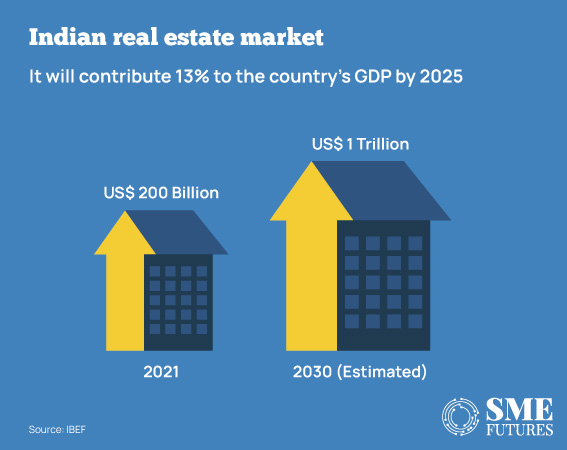

Being one of the top ten real estate markets in the world, the Indian realty sector is expected to reach US$ 1 trillion in market size by 2030, up from US$ 200 billion in 2021 and contribute 13 per cent to the country’s GDP by 2025, according to IBEF.

Rising populations, the emergence of nuclear families, rapid urbanisation and rising household incomes are likely to remain the key drivers for growth in all spheres of real estate, including residential, commercial, and retail.

According to Jones Lang LaSalle (JLL) India, a real-estate consultancy firm, the net absorption of India’s office property market across the top seven cities of India-Mumbai, the Delhi- National Capital Region (NCR), Bengaluru, Hyderabad, Chennai, Kolkata, and Pune hit a three-year high of 38.25 million square feet in 2022. It surpassed the five-year pre-pandemic average from 2015-2019 by 3.1 per cent.

Also, housing sales in India witnessed a record high in 2022 along with some new launches across the top seven cities in the country, says the data from a real estate services company, ANAROCK. Unit completions also remained on top from 2017 to 2022. Around 4.02 lakh homes were completed in 2022, registering a 44 per cent increase, as compared to around 2.79 lakh homes in 2021.

Amid this tremendous growth, there are several challenges and obstacles that the real estate sector has been facing, and its stakeholders want to overcome them.

Most are past issues, while a few have emerged recently, and to tackle those, the real estate industry has some suggestions for and some expectations from the Union Budget 2023-24.

Long-due industry status

Although the real estate sector supports a lot of businesses and groups, from steel to cement and from daily wage labourers to big dealers, it is still argued whether real estate should be given ‘Industry’ status or not. Because due to its not being considered an industry in India, there are several policies, incentives, easy access to loans, and tax exemptions that the real estate sector is unable to access and benefit from.

“We urge the government to consider giving the long-due industry status to the real estate sector. We also want large townships to get benefits like low or no stamp duty and the infra required for large townships to be treated as infra projects. In addition to that, we want infra financing and single window clearances for approvals and outer time limits to be considered for approvals,” says Navin Dhanuka, MD and CEO of ArisUnitern RE Solutions.

Stressing on the same, Director at SKA Group, Sanjay Sharma says, “Giving industry status to the real estate sector is one of our foremost demands. This will allow developers to take loans at relatively low-interest rates and will enable them to avail themselves of tax incentives and waivers, which will act as relievers in times of grave economic crises.”

Speaking on the same, Kaushal Agarwal, Chairman of The Guardians Real Estate Advisory says, “The real estate industry will be able to draw equity investment, restructure its debt, and get loans at cheaper interest rates with the support of a long-pending request for ‘Industry’ status.”

Tax compliance needs to be eased

Even though the realty sector has made a smooth transition from the pandemic-induced turbulence, it should further be stabilised by introducing profound measures in the Union Budget. Speaking of which, the Director of Mahagun Group, Amit Jain says, “Reductions in GST, in the circle rates, and in the stamp duty would be significant fresh-start policies allowing the housing sector to gain an upper hand advantage right at the year’s outset.”

Highlighting the same issue, Kushagr Ansal, Director at Ansal Housing, says, “Reducing the GST rates and the stamp duty will allow the real estate sector to adopt a policy of price moderation in the pricing of housing units and apartments and will also give the sector a breather from increasing the cost valuation of projects.”

CEO of Bhartiya Urban, Ashwinder R Singh explains that as per section 80IBA, a 100 per cent tax break for affordable housing projects was available for the projects that received approval until March 31, 2022. Developers were able to claim this tax exemption on earnings under the terms of this section, provided they met several qualifications, including the approval deadline. “I believe it’s critical to reinstate this policy since it has undoubtedly been the most substantive step towards increasing the viability of affordable housing developments,” he elaborates.

For the developers who are focused on redevelopment projects, the double GST payment has been a major deterrent as it has led to a cost escalation at a time when the margins are already under pressure. Commenting on this, Amit Jain, Chairman and MD of Arkade Group says, “Enhanced tax concessions on incomes from the renting out of housing properties and the removal of taxation on notional rental income can further boost demand for new properties. Hence, the finance minister should reverse the decision on GST payments of 5 per cent to give a fillip to redevelopment projects.”

“The budget should offer a degree of personal tax relief, either by way of lower tax rates or by readjusting the tax slabs,” he adds.

For a steady growth in the number of home buyers in the country, Agarwal from Guardians Real Estate Advisory suggests, “The government should raise the tax deduction limit for home loans from INR 2 lakhs to INR 5 lakhs per year, thereby providing tax relief to homebuyers.”

Increase in incentivisation

Since the advent of COVID-19, there has been a major decrease in the supply of affordable housing, and to maintain the affordable housing market, incentives and subsidies are critical.

“The government must provide extra incentives to promote affordable housing in addition to the standard requirements for a single-window clearance system and industry status for real estate,” says Shiwang Suraj, Founder & Director of Inframantra.

Also Read: Hospitality sector’s expectations from Union Budget 2023

Weighing in, Jain from Mahagun Group says, “interest rate subsidies should be provided to realtors to cushion the impact of the torrid inflation rates and the construction process of stalled projects should be expedited.”

“Tax waivers on interest paid on home loans are one of the most pressing demands of the realty sector,” Jain adds in.

Interest rates are deterring loan repayments

In 2022, the RBI hiked the repo rate, taking it up from 4 per cent to the current 6.25 per cent. These hikes in the repo rate have put some pressure on homebuyers as their EMIs have increased. “To rectify this, the most critical step would be to remove the 2 lakhs deduction cap against home loan interest rates,” says Singh from Bhartiya Urban.

Highlighting the same, the Director of Empire Prime Realty, Jasmeet Singh Suri says, “The home loan interest rates need to be rationalized as in recent times, the increased rates by the RBI have made a huge dent in the affordability of home loans, resulting in lower demand.”

Suggesting an alternative, Jain of Arkade Group says, “The FM should consider increasing the standard deduction on home loans to Rs 5 lakhs and should also increase the standard deduction from 30 to 50 per cent.”

Schemes for ease of doing business

Strong and supportive schemes or policies are what make any sector resilient and help it to grow.

The stakeholders of the real estate sector are expecting the same from the government. “The scope of the Pradhan Mantri Awas Yojna (PMAY) scheme needs to be marginally increased to help the middle-income group to opt for the EWS and LIG schemes,” says Suri from Empire Prime.

To improve access to housing in the low-to-mid-income segments, the government should continue its focus on budgetary and extra-budgetary allotments to the PMAY schemes. “The government needs to ramp up budgetary allocations in the forthcoming budget to meet the target of 50 million dwelling units under PMAY,” asserts Jain from Arkade.

In conclusion, the stakeholders of the real estate sector are full of hope and are very optimistic about the sector’s growth, as the real estate market has grown tremendously from the last fiscal year. They are hoping for industry status, relaxation from tax and inflation, and better policies from the upcoming Union Budget 2023.