to publicly list your company is the ultimate dream for entrepreneurs. It provides market validation for the company’s valuation, besides providing liquidity for the private investors, the ESOP holders and the founders. An added benefit is a marked decrease in borrowing costs, thereby improving its ability to scale and improve margins,” says Ashok Kumar Damani, Member of Bombay Stock Exchange (BSE) and co-founder of the Artha Group.

Further, listing your company for an IPO has many other benefits which include- an early access to capital, enhanced visibility and prestige, encouragement to the growth of SMEs, enabling liquidity for the shareholders, equity financing through venture capital (VC), efficient risk distribution and employee incentives.

“The BSE SME platform provides an avenue for raising capital through equity infusion for growth-oriented SMEs. It also benefits the SMEs by providing them with greater credibility and an enhanced financial status, generating demand for the company’s shares and leading to a higher valuation of the company,” Manoj Dalmia, Founder and Director, Proficient Equities Limited points out.

“Equity financing provides growth opportunities like expansions and mergers & acquisitions by being cost-effective and tax efficient at the same time. A listing also provides an incentive for VC funds by creating an exit route and reducing their lock in period. Capital markets ensure that the capital flows towards its best uses and the riskier activities with higher payoffs are funded,” Dalmia elaborates.

- Tax benefits – While the selling of unlisted shares incurs a long-term capital gains tax of 10 per cent without indexation or 20 per cent with indexation, the long-term capital gains for the companies that are listed on the SME exchange results in a far more efficient taxation regime.

“In the case of the listed shares, the tax on long-term capital gains is 10 per cent and the tax on short-term capital gains is 15 per cent, provided that the transaction has been subjected to the securities transaction tax (STT). This preferential tax treatment on the transfer of listed shares is also available to the shares that have been listed in the SME category on the stock exchange. A listing on the SME exchange is a valid tax-planning tool and could, thus, lead to enormous tax savings for entrepreneurs and investors,” Rajan Bhatia, a renowned chartered accountant and India’s leading IPO advisor points out.

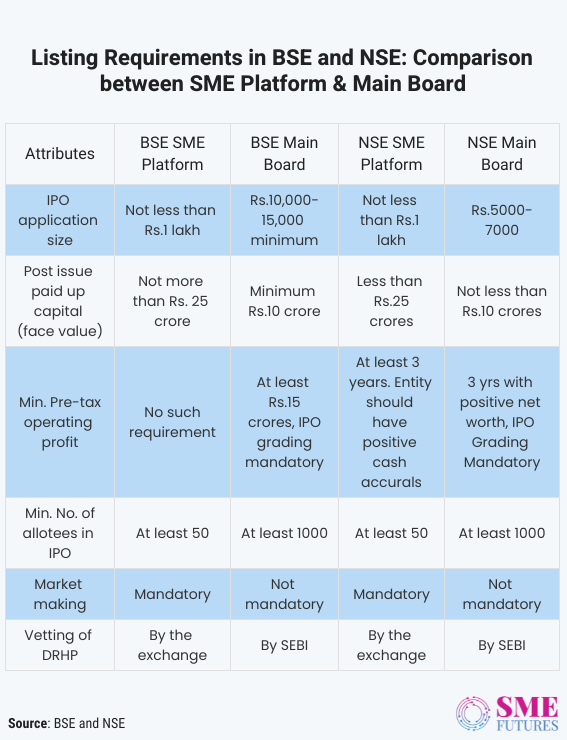

- Listing requirements – According to the SEBI website, it takes 2 to 3 months for a company to get listed on the SME exchange. The listing procedure is relatively well-defined on the government institutions and BSE/NSE websites. For starters, the issue needs to have a minimum of 50 allotted shareholders, and 100 per cent of the IPO must be underwritten, out of which a merchant banker must compulsorily hold 15 per cent.

“The process has multiple steps and the conditions involved are- a minimum paid up capital of Rs 1 crore must be there, and the maximum paid up capital cannot be above 25 crores while the minimum number of allotters cannot be below 50. For investors, the IPO application lot size is a minimum of Rs 1 lakh while for the MSMEs that are to be listed, its mandatory to appoint a merchant banker for underwriting the IPO. Reporting requirements are half-yearly for the MSMEs once they get listed and an average duration of 3-4 months is required for the process to be completed,” Dalmia explains.

Recent trends at the SME exchange

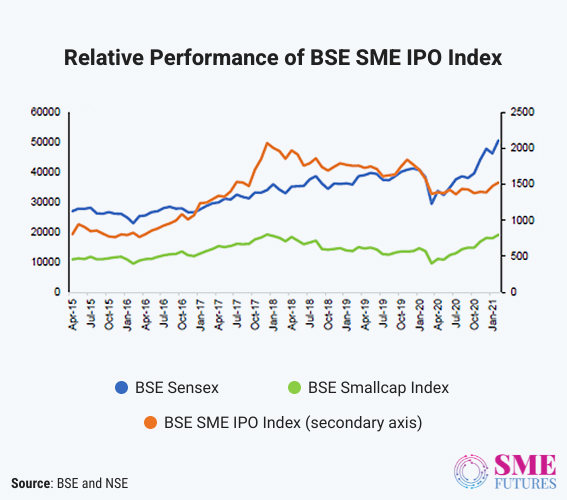

According to a recent RBI study, the listed SMEs have performed better than the unlisted ones in terms of profitability, liquidity and asset utilization. The average daily trading turnover for the BSE SME exchange was estimated at around Rs. 18.5 crores in July 2022, which is expected to steadily grow with time.

Also Read: Indian companies to generate 49% of revenue from digital infra by 2027

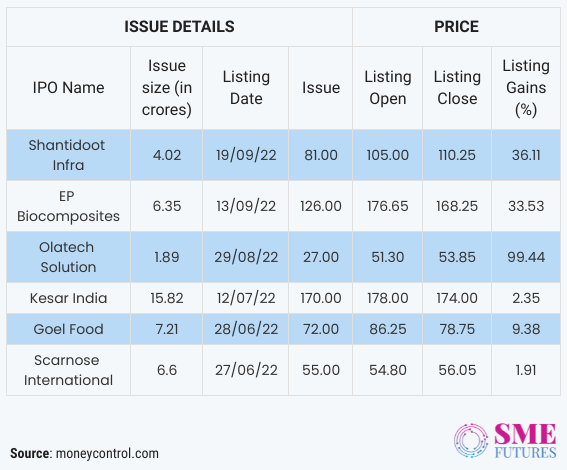

“Over the last quarter, several listings on the SME exchange have averaged about one IPO per week. In September alone, there have been more than 10 IPOs, and the average first-day listing premium has been 25 per cent plus. Many of these companies are in the infrastructure space, but two of these companies have stood out. EKI Energy Services debuted a year ago and quickly clocked 100x returns for its investors; Gensol Engineering has recently done well in the market and has piqued investor interest,” says Damani.

“Currently more than 700+ SME companies have successfully been able to launch SME IPOs. It has tremendously helped companies to raise funds and multiply their wealth many times over. The stock market can be either up or down depending on market sentiment. This is pretty normal as market sentiments keep changing over time,” Bhatia asserts.

The number of SME companies listed to date is 392 and their combined market cap is Rs 6,0230 crores. Some of these companies are:

“All these companies have performed well with good gains, much better than the other IPOs. Investors should invest with caution in these SMEs as they are volatile. Reading the Draft Red Herring Prospectus (DRHP) about the company is important before investing,” Dalmia cautions.

The road ahead for the SME exchange platforms in India

The BSE SME exchange platform has been acting as the torchbearer for SME exchanges in India. It has been providing help and support to the early start-ups and has been educating entrepreneurs about the benefits that come with listing their companies, along with making them cognizant of the fact that this can be a revolutionary step towards building an ecosystem for start-ups.

“The BSE SME platform has companies listed from 20 states and a part of its future expansion will be to spread across all states. As SMEs are the backbone of the Indian economy, the coming together of all the stakeholders to formalise this sector will likely yield good results in the future. There is a strong existing pipeline of companies and start-ups that need to be listed, and it will be important to nurture and grow that pipeline,” says Shah.

Also Read: RBI-MPC may hike repo rate again in April: Acuite Ratings

The BSE SME platform is also trying to reach out to more VC firms and angel funds to access relevant and higher-quality deal flows. It makes sense for the BSE to invest in some of these funds to gain access and knowledge about what the Indian start-up ecosystem needs from an SME IPO platform.

“They may cherry-pick some start-ups and handhold them through the listing process, making them the poster children for the larger start-up ecosystem, to bring home the point that SME listings are a viable and exciting option. This approach might encourage the family offices and the HNIs to take a serious look into the SME IPOs by levelling the playing field for investing in exciting tech-enabled start-ups, which was otherwise being monopolized by private investors stitching together complicated deal structures. It is a long game, but someone must play it!” says Damani as he signs off.