The Small Industries Development Bank of India (SIDBI) along with Equifax (a global information solutions company) has rolled out the 11th edition of the ‘Microfinance Pulse’ report on the data and developments in the microfinance industry (MFI) of India.

This report tells us that the microfinance industry is gradually penetrating the Indian cities and engendering self-employment on a comprehensive scale.

What is microfinancing

For those who are not very aware of the concept, microfinancing in India is a type of financial service. It is a system through which loans, credit, insurance, access to savings accounts, and money transfers are provided to small business owners and entrepreneurs in the underdeveloped parts of the country.

This concept was introduced in the 1980s for those who did not have access to the traditional sources of finance, to empower women and to financially help the weaker sections of society.

In India, it was first initiated as the Self-Employed Women’s Association (SEWA) in Gujarat, which later formed the SEWA bank and since then, it has been empowering numerous small businesses from the rural areas, helping them to grow and expand.

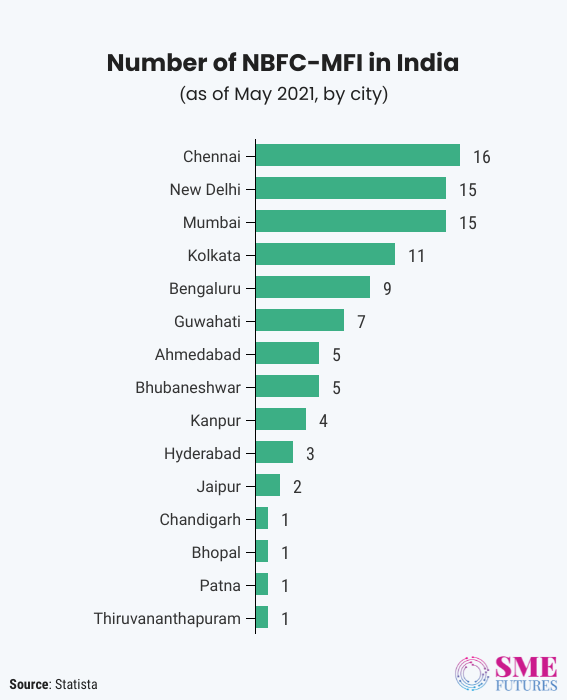

After undergoing various developments, the microfinance institutions have now grown into a sector and there are approximately 3000 MFIs including NGOs and NGO-MFIs in the country. While there are at least 94 non-banking financial companies (NBFCs) which run microfinance institutions as of May 2021, according to RBI data.

These MFIs provide small loans to people with no banking facilities. Here the definition of “small loans” often varies. In India, all loans that are below Rs.1 lakh can be considered as microloans.

MFIs in India

MFIs were established to achieve some specific goals. To begin with, the motive was to assist in the provision of resources for the poorer segments of society.

The other goals were- the empowerment of women, eradicating poverty, creating jobs and self-employment opportunities for the underprivileged, and skilling. Furthermore, MFIs work in a structured group format to provide credit, insurance, and financial education to India’s rural population. MFIs include Joint Liability Groups, Self Help Groups (SHG), Grameen Model Banks, and Rural Cooperatives.

Despite all these commendable motives and lofty goals, the MFIs have come up short in their attempts to reach out to the remote areas of the country with their microfinance programmes, paying less attention to the depth, quality, and viability of these financial services.

In addition, India must create a strong framework of guidelines and regulations for the microfinance industry.

However, in the last few years this industry has witnessed a surge, owing primarily to the various government initiatives and the emphasis that it is placing on the Aatmanirbhar Bharat programme.

Talking about the industry, the Chairman and Managing Director of SIDBI, Sivasubramanian Ramann said in a statement, “Microfinance has evolved as an important financial delivery mechanism to promote financial inclusion. Due to the hardship and loss of livelihoods caused by the pandemic, the sector needs the renewed focus of all the stakeholders.”

The declining delinquency trends in the sector in the Sept 2021 quarter are also an encouraging sign for the future growth perspectives of this sector, Ramann added.

Let’s take a peek inside the report ‘Microfinance Pulse’ presented by SIDBI, that gives a detailed account of the industry’s growth from July 21 to September 21.

MFI Growth

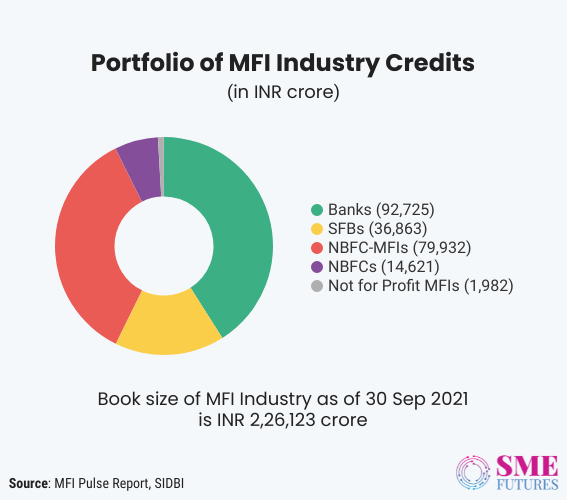

Microfinance Pulse reports that the book size of MFIs as of 30th September 2021 was Rs 2,26,123 crores. Tamil Nadu was at the top with Rs. 29,335 crores and contributed 13 per cent of the total portfolio outstanding.

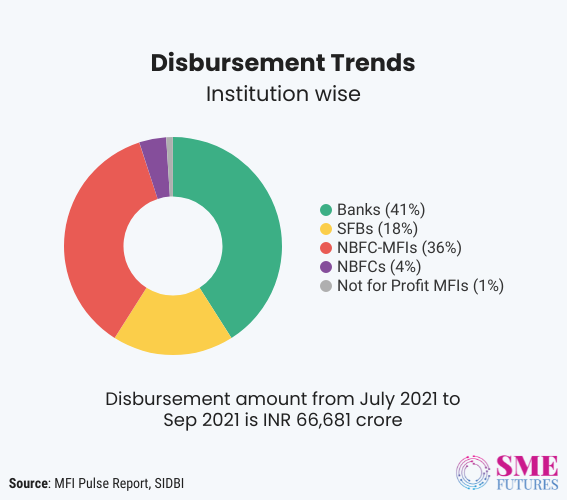

The report delivers a snapshot of the data submitted for the period up to September 2021 and of the developments in MFI during this period. Banks, SFBs & NBFC-MFIs contributed more than 90 per cent of the total portfolio outstanding and 95 per cent of the disbursed amount.

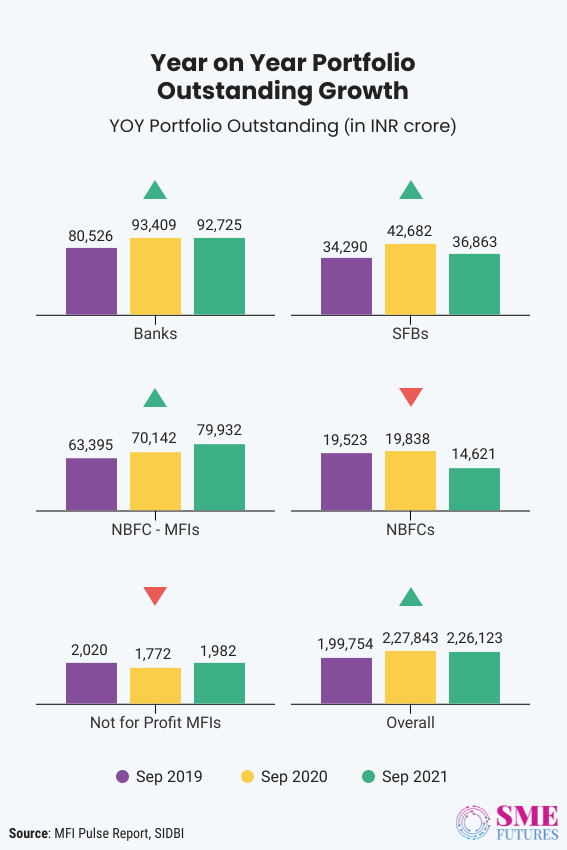

The MFI witnessed 2 per cent Q-o-Q growth from June 2021 to September 2021. NBFC-MFIs witnessed the highest Y-o-Y growth of 14 per cent from September 2020 to September 2021 and Q-o-Q growth of 10 per cent from June 2021 to September 2021. However, the bank’s

portfolio outstanding had declined by 3 per cent from June 2021 to September 2021.

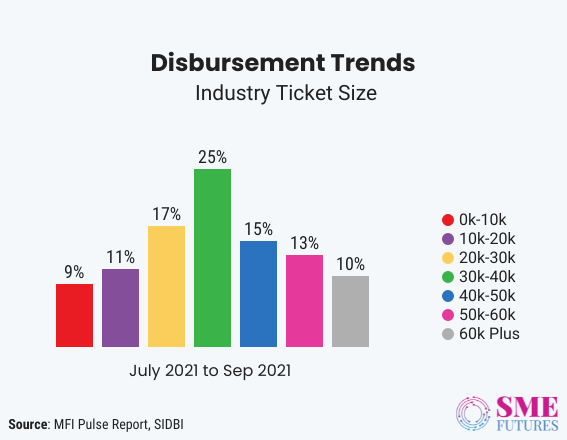

The number of loans disbursed grew by 94 per cent from (July-September) 2020 to (July-September) 2021 and the disbursement amount grew by 96 per cent for the same period. The highest number of loans were disbursed under the 30-40 thousand ticket size category across all the quarters. Average ticket size grew by 1 per cent from JAS’20 to JAS’21. All the delinquency buckets had declined in September 2021 compared to June 2021. The 60-89 days past due delinquency bucket had the lowest delinquency across all the quarters except that of June 2021.

Disbursement Trends

The number of loans disbursed during JAS’21 grew by 94 per cent and the amount disbursed grew by 96 per cent as compared to July-September 2020. The highest number of loans were disbursed by the Banks and NBFC-MFIs across all the quarters. While the SFB’s witnessed the highest growth in terms of loan disbursal by volume and value from JAS’ 20 to JAS’ 21.

The highest number of loans were issued under the 30k-40k ticket size category across all the quarters. In fact, 40 per cent of loans were issued under the 30k-50k ticket size category. Also, the average ticket size grew by 1 per cent from JAS’ 20 to JAS’ 21.

State/UT wise Portfolio Outstanding

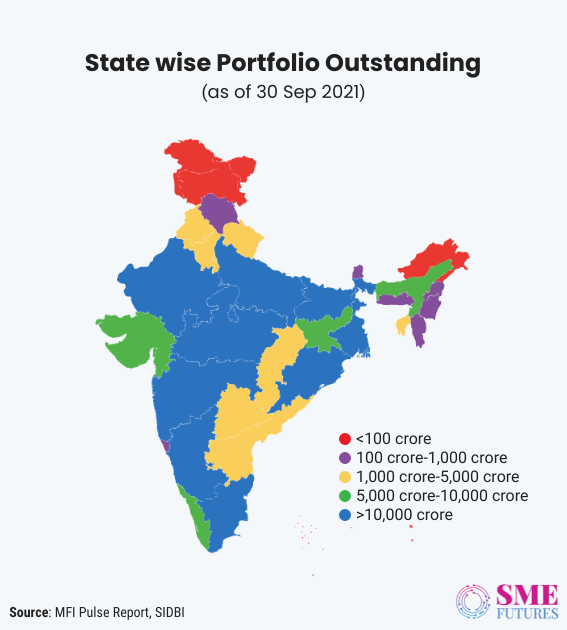

As of 30th September 2021, the top ten states including Rajasthan, Madhya Pradesh, West Bengal, Uttar Pradesh, Odisha, Maharashtra, Tamil Nadu, Bihar, Karnataka and Assam, had contributed 82 per cent of the total portfolio outstanding.

Tamil Nadu was leading with a portfolio outstanding of Rs. 29,335 crores and contributed 13 per cent of the total portfolio outstanding. Along with it, West Bengal, Bihar, Karnataka and Uttar Pradesh were the top 5 states with the most contributions.

However, the 90 plus delinquency of West Bengal alone was higher than the whole industry delinquency. While the 90 plus delinquency of Tamil Nadu, Bihar, Karnataka and Uttar Pradesh was lower than the industry delinquency.

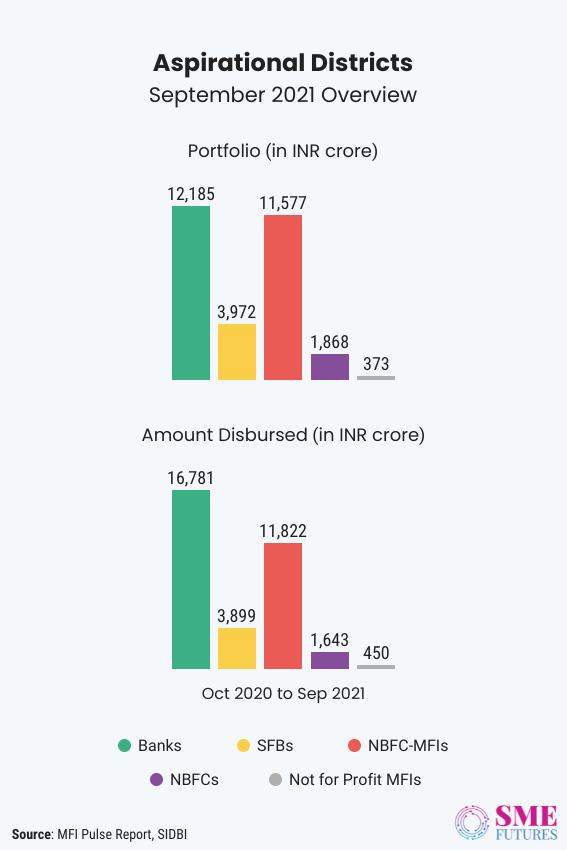

Aspirational Districts

As of 30th September, the portfolio outstanding for the Aspirational Districts was Rs. 29,975 crores and it grew by 168 per cent from December 2017 to September 2021. A total of Rs. 34,595 crores of loans were disbursed in Aspirational Districts from October 2020 to September 2021. The 30 plus and 90 plus delinquency of Banks & SFBs was higher than the overall 30 plus and 90 plus delinquency of the Aspirational Districts.

Year on Year Disbursement Growth

The COVID-19 pandemic and the mobility restrictions that it brought in its wake have adversely affected the microfinance industry. To analyse the impact of COVID-19 on the microfinance industry for the last 3 years, lender wise and state wise trends were analysed in terms of sourcing, portfolio outstanding and delinquency.

The microfinance industry witnessed a slowdown due to the nationwide lockdown from March 2020. Loan sourcing contracted in the October 2019 to September 2020 period by 28-24 per cent in terms of volume and value respectively from October 2018 to September 2019. However, the microfinance industry is back to expansion mode, and it grew by 35 and 37 per cent by volume and value respectively during the October 2020 to September 2021 period.

Amongst all the lenders, the NBFCs were hit the most badly during the pandemic and their loan disbursal came down to 40 per cent by volume and 39 per cent in terms of disbursement value from October 2019 to September 2020 and from October 2018 to September 2019.

Except for the NBFCs and the Not-for-Profit MFIs, all lender categories had witnessed positive growth from September 2019 to September 2021. However, only the NBFC-MFIs had witnessed positive Y-o-Y growth in September 2020 and September 2021. The banks had the lowest 90 plus delinquency in September 2019 whereas in September 2021 it was the highest amongst all the lenders. The 90 plus delinquency of all the lenders had increased in September 2021 compared to September 2019 and September 2020.

Overall, the microfinance industry has grown but it still needs the dedicated focus of the central government and all its stakeholders to grown exponentially.