2019 has proven to be quite a challenging year for the Indian real estate sector. Dwindling consumption, NBFC crunch, and slowdown in the economy overshadowed all possibilities for growth of the real estate sector – which is one of the major contributors to India’s GDP. And as India’s GDP growth rate fell to a six-year low at 4.5% in FY20, the sector enters 2020.

Rounding up the 2019 performance of the sector, Anuj Puri, chairman, Anarock Property Consultants, says, “Multiple developers fell off the grid, while others still struggle to stay viable. However, strong players with healthy balance sheets – in many cases diversified beyond real estate – sailed through 2019, and recorded decent housing sales and revenue growth. Towards the end of 2019, more than 72% (approximately US$ 47 billion or nearly Rs. 3.3 lakh crore) of the total loans advanced to Grade A builders (US$ 65 billion) are safe and stress-free. Grade B and C developers collectively accounted for just US$ 28 billion of the total loan advances.”

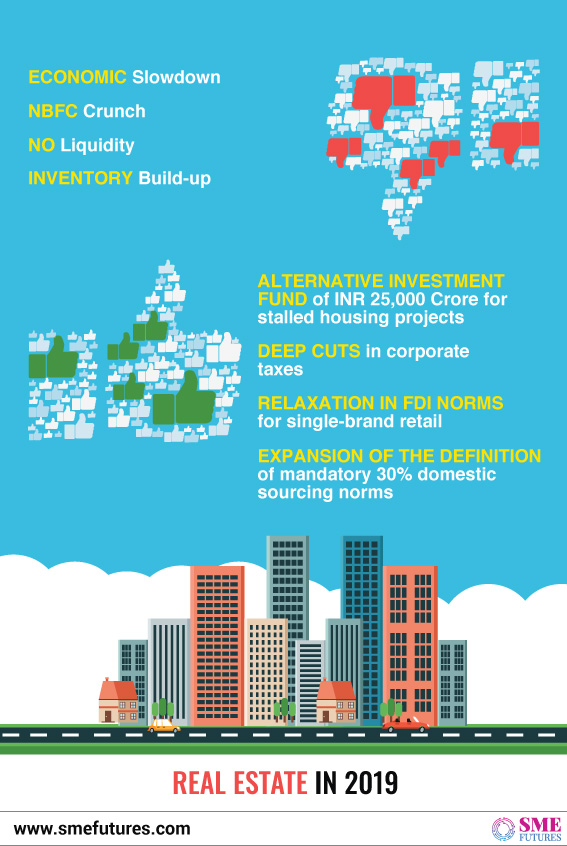

Sector marred by liquidity crunch, subdued consumer demand in 2019

#Liquidity crunch: the year was dominated by the liquidity crunch in non-banking finance (NBFC) and housing finance (HFC) segments, that led to severe stress on the supply side dynamics. Expressing his views on this, Khetsi Barot, director at The Guardians Real Estate Advisory, says, “The larger challenge facing the economy today is demand creation. We are observing that the high transaction and borrowing cost for home-buyers has continued to pinch the developers in under-construction properties, especially the premium and luxury housing segment.”

The industry feels the Rs. 25000-crore fund – that was announced, in the form of an alternative investment fund (AIF), by the government to provide relief to developers – is expected to ease the liquidity situation and restart stalled housing projects.

#Residential was down: For the housing sector, 2019 remained non-eventful in terms of sales growth and investor interest. Sentiments remained subdued, sustaining almost solely on the “ready-to-move-in or almost-complete homes.” The segment saw limited yearly growth of 4-5 per cent with over 2.58 lakh homes sold.

Most of the time housing prices were stagnant. According to a research done by Anarock, the housing sales value of India’s top nine listed players touched Rs. 108 billion in the second and third quarters of 2019 – amounting to a 5 per cent quarter-over-quarter growth. However, some other big names were dragged into insolvency. While other small developers either collaborated with big players or perished due to funding constraints.

The residential real estate witnessed a muted private equity inflow, with major PE funds focusing on the commercial segment.

On the other hand, the affordable housing segment gained traction. Of the estimated 2.3 lakh new unit launches in 2019 in the top seven cities, nearly 40 per cent (or approximately 92,000 units) were in the affordable segment, followed by the mid-segment (33 per cent) and the luxury and ultra-luxury segments that accounted for 10 per cent share (with 23,000 new units).

“The year 2019 has been a roller-coaster ride for the realty sector with the developers understanding the preferences of home-buyers and altering the supply accordingly. The metropolitan and large cities in India have several real estate micro markets that are reasonably priced and offer good returns for consumers and investors alike,” asserts Anuj Khetan, director, Vijay Khetan Group.

He further adds, “Speaking of Mumbai Metropolitan Region, extended Western Suburbs such as Andheri, Jogeshwari, Dahisar, Kandivali, and Borivali saw the maximum influx of new projects. While in first half of 2019, ready-to-move-in units ruled the sector, the second half of the year saw under-construction units driving the market. However, home-buyers’ preference experienced a significant shift in Mumbai.”

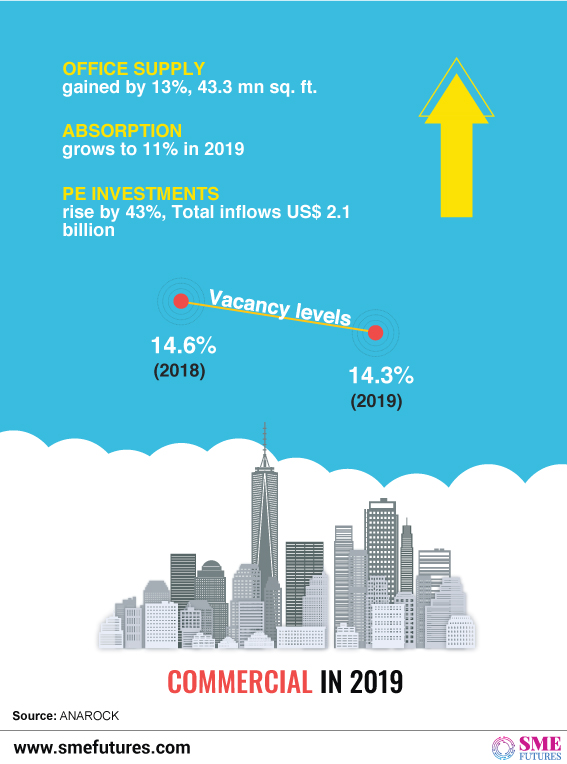

#Commercial saw growth: In spite of the challenges faced by the sector on the demand and liquidity side, commercial office real estate flourished and remained the top-ranking real estate asset class. Other asset classes such as co-working, logistics and warehousing, co-living and student housing gained traction in 2019, attracting slow but steady investments (collectively US$ 210 million).

By the end of 2019, office supply grew by 13 per cent, touching 43.3 mn sq. ft against 38.2 mn sq ft in 2018. Commercial spaces also attracted maximum investments close to US$ 3 billion in the first three quarters of the previous year. Vacancies level came down from 14.6 per cent in 2018 to nearly 14.3 per cent in 2019.

Summing this up, Puri from Anarock informs 2019 saw RERA gain firmer ground with over 40 per cent growth in project registrations.

“To make under-construction projects more attractive, the government slashed GST rates to 5 per cent unfortunately, without ITC benefit. The government also took a major step towards safeguarding home-buyers’ interests by banning the once popular (but often misleading) subvention schemes. RBI reduced the repo rates by a significant 135 bps all through 2019 and mandated commercial banks to link home loan rates to it,” he notes.

Outlook 2020

As 2020 dawns, the sector will see expectations initially overtaking on-ground improvement. The current trends indicate that first half of this year will not see much growth over the patterns of 2019. However, the second half does hold promise as the positive impacts of various government measures kick in.

“The co-living and rental apartment in Mumbai is in demand for evolved housing solutions coming from millennials, students and young working professionals. Therefore, such trends will remain the flavour of the season for the next few years to come,” according to Khetan, who also expects 2020 to be more stable and propel real estate growth.

He further anticipates that gradual recovery will speed up with “more fence-sitters converting into actual buyers.”

On the other hand, the government can help the sector by providing incentives to corporates venturing out into peripheral areas, where majority of the affordable housing stock is required, Deepak Nair, head-marketing, JP Infra Mumbai hopes. “Not only would this improve productivity, but it also would renew the industry’s appetite for investment and risk, thereby creating myriad opportunities along the way.”

As the sector is in dire need of growth, Barot from The Guardians Real Estate Advisory believes a temporary suspension of GST or introduction of 1 per cent GST for under-construction properties across product classes would help reduce the transaction cost for the home-buyers and would boost the much-needed demand in the market. And, as the real estate market in 2020 will see a multi-fold increase in the number of residential projects in the affordable, small and mid-size home segments, the focus of developers and the industry at large needs to be on project completion and timely delivery.

Trends to watch out in 2020

- Consolidation and mergers will continue across all real estate sectors.

- Environmental concerns will gain prominence, such as was seen by the construction ban to combat air pollution in Delhi. Developers will have to accept and embrace these concerns in 2020, and reorganize launch rates and construction labour.

- Some large stuck realty projects will be revived by government funds.

- Residential property prices will remain stagnant.

- While new launches will remain muted, housing sales could see improvement – especially ready properties or those nearing completion.

- Branded players will gain more strength

- Private investment could increase from H2 2020 onwards depending on macro-economic factors in the first half.

- More commercial real estate investment trusts (REITs) to be listed in 2020 as more commercial developers look to unlock the value of their assets to raise capital.