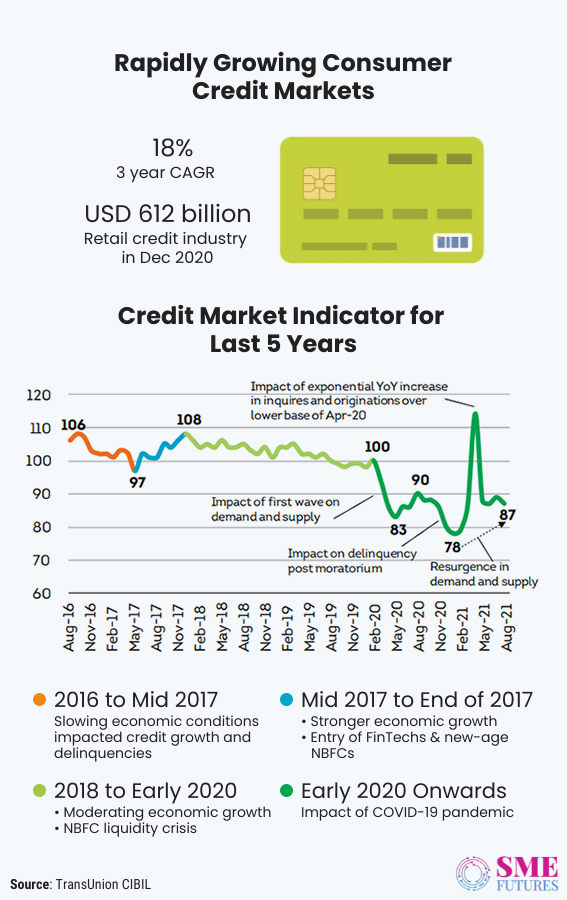

According to TransUnion CIBIL, the largest credit bureau, the credit market is expanding rapidly despite the disruptions in the market due to the pandemic.

Lenders have become more tech-savvy, while outstanding balances and credit active consumers have grown by 8 and 7 per cent, respectively, between February and October 2021, states the report. Even credit inquiries increased by 54 per cent during the same time period.

It certainly implies that Indians are borrowing more.

But why is that? As previous generations can vouch, taking loans was only restricted to times of dire need, such as a financial emergency. The answer is that there has been a psychological shift.

Gen X is opted for loans to check off the essential goals from their lists, such as marriage, education and buying a house or a vehicle. Today’s generation values having a good time more than their Gen X siblings or the baby boomers did. And with the prevailing you live only once (YOLO) attitude, the current crop of consumers (millennials) believe in the consume first and pay overtime philosophy.

According to one report, the average age for the first loan taken by customers born around the 1970s was 38. It was 27 for those born in 1985. And it has now dropped even further, resulting in a significant increase in the demand for personal credit.

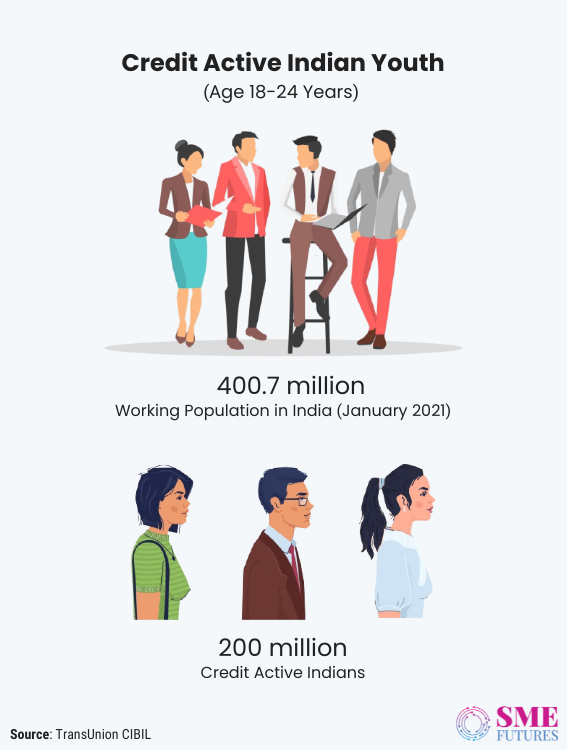

Meanwhile, half of the country’s working population of 400 million people is credit active, as estimated by Transunion CIBIL in a report last year. According to them, India’s overall working population was said to be at 400.7 million as of January 2021, and the credit market had 200 million unique individuals who were credit active.

Then it further diversifies into various borrower profiles. A joint study by Transunion CIBIL and Google found that in 2020, 49 per cent of first-time borrowers were less than 30 years old, 71 per cent were based in non-metro locations, and 24 per cent were women.

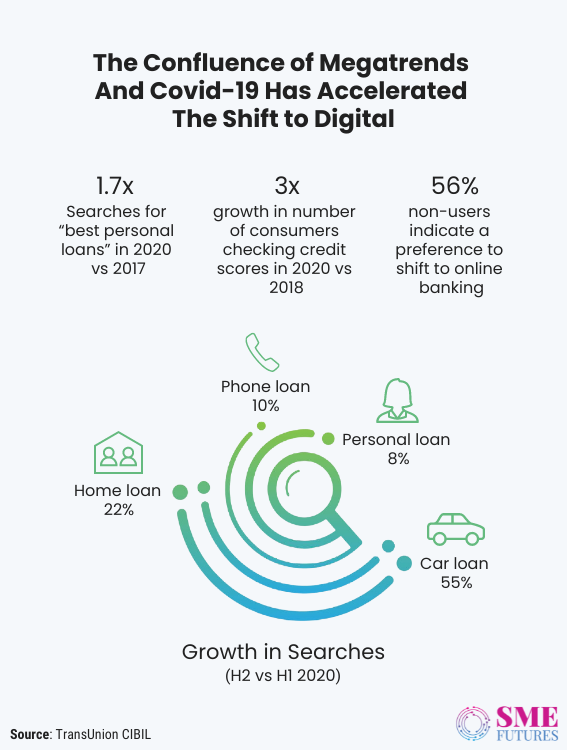

Also, the study observed a 2.5X surge in searches for loans from non-Tier 1 cities as compared to those from tiered cities across 2017-2020. Overall, growth in searches for car loans between the two halves of 2020 grew the fastest at 55 per cent followed by home loans with a growth of 22 per cent.

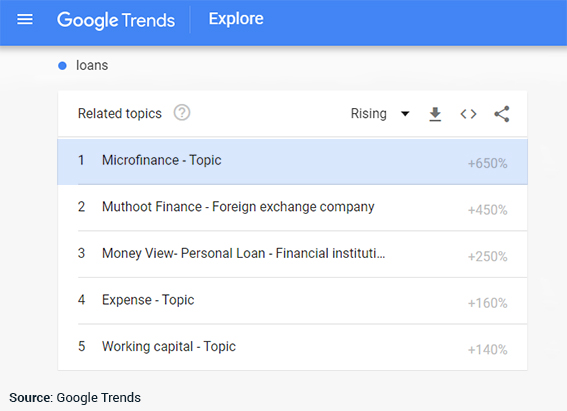

Upon further investigation, as we sifted through Google Trends to look for how people were searching for the term “loan” in the past 12 months, we found out that microfinance was at the top of the list.

Funding millennial dreams

The reasons that millennials are taking loans for are pretty interesting. Many primarily choose to take a personal loan to either satisfy their wanderlust or to purchase consumer durables and vehicles.

According to a recent survey conducted by IndiaLends and the Entrepreneurship and Innovation Cell of IIM Kozhikode, credit is popular among millennials. The survey says that more than 81 per cent of millennials (out of 1400 respondents) intended to apply for a personal loan in the near future.

Over 27 per cent of those polled intended to apply for a personal loan to cover medical expenses, while 18 per cent intended to borrow to plan their weddings. Also, the negative financial impact that the pandemic has had on all of us has only added to the list of reasons. According to the report, the second wave has had a significant impact on about 66 per cent of the zillennials.

Which again indicates that there will be more borrowing, states IndiaLends Founder and CEO Gaurav Chopra in the report. According to him, with 65 per cent of Indians planning to opt for a personal loan in the immediate future, this is a clear indication of the pent-up demand for credit products and the overall optimism among customers.

Ease of borrowing

This optimism is also due to the ease of borrowing. Given that we live in an era of easy money, borrowing money is just a click away. Just google the term ‘personal loan’ and you will find multiple options in the form of fintech platforms and apps that are ready to grant you a loan almost instantly, be it for a mere Rs 500 or for a figure running into lakhs.

This is also due to the dramatic evolution of the financial services industry, its digital transformation and internet penetration. Also, there are multiple new and under-tapped segments of credit demand which are distributed across loan product constructs, geographies, CIBIL score-based risk segments, end-use requirements, and borrower profiles. For instance, you can tap in quick cash as an instant salary advance for up to Rs 5 lakhs, so you can fulfill your expenses, in just 10 minutes.

It’s as easy as downloading an app or playing a game on your phone.

Credit card mathematics

Simultaneously, there has been a hike in the number of credit cards as well. Towards the end of 2021, data from RBI shows that credit card spending crossed the Rs 1 trillion mark in October (1,01,200 crore).

Taking note of this trend, ICICI securities analysts observed that credit card spending grew by 26 per cent MoM in Oct’21. However, the spending rate in November was flat and there was a decline of 12 per cent to Rs 892 billion. However, overall spending is estimated to be strong, despite there being less spending.

ICICI and HDFC banks led the way with net additions of 13,36,000 new credit cards in October 2021. With this, the total credit card base reached 6.64 crore, the highest in the previous 14 months.

During this time, brokerage firm Motilal Oswal observed that the average monthly credit card spending increased to Rs 12,400 from Rs 10,700. Keep in mind that the current figures are higher than the pre-pandemic levels, and the experts believe that this trend will only continue.

The figures mentioned above certainly bode well for the credit lending industry.

And the sector is poised for constant growth owing to timely policy interventions and better adaptability by lenders.

In fact, down the line newer technological interventions such as the launch of Account aggregator and OCEN platforms, will make credit more accessible to the underserved segments such as the self-employed and lower income groups.

They will improve the matching of cash flows with repayments, thus helping in reducing the efforts that had to be made by the borrowers in managing their cash flows, which in turn will reduce the chances of them falling into debt traps.

But is all this really good for the consumers? Or is it creating a habit of taking loans…and trapping millennials in debt? This is an important question that we have chosen to ignore.

Is this the road to a debt trap?

According to an old adage, it takes 20 days to form a habit. Abhishek Soni, CEO and Co-founder of Upwards, an instant loan provider believes that ease of borrowing is diverting young borrowers towards a debt trap, as they fall into the morass of easy money and overstretch their expenses.

“But debt is a double-edged sword,” remarks Anshuman Narain, Vice President, CashBean (P.C.Financial Services Pvt Ltd.).

“Unchecked borrowing has been the bane of many people, organisations and even nations. In the context of the millennial generation, there is a lot of exposure to consumerism and this behavior is further exemplified through social media. But one cannot say whether debt over-reach is a bigger problem today than it was before. It is not the generation itself but the inability of individuals to have financial foresight that leads to a debt trap,” says Narain.

CEO and Co-founder of Namaste Credit, Gaurav Anand’s views are quite similar. He too blames millennial recklessness for taking credit lightly.

“With great power comes greater responsibility, ala Spiderman! In the current digital lending world, tech brings a lot of power including ease of access, instant gratification and a quick process. However, it’s the millennials who need to exercise prudence when faced with such easy access to credit,” he says.

In Anand’s opinion, this new to credit (NTC) borrower segment has limited fiscal prudence, believes in quick gratification and has an extremely shaky cash flow outlook.

“The upshot of this trend is leaving our millennials in a debt trap with more than one downside (per the latest Transunion report, ~45 per cent of the NTC borrowers are sub-prime), including bad credit scores that ruin future loan taking ability and severely stressed lifestyles,” he asserts.

However, not all experts think alike about easy credit equating to a debt trap.

“I don’t believe that the ease of borrowing is trapping millennials in debt,” says Aditya Damani, Founder of Credit Fair, a consumer lending fintech start-up. “We live in a world where everything is available at the click of a button and users need to make smart informed choices. Whether its junk food, social media or availing loans, they all need to be consumed in moderation by the user,” he says.

Another industry player Anil Pinapala, CEO & Co-Founder of Vivifi India Finance opines that most millennials understand the consequences of over-leveraging their salary and are thus, watchful.

“They try to maintain a healthy ‘income to repayment obligation’ ratio. It is best to have a line of credit available either with a credit card or products like FlexPay which help when an individual overspends, without being tied into a mismatched loan product,” he tells us.

More borrowing, less saving

Buying on credit or the buy now pay later concept can surely convey instant gratification. But that bubble can burst easily, resulting in various negative ramifications.

One of them is stress or social humiliation.

“The obvious one is the fact that you will be constantly shadowed by the lenders for their return, which can be an emotionally traumatising experience as some companies are also known for their heavy-handed approach towards recoveries,” shares Narain of CashBean.

“It’s important for us to recognise if we’ve dug ourselves a financial hole, and the first step is to stop digging, i.e. stop borrowing further,” Damani adds, as he believes that excessive borrowing causes stress and strain on both the financial and mental fronts.

But millennials are more prone than ever towards falling into credit habits, either due to a desire to live a larger life beyond their means or due to buckling under peer pressure. Massive credit card bills, frequent interest-bearing debts, high EMIs with little or no cash deposits, and a lack of investments or savings take a negative toll on their finances, usually trapping them in unending cycles of debt.

“Yes, excessive borrowing with EMI based products does put pressure on the monthly repayment obligations, leaving little room for life’s surprises,” says Pinapala. “But using a line of credit also gives the individual a chance to manage monthly cash flows while repaying their loan obligations,” he points out.

The next issue is more long-term in nature as consumers’ future gains will also be tied to their outstanding loans within the debt market.

“So self-fulfilment via a car, marriage or even a house may come much later as one will have to stabilize first before moving ahead in life. Remember too much of anything is bad and debt is no exception,” elaborates Narain.

In a nutshell, borrowing is okay but excessive borrowing brings you face to face with debts, EMI burdens, a damaged credit score, stress in your personal and professional lives; and the inability to get material loans like car loans, housing loans etc. which are crucial for the later stages of life.

Expert advice to borrow safely

There is a plethora of financial solutions out there. Loan approval is the matter of a few clicks and banks and other financial service providers tempt consumers to borrow from them in a myriad of ways. And the current scenario shows that young borrowers don’t hesitate to avail of any of these services.

To remain debt-free can be a daunting task, if one is not cautious.

Do your research

To start a debt free journey, Narain suggests that individuals should do significant research before borrowing. Don’t get played he advices, saying, “First and foremost do research on the source of the fund before taking a loan of even a single rupee. With so many bad-actors in the market operating without proper oversight, these companies tend to take the most unmeasured approach when doing debt recovery. Your safety comes first so ensure that you do at least this much for yourself.”

Plan your financials

One way to tackle debt is to live within your means. Budget your expenses and stick to it, which helps you to save in the long run.

Damani suggests that EMIs and credit card payments should be limited to 50 per cent of your monthly income, so borrow safely and avoid falling into a debt trap.

Soni says that this needs planning and budgeting and adhering to financial discipline. “Everyone must follow a strong investment and savings routine and spend what is left over after these two, rather than the other way around. Typically, you should save and invest at least 40-50 per cent of your monthly income,” he recommends.

Narain advocates being far-sighted in financial matters and says, “One must know where they will be mostly placed during the period of this loan and do everything to keep within that target range; keep the borrowing period as surprise free as possible from any financial impacts.”

Read the asterisk carefully

Signing up for anything is now instant, like an app. But taking credit is another thing. There are always terms & conditions that come with it, which we often ignore. But the experts are urging everyone to do the opposite and read the fine print carefully.

It is now relatively easy to get a grasp of the T&C’s of a loan so do spend time in getting your head around those, says Narain. This way, you won’t need to deal with the repercussions of these arcane terms that you might have chosen to either ignore or just skim over earlier.

Responsible borrowing

Short term loans sound really tempting, and the convenience of taking app-based loans is addictive. But a responsible borrower is one who sticks to the rule of the 40 per cent debt-to-income ratio.

Also, look for the solutions that match your needs.

“There are ample solutions. I will recommend to people to look for a loan product that matches their needs based on their existing and future cash flows. Borrowers should also ensure that they avail of loans from only legitimate lenders and understand the terms of the loan before drawing down on their approvals. It is also important to have a good credit score so that the borrower can demand better terms on their loans,” advices Pinapala.

Also, borrowing from your loved ones can be a good idea. “Family elders are usually a good source of sound financial knowledge as they have gone through such a journey themselves, especially if you are a young first-time borrower; they can also leverage their network to get you a good deal,” says Narain.

However, there are no silver bullets for building wealth. There are a few timeless key lessons though that everyone should remember and imbibe, such as building a solid credit history by making timely payments, saving regularly and diversifying your investments. “Millennials can borrow safely by signing up for credit cards or consumer loans but should only spend as much as they can repay in any given month,” says Damani.

In the current scenario, lending businesses are doubling in number and doing well due to increasing consumer spending and some other key factors. Controversially, borrowing may also serve to lower your taxes, as it’s too easy to borrow money and it doesn’t count as an income either.

But for an unaware consumer, this whole scenario can quickly turn into a financial nightmare.

“The onus has to be shared by the lenders who target this credit gullible segment where the take rates are as high as 50 per cent to match the risk-reward lending metrics and the cost of digital acquisition,” Anand clarifies.

This is one way in which the financial service providers can take responsibility, he asserts, saying, “In the end, it will be a lose-lose proposition for the entire ecosystem if this trend continues unabated. It’s high time that the digital lending power is channeled judiciously and responsibly!”