“Rubi explains everything to me very patiently and calmly,” says Dharamsheela, a local from Pawna village in Bihar, who goes to Bank Sakhi Rubi every time she has some financial query, even after banking hours are over.

“Now we don’t have to go to a bank branch, as the Bank Sakhi not only gets our passbooks updated, but we are also able to deposit through them,” she adds.

In a case study conducted in Bihar, a self-help group recorded that since the JEEVIKA bank counter started, women had started to become financially aware.

Similarly, during the pandemic, when banks were unreachable and monetary issues abounded especially in the rural regions, these business correspondents or BCs were the ones that made people’s lives easier.

These two examples clearly illustrate how BCs are filling the gaps in places where the actual banks can’t reach. In other words, Business Correspondents are imperative for India’s financial ecosystem.

Business correspondents in India

Even though India is witnessing a breakthrough in digital finance and banking services, they are yet to reach the hinterlands in many regions of the country. That’s why the central bank of India, the RBI started to send out BCs or banking agents to engage citizens who were otherwise deprived of financial services.

The monikers that are used to refer to them change with the regions that they are in, Bank Mitra, Bank Sakhi or Bank Didi etc…and they offer a limited range of banking services at a low cost, as setting up an actual bank branch may not be possible in all cases.

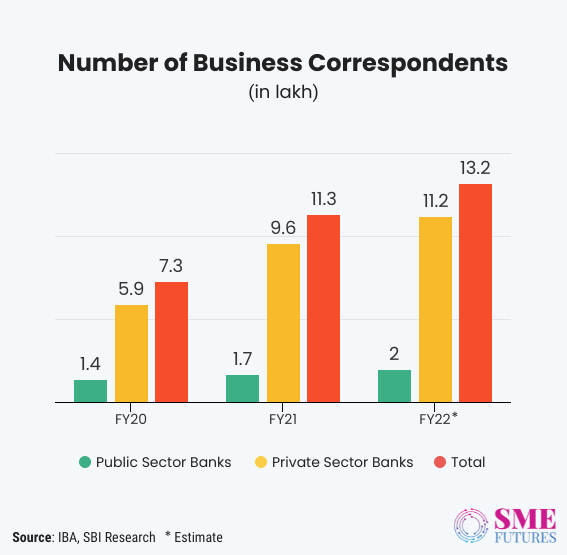

As of FY22, India has 13.2 lakhs BCs, which has increased from the 11.3 lakhs BCs in FY21 and the 7.3 lakhs BCs in FY20. Furthermore, the SBI has close to 72,000 odd BCs servicing around 13 crore PMJDY accounts. While the Bank of Baroda ranks second with around 24,000 BCs, serving more than 5 crore PMJDY accounts, according to an estimate by SBI Research.

The numbers imply that there has been a considerable growth in the number of BCs in India over the years. Which is of course a good thing.

Unfortunately, these business correspondents are also dealing with a gender parity challenge. Which means that India lags way behind in the number of women BCs when compared to the number of BCs who are men.

Gender inequality amongst the BCs

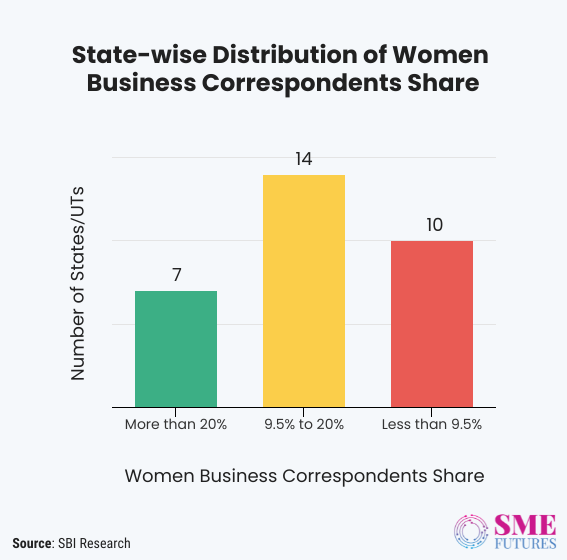

As mentioned earlier, India already has a large number of BCs. But less than 10 per cent of the total BC workforce are women. In fact, SBI Research talks about how we have a fewer number of women BCs and how this number needs to increase in the banking ecosystem.

The data clearly shows that the southern states are faring better on the women BCs parameter. This reiterates the fact that digital literacy has permeated to the bottom of the pyramid and is now being leveraged at the grassroots levels, according to the SBI.

“The problem is more accentuated in the northern, eastern and central states,” states the SBI report.

The report highlights the fact that the belt with the population bulge accounts for an almost two-thirds share of the entire BC network but falls quite short when it comes to the better representation of women agents in its ranks.

“Which can alter the socio-economic fabric of these areas considerably and meaningfully if more women find a foothold within the BC ecosystem, becoming the agents of change. The southern states fare better on this parameter,” it adds.

To double check these facts and figures, I went to a nearby village in Noida, and asked a few women if they were aware of the Bank Sakhis or female BCs. One of them, a vegetable vendor, answered, “We don’t have any knowledge about them or about this kind of a banking initiative.”

Similarly, other villages in Uttar Pradesh, such as Jagatiya in Mathura and Kheri Rangudan in Muzaffarnagar, neither have a bank nor do they have a Bank Sakhi/Mitra visiting them.

Locals from these villages mentioned that they do not have any banking facilities in their villages, and they have to travel far in order to avail of them. At the same time, the women from these villages are not financially literate and they do not even feel the need to get financial awareness as they do not want to interfere in what is according to them the ‘men’s business’.

Why India needs more women BCs

Considering the examples given above and the fact that banking agents are the building blocks of the financial ecosystem, we need more BCs, especially women BCs. And there are several reasons for this.

To begin with, women BC agents increase system transparency. They are capable of building a rapport with diverse customer groups and promote demand-driven incremental revenue while promoting small savings schemes and social security offerings. In short, they are born marketers!

Other than that, the customers perspective is that women BC agents have more patience and are more willing to address queries or explain product features. In addition, female customers are willing to share their family’s financial issues and needs more openly with female BC agents.

Second, as a change agent, they are critical in deepening financial inclusion.

Female BC agents bring similar or more business and might serve more of the underserved. They are more likely to serve the customers in remote areas, the elderly customers, and the other underserved sections of the population.

Third, women agent networks could offer a mix of advantages, such as encouraging savings among women, onboarding more first-time female users, low-value but high-frequency transactions, and the doorstep delivery of financial services.

Fourth, they are less susceptible to malpractices, and are also less prone to commit fraudulent acts towards the customers in the financial ecosystem.

Last but not least, they are encouraging other women to become financially independent.

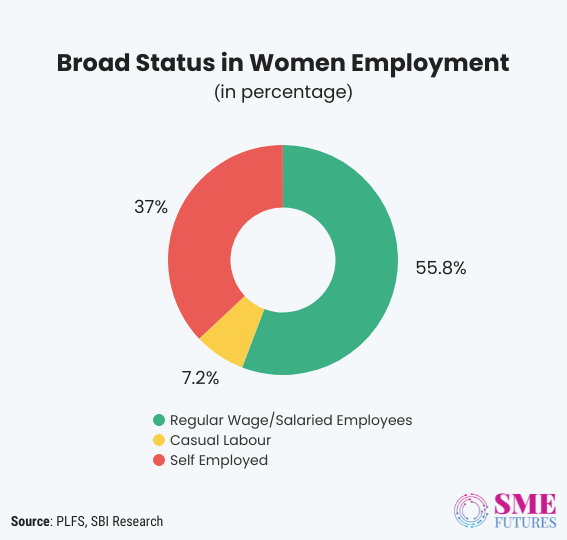

As women are considered imperative for any economy, it’s important that Indian women have a larger role to play in the labour force and the financial ecosystem. And increasing the number of female BC agents is definitely a step forward towards achieving this goal.

The social fabric woven around economic opportunities is gradually gaining upward traction as more women begin to understand savings, social security and investments. This will indeed provide a boost to the SHG movement.

The SBI report states, “When considering the ability of BCs to positively impact the financial inclusion of the ~25 crore women Jan Dhan account holders, the “gender” of the agent in the unending financial landscape becomes a decisively important factor to proliferate and deepen the financial inclusion drive.”

Clearly, we need to earmark more women as the torch bearers of the Banking Correspondents rank and file.

A quota can resolve the issue: SBI

The SBI in its findings notes that the BC network is disproportionately dominated by men owing to a host of issues which can be attributed to socio-economic factors, limited mobility, the lop-sided selection process and the shortcomings in the education system in select pockets of our country.

Evidently, the participation of women in the BC landscape requires a strong push and a quota system may resolve this issue, says the SBI. To hasten the creation of more women BCs, the SBI suggests that a 30 per cent quota be instituted to recruit more women BC agents.

It says, “Policy may also be framed for BCs to mandatorily recruit at least 30 per cent of their total workforce in the future as women Customer service points (CSPs), particularly in locations where access to and usage of the accounts by women is low. Banks may also be advised to reserve 30 per cent of their new codes for woman CSPs.”

It explains that Bank Sakhis hired under NRLM/SRLM may be considered for appointments as CSPs, as they are well versed with routine bank operations and possess the mandated IIBF certification. “This will bridge the gender gap to a large extent,” the report further notes. NRLM is the acronym for the National Rural Livelihood Mission.

The SBI further recommends that a central pool may be created containing the details of all the Bank Sakhis. As an enabler, provisions are to be made on the NRLM/NULM site for uploading all the information about the Bank Sakhis which may be accessed by banks and BCs when they are engaging them as CSPs, says the SBI.

The processes need to be sped up

Women business correspondents, employed under the aegis of the NRLM have been painstakingly driving the concept of ‘personal’ or ‘own/self’ money to crores of women, a precursor to the deepening financial literacy, which is riding the digital stack, particularly in states like Uttar Pradesh, Maharashtra and Tamil Nadu.

With this, scores of women have been warming up to the idea of incremental savings and entrepreneurship due to the ground-breaking work of the thousands of these Digital Sakhis/Didis who are actively working to bridge the financial gap.

To maintain this momentum, our banks need to make them future-ready through the relevant training and by imparting skill sets to them, which in turn will help usher in a silent revolution through contact intensive field visits in the hinterland.