India’s audio devices market is booming, fuelled by the growing popularity of immersive sound technologies and a surge in demand for high-quality audio products in both home and personal categories, according to a recent report by GfK – An NIQ Company. The firm notes that as the entertainment landscape evolves, consumers are increasingly seeking premium, cinematic audio experiences, creating significant opportunities for growth and revenue within the sector.

Anant Jain, Head of Customer Success – Tech & Durables, GfK explains – “The Indian audio devices market in offline retail is valued at INR 5000 Cr, reflecting increased consumer engagement and a shift towards superior quality, immersive audio experiences. As home and personal audio solutions become more sophisticated and accessible, they are becoming integral to the lifestyle of the Indian consumer.”

Home audio shifts focus to quality and experience

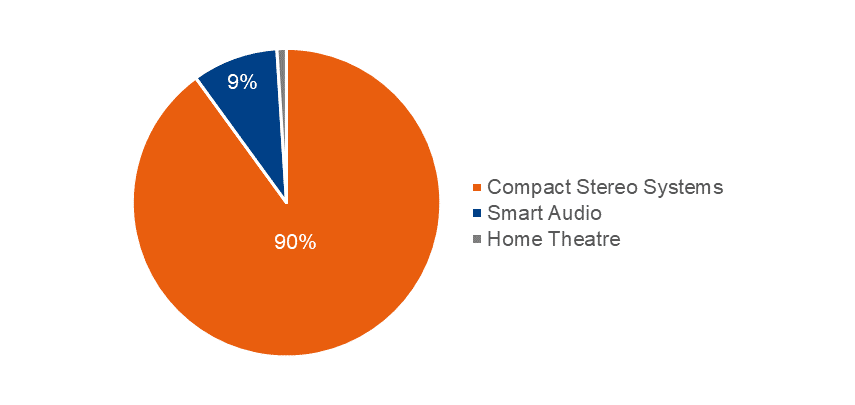

The home audio segment, valued at INR 1600 Cr, experienced a 6% YoY growth in volume during MAT June 2024 (July’23-June’24), highlighting consumers’ rising focus on immersive sound technologies such as Dolby Atmos and DTS. This growth is largely attributed to improving living standards, affordability, and the growing preference for premium home entertainment setups. Compact stereo systems continue to dominate the home audio market, accounting for 90% of sales. However, higher-end 5.1 and 6.1 channel systems are gaining popularity as consumers prioritise superior surround sound experiences.

Despite an overall 11% YoY volume decline in audio home systems during MAT June 2024, the premium segments are making significant strides. The entry segment, priced below INR 3,000 dominates 27% of the market, while the premium segment (priced above INR 8,000) accounts for 23%, reflecting a shift towards higher-quality products.

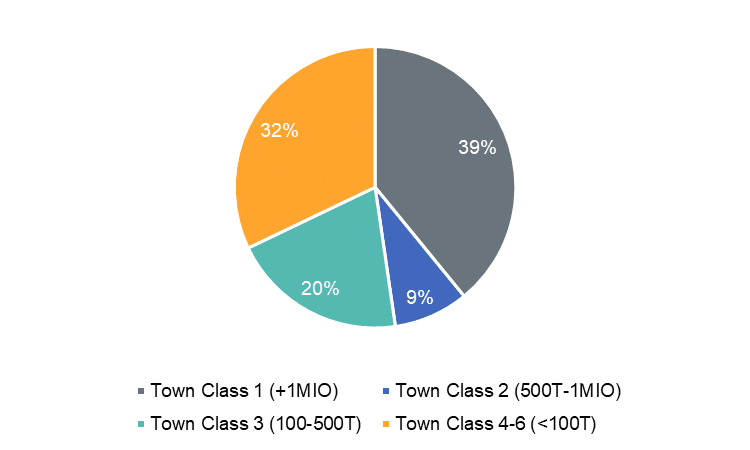

Regionally, the North Zone contributes 31% of home audio sales, with a notable increase in demand from smaller cities and lower-tier towns, representing a significant growth opportunity for brands. For example, tier 4-6 towns saw an impressive rise in sales, from 28% to 32% of the market, underscoring the growing importance of non-metropolitan regions.

Personal audio soars with high smartphone penetration

The personal audio market in India, valued at INR 3400 Cr, experienced a 32% YoY growth in value in MAT June 2024. Headphones, Headsets and mini/Bluetooth speakers have become essential for the Gen Z consumers, who increasingly demand flexibility, affordability, stylishness and quality in audio experiences. This demand is fuelled by the rise of new content formats such as podcasts and audio series.

True Wireless Headsets, in particular, saw significant demand with increasing share of 38% within personal audio headsets segment. By value, True Wireless segment lead the audio market with 50% contribution Neckbands continued to dominate the personal audio market by volume, contributing to 55% of sales. Mini/Bluetooth speakers also witnessed a 15% YoY value growth, with entry-level products (up to INR 2,000) driving 3% of sales by volume.

Consumer demand for wireless and True Wireless models, along with advanced features such as noise cancellation and voice assistant integration, continues to push the market forward. As the average selling price in the category declines by 18%, to INR 1,400, accessibility to quality audio devices is broadening, catering to a wider range of consumers.

Anant Jain adds, “With rising disposable incomes, availability of affordable device options, a growing Gen Z population, and the expanding digital content consumption, there is increasing opportunity for these wireless technology devices with AI integration for smoother user experiences.”

Loudspeakers Lead the Home Audio Market

The loudspeaker segment, dominated by soundbars, registered a 24% YoY volume growth in MAT June 2024, reaching INR 1100 Cr, signaling its growing appeal among Millennials and Gen Z, tech-savvy consumers. With 70% of loudspeaker sales coming from large retail chains, the South Zone, particularly cities like Bangalore, Chennai, and Hyderabad, has emerged as a hotspot for loudspeaker demand.

The growth of loudspeakers in smaller towns and cities, contributing nearly 30% of the category’s sales, also reflects the broader market trend of increasing demand from non-metropolitan areas.

Growth prospects for audio devices market in India

The India Audio Devices Market reflects a dynamic shift in consumer preferences towards quality products that bring about convenience and enhanced experiences. With a massive appetite for audio devices, Indian consumers are seeking a cinematic experience and convenient listening.

As brands innovate around consumer demand for better connectivity, sound quality, and affordability, the Indian audio devices market is poised to remain a key sector in the country’s broader digital lifestyle transformation.