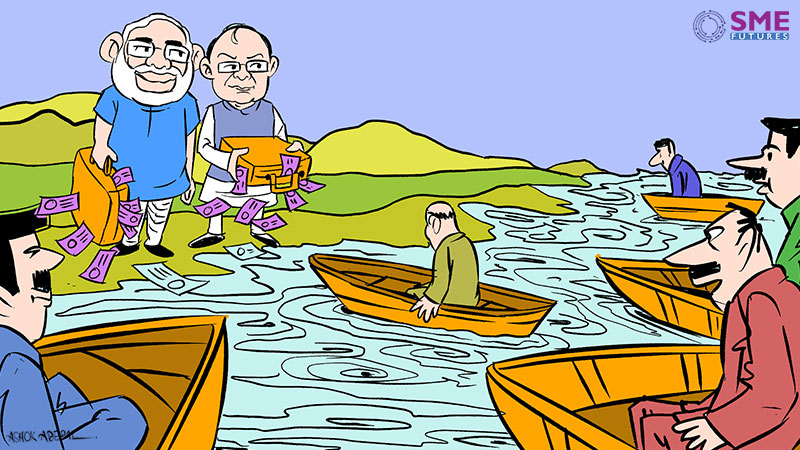

The micro, small and medium enterprises (MSME) sector has been through a couple of tough phases, including goods and services tax (GST) and demonetisation, in the recent past. This has had a significant short-term impact on cash-based enterprises and the overall economy. Budget 2018 made a considerable allocation and relaxed norms to revive the largest employment sector of the country. Having taken a hawk’s eye view of the economy, government has attempted to boost its backbone – the MSME sector.

The most obvious benefit, of course, is the adoption of new revenue-based definition of MSMEs, which has allowed the government to make tax concessions to medium enterprises as well. Expectedly, industrialists have welcomed it. “Reduction in tax rate to 25 per cent for companies with an annual turnover of less than Rs 250 crore in FY17 against the effective tax rate of 34 per cent at present is a big boost to the sector. The difference of nine per cent will give more financial credits to entrepreneurs for re-investment into expansion and creation of jobs in addition to the existing more-than-eight-crore workforce employed in the MSME sector,” says Nishant Arya, executive director of the JBM Group. He observes that MSMEs still have to undergo a lot of difficulties in getting loans at suitable rates. “The government should also look at making funds available for organic expansion to really create a level-playing field,” he adds.

On the other front, with increased allocation to rural and agriculture sectors, the government intended that Budget 2018 will create optimism on the demand front for user industries like FMCG and automobile. This can further drive businesses across various segments. In Budget 2018, the finance minister emphasised on formulating an integrated transportation policy with a balanced multimodal mix, apart from ensuring better connectivity with logistics hubs, like warehouses, logistics parks and cold storage.

Ratheen Shroff, executive director, Sunways Laboratories Pvt. Ltd, opines, “All the announcements made for MSMEs are a welcome reward for the sector, which, I believe, is the backbone of the country. Inclusion of companies with turnover up to Rs 250 crore would widen the net of the segment and further help strengthen the space.

“However, one must note that MSMEs are companies which are just starting up and need more support from the government and other agencies in order to compete with the big players.” He rues the fact that “no schemes or announcements of such benefits were declared”. Further, there is a sharp inflow of international companies which receive due importance for their capital infusion, mostly at the cost of smaller MSMEs, he notes. “This also affects the competitiveness in the market. Some amount of protectionism is required in this space. This need was ignored. Also, companies with export exposure negatively affected by the implementation of the GST regime were ignored,” he adds.

Outlook for 2018-19

The MSME sector has grown rapidly over the years. It plays a vital role in the country’s growth by contributing almost 40 per cent of the gross industrial value added in the Indian economy. When the performance of this sector is viewed against growth in the manufacturing and industry sector as a whole, it instills confidence in the resilience of the small-scale sector. “Overall, MSMEs thrive on liquidity and government spending, both of which put money in the hands of masses. Budget 2018 has successfully declared this intention of the current government. With many of the MSME companies focusing on regional growth – by putting special emphasis on rural/interior markets and tier 2/3/4 cities – there will be higher spending by consumers, leading to robust growth of the economy/MSME sector,” says Shroff. “The outlook for MSMEs looks strong for the year ahead. Increased availability of funds in the form of liquidity will further fuel the rise in capital goods spending and expansion. The theme of the budget was largely positive, which further helps build a more confident environment, accentuating the overall MSME growth,” he avers.

Growth in major consumer segments, like FMCG, beverages, pharma and auto, can drive the demand for advanced solutions in supply-chain management as well. The large corporates have already implemented international-level changes in how their goods are be stored and transported. “The MSME sector, specially micro and small enterprises, will become stronger after the budgetary impetus announced by the government. Like all other sectors, artificial intelligence (AI), Internet of Things, machine learning and data analytics will create the next level of growth for MSMEs as well,” says an optimistic Arya. Elaborating, he says, “MSMEs differ by nature of business, size of operations and geographical location. But, emerging IT solutions are real enablers to removing the superficial differences that limit growth prospects. The latest technologies have created new businesses altogether. Fields of health, finance, insurance and trade have much more to offer now than ever before, just because of these technologies. India has so far been a receiver of innovation in these segments of technologies and not an innovator itself. I can see that going forward; we would do well in terms of innovation as well.”

Improvement in industrial activities and infrastructure is expected to directly benefit the logistics, warehousing and material-handling sectors. Moreover, with the policy thrust given to the food-processing industry by the government and the developing e-commerce market in India, these could become the next big thing in the coming future. “The budget has further strengthened the sector by making key structural changes, enabling ease of doing business and providing tax benefits. The government’s expenditure on projects like railways, roads and irrigation will take the number of SMEs in the country to the next level. The entire manufacturing is slowly shifting to India, which will further enhance the number of SMEs in the country and some of the current SMEs will become large corporate,” says Sunu Mathew, the managing director of LEAP India, a leading provider of wooden pallets and foldable large containers giving direct and indirect employment to over 2,000 people.

Future strategy

As a consumption economy, India can thrive with strong and robust in-house manufacturing capabilities. The government has sought to incentivise the MSME sector through employment and technology adaptation (Prime Minister Employment Generation Program, National Manufacturing Competitiveness Program, ASPIRE – A Scheme for Promotion of Innovation, Rural Industry and Entrepreneurship), which some industrialists see as a solution to the employment problem. “India has the fastest growing and currently the largest population in the working age group; the same needs to be utilised. There is a high percentage of disguised employment in the rural part of the country and whole untapped market in tier 3/4 and remote areas, both of which can be monetised extensively. With the big organisations focusing on the urban, metro and tier 1/2 cities, a large segment of the country depends on MSMEs to fill the void, which they do effectively. We are seeing strong penetration of MSMEs through all sectors and industries looking at this space for growth. This region is untapped and void of serious competition,” says Shroff.

Economists believe that business confidence plays a crucial role for sustainable economic growth; therefore, it is necessary to boost MSME confidence for the Indian economy, considering its size and coverage, to overcome its growth slowdown. The current government has come out with many policy measures that have sought to fast-track many stalled projects in roads, power, irrigation, railways and defence sectors with the hope that this will help SMEs grow and generate more employment. Demonetisation and GST have had some impact on SMEs in the recent past; however, the overall growth during the last quarter has picked up and reached 7.6 per cent, which is a good sign.

The MSME sector plans to reap the benefits of the government’s focus on generating employment and increasing the manufacturing sector’s share in GDP. This year’s budget outnumbers allocation to the sector as compared to the previous years. Budget 2018 focuses on boosting the economy by focusing on agriculture sector and takes into consideration steps to generate employment in the country.

The government has also restored balance in the corporate tax structure through reduction of rates, but the challenges toward better financing remain intact. There is a related issue of unstructured enterprises. If MSMEs on their own look at listing on stock exchanges, they will evolve as better stakeholders of the economy and can have ample funds for growth.

“Management techniques like lean manufacturing, just-in-time stockholding, etc. should be utilised for best management of capital flow. The government’s decision to recapitalise public sector banks will definitely boost credit flow to companies with high profitability. The companies should also make digital technology part of their operations by taking their products online, converting their payrolls, warehouse management, working capital management, et al. from conventional platforms to digital. Of course, one has to prepare a strong backend to support these activities digitally,” says Arya.