Last week, government announced a giant Rs. 20 lakh crore stimulus package to save the lockdown battered economy. According to the government, the package has provisions related to land, labour, and liquidity for various sections of economy. The package is claimed to be 10 percent of GDP, making it among most substantial across various countries in the world. Earlier, United States and Japan announced their financial packages which are 13 per cent and 21 per cent of their GDPs respectively. In a conversation with SME Futures, Anil K Sood, Professor and Co-founder of Institute for Advanced Studies in Complex Choices (IASCC) discusses the economic package and terms it as a repackage of old schemes and programmes.

Edited Excerpts

What does government’s Rs 20 lakh crore economic stimulus package means for industries? Is this package enough to revive currently ailing sectors?

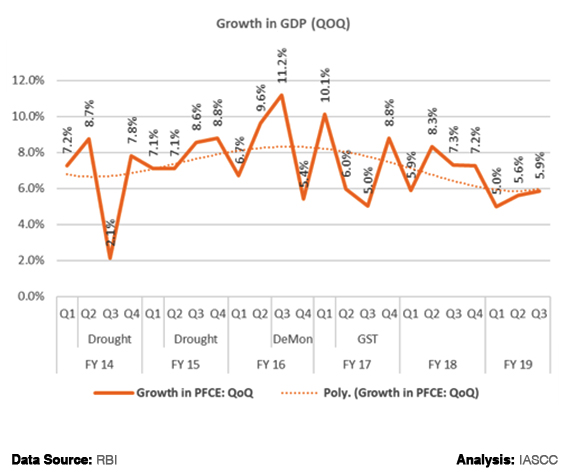

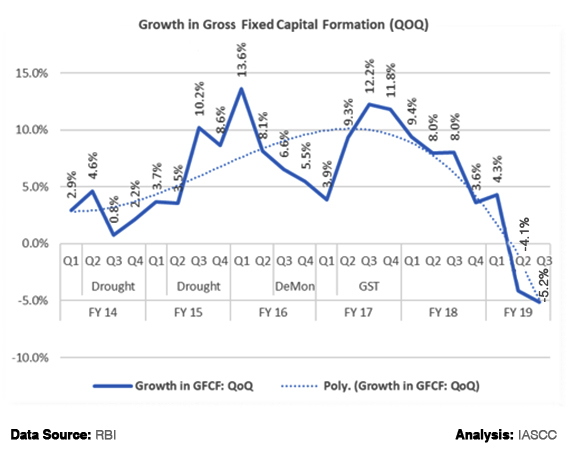

Even before COVID-19 turned into a mammoth health and economic crisis, the Indian economy was experiencing a structural slowdown. I would like to term it as a structural slowdown. This is because the consumption (Figure 1 shows QOQ growth in Private Final Consumption expenditure) and investment (Figure 2 shows growth in Gross Fixed Capital Formation) growth of our economy had reached a lower trajectory for about 2 years. The government’s effort (economic reforms like GST implementation or fiscal support in form of reduction in corporate tax) to revive the economy still were not paying off.

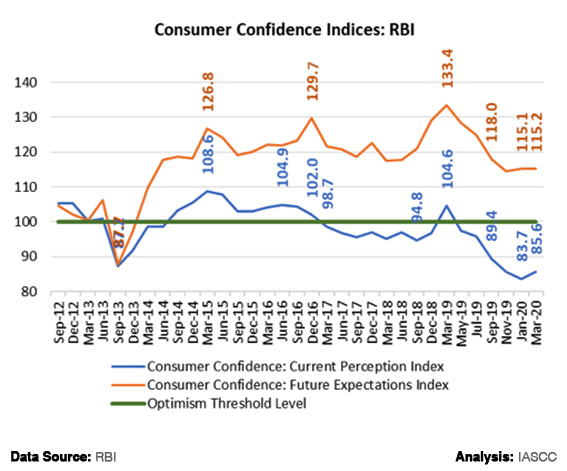

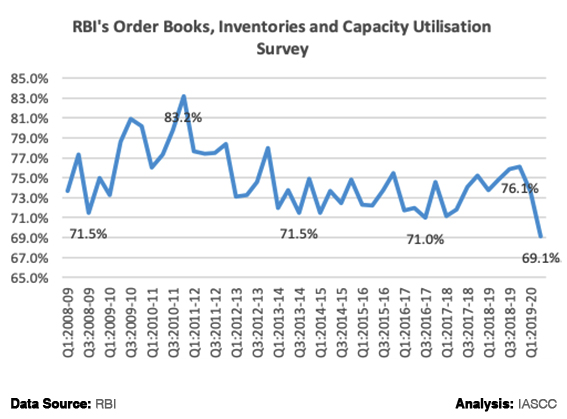

As consumption growth rate came down from an average of ~8 per cent to ~6 per cent, the investment growth had turned negative last year itself. We also had a situation where the consumer confidence about current situation was in the pessimism zone for nearly two years. This was lower than the level experienced during September 2013 (Figure 3). In addition to this, the manufacturing capacity utilisation levels had fallen to their lowest level in a decade (Figure 4).

COVID-19 has created a more difficult situation as it has resulted in collapse of demand and also has led to near-complete shutting down of supply chains across various sectors. Consequently, we have a situation where we need to revive demand, restart supply chain, and improve capacity utilisation. This will hopefully revive investment sentiment at some stage in future. As we all know, the stimulus announced is largely centred on restarting the supply chain, as it talks about providing liquidity through various means.

Further, it does not address the problem of demand revival, except through MNREGA allocation (which is only about Rs 40,000 crore is additional allocation) and front-loading of direct transfer under PM-KISAN programme and also small amounts of ex-gratia transfers. Even if it is trying to address the need for liquidity, the chances of liquidity flowing to the concerned sector are relatively low. For example, it is not sufficient to say that the government will guarantee loans to SMEs. Instead, the SMEs should be able to use those loans for productive purposes.

If they do not have labour to start operations (since migrant workers have gone back to their villages) or demand for their goods (household earnings don’t grow due to lay-off or wage cuts of staff), the availability of finance has a very limited worth. The government and large private enterprises could have simply released their own dues to SMEs and gave them the required liquidity. Some estimates show these loans are of worth approximately Rs 5,00,000 crores. All of this money was held back by large firms when the SMEs, particularly of manufacturing sector were already stressed.

My assessment is that the package is based on an inappropriate premise – demand exists, and we just need to kick-start the supply chain – and it will therefore not be of much help.

SME Credit Guarantee scheme helps the banking sector clean up their balance sheet, as the MSME loans are now guaranteed by the Central Government. It will help the MSME businesses only if the interest rates fall in line with the credit risk and credit flows to businesses that need it the most. Provided that MSME loans are now guaranteed by the Central Government, they are effectively risk-free loans. Therefore, the banks should price them accordingly. Otherwise, the banks will earn more than what they deserve to earn. The story is similar in other sectors too. The government seems to believe that financing an economic activity is a major problem, but the problem is due to collapse of economic activities.

What measures were expected and what could have been the appropriate steps?

I would have liked the government to focus on demand generation as the top-most priority. Secondly, ensuring the supply chain disruption does not become long lasting would have been a effective step. For example, if supply chains were to kick start at a short notice, migrant workers should have stayed in cities. Instead, we chose to disown them and leave them without a home. Now, most of them may not have money to come back to restart their life in cities.

Hence, the supply chain disruption will continue for much longer period if businesses do not fund their return. Most of the MSMEs will find it difficult to finance the return of their labour workforce since they themselves are economically burdened. I wished that government provided a wage subsidy to MSMEs and gave one-time grant to refuel their operations.

An economic problem cannot be solved by providing credit. It is a problem of economic viability for a large number of MSMEs.

Do you consider the economic package politically driven?

I believe that good politics is a right blend of good economics and governance. If the elected political leadership does not make good economic decisions, it is not serving its raj dharma. An elected leader hence should be there to serve largest possible number of people. The government must help people and businesses, particularly small businesses which provide employment to millions of families, and deal with losses caused by such crisis. Providing liquidity and credit is of no serious value here. Another problem with the current package is that it is a repackage of lot of old schemes and programmes and therefore does not address the problems arising from crisis. These schemes would have served their purpose under the normal circumstances and not now when the economy is gravely impacted by a pandemic.