The wrath of COVID-19 proved to be a nightmare for gems and jewellery sector of India as sales plummeted to lowest in the century’s quarter. According to the data compiled by World Gold Council, the jewellery and gemstone market has registered smallest annual purchase since 1995 when just 477 tons were bought.

Pankaj Khanna, MD and Founder at Gem Selections, a gemstone brand dealing in export, retail and wholesale observes, “The impact of COVID-19 is going to be devastating for gems and jewellery industry of India as the market size is going to shrink. The players with deep pockets and ability to capture a larger market share will only survive and the rest will perish.”

Talking about the apathy of gemstones caused due to the decreased sales, Khanna informs that unsold diamonds have piled up with retailers while manufacturing of new jewellery remains on complete standstill.

Aditya Pethe, Director, WHP Jewellers tells that manufacturers have not been producing jewellery since few months. This has affected payments and supply chain cycle badly. He confesses, “Currently, our factory is working in its 20 per cent capacity. Though the manufacturing is at its lowest, we should admit that the demand is also low.”

Elaborating on the above scenario, Vaibhav Saraf, Director, Aisshpra Gems and Jewels asserts, “The income became nil for business owners. In fact, the cash flow came out to be negative after deducting fixed expenses. Although lockdown is lifted, consumers are not willing to step out of their houses due to the fear of coronavirus. This has resulted in decreased sales of luxury goods.”

A recent report by World Gold Council (WGC) states that COVID-19 is the single biggest factor which has influenced the demand of jewellery. The global jewellery demand has hit its lowest in Q1 2020, dropping 39 per cent y-o-y to 325.8 tonnes.

For India, the demand fell by 41 per cent to an eleven year low of 73.9 tonnes amid high domestic gold prices. This has depreciated current and softer economic growth. The local gold price continued its upward trajectory in Q1 2020 surpassing previous historical highs. In average, it touched Rs 41,124/10g.

Unlocking the Sector

However, the gems and jewellery industry is crawling towards normalcy gradually. The report suggests that industry has witnessed 20-25 per cent sales since unlock 1.0. Finding the situation arduous in Gujarat, Ketan Chokshi, co-owner of Narayan Jewellers tells, “The footfall is very less as compared to earlier. The operating timings have also increased to 7 pm since June 1. It was till 4.30 pm earlier. As a result, the retail market was open only for 3 to 4 hours.”

Further speaking on the current market scenario Chokshi adds, “Customers are taking time to get back to us since, the jewellery stores have re-opened. This has resulted in limited footfall. I believe people will first take time to ensure that they have enough savings, have a job in hand, and are also healthy amongst other things.”

Also, the community of jewellers understands that the market is undergoing a major shift which they need to embrace. On this, founder of 34-year old jewel brand, Anmol Jewellers, Ishu Datwani tells, “I believe COVID-19 is going to be a game-changer for retail in jewellery. We have to brace ourselves for the new normal as it is bringing a radical shift in consumer behaviour and buying patterns.”

With a sudden impact on sales, jewellery sector has witnessed no revenue movement in consumer businesses. CRISIL research states that revenue growth of organised jewellery retailers is set to tumble down to 500-600 basis points (bps) which is nearly 5-6 per cent during the fiscals of 2020 and 2021. This will follow the triple headwinds of higher import duty, elevated gold prices, and sluggish demand.

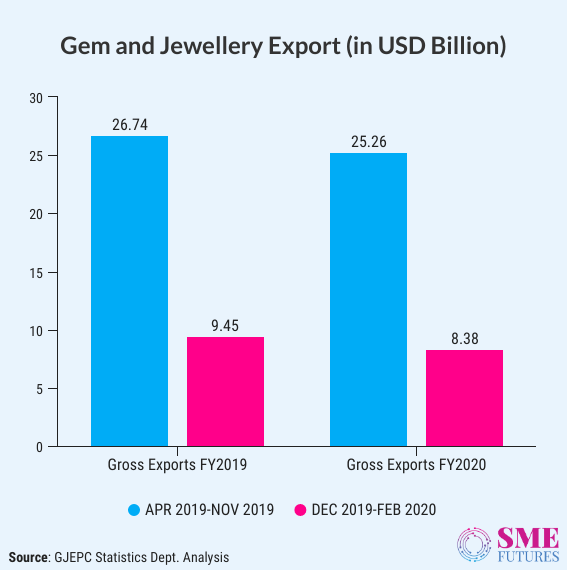

This constitutes half of the compound annual growth rate (CAGR) of 12 per cent seen as in three fiscals since 2019. The industry exports also witnessed a steep decline of (-) 19.37 per cent recorded in Feb 2020. It was against a decelerating rate of (-) 9.17 per cent in Jan 2020, and (-) 1.89 per cent in Dec 2019.

New Avenues in Jewellery Retail

Although gems and jewellery industry is slowly crawling back to normalcy, consumer behaviour has changed drastically. This has forced retailer community to transform themselves according to needs of their newly evolved customers.

Discussing about the changed consumer behaviour, Ketan Chokshi of Narayan says that the lockdown has affected trade to a great extent. People are still scared to go out and make jewellery purchase. “People will start buying jewellery gradually. However, this will happen after some time once they are healthy and economically secure.”

Considering all aspects of precautions, Narayan Jewellers have brought extensive changes in their retail service. One of them is to attend customers only on the basis of appointment. Their retail stores have also unanimously implemented technology in creating a retail infrastructure to reach out to customers.

Vaibhav Saraf adds to this saying, “The jewellery business is witnessing a shift towards e-commerce with low footfall in the stores. A lot of traditional jewellers will have to shift to digital platforms through a user-friendly website and e-commerce platforms for maximum customer engagement.”

His organisation Aisshpra has introduced a plethora of shopping options for the customer according to their convenience. Their customers can view products through video calling facilitated by Zoom, WhatsApp, FaceTime, Google Meet etc before making an appointment. An online shopping store of their products is about to be launched soon.

Datwani too emphasised the usage of technology in creating alternate avenues to reach out to consumers. He agrees that online stores or e-commerce websites, augmented reality, and virtual consultation can enhance sales of stores. Snehal Choksey, Director at Shobha Shringar J ewellers also advocates integration of digital mediums to grow business.

He says, “We are adhering to all possible guidelines. In addition to this, we have started video consultations after our reopening. With this, our first delivery came from a sale we closed on video call. Further, we will soon go live on our e-commerce portal to expand our geographic reach. The pandemic has brought our future to present.”

Hence, gems and jewellery sector is looking at omni-channel strategy to enhance their customer experience and business. On this Pethe comments, “One of the major changes the pandemic has caused is inclination of retailers towards an omni-channel strategy and digitalisation for products across all industries.”

Return of Yellow Metal and Precious Stones

Keeping in mind the new normal and safety concerns, retail sphere of gems and jewellery is proactively embracing changes. They now believe that new normal will bring back gold ornaments in the priority list of consumers.

“When the dust settles, wedding industry will witness more small-sized guest list weddings as compared to usual big fat weddings,” explains Pethe of WHP Jewellers. Pethe looks after the strategic aspect of WHP Jewellers which is a century old ornament brand with its presence in Maharashtra, Goa, and Indore.

He elaborates that historically jewellery has played an important role in Indian weddings, but in past few years focus of consumers has shifted to enhancing grandeur of weddings such as organising big feasts, interiors, destinations, clothing etc.

But according to him, new normal might overtake old ways. He maintains, “People would again want to spend money in the new normal as spending lavishly in weddings is a status symbol in our country. Therefore, jewellery will regain its much deserved status again.” Mumbai’s Shobha Shringar Jewellers has already delivered to requirements of weddings which were scheduled in June end.

Snehal Choksey, Director of the bespoke jewellery boutique tells us, “Once this patch of weddings ends by December, the demand will slow down. As far as bridal requirements are concerned, we haven’t seen any downsizing. This is because of the reason that jewellery budget is usually predefined and it is last thing a family compromises on.”

Contemplating on the upcoming trends, S Choksey adds, “We are seeing consumer preference shifting towards temple jewellery. It is gold ornaments in its purest form. Hence, the yellow metal has managed to prove its dominance in last two years with much appreciation it has got.”

Dealing in wide range of jadau and gold bijous diamonds, Chokshi of Narayan opines, “Customers have started to consider gold jewellery as a form of investment rather than just a mere accessory or expenditure.”

An interesting trend pertaining to gemstones has also been witnessed during the lockdown. Consumers are increasingly buying astrologically significant precious and semiprecious gemstones. Therefore, businesses involved in it such as Khanna’s online store Gem Selection are witnessing good sales.

Khanna tells, “Our core business is related to astrological gemstones and we are witnessing 300 per cent growth during this time. The demand for pure, precious, and semiprecious stone has skyrocketed during this time due to increased stress and anxiety levels in people.”

Challenges Galore

As the footfall to jewellery stores slowed early in March, urban middle-class and rural consumers became more apprehensive in opening their wallets to purchase gold. This was followed by a gradual closing of retail stores during mid-March. A full lockdown was imposed after that in the final week of quarter.

According to Khanna of Gem Selection, the market size has been reduced to 10 per cent of what it used to be. Therefore, traditional jewellers are facing severe challenges at this time. The biggest challenge faced by renowned brands and designers currently is exodus of artisans to their native places.

Talking about this, Choksey says, “Artisans are a very important aspect of the jewellery industry as entire manufacturing is dependent on them. But, at such times we all need to become support systems for each other. We have supported at least 30 per cent of the rural artisans we usually work with. We did this by retaining them in the city through financial aid.”

In addition to this, Shobha Shringar is also supporting some of the artisans not based in their city. This thereby helps in supporting any current requirement of our clients. Choksey informs, “Currently the demand is low which can be easily catered with the limited number of karigars that we have. By the time the demand increases, rest of the karigars will be back too. I believe this is the best solution one could offer to tackle this situation.”

Sharing his thoughts on workforce management, Pethe of WHP says that these are testing times and brands had to take tough calls. He adds, “At WHP we believe that you can’t take decisions without keeping the humanitarian aspect in mind. Therefore, we have also worked out on various models where our staff can work on alternate days instead of applying layoffs.”

Similarly, at Narayan’s work has also been affected due to shortage of skilled workers. Chokshi reveals that manufacturing was put on hold due to this. But, they are trying to cope up with the situation by preparing themselves for future demands through various models of operation.

Second prominent challenge for the jewellery retail seems stringent sanitization guidelines. It is a roadblock for retailers to serve their customers as a buyer would like to try jewellery before buying it. The excess chemicals used in sanitizers deteriorate quality of products.

Explaining why this is a challenge Saraf says, “The sanitisation of jewellery between every viewing is a bigger challenge. It becomes more difficult for luxury jewellers who sell their jewellery products with polishes and treatments. Such polishes react adversely with chemicals involved in various sanitisation methods.”

Waiting for the Impact to Subside

While gold imports were down, demand was hard hit due to a sluggish economic growth in Q1. According to the World Gold Council, the impact is likely to be more severe by the end of second quarter. This will impact gold demand during the key buying festival of Akshaya Tritiya along with increased wedding-related purchases.

Many branded retailers have reported increased attention for products on their online platforms. Yet, logistical constraints imposed by lockdown have made it difficult to complete the orders on time. Saraf opines that it is difficult to predict trend of the industry right now as the situation is changing rapidly every day.

Retailers are expecting things to be normal for the industry till upcoming season of Diwali. Datwani of Anmol Jewellers believes that the impact of the virus could subside in almost a year. “There is a place for growth in near future but it will take time. We humans are social beings, so things will eventually come back to normal maybe after a year.”

While Choksey prefers to be realistic and admits that gems and jewellery industry both local and global is far from recovery. He confesses, “This will be a low performing quarter for the jewellery industry. The wedding season and festive shopping also will be relatively slower as compared to last year.”

Usually, duration from April to June and festive season beginning from August is favourable for ornament business in India. The sector has lost opportunity in this financial year due to ongoing pandemic crisis. The retail jewellery segment is still optimistic and has prepared to work under various kinds of pressure.

Businesses are still expecting the COVID-19 curve to flatten and are hoping that they can go back to the usual business cycle in a year. The pace of recovery from pandemic is going to decide how the sector will perform during the rest of the year. Considering this, the Indian gems and jewellery sector is still in wait and watch mode.