It was one of those days when I hadn’t brought lunch to office. I didn’t want to order a heavy meal, so I grabbed a ready-to-cook (RTC) Upma, put some boiled water in it, and in just three minutes, it was all ready to eat.

Though it was not the first time that I had eaten RTE snacks, my curiosity was peaked, and I searched for more. The search results amazed me. To begin with, the RTE segment has completely evolved due to several innovations. The market is flooded with brands manufacturing a variety of products, that even a child can cook. For instance, I came across a ready to cook brand which has introduced RTC eggs, which are not even actual eggs!

Sounds a little quirky, but it’s true.

Realising that there has been a huge influx of new age start-ups with creative and new products in the RTE segment, I decided to talk to the industry people in this space to know more.

Most of the experts that I spoke to are in unanimous agreement about the fact that the ready-to-cook segment is growing at a really fast pace. In fact, the pandemic has spurred this growth with the inclusion of a vast range of items being done during the lockdowns. They also pointed out the immense opportunities for India in this arena and talked about the challenges and new trends that have been cropping up in this space.

From the factories to the consumers’ kitchens

Most of us are aware of Nestlé’s Maggi as an instant noodle dish. Following suit, many food brands started leveraging the technology that they had in hand to launch similar products. Still, until a few years ago, India’s ready-to-cook segment was small, with very few options available. Dehydrated items where you could prepare a dish instantly by adding hot water to them, were all we knew.

But that has changed.

From palak paneer to idli sambar, burger patties to plant-based meats like jackfruit, and even momos, parathas and meat curries, the industry has curated a plethora of ready-to-eat dishes. Also, this segment is also witnessing more local made brands producing a whole new gamut of RTC meals customised for the Indian populace.

If we go by the numbers, according to a RedSeer Consulting report, the Indian RTC industry grew at a 16 per cent CAGR from 2014 to 2019, but it is now expected to grow by US$ 451.57 million during 2022-2026, decelerating at a 7.61 per cent CAGR during the forecast period, as per the findings by Technavio.

The pandemic has spurred this growth

And this growth is being driven by a number of factors, including increasing urbanisation, fast-paced modern lifestyles, RTC foods being more convenient and quicker to prepare and more cost-effective, and professionals facing time constraints while juggling work-life responsibilities.

But, above all, it has been a pandemic-induced growth.

COVID-19 restricted people’s movements but not their cravings during the various lockdowns that it engendered. During the last two years, the work-from-home culture has had a positive impact on the snacks or bakery industry. As a result, RTE and RTC adoption rates have also increased.

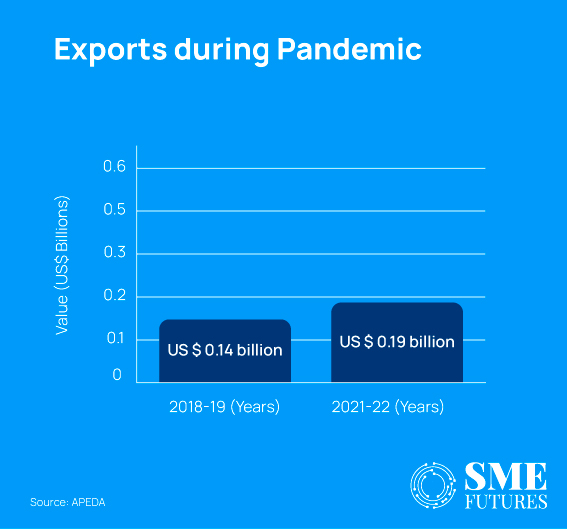

According to the most recent APEDA data, RTC product exports totalled US$ 0.14 billion in 2018-2019, rising to US$ 0.19 billion in 2021-22, which indicates that people are finding it difficult to find time to cook while working from home.

To back up the data, one of the players in the segment, CG Foods, makers of Wai Wai Noodles talk about their tremendous growth during this period. Noodles, being the first ever RTC food product attract a large number of consumers.

“Our company did extremely well in this pandemic period. I believe that the preference for packaged food has increased. Wai Wai Noodles grew by 50 per cent during these times, with India accounting for 1 billion packets a year. The total worldwide consumption of Wai Wai is 3 billion packets per annum,” Dr Varun Chaudhary, Managing Director at CG Foods tells us.

CG Foods India manufactures a wide range of Wai Wai Noodles and instant pasta in around 45-50 flavours. According to Chaudhary, the instant noodles market is powered mainly by the millennials and Gen Z. And the WFH and hybrid work modes have only increased their consumption.

Chaudhary informs us that due to the surge in their growth, CG Foods has announced a capacity expansion in 5 factories and has furthermore created robust new product launch plans with an investment of Rs 120 crores which will make it no longer just a noodle brand.

Also Read: India leads world in highest rate of recognising start-ups per day

Similarly, other players have also enjoyed significant growth in their RTC portfolios.

Sharing the triumphant story of her own growth, Prachi Patil, co-founder of Suzu Agro says, “The shelf life of ready-to-cook items is their most significant selling point. They are not as easily perishable as fruits and vegetables. But we recorded a significant spike during the pandemic for this very reason.”

Shraddha Bhansali, COO and co-founder of EVO Foods, adds that e-commerce sales have more than doubled the retail business of companies like hers.

For example, ID-Fresh Food saw a 60 per cent increase in sales in Q1 FY2021 compared to the previous quarter. Licious, a seafood company, has seen a two-fold increase in its RTC product sales and a 300 per cent increase in the sales of its RTE meat spreads.

Innovation led surge in consumption

Consumers have wholeheartedly welcomed not only the larger brands like MTR, McCain, Bikanerwala, ITC and Nestlé, but also the smaller brands with newer concepts. This has provided opportunities for newer ventures to emerge in this arena. Because food is one segment where revenue generation begins on the first day of business itself, unlike in the other technology businesses.

Suzu Agro offers a line of RTC products called Aaj Pakao, which includes six beans and seven curries packaged in vacuum-proof bags. Pav bhaji, Mangalorean ghee roast, Goan Xacuti gravy, Dal makhani, Missal, and Chettinad gravy are also among their offerings.

“Aaj Pakao focuses on Indian families, where cooking is a substantial part of the daily routine,” Patil says while talking about her brand’s strategy. “It is always better to target the problem directly. And the problem here is that cooking takes time. Our core strategy is to be a people-centric product that keeps our customers satisfied and things simple,” she further points out.

Another new entrant, EVO Foods, has developed a vegetarian egg!

It’s hard to believe that this 2019 start-up is producing an RTC egg. They claim it is the world’s first heat stable plant-based boiled egg. This consumer-packaged goods (CPG) company aims to eliminate animal products from the food chain, and as a result, they have launched this plant-based revolution from India and have taken it to the rest of the world as well.

“We are looking at hybrid channels for our sales. Our primary focus is to push D2C in India and we are already available in a few restaurants across Mumbai. Our goal is to grow offline via restaurants and hotel chains, and online through our website and we will be planning for retail in the coming years,” says Bhansali.

Another start up is Nutrition Dynamic Foods (NDF) LLP, which has innovated and is manufacturing natural, green vegetable-based beverage premixes. NDF uses freeze drying technology that retains nutrients and antioxidants along with dietary fibres in its products. The company says that their products help consumers to maintain their gut health.

Also Read: IMA urges government to withdraw GST on healthcare services

Arpita Divyesh Doshi, its founder, claims that her start-up was incepted due to her own deteriorating health, adding that NDF is a brand that is innovative, natural, and nutritious without sacrificing the taste factor.

“The products are built in such a way that they can sustain their health even when people are in remote locations with unfavourable conditions. Our Innovation has given us the first mover advantage in such a competitive sector,” she points out. “And after innovation, we go for patenting rights that protect us from the competition,” she further says.

Health is wealth

This adage is indeed true. Today health related food products are raking in the moolah. And the same kind of growth and expansion can be seen in the RTC segment. Consumers have become more health conscious and are choosing products that have zero artificial ingredients, even if they cost more.

Clearly health is wealth and is in fact the dominant trend in these times, say all the entrepreneurs that we spoke to.

“Post-pandemic, we noticed a significant shift in the eating habits of our consumers. The demand for fresh, healthy food was evident, and immunity ‘boosters’ were at their peak during this time,” says Patil of Suzu Agro.

Arpita Doshi, founder at NDF also weighs in with her opinion, saying, “In terms of breakfast options, products like instant batters, yoghurt-based smoothies, healthy juices, nutritious and natural energy-dense foods and beverages have seen more demand due to the consumers being more inclined towards healthier options that are convenient and natural.”

“The RTC segment has always kept up with the trends. Due to the pandemic, people got more and more health conscious and turned towards healthy and nutritious food options,” she continues.

Viral quirky food

Not just healthy eating has become a trend but experimenting with food has also gone viral. A lot of people have now started sharing their own versions of healthy cooking and baking on social media. Dalgona coffee, homemade wraps and healthy versions of pizzas and pastas are a few of the more prominent viral food trends on social media. Lately, healthy recreations of fast-food snacks have also started taking the internet by storm.

This has also made people more inclined to try RTC products.

“The pandemic has engendered the concept of “TV Dinners” to enable people to maintain their work life balance in the urban areas and metropolitan cities. Snacks and munchies have become the most preferred items to satisfy small hunger pangs. They include plant-based meat, frozen vegetables, nuggets, fries, and meat-based snacks,” says Doshi.

Packaging norms are shaping up the RTC market

There have been some inevitable changes that have recently kicked in that are reshaping the RTC market. The new packaging norms are one such change.

Due to the government’s directives to ban the use of single-use plastics and the other new guidelines about packaging, RTC stakeholders have become more aware and more innovative as well. Decreasing their carbon footprint has also become a goal for most of them.

Thus, most of these companies have started to inculcate sustainable practices in their operations and their packaging methods.

Dr Chaudhary from CG Foods informs us that they have already begun working on bio-degradable plastic made with corn and maize starches to replace single-use plastics. “Furthermore, we intend to include forks in our cup noodles, which are quickly decomposable,” he further tells us.

Retort pouches are also an alternative to the traditional food packaging methods. They are made of a high-density PP material with an aluminium layer to extend the shelf life of products. Patil from Suzu Agro tells us that pouch and tray packaging are the result of an innovation using retort technology.

Many companies are now using glass bottles, tetra packs, eco-friendly paper or bamboo packaging as alternatives to single-use plastics. Doshi tells us that they use recyclable virgin aluminium coated sachets with outer paper mono cartons.

But the challenge is that the costs are increasing due to this, something which the consumers may not be comfortable with.

Also Read: Plastic ban: Imported paper straws to have cost implications, says packaged food industry

Bhansali of Evo Foods says, “If the government outlaws single-use plastics, paper offers a sustainable substitute for plastic and may take a fourth of the Rs 80,000 crore industry by 2025.”

Push from the government

The snack industry’s major challenges are demand and supply-side bottlenecks, as well as infrastructure bottlenecks.

However, the government is providing impetus to this industry. There is the PLI Scheme and the PMFME (Pradhan Mantri Formalisation of Micro Food Processing Enterprises) Scheme, which provide subsidies and financial assistance to all micro food processing enterprises that form a cluster, and many subsidies and training are available under the ODOP.

Also Read: India’s sustainable future lies in green packaging

Furthermore, the segment is also evolving on the back of frequently improving regulations by the FDA and the FSSAI around food processing. But considering how consumer trends are always changing, the start-ups in this segment are trying their utmost to stay in this highly competitive space, which is already dominated by the biggies like MTR, ITC, Bikaner, McCain, etc. Meanwhile, the innovations that are happening in this space have propelled the RTC segment like never before. The experts foresee this growth only increasing in momentum in the coming days.