Of what started as a temporary fix to deal with office work during lockdowns is now well accepted across the world. The pandemic compelled big corporates such as Twitter, Microsoft, and Facebook to quickly escalate to work from home mode from conventional at office work models. Tata Group’s recent announcement of new work model prioritizing remote work culture cues that the remote work fits the modern work culture ergonomics.

Meanwhile, government has also extended some guidelines to facilitate work from anywhere for IT-BPM sector for the longer term. The news may be a delight for some sectors but for others it may prove to be dismay. This includes the real estate office segment players. Now, as remote work culture stretches on, cracks have emerged for the office space segment.

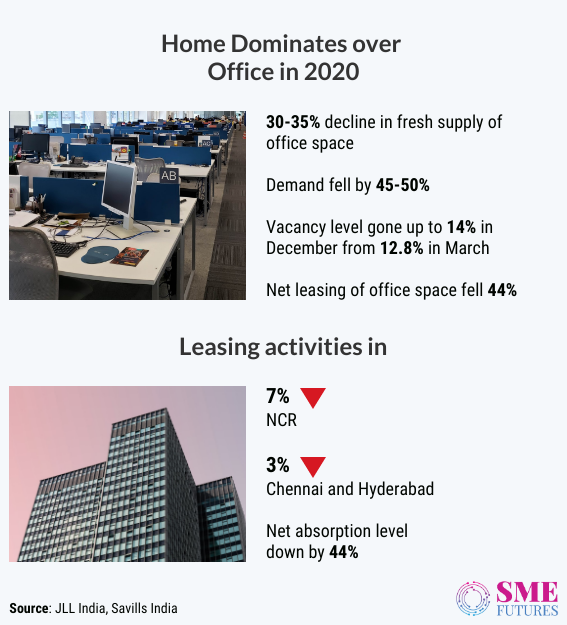

Property consultants, JLL and Savills report that fresh supply of office space fell 30-35 per cent year-on-year in 2020 across major cities mainly because of lower demand but the demand for office space was far more impacted than supply. According to the industry estimates, demand fell by around 45-50 per cent with corporates deferring their expansion plan and adopting work-from-home policy for employees actively.

Amit Agarwal, Co-Founder & CEO, NoBroker.com, a proptech C2C platform is of opinion that most of the players faced financial distress during lockdowns. “There has been a significant gap in supply and demand when it comes to commercial properties in the previous year. The gap is most stark in office properties due to the prevalent work-from-home trend. The supply of office spaces grew by 150 per cent in December 2020 as compared to last year.”

This also means a vast inventory is opened for commercial spaces which have been vacated not including the new commercial properties. Agarwal tells us, “While there was meagre or no rise in the supply of fresh office spaces, the supply grew because of existing businesses letting go of office spaces to adopt work from home culture or to reduce the leasing size of an office setup to accommodate a smaller number of employees that are required to operate from office.”

The recent JLL report has stated that vacancy level of office space has increased. The report says, “Occupiers continue to review their real estate portfolios and are adopting consolidation and optimisation strategies through the year. The subdued net absorption levels could not keep pace with new completions. This resulted in overall vacancy increase from 13.5 per cent in Q3 2020 to 14 per cent in Q4 2020.”

In addition to this, leasing activities for office space properties also plummeted on demand side. As per the JLL India database, net leasing fell 44 per cent during 2020 to 25.82 million sq ft from a record 46.5 million sq ft in the previous year across Delhi-NCR, Mumbai, Chennai, Kolkata, Hyderabad, Pune, and Bengaluru.

Savills estimates the fall to 27.4 million sq ft in 2020 from 55.7 million sq ft across six cities excluding Kolkata market. The consultancy firm also observed a variation on the office rentals. Changing dynamics attributed to the rental value change across micro-markets which vary within a city as compared to last year.

NCR saw an average decline of about 7 per cent year-on-year while Chennai and Hyderabad saw 3 per cent year-on-year fall. According to the analysis of Savills India, CEO Anurag Mathur, the overall story of 2020 is the one of survival. “While the story of Indian office market in 2020 may not be as glorious as it was in 2019 and 2018, it still continues to strive and display resilience in the face of COVID-induced slowdown,” he said in a statement.

Trends in office market space

Discussing whether the downturn of the office space segment is a short term or medium-term Khetsi Barot, Executive Director at the Guardians Real Estate Advisory speaks to us. “To be honest, a lot of businesses are not returning to brick-and-mortar office spaces,” says Barot.

At this moment, businesses and professionals in consulting, advertising, travel, etc. which at one point required large spaces are comfortably operating from home. The lockdowns have compelled several businesses to adopt a contemporary style and method of functioning, he says.

The real estate experts are now hoping for some ease with various government interventions in budget. But everyone is confident that significant percentage of professionals will still opt working from home. Commenting on it, Barot says, “The year of 2021 is bound to bring renewed hope for the commercial real estate sector. It was among the worst affected due to the spread of COVID-19 but now we expect the demand to bounce back.”

Barot further recommends that a good growth trajectory can be achieved if the government and finance institutions lend a helping hand. “We expect banks and the government to offer solutions to revive this particular vertical by reducing the transaction as well as borrowing the cost. Banks should also look at increasing the lending limits for commercial real estate assets to bring the latent demand in the market,” he says.

However, the real estate sector should not forget that growth doesn’t depend solely upon the stimulus packages or funds. There should be an ever-increasing demand too. For instance, the IT sector contributed 44 per cent of cumulative office space demand in the last 10 years (2010-2019) as per Knight Frank’s data.

According to the Knight Frank report, the real estate operating expense (real estate opex) of the Indian IT industry is around 4.3 per cent of its operating income annually on real estate costs. Smaller IT companies spend their 4.7 per cent on real estate, followed by large IT companies at 4.4 per cent and mid-sized IT companies at 3.6 per cent. Overall, office space rent paid by IT companies constitutes 0.5 per cent to 2 per cent.

“We are already seeing a lot of organisations managing their business virtually and drastically bringing down their office requirements. This year too leasing will take precedence over ownership,” says Barot. Indeed, the year is going to be challenging for the commercial real estate sector as it is already witnessing variations in the rental.

With every trough, crests come also along. Agarwal of nobroker.com observes that the scenario tells us if the work culture is changing so is the demand for office space. It is molding in a way that the real estate sector can reimburse the loss gradually.” he remarks.

Given this, there will be sure shot success for office space and co-working spaces will play imperative role in this growth trajectory. In the arena of office sharing spaces, startups were first to face the wrath during pandemic but with the decreasing virus cases most co-working spaces are enthusiastic now. They believe that there is a wave of new opportunities for them.

Manas Mehrotra, Founder, 315Work Avenue, a co-working firm says, “Now, flexibility is crucial more than ever. Hence, co-working spaces with their natural flexibility and inherent readiness to add values are best positioned to adapt and redefine the future of work and workspace.”

Companies will strive to be agile and prefer to build more flexibility into their real estate portfolios. As companies look to resume business, redesigning and restructuring of existing real estate will pose yet another challenge, however co-working spaces will be able to respond to design changes required post-COVID-19 quicker and more efficiently than traditional office spaces, believes Mehrotra.

On other side, sect of experts predicts a continuing growth as commercial office properties are still hotbed for investments. Talking on the topic, Rajesh Binner, Founder and CEO of YieldAsset Real Estate Tech, a proptech platform tells us that with policy reforms, institutional investments, foreign partnerships, and growth in the IT-ITES service sector demand for grade A office real estate has become very attractive.

“With several notable government initiatives like Make in India, reforms like RERA and GST amendments and the coming of Real Estate Investment Trust (REIT) and Infrastructure Investment Trust (InvIT), India is expected to continue its growth in the commercial segment in 2021 and beyond owing to assured and lucrative returns.”

Rajesh Binner, Founder and CEO of YieldAsset Real Estate Tech

Greenshoots that emerged during lockdown

Remote working is not a new trend, but it was not prevalent to the extent as it is today. Now as this new working trend is getting popular, it has also given way to innovative approaches and business models. In terms of business outlook, there has been a massive supply-demand gap after initial phase of COVID-19 spread in top cities when it comes to commercial property trends.

For instance, there has been a 100 percent year-on-year growth in supply of retail commercial properties for rental in December 2020. The volume of rental transaction has seen a downfall of 10 per cent in December 20 over December 19. Another significant trend that has emerged in office space segment is the preference of smaller spaces as opposed to larger spaces.

Agarwal tells, “One of the primary reasons that can be attributed to this is that most employees in an organization are working from home with only a small chunk especially from sales and other vital divisions allowed to work in office space. Another reason can be the reduction in team sizes or layoffs. The average size of office rented in December 2020 has fallen by 55 per cent compared to a year back.”

On the other hand, there still are opportunities soaring for renting out commercial space for other purposes. The real estate sector today is witnessing a boom in demand for space for data centres. Barot says, “We are also witnessing interest amongst developers of commercial spaces for data centres. Data centres because of the rapid rise in need for storing data has been attracting an encouraging number of investors.”

Despite overall fall in demand for commercial retail spaces, demand for warehouses is on upward trajectory. “There has been a 10 per cent increase in the average size of warehouses,” says Agarwal. This could be attributed to increase in delivery services resulting in more demand for storage spaces.

“Also, people who have moved to their hometowns from metropolitan cities have parked their belongings in warehouses till they will be operating from home. The overall demand has been picking up pace. Predictions suggest that the current quarter has already surpassed the previous quarter with 7 per cent growth,” he adds.

As per the Knight Frank report, the demand for warehousing remained resilient in 2020, correcting only by 11 per cent year-on-year. This is as compared to the 44 per cent CAGR recorded from FY17 to FY20. Going further, the Indian warehousing sector is expected to grow due to the rising e-commerce demand.

On top of this, technology has been a vital component of the paradigm shift in the real estate industry. It has almost transformed the industry. All the business purposes such as virtual meetings and specialty tools such as 3D virtual are used for virtual conferences now.

“Technology has helped in bridging the gap created by lockdowns across the world,” states Barot. Technology has cut out the first inspection required for successful transactions, as the same now happens virtually. He tells, “Virtual meetings and interactions were never really preferred as much as it has been since the announcement of lockdowns.”

“In spite of easing in lockdown restrictions, people and businesses are happy to connect virtually. We know quite a few buyers who have been willing to take decisions without too many visits. For MNCs and organisations with a global footprint, approvals and feedback are being received based on virtual visits of premises,” he adds.

Considering the new normal and shift in business models, main office markets are looking for a demand to comeback. It is still short since pre-covid era. Knight Frank in its report estimates that the overall demand for office space could remain strong during this year. Bengaluru market is expected to experience a rise in rental values in the next year while Mumbai and NCR are expected to remain stable in rental values, the report says.

Bengaluru has the benefit of existing low vacancies that will support absorption of the upcoming supply. So far, the impact of government packages on this vertical has been limited due to shift in priorities for various businesses.

“The focus of businesses has been on meeting their cash flow requirements and decisions on office space have not taken precedence. While the residential sector of real estate has experienced a V-shaped recovery because of the reduced repo rates and a cut in stamp duty charges announced by several state governments, the commercial real estate vertical is still a couple of quarters away from the desired revival,” concludes Barot.