The key benchmark Indian stock market index, Nifty 50 is swinging at an unprecedented 17,500 levels (approx.) and the free-float market-weighted stock market index, Sensex breached elusive 55,000 mark recently. The Indian stock markets witnessed the Bull Run and massive rally for the first time ever, and it may make record of new levels every day. Keeping all this in mind, it becomes extremely important for you as an investor to do a fundamental check about whether all these unprecedented runs are being supported by basic data or not, and how much strength do these levels possess?

Ravi Singhal, Vice Chairman of GCL Securities Private Limited, suggests that there is no need to worry about a higher level of these stock market indices because the price of any stock or index is always a reflection of its earning base. All of us are well aware of the fact that the pandemic has hit the earnings of businesses very badly. Hence, now when businesses are bouncing back into financial action, the earnings of almost every company is improving in their quarterly results.

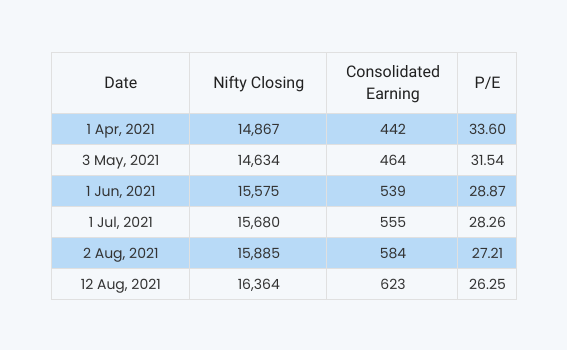

If we take a look at the consolidated earnings of Nifty 50 companies, it was at almost Rs 358 per share, average in August 2020, and has been continuously improving since then. The same figure was at an average of Rs 446 in April 2021 and Rs 607 in Aug 2021. Therefore, if we look at the PE data of this year, it is continuously on a decline, even though the key indices are touching new levels.

Let’s take a look at the data to check what all it reveals: –

Keeping in mind the above-cited data, now, a big question emerges here – Is it worth buying in Nifty 50 at 26.25 P/E? To answer this, we have to look into some of the key facts here:-

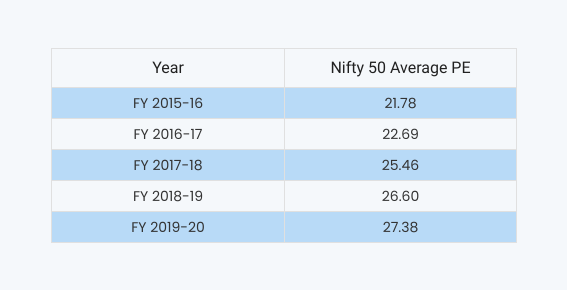

1. Historical P/E: FY 2020-21 was an exception, therefore we cannot take the data of this year into consideration while calculating the average. However, if we look at historical data of the past 5 years before FY’21, the Nifty 50 P/E average was 24.78 from the beginning of FY 2015-16 till the end of FY 2019-20.

Therefore, at 26.25 level it is almost 6% higher than last 5 years average.

2. Nifty 50 P/E calculation: As we know, NSE has changed the calculation method for Nifty 50 P/E. Now it is calculated on the basis of consolidated earnings of all the companies instead of standalone P/E. This calculation has changed P/E data significantly. It is important to note here that after that this calculation change came into effect, Nifty 50 P/E immediately came at 33.2 on 31st March 2021 from 40.43.

3. Future growth: If we evaluate the P/E of any company or any of the indices, we must look at the future earnings expectations as well. Current higher P/E may be a result of market expectations of higher earnings in the future.

Conclusion: P/E is the most important factor for market strength analysis and it is running higher than its 5 years average. It may be the result of the market expectation of higher earnings growth of Nifty 50 companies but at the same time, we also expect that earnings will improve further as the festive season will perform well and the monsoon is going good all over India. Finally, long-term investors who have 3-5 years of investment horizon should not fear at all from the levels of 16,500 and 55,000 of Nifty 50 and Sensex respectively.