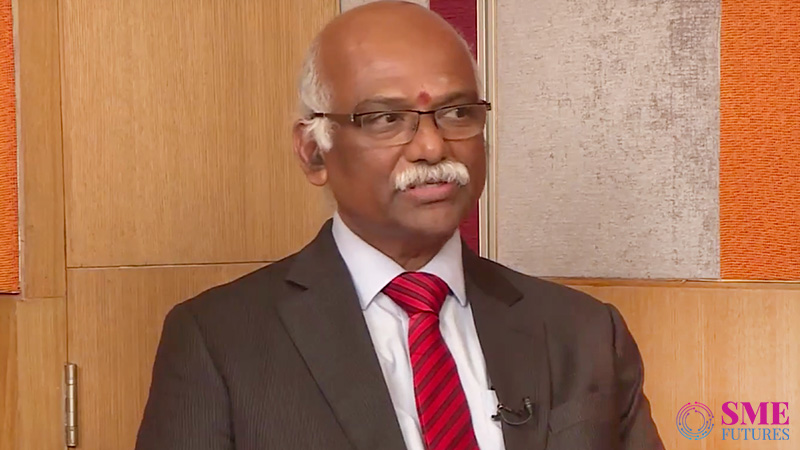

The former deputy governor of the Reserve Bank of India, R Gandhi doubts the claims of MSMEs owners who blame the government’s policies, particularly demonetisation and GST, for the slowdown of their businesses. He says that those who cite the two policies as the reason behind a drop in their revenues are the ones who want to avoid paying taxes. He also disagrees that demonetisation still has an impact on the economy in general and MSMEs in particular after six quarters.

Gandhi was in charge of the crucial tasks of currency management and banking operations at the time of demonetisation. He retired from the Reserve Bank of India in 2017 with over three decades of experience in monetary policy and macroeconomics.

R Gandhi spoke to SME Futures on the problems in credit access for MSMEs, regulating the fintech industry, demonetisation, FRBM Act and cash crunch in the economy. Follow this link to watch the detailed interview.

What is the current state of financial inclusion in India?

On the financial inclusion, several consistent steps have been taken by the government of India, Reserve Bank of India and the banking system as a whole. The number of people who have been brought into mainstream banking circle has been increasing. The inclusive index which has been brought out by the World Bank endorses this fact. The major flip, of course, is PM’s Jan Dhan Yojna under which banks opened accounts at a large scale. Now over 60 per cent of people have accounts opened in their name. A lot of efforts still need to be done to complete the whole program. But we are happy with the progress that we have made so far.

What role does technology play in financial inclusion?

India realised way back in 2006-07 that digital tech is going to be the biggest enabler for the purpose of financial inclusion. After all, we are talking about mainstream bank following an alternative stream through which they will bring these excluded people. The firm belief is digital technology will help banks and the other financial institution reduce the cost of offering and accordingly bring more people into the mainstream.

What are the constraints for banking to serve the need of MSME sector? And what can be done to bring the lending rate down for MSMEs?

It is true that MSME sector as a whole does not get adequate financial services from the mainstream banks. It is not that banking system is not expanding the credit reach to the MSME sector. There are historic and legacy factors. However, data clearly establishes that year after year, the sector is getting more and more credit. But obviously, it is inadequate given that the gap is huge.

Also Read: Fading arts of Kutch: change in lifestyle, reduced demand pushing craft to the brink

The biggest challenge is that typically an MSME sector will not have a proper documentation of their financial position and proper documentation of their businesses, which are normally required for a mainstream bank to access their capacity to pay back the loan. So what is required is an alternate model. That is the reason why a great deal of efforts are being put in by both banks and the NBFCs to find out different methods using technology such as big data to determine person’s creditworthiness. It requires quite a bit of effort.

As of the cost of credit for MSMEs, banking and financial institution are commercial organisations. Their money is not for charity. There is money from the cost of depositors and they have their own operating cost and normal expectations in terms of return. So, we should factor all these things.

There is no question of cross-subsidising by the banks to charge somebody else heavily or give commission in terms of deposit to the depositors so that they give low-cost credit to the MSME. If people believe that MSME is important and they should be given at low-cost loans then there should be a public subsidy. You cannot expect the banking system to give that subsidy. The cost to the MSME will be based on the cost of operations and the cost of funds by the banks.

Reserve Bank of India was trying to bring back the banking system towards cost-based credit from base rate based. Their recent approach is towards marginal cost of funds based lending rate. It is the requirement of the banks that every month, they have to reassess the cost of their operations, including the cost of funding which is their own cost of borrowing.

What role does mobile technology play in financial service outreach and what is the role of Reserve Bank of India here?

In terms of financial outreach, several technologies have been used. Telephony, traditional telephone-based banking, V-SAT, radio frequency, etc are leveraged. Mobile seems to have the highest potential today. The availability of the mobile phones in the hands of a larger population is much higher as compared to landline telephone connection, VSAT or radio frequency. The cost of mobile is coming down and the features that are added to the low-cost phones are also increasing.

The MSME sector continues to complain that it is not recovering from the impact of demonetisation. Reserve Bank of India, in December 2016, immediately after demonetisation had clearly brought out segments that will be affected. It was definitely an anticipated act. The demonetisation related negative impact was there in the quarter ending December 2016 and quarter ending March 2017. Hurdles that MSMEs faced during the financial year 2017-18 cannot be related to demonetisation. By March 2017, cash has been brought back to 13 lakh crores out of the 17 lakh crores, which was in circulation before demonetisation. That argument cannot hold good.

During fiscal 2017, the economy improved. Growth in the third quarter was 7.1 per cent and in the previous quarter, it was 6.8 per cent. If MSME sector was not gaining proportionately, then we have to find out why. One factor could be MSME sector is one of the large sectors that contribute to exports. There are some studies that 45 per cent of the country’s exports come out of the MSME sector. During the last year, even the world trade was increasing. Our exports had not been correspondingly increasing.

MSME sector blaming the slowdown on demonetisation and GST do not want to pay taxes. MSMEs provide a lot of employment and there is a trickledown effect wherever MSME sector is present. So are moves like demonetisation and GST, which totally changed the market dynamics.